4. PERSONS RESPONSIBLE FOR DEDUCTING TAX AND THEIR DUTIES:

4.1. As per section 204(i) of the Act, the “persons responsible for paying” for the purpose of Section 192 means the employer himself or if the employer is a Company, the Company itself including the Principal Officer thereof. Further, as per Section 204(iv), in the case of credit, or as the case may be, if the payment is by or on behalf of Central Government or State Government, the DDO or any other person by whatever name called, responsible for crediting, or as the case may be, paying such sum is the “persons responsible for paying”.

4.2. The tax determined as per para 9 should be deducted from the salary u/s 192 of the Act.

4.3. Deduction of Tax at Lower Rate:

If the jurisdictional TDS officer of the Taxpayer issues a certificate of No Deduction or Lower Deduction of Tax under section 197 of the Act, in response to the application filed before him in Form No 13 by the Taxpayer; then the DDO should take into account such certificate and deduct tax on the salary payable at the rates mentioned therein.(see Rule 28AA).

4.4. Deposit of Tax Deducted:

Rule 30 prescribes time and mode of payment of tax deducted at source to the account of Central Government.

4.4.1. Due dates for payment of TDS

Prescribed time of payment/deposit of TDS to the credit of Central Government account is as under:

a) In case of an Office of Government:

| Sl No. |

Description |

Time up to which to be deposited. |

| 1 |

Tax deposited without Challan [Book Entry] |

SAME DAY |

| 2 |

Tax deposited with Challan |

7TH DAY NEXT MONTH |

| 3 |

Tax on perquisites opt to be deposited by the employer. |

7TH DAY NEXT MONTH |

b) In any case other than an Office of Government

| Sl No. |

Description |

Time up to which to be deposited. |

| 1 |

Tax deducted in March |

30th APRIL NEXT FINANCIAL YEAR |

| 2 |

Tax deducted in any other month |

7TH DAY NEXT MONTH |

| 3 |

Tax on perquisites opted to be deposited by the employer |

7TH DAY NEXT MONTH |

However, if a DDO applies before the jurisdictional Additional/Joint Commissioner of Income Tax to permit quarterly payments of TDS under section 192, the Rule 30(3) allows for payments on quarterly basis and as per time given in Table below:

| Sl. No. |

Quarter of the financial year ended on |

Date for quarterly payment |

| 1 |

30th June |

7th July |

| 2 |

30th September |

7th October |

| 3 |

31st December |

7th January |

| 4 |

31st March |

30th April next Financial Year |

4.4.2 Mode of Payment of TDS

4.4.2.1 Compulsory filing of Statement by PAO, Treasury Officer, etc in case of payment of TDS by Book Entry:

In the case of an office of the Government, where tax has been paid to the credit of the Central Government without the production of a challan [Book Entry], the Pay and Accounts Officer or the Treasury Officer or the Cheque Drawing and Disbursing Officer or any other person by whatever name called to whom the deductor reports about the tax deducted and who is responsible for crediting such sum to the credit of the Central Government, shall‐

(a) submit a statement in Form No. 24G within ten days from the end of the month to the agency authorized by the Director General of Income‐tax (Systems) [TIN Facilitation Centres currently managed by M/s National Securities Depository Ltd] in respect of tax deducted by the deductors and reported to him for that month; and

(b) intimate the number (hereinafter referred to as the Book Identification Number or BIN) generated by the agency to each of the deductors in respect of whom the sum deducted has been credited. BIN consist of receipt number of Form 24G, DDO sequence number in Form No. 24G and date on which tax is deposited.

The procedure of furnishing Form 24G is detailed in Annexure III. PAOs/DDOs should go through the FAQs in Annexure IV to understand the correct process to be followed. The ZAO / PAO of Central Government Ministries is responsible for filing of Form No. 24G on monthly basis. The person responsible for filing Form No. 24G in case of State Govt. Departments is shown at Annexure V.

The procedure of furnishing Form 24G is detailed in Annexure IV. PAOs/DDOs should go through the FAQs therein to understand the correct process to be followed.

4.4.2.2 Payment by an Income Tax Challan:

(i) In case the payment is made by an Income Tax Challan, the amount of tax so deducted shall be deposited to the credit of the Central Government by remitting it, within the time specified in Table in para 4.4.1 above, into any office of the Reserve Bank of India or branches of the State Bank of India or of any authorized bank;

(ii) In case of a company and a person (other than a company), to whom provisions of section 44AB are applicable, the amount deducted shall be electronically remitted into the Reserve Bank of India or the State Bank of India or any authorised bank accompanied by an electronic income-tax challan (Rule125).

The amount shall be construed as electronically remitted to the Reserve Bank of India or to the State Bank of India or to any authorized bank, if the amount is remitted by way of:

(a) internet banking facility of the Reserve Bank of India or of the State Bank of India or of any authorized bank; or

(b) debit card. {Notification No.41/2010 dated 31st May 2010}

4.5 Interest, Penalty & Prosecution for Failure to Deposit Tax Deducted:

4.5.1 If a person fails to deduct the whole or any part of the tax at source, or, after deducting, fails to pay the whole or any part of the tax to the credit of the Central Government within the prescribed time, he shall be liable to action in accordance with the provisions of section 201 and shall be deemed to be an assessee -in-default in respect of such tax and liable for penal action u/s 221 of the Act. Further Section 201(1A) lays down that such person shall be liable to pay simple interest

(i) at 1% for every month or part of the month on the amount of such tax from the date on which such tax was deductible to the date on which such tax is deducted; and

(ii) at one and one-half percent for every month or part of a month on the amount of such tax from the date on which such tax was deducted to the date on which such tax is actually paid.

Such interest, if chargeable, is mandatory in nature and has to be paid before furnishing of quarterly statement of TDS for respective quarter.

4.5.2 Section 271C inter alia lays down that if any person fails to deduct whole or any part of tax at source or fails to pay the whole or part of tax under second proviso to section 194B, he shall be liable to pay, by way of penalty, a sum equal to the amount of tax not deducted or paid by him.

4.5.3 Further, section 276B lays down that if a person fails to pay to the credit of the Central Government within the prescribed time, as above, the tax deducted at source by him, he shall be punishable with rigorous imprisonment for a term which shall be between 3 months and 7 years, along with fine.

4.6 Furnishing of Certificate for Tax Deducted (Section 203):

4.6.1 Section 203 requires the DDO to furnish to the employee a certificate in Form 16 detailing the amount of TDS and certain other particulars. The Act stipulates that Form 16 should be furnished to the employee by 31st May after the end of the financial year in which the income was paid and tax deducted. Even the banks deducting tax at the time of payment of pension are required to issue such certificates. Revised Form 16 annexed to Notification No 11 dated 19-02-2013 is enclosed. The certificate in Form 16 shall specify

(a) Valid permanent account number (PAN) of the deductee;

(b) Valid tax deduction and collection account number (TAN) of the deductor;

(c) (i) Book identification number or numbers (BIN) where deposit of tax deducted is without production of challan in case of an office of the Government;

(ii) Challan identification number or numbers (CIN*) in case of payment through bank.

(*Challan identification number (CIN) means the number comprising the Basic Statistical Returns (BSR) Code of the Bank branch where the tax has been deposited, the date on which the tax has been deposited and challan serial number given by the bank.)

(d) Receipt numbers of all the relevant quarterly statements in case the statement referred to in clause (i) is for tax deducted at source from income chargeable under the head “Salaries”. The receipt number of the quarterly statement is of 8 digit.

Further as per Circular 04/2013 dated 17-04-2013 all deductors (including Government deductors who deposit TDS in the Central Government Account through book entry) shall issue the Part A of Form No. 16, by generating and subsequently downloading it through TRACES Portal and after duly authenticating and verifying it, in respect of all sums deducted on or after the 1st day of April, 2012 under the provisions of section 192 of Chapter XVII-B. Part A of Form No 16 shall have a unique TDS certificate number. ‘Part B (Annexure)’ of Form No. 16 shall be prepared by the deductor manually and issued to the deductee after due authentication and verification alongwith the Part A of the Form No. 16.

It may be noted that under the new TDS procedure, the accuracy and availability of TAN, PAN and receipt number of TDS statement filed by the deductor will be unique identifier for granting online credit for TDS. Hence due care should be taken in filling these particulars. Due care should also be taken in indicating correct CIN/ BIN in TDS certificate.

If the DDO fails to issue these certificates to the person concerned, as required by section 203, he will be liable to pay, by way of penalty, under section 272A(2)(g), a sum which shall be Rs.100/- for every day during which the failure continues.

It is, however, clarified that there is no obligation to issue the TDS certificate in case tax at source is not deductible/deducted by virtue of claims of exemptions and deductions.

[Note: TRACES is a web-based application of the Income – tax Department that provides an interface to all stakeholders associated with TDS administration. It enables viewing of challan status, downloading of NSDL Conso File, Justification Report and Form 16 / 16A as well as viewing of annual tax credit statements (Form 26AS). Each deductor is required to Register in the Traces portal. Form 16/16A issued to deductees should mandatorily be generated and downloaded from the TRACES portal]

4.6.2. If an assessee is employed by more than one employer during the year, each of the employers shall issue Part A of the certificate in Form No. 16 pertaining to the period for which such assessee was employed with each of the employers and Part B may be issued by each of the employers or the last employer at the option of the assessee.

4.6.3. Authentication by Digital Signatures:

(i) Where a certificate is to be furnished in Form No. 16, the deductor may, at his option, use digital signatures to authenticate such certificates.

(ii) In case of certificates issued under clause (i), the deductor shall ensure that

(a) the conditions prescribed in para 4.6.1 above are complied with;

(b) once the certificate is digitally signed, the contents of the certificates are not amenable to change; and

(c) the certificates have a control number and a log of such certificates is maintained by the deductor.

The digital signature is being used to authenticate most of the e-transactions on the internet as transmission of information using digital signature is failsafe. It saves time specially in organisations having large number of employees where issuance of certificate of deduction of tax with manual signature is time consuming (Circular no 2 of 2007 dated 21.05.2007)

4.6.4. Furnishing of particulars pertaining to perquisites, etc (Section 192(2C):

4.6.4.1 As per section 192(2C), the responsibility of providing correct and complete particulars of perquisites or profits in lieu of salary given to an employee is placed on the person responsible for paying such income i.e., the person responsible for deducting tax at source. The form and manner of such particulars are prescribed in Rule 26A, Form 12BA (Annexure II) and Form 16 of the Rules. Information relating to the nature and value of perquisites is to be provided by the employer in Form 12BA in case salary paid or payable is above Rs.1,50,000/-. In other cases, the information would have to be provided by the employer in Form 16 itself.

4.6.4.2 An employer, who has paid the tax on perquisites on behalf of the employee as per the provisions discussed in para 3.2 of this circular, shall furnish to the employee concerned, a certificate to the effect that tax has been paid to the Central Government and specify the amount so paid, the rate at which tax has been paid and certain other particulars in the amended Form 16.

4.6.4.3 The obligation cast on the employer under Section 192(2C) for furnishing a statement showing the value of perquisites provided to the employee is a crucial responsibility of the employer, which is expected to be discharged in accordance with law and rules of valuation framed there under. Any false information, fabricated documentation or suppression of requisite information will entail consequences thereof provided under the law. The certificates in Forms 16 and/or Form 12BA specified above, shall be furnished to the employee by 31st May of the financial year immediately following the financial year in which the income was paid and tax deducted. If he fails to issue these certificates to the person concerned, as required by section 192(2C), he will be liable to pay, by way of penalty, under section 272A(2)(i), a sum which shall be Rs.100/- for every day during which the failure continues.

As per Section 139C of the Act, the Assessing Officer can require the taxpayer to produce Form 12BA alongwith Form 16, as issued by the employer.

4.7 Mandatory Quoting of PAN and TAN:

4.7.1 Section 203A of the Act makes it obligatory for all persons responsible for deducting tax at source to obtain and quote the Tax deduction and collection Account No (TAN) in the challans, TDS-certificates, statements and other documents. Detailed instructions in this regard are available in this Department’s Circular No.497 [F.No.275/118/ 87-IT(B) dated 9.10.1987]. If a person fails to comply with the provisions of section 203A, he will be liable to pay, by way of penalty, under section 272BB, a sum of ten thousand rupees. Similarly, as per Section 139A(5B), it is obligatory for persons deducting tax at source to quote PAN of the persons from whose income tax has been deducted in the statement furnished u/s 192(2C), certificates furnished u/s 203 and all statements prepared and delivered as per the provisions of section 200(3) of the Act.

4.7.2 All tax deductors are required to file the TDS statements in Form No.24Q (for tax deducted from salaries). As the requirement of filing TDS certificates alongwith the return of income has been done away with, the lack of PAN of deductees is creating difficulties in giving credit for the tax deducted. Tax deductors are, therefore, advised to procure and quote correct PAN details of all deductees in the TDS statements for salaries in Form 24Q. Taxpayers are also liable to furnish their correct PAN to their deductors. Non-furnishing of PAN by the deductee (employee) to the deductor (employer) will result in deduction of TDS at higher rates u/s 206AA of the Act mentioned in para 4.8 below.

4.8 Compulsory Requirement to furnish PAN by employee (Section 206AA):

4.8.1 Section 206AA in the Act makes furnishing of PAN by the employee compulsory in case of receipt of any sum or income or amount, on which tax is deductible. If employee (deductee) fails to furnish his/her PAN to the deductor , the deductor has been made responsible to make TDS at higher of the following rates:

i) at the rate specified in the relevant provision of this Act; or

ii) at the rate or rates in force; or

iii) at the rate of twenty per cent.

The deductor has to determine the tax amount in all the three conditions and apply the higher rate of TDS. However, where the income of the employee computed for TDS u/s 192 is below taxable limit, no tax will be deducted. But where the income of the employee computed for TDS u/s 192 is above taxable limit, the deductor will calculate the average rate of income-tax

based on rates in force as provided in sec 192. If the tax so calculated is below 20%, deduction of tax will be made at the rate of 20% and in case the average rate exceeds 20%, tax is to deducted at the average rate. Education cess @ 2% and Secondary and Higher

Education Cess @ 1% is not to be deducted, in case the tax is deducted at 20% u/s 206AA of the Act.

4.9 Statement of deduction of tax under section 200(3) [Quarterly Statement of TDS]:

4.9.1 The person deducting the tax (employer in case of salary income), is required to file duly verified Quarterly Statements of TDS in Form 24Q for the periods [details in Table below] of each financial year, to the TIN/facilitation Centres authorized by DGIT (System’s) which is currently managed by M/s National Securities Depository Ltd (NSDL). Particulars of e-TDS Intermediary at any of the TIN Facilitation Centres are available at http://www.incometaxindia. gov.in and http://tin-nsdl.com portals. The requirement of filing an annual return of TDS has been done away with w.e.f. 1.4.2006. The quarterly statement for the last quarter filed in Form 24Q (as amended by Notification No. S.O.704(E) dated 12.5.2006) shall be treated as the annual return of TDS. Due dates of filing this statement quarterwise is as in the Table below.

TABLE: Dates of filing Quarterly Statements E-TDS Return 24Q

| Sl No |

Return for Quarter ending |

Due date for Government Offices |

Due date for Other Deductors |

| 1 |

30th June |

31st July |

15th July |

| 2 |

30th September |

31st October |

15th October |

| 3 |

31st December |

31st January |

15th January |

| 4 |

31st March |

15th May |

15th May |

4.9.2 The statements referred above may be furnished in paper form or electronically under digital signature or alongwith verification of the statement in Form 27A of verified through an electronic process in accordance with the procedures, formats and standards specified by the Director General of Income‐tax (Systems). The procedure for furnishing the e-TDS/TCS statement is detailed at Annexure VI.

4.9.3 All Returns in Form 24Q are required to be furnished in electronically except in case where the number of deductee records is less than 20 and deductor is not an office of Government, or a company or a person who is required to get his accounts audited under section 44AB of the Act. [Notification No. 11 dated 19.02.2013].

4.9.4 Fee for default in furnishing statements (Section 234E):

If a person fails to deliver or caused to be delivered a statement within the time prescribed in section 200(3) in respect of tax deducted at source on or after 1.07.2012 he shall be liable to pay, by way of fee a sum of Rs. 200 for every day during which the failure continues. However, the amount of such fee shall not exceed the amount of tax which was deductible at source. This fee is mandatory in nature and to be paid before furnishing of such statement.

4.9.5 Penalty for failure in furnishing statements or furnishing incorrect information (section 271H):

If a person fails to deliver or caused to be delivered a statement within the time prescribed in section 200(3) or furnishes an incorrect statement, in respect of tax deducted at source on or

after 1.07.2012, he shall be liable to pay, by way of penalty a sum which shall not be less than Rs. 10,000/- but which may extend to Rs 1,00,000/-. However, the penalty shall not be levied if the person proves that after paying TDS with the fee and interest, if any, to the credit of Central Government, he had delivered such statement before the expiry of one year from the time prescribed for delivering the statement.

4.9.6 At the time of preparing statements of tax deducted, the deductor is required to mandatorily quote:

(i) his tax deduction and collection account number (TAN) in the statement;

(ii) his permanent account number (PAN) in the statement except in the case where the deductor is an office of the Government( including State Government). In case of Government deductors “PANNOTREQD” to be quoted in the e-TDS statement;

(iii) the permanent account number PAN of all deductees;

(iv) furnish particulars of the tax paid to the Central Government including book identification number or challan identification number, as the case may be.

(v) furnish particular of amounts paid or credited on which tax was not deducted in view of the issue of certificate of no deduction of tax u/s 197 by the assessing officer of the payee.

4.10 TDS on Income from Pension:

In the case of pensioners who receive their pension from a nationalized bank, the instructions contained in this circular shall apply in the same manner as they apply to salary- income. The deductions from the amount of pension under section 80C on account of contribution to Life Insurance, Provident Fund, NSC etc., if the pensioner furnishes the relevant details to the banks, may be allowed. Necessary instructions in this regard were issued by the Reserve Bank of India to the State Bank of India and other nationalized Banks vide RBI’s Pension Circular(Central Series) No.7/C.D.R./1992 (Ref. CO: DGBA: GA (NBS) No.60/GA.64 (11CVL)-/92) dated the 27th April 1992, and, these instructions should be followed by all the branches of the Banks, which have been entrusted with the task of payment of pensions. Further all branches of the banks are bound u/s 203 to issue certificate of tax deducted in Form 16 to the pensioners also vide CBDT circular no. 761 dated 13.1.98.

4.11. Matters pertaining to the TDS made in case of Non Resident:

4.11.1 Where Non-Residents are deputed to work in India and taxes are borne by the employer, if any refund becomes due to the employee after he has already left India and has no bank account in India by the time the assessment orders are passed, the refund can be issued to the employer as the tax has been borne by it [Circular No. 707 dated 11.07.1995].

In respect of non-residents, the salary paid for services rendered in India shall be regarded as income earned in India. It has been specifically provided in the Act that any salary payable for rest period or leave period which is both preceded or succeeded by service in India and forms part of the service contract of employment will also be regarded as income earned in India.

ANNEXURE III

POINT NO.4.4.2.1 OF CIRCULAR OF DEDUCTION OF TAX AT SOURCE – INCOME TAX DEDUCTION FROM SALARIES U/S 192 OF THE INCOME-TAX ACT, 1961 – FINANCIAL YEAR 2013-14

Compulsory filing of Statement by PAO, Treasury Officer, etc. in case of payment of TDS by Book Entry.

1. Procedure of preparation and furnishing Form 24G at TIN-Facilitation Centres (TIN-FCs):

The form 24G should be prepared by the PAO/DTO/CDDO as per the data structure (File format) prescribed by the DIT (Systems), Delhi which is available on TIN website www.tin-nsdl.com. The AOs can prepare Form 24G either by using in-house facilities, third party software or by using form 24G Return Preparation Utility (RPU) developed by NSDL e-Governance Infrastructure Limited (NSDL), which is freely downloadable from the TIN web-site www.tin-nsdl.com.

After preparation of form 24G, the AO is required to validate the same by using the Form 24G File Validation Utility (FVU) which is freely available on TIN website.

Once file is validated through FVU, ‘.fvu file’ in CD/DVD/Pen Drive along with physical Statement Statistic Report (SSR) signed by the AO, to be furnished at TIN-FCs. On successful acceptance of Form 24G at the TIN- FC, an acknowledgement containing 15 digit Token no. is provided to the AO. The AO can view the status of Form 24G on TIN website.

Book identification Number (BIN) is generated for each ‘DDO record with valid TAN’ reported in Form 24G, which is further disseminated to the AOs on email ID mentioned in Form 24G. AOs need to communicate the BIN details to respective DDOs. BIN is to be quoted by the DDOs in quarterly e-TDS/TCS statements. BIN consists of receipt number of Form 24G. DDO serial number and date of transfer voucher.

The AO is required to furnish Form 24G within ten days from the end of the month in respect of tax deducted by the deductors and reported to him for that month. Only one regular Form 24G for a ‘month-FY’ can be submitted.

1.1 Correction in Form 24G:

AO can file a correction Form 24G for any modification or cancellation of Form 24G accepted at TIN central system. Preparation and validation of correction Form 24G is in line with regular form 24G. The validated Form 24G correction file (.fvu file) copied on a CD/pen drive is to be submitted along with the provisional receipt of original Form 24G and SSR to TIN-FC. On successful acceptance of correction Form 24G at the TIN-FC, an acknowledgement containing 15 digit Token no. is provided to the AO. The AO can view the status of Form 24G on TIN website.

2. Online upload of Form 24G at TIN websites:

For online upload of Form 24G at TIN website, the Accounts Office Identification Number (AIN) is a pre-requisite. For online AIN registration, AO need to file at least one Form 24G through TIN-FC. After AIN registration, AO can file Form 24G through AO Account at TIN website. Preparation and validation of correction Form 24G is in line with regular Form 24G (submitted at TIN-FC) . The validated Form 24G correction file (.fvu file) is to be uploaded at TIN website. There is no need to submit SSR in online upload. For Form 24G accepted at TIN Central System an online acknowledgement containing a 15 digit token number is generated and displayed to the AO. The format of the acknowledgement is identical to the one issued by the TIN-FC.

No charges are applicable to AOs for online upload of Form 24G.

On login, AO can also View/Download BIN details and update demographic details.

No Digital Signature Certificate (DSC) is required for registration and online uploading of Form 24G.

2.1 Online uploading of correction Form 24G at TIN website:

AO can file a correction Form 24G for any modification or cancellation of Form 24G accepted at TIN Central System. Preparation and validation of correction form 24G is in line with regular form 24G. The validated Form 24G correction file (.fvu file) can be uploaded online through AO account at TIN website. For correction Form 24G accepted at TIN central system, an online acknowledgement containing a 15 digit token number is generated and displayed to the AO. The format of the acknowledgement is identical to the one issued by the TIN-FC. There is no need to submit SSR and provisional receipt of original form 24G in online upload.

3. For FAQs and further details, AOs are advised to log on TIN website www.tin-nsdl.com

ANNEXURE IV

Furnishing of Monthly Form No. 24G Statements by Pay and Accounts Officers (PAOs)/District Treasury Officers (DTOs)/Cheque Drawing and Disbursing Officers(CDDOs)

1. Under what income tax rule should Form 24G be filed?

Income-tax Department Notification no. 41/2010 dated May 31, 2010 amended the Income Tax Rule 30 which mandates that in case of an office of the Government, where tax has been paid to the credit of Central Government without the production of a challan (associated with deposit of the tax in a bank), the relevant PAO / CDDO / DTO or an equivalent office of the government (herein after called as AO in this document) is required to file Form 24G on monthly basis.

2. Who is the relevant PAO/CDDO/DTO who is liable for filing Form 24G?

A relevant PAO/CDDO/DTO is that office to whom the Deductor/DDO (TAN holder) reports remittance of TDS/TCS through book adjustment. Generally, the Central Government DDOs report TDS through book entry to their respective Pay and Accounts Officers (PAOs) and the State Government DDOs report TDS through book entry to their respective District Treasury Officers(DTOs). Such PAOs and DTOs are required to file Form 24G on monthly basis.

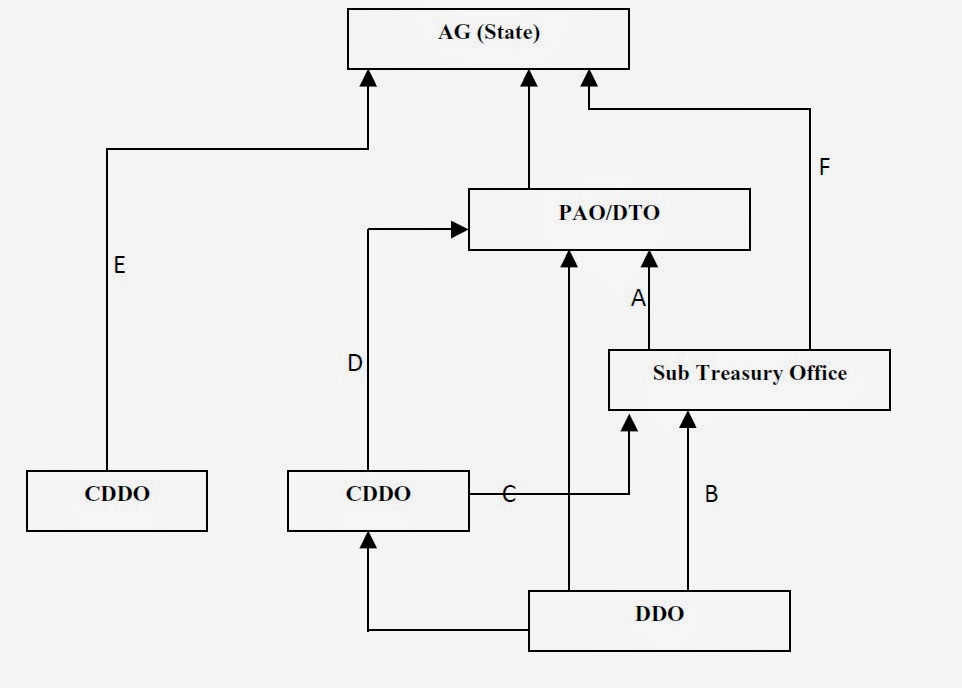

There are also cases of Cheque Drawing and Disbursing Officers (CDDOs) who report TDS through book entry directly to State AG. For example, PWD, Forest Department etc. Such CDDOs are also required to file Form 24G on monthly basis. Schematic Diagram at Annexure-III clarifies the person responsible for filing Form 24G in different scenarios.

3. Can the same office/officer also act as DDO and AO?

Ordinarily, the PAO office is the one to whom the DDO reports the TDS and therefore, both should be from different offices. However, where the DDO and AO are the same, as in the case of CDDOs, the statistics report of Form 24G should be counter signed by his superior officer.

4. What is AIN and who should apply?

Accounts Office Identification Number (AIN) is a unique seven digit which is allotted by the Directorate of Income Tax (Systems), Delhi, to every AO. Each AO is uniquely identified in the system by this number. AOs are required to apply for AIN with jurisdictional TDS office. The AIN application can be downloaded from TIN site. Every AIN holder is required to file Form 24G.

Each DDO is identified in the system by a Tax Deduction and Collection Account Number (TAN). This number is allotted by Income Tax Department.

5. Where should the Accounts Office Identification Number (AIN) application be submitted ?

The duly filled and signed application for AIN allotment is to be submitted in physical form by the PAO / CDDO / DTO to the jurisdictional CIT (TDS). Complete and correct AIN application forms will be forwarded by the jurisdictional CIT (TDS) to NSDL e-Governance Infrastructure Limited (NSDL), Times Tower, 1st Floor, Kamala Mills Compound, Senapati Bapat Marg, Lower Parel, Mumbai – 400013 recommending allotment of AIN to the PAO / CDDO / DTO.

6. What information should be submitted through Form 24G?

Every AO should furnish one complete, correct and consolidated Form 24G every month having details of each type of deduction / collection separately viz. TDS-Salary / TDS-Non Salary / TDS-Non Salary Non Residents / TCS made by each DDO under his jurisdiction.

7. Where should Form 24G be submitted?

Form 24G is to be furnished only in electronic form in a CD/pen drive at TIN-FCs or online through AO Account at www.tin-nsdl.com web portal. The facility to submit Form No. 24G online is available free of cost. Provisional Receipt Number (PRN) is issued as an acknowledgement of the receipt of Form 24G.

8. How to register for online facility?

Registration for AO Account is mandatory for filing Form No. 24G online through TIN website, www.tin-nsdl.com. Registration AO Account is required once only. AO required to submit the Form No. 24G at TIN-FC at least once to comply with the Know Your Customer (KYC) norms for registration of the AO Account. After registration, it is optional for AO either to submit the Form No.24G in CD/Pen drive at TIN-FC or online.

9. What are the functionalities available with AO Account?

Through the AO Account, the AO can view the status of Form No. 24G filed, obtain BIN (Book Identification Number) details, update AO profile and upload Form No. 24G. The status tracking is based on AIN and concerned Provisional Receipt Number (PRN) of Form 24G.

10. Can the AO furnish Form No. 24G in paper form?

No. Form 24G is to be filed only in electronic form.

11. Can the AO submit the electronically prepared Form No.24G at the Income Tax Office?

No. Electronically prepared Form No.24G can only be submitted at TIN-FC or online .

12. What does Form 24G contain?

Every Form 24G should be prepared in accordance with the data structure prescribed by the Income Tax Department (ITD). Form 24G contains-

• Details of the AO filing Form 24G (AIN, name, demographic information, contact details).

• Category of AO (Central / State Government) along with details of ministry / state.

• Statement details (month and year for which Form 24G is being filed).

• Payment summary; nature of deduction wise (TDS – Salary /TDS Non-salary / TDS – Non-salary Non-resident / TCS).

• DDO wise payment details (TAN of DDO, name, demographic details, total tax deducted and remitted to the Government account (A.G. / Pr.CCA).

• DDOs which are associated with the AO. If the DDO wants to add/delete or update details of DDO, same should be mentioned in the statement.

13. What is the procedure to prepare the Form 24G statement?

The AOs can prepare Form 24G either by using in-house facilities, third party software or by using Form 24G Preparation Utility developed by NSDL, which is freely downloadable from the TIN web-site (www.tin-nsdl.com) or ITD website (www.incometaxindia.gov.in).

Once the statement is prepared, the AO shall validate the same by using File Validation Utility (FVU) developed by NSDL and freely available at the TIN or ITD website. The statement can be furnished in Compact Disk (CD) at any of the TIN-Facilitation Centres (TIN-FC) managed by NSDL along with Form 24G Statement Statistics Report (generated through File Validation Utility), duly signed by the AO. The list of TIN-FCs is available at TIN or ITD website.

Once Form 24G is accepted by the TIN-FC, it will issue a provisional receipt with a unique Provisional Receipt Number (PRN) to the AO as a proof of submission of the statement.

14. What is Form 24G Preparation Utility?

The Form 24G Preparation Utility is a Java based utility. Form 24G Preparation Utility can be freely downloaded from www.tin-nsdl.com. After downloading, it needs to be saved on the local disk of the machine.

JRE (Java Run-time Environment) [versions: SUN JRE: 1.4.2_02 or 1.4.2_03 or 1.4.2_04 or IBM JRE: 1.4.1.0] should be installed on the computer where Form 24G Preparation Utility is being installed. JRE is freely downloadable from http://java.sun.com and http://www. ibm.com/developerworks/java/jdk or you can ask your computer vendor (hardware) to install the same for you.

Form 24G Preparation Utility can be executed on Windows platform(s) Win 2K Prof. / Win 2K Server/ Win NT 4.0 Server/ Win XP Prof. To run the ‘Form 24G Preparation Utility’, click on the ‘24GRPU.bat’ file.

If JRE is not installed on the computer, then on clicking ‘24GRPU.bat’, a message will be displayed. In such cases, install JRE and try again. If appropriate version of JRE is installed, then the ‘Form 24G Preparation Utility’ will be displayed.

15. What are the steps to download and install Form 24G Preparation Utility?

For assistance in downloading and using Form 24G Preparation Utility, please read the instructions provided in ‘Help’ in the Form 24G Preparation Utility. This utility can be used for preparation of Form 24G with upto 75,000 records. Form 24G Preparation Utility (version 1.2) should be used for regular and correction statements.

16. What is File Validation Utility (FVU)?

The AO should pass the Form 24G (Regular/Correction) file generated using Preparation Utility through the File Validation Utility (FVU) to ensure format level accuracy of the file. This utility is also freely downloadable from TIN website. In case the Form 24G contains any errors, the AO should rectify the same. After rectifying the errors, user should pass the rectified Form 24G

through the FVU. This process should be continued till an error-free Form 24G is generated. Form 24G (regular/correction) prepared from F.Y. 2005-06 onwards can be validated using this utility.

The Form 24G FVU is a Java based utility. JRE (Java Run -time Environment) [versions: SUN JRE: 1.4.2_02 or 1.4.2_03 or 1.4.2_04 or IBM JRE: 1.4.1.0] should be installed on the computer where the Form 24G FVU is being installed. JRE is freely downloadable from http://java.sun.com and http://www.ibm.com/developerworks/java/jdk or you can request your computer vendor (hardware) to install the same for you.

The Form 24G FVU setup comprises of two files, namely-

• Form 24G FVU.bat: This is a setup program for installation of FVU.

• Form 24G_FVU_STANDALONE.jar: This is the FVU program file.

These files are in an executable zip file (Form24GFVU.exe) (version 1.2). These files are required for installing the Form 24G FVU.

Instructions for extracting and setup are given in:

• Form 24G FVU Extract and Setup

17. After preparation of Form No. 24G statement through RPU, three files are generated when such statement passes through FVU. Is the AO required to take all three files in CD /Pen drive to TIN-FC?

When a valid file is passed through the FVU, the following three files are generated:-

(a) The upload file

(b) Form 24G statement Statistics Report and

(c) Form 24G.

Every Form 24G (upload file) mentioned at Sr. No. (a) is to be saved in CD and the same should be accompanied with the Statement Statistic Report mentioned at Sr. No. (b), in paper form duly signed by the Accounts Officer, which needs to be submitted at TIN-FCs.

Form 24G: Form 24G, at serial number (c) above, is a reader friendly format of TDS/TCS Book Adjustment form. This is like the physical form of Form 24G in html format. It contains all the details of Accounts Officer as well as Drawing and Disbursement Officer. There is no need to submit this file.

18. Can the Form 24G Statement be corrected?

Every Form 24G is to be prepared in accordance with the data structure prescribed by the Income Tax Department (ITD). If it does not confirm to the new data structure it will be rejected by TIN.

As per procedure, statements relating to Form 24G should be complete and correct. No fragmented statements are expected to be filed (i.e. separate statements giving details for deductions under different form type with respect to the same AIN, FY and month). However, any mistake made in an original accepted statement can be rectified by submitting a ‘correction statement’. For correction, the latest version of the RPU should be downloaded from TIN website.

Form 24G corrections can also be uploaded directly at the TIN website. For direct upload at TIN Central system, AO has to first register AIN at TIN website and upload the Form 24G correction.

19. What are the different kinds of correction statements allowed?

There are two different types of correction statements that can be furnished by the AO. These are listed below.

• M (Modify) -: For any modification in the existing Form 24G statement.

• X (Cancel) -: For cancellation of an existing Form 24G statement.

For preparation of correction statement, the receipt number of the original statement and receipt number of the previous statement is mandatory.

In case of first correction, PRN of original statement should be provided in field “Receipt number of Original Statement” and also in the field “Receipt number of Previous Statement “.

In case a correction statement has already been filed earlier, PRN of original statement should be provided in field “Receipt number of Original Statement” and PRN of last correction to be mentioned in field “Receipt number of Previous Statement”.

20. What is M –Type of Correction Statement?

This type of correction statement is to be furnished by AO, if it wishes to update any of its details like its name, address, Responsible person details, category, Ministry, State or deletion and addition of DDO (Drawing & Disbursing Officer) etc. Modifications in AIN (Account office

Identification Number), Financial Year and Month are not allowed.

There are three modes by which changes can be made in the DDO details provided in original Form 24G statement:

• Add: DDO records can be added to the original Form 24G statement

• Update: details of DDO (i.e. TAN, TAN Name, demographic and contact details, amount of tax deducted and remitted, nature of deduction) can be updated for the DDO records provided in original or subsequent correction statement

• Delete: DDO records provided in original Form 24G or subsequent correction statement can be deleted

M-type correction statement will always contain AO details and details of DDO which are added and/or deleted.

21. What is X–Type of Correction Statement?

This type of correction statement is to be furnished by AO if it wishes to cancel an existing Form 24G statement. Filing of Correction type X will allow AOs to file regular Form 24G for the same primary key (AIN, Financial year and Month) . This type of correction is to be filed only if the Form 24G has been filed with wrong AIN, F.Y. or Month.

22. What is BIN?

BIN stands for “Book Identification Number” for each form type mentioned in the accepted monthly form No. 24G. BIN consists of the following:

(i) Receipt Number: Receipt number is a seven digit unique number generated on successful acceptance of Form 24G.

(ii) DDO Serial Number: It is a five digit unique number generated for every DDO transaction reported in Form 24G statement.

(iii) Transfer Voucher Date: It is the last date of month for which Form 24G statement is filed.

BIN is required to be disseminated to the respective DDOs who in turn are required to report the same in the TDS/TCS Statement. The quoting of BIN has been made mandatory w.e.f 01st February, 2012. BIN is a unique number to verify the claim of TDS deposited without production of challan. As it is a verification key, it is advised that valid BIN disseminated by AO to the respective DDO should be correctly filled in TDS statement.

23. When is BIN generated?

On processing of accepted Form 24G statement, BIN is generated for each DDO record (with valid TAN) present in Form 24G statement. BIN are generated at TIN Central System and intimated to the PAOs with details of TAN and Form Type.

24. What do the PAO and DDO have to do with the BIN?

PAOs have to disseminate the BINS to respective DDOs. While preparing the quarterly TDS/TCS statement, DDO has to quote the said BIN details, if tax has been paid through transfer voucher (book adjustment).

BINs generated for a particular 24G are mailed to the AO on the e-mail id provided in Form 24G. In addition, AO may also download the BIN details through AO login at TIN site.

25. Under what circumstances will BIN be generated?

• BIN will be generated for valid TAN-DDO records added in Form 24G correction statement.

• BIN will be generated for DDO records where invalid TANs/TAN not present in Income Tax Department database is updated with a valid TAN.

• New BIN will not be generated for any update made in TAN name, demographic and contact details, amount of Tax deducted and remitted or nature of deduction.

• BIN details will not be generated for deleted DDO records.

26. What is the utility of BIN?

The BIN details and amount of TDS reported in the quarterly TDS/TCS Statement filed by the DDO will be matched with the respective details filed in Form No.24G filed by the PAO for verification purpose.

27. Are there instances where BIN details and amount of TDS reported in TDS/TCS statements do not match with that reported in Form 24G? What are the consequences of such mismatch?

(i) Instances of wrong/incorrect reporting of BIN by the DDOs in the TDS/TCS Statement have been observed. Reporting of incorrect BINs and corresponding amount in TDS statement will lead to mismatch with the respective amount as reported in the Form No. 24G. In this situation, the corresponding deductees may not get credit of the TDS/TCS. Therefore, the BIN as disseminated by the respective PAO should be reported correctly along with the corresponding amount in the TDS/TCS Statement filed by the DDOs.

(ii) In a number of cases, one distinct DDO has been found to be reported by more than one AO in the Form No. 24G for the same form type of TDS statement which is not a valid scenario. The DDOs and respective AOs are advised to reconcile the issue and one DDO should be mapped to one AO only for a particular form type for a particular month.

28. What are the duties of PAOs/DTOs/CDDOs?

i. To apply for AIN with jurisdictional TDS office. AIN application can be downloaded from TIN site.

ii. To obtain correct TAN from the reporting DDOs.

iii. To file Form No. 24G (in CD, DVD, Pen Drive), within 10 days from the end of the month, electronically either at TIN-FC or by direct online upload at TIN website.

iv. To track status of the filed Form No. 24G through TIN website.

v. To download Book Identification Number (BIN) generated on the basis of 24G statement.

vi. To disseminate BIN to the respective DDOs.

29. What are the duties of DDOs?

i. To provide correct TAN to their PAOs/DTOs/CDDOs to whom the DDO/Deductor reports the tax so deducted & who is responsible for crediting such sum to the credit of the Central Government.

ii. To report to PAOs/DTOs/CDDOs, the details of tax deducted and credited to the Central Government account through book adjustment.

iii. To quote BIN in the quarterly TDS/TCS Statement (24Q, 26Q, etc) for the tax deducted and credited through book adjustment.

30. What are the consequences of non-quoting of BIN details in quarterly TDS/TCS statement?

(a) BIN details and amount of TDS reported in the quarterly TDS/TCS Statement filed by the DDO will be matched with the details filed in Form No.24G filed by the PAO for verification purpose.

(b) Any wrong information reported by the DDOs in TDS/TCS Statement may lead to mismatch due to which credit to the respective deductee will not be available in the deductee’s Form 26AS.

(c) Further details are available at TIN website www.tin-nsdl.com and ITD website www.incometaxindia.gov.in.

***

ANNEXURE V

“Person Responsible for filing Form No. 24G in case of State Govt. Departments”

|

Type of Reporting of

|

Person Responsible (AIN

|

|

Book Entry

|

holder) for filing 24G.

|

|

A

|

PAO / DTO

|

|

B

|

PAO / DTO

|

|

C

|

PAO / DTO

|

|

D

|

PAO / DTO

|

|

E

|

CDDO

|

|

F

|

STO

|

|

AG

|

Accountant General

|

|

PAO

|

Pay & Accounts Officer

|

|

DTO

|

District Treasury Office

|

|

STO

|

Sub Treasury Office

|

|

DDO

|

Drawing & Disbursing Officer

|

|

CDDO

|

Cheque Drawing & Disbursing Officer

|

POINT NO.4.9 OF DRAFT CIRCULAR OF DEDUCTION OF TAX AT SOURCE FROM SALARIES U/S 192 OF THE INCOME TAX ACT, 1961 – FINANCIAL YEAR 2013-14 – PROCEDURE OF PREPARATION OF QUARTERLY STATEMENT OF DEDUCTION OF TAX UNDER SECTION 200(3) OF THE ACT

1. Quarterly e-TDS statement/return should be prepared by Deductor/DDO as per the data structure (File Format) prescribed by the DIT (Systems), Delhi which is available on TIN website www.tin-nsdl.com. Deductor/DDO can prepare e-TDS statement/return either by using in-house facilities, third party software or by using Return Preparation Utility (RPU) developed by NSDL e-Governance Infrastructure Limited (NSDL), which is freely downloadable from the TIN website.

After preparation of e-TDS statement/return, the Deductor/DDO is required to validate the same by using the File Validation Utility (FVU) which is freely available on TIN website.

2. Procedure of furnishing of e-TDS statement/return at TIN Facilitation Centres (TIN-FCs):

Once file is validated through FVU, ‘.fvu file’ is generated. Copy of this ‘.fvu file’ in CD/DVD/Pen Drive along with physical Form 27A duly filled and signed by the Deductor/DDO or by the person authorized by the Deductor/DDO, to be furnished at TIN-FC, an acknowledgement containing a unique 15 digit token number is provided to the Deductor/DDO. Deductor/DDO can view the status of e-TDS statement/return on TIN website.

Only one regular e-TDS statement/return for a ‘FY-Quarter-TAN-Form’ can be submitted.

2.1 Correction in e-TDS statements/returns:

Deductor/DDO can file a correction e-TDS statement/return for any modification in e-TDS statement/return accepted at TIN central system. Correction statement/return can be prepared by using the TDS consolidated file only, available at the CPC-TDS portal www.tdscpc.gov.in through TAN registration. Validation of correction statement/return is in line with regular e-TDS statement/return. The validated e-TDS correction statement/return (.fvu file) copied on a CD/DVD/pen drive is to be submitted along with the copy of provisional receipt of regular e-TDS statement/return, physical Form 27A duly signed and SSR at TIN-FC. On successful acceptance of correction e-TDS statement/return at the TIN-FC, an acknowledgement containing a unique 15 digit token no. is provided to the Deductor/DDO. Deductor/DDO can view the status of e-TDS statement/return on TIN website.

3. Procedure of preparation and furnishing of paper TDS statement/return at TIN-Facilitation Centres (TIN-FCs):

All statement/return in Form 24Q are required to be furnished in computer media except in case where the number of deductee records are equal to or less than 20. Paper statement/return duly filled and signed by the Deductor/DDO can be furnished at TIN-FC. On successful acceptance of paper statement/return at the TIN-FC, an acknowledgment containing a unique 15 digit token no. is provided to the Deductor/DDO. Deductor/DDO can view the status of paper statement/return on TIN website. No charges are applicable for paper TDS statement/return.

3.1 Correction in paper statements/returns:

The physical TDS statement/return is to be filed again in case of any correction to a physical TDS statement/return accepted at TIN. The deductor will submit the duly filled and signed physical TDS statement/return along with a copy of provisional receipt of regular paper statement/return at TIN-FC. On successful acceptance of correction paper statement/return at the TIN-FC, an acknowledgement containing a unique 15 digit token number is provided to the Deductor/DDO. Deductor/DDO can view the status of paper statement/return on TIN website.

4. Procedure of furnishing of e-TDS statement/return online at TIN website:

Deductor/DDO is required to procure Digital Signature Certificate (DSC) for online upload of e-TDS statement/return. After registration on TIN website, an authorization letter by the Deductor/DDO should be provided on the letter head of the organisation to NSDL. Once application is approved by NSDL, user ID is created and intimated to Deductor/DDO on their registered email ID provided at the time of registration. Preparation and validation of e-TDS statement is in line with regular e-TDS statement/return (submitted at TIN-FC).Deductor/DDO can login with its user ID and DSSC and upload the validated e-TDS file (.fvu file) generated by the FVU to the TIN website. On successful acceptance of e -TDS statement/return at TIN, an acknowledgement containing a unique 15 digit token no. and 8 digit receipt number is generated and displayed. There is no need to submit physical form 27A in online upload. Deductor/DDO can view the status of e-TDS statement/return on TIN website.

No charges are applicable for online upload of e-TDS statement/return.

4.1 Correction of e-TDS statement/return online at TIN website:

Deductor/DDO can file a correction e-TDS statement/return for any modification in e-TDS statement/return accepted at TIN central system. Correction statement/return can be prepared by using the TDS consolidated file only, available at the CPC-TDS portal www.tdscpc.gov.in through TAN registration. Preparation and validation of e-TDS statement is in line with regular e-TDS statement/return (submitted at TIN-FC) Deductor/DDO can login with its user ID and DSC and upload the validated e-TDS file (.fvu file) generated by the FVU to the TIN website. On successful acceptance of correction e-TDS statement/return at TIN, an acknowledgement containing a unique 15 digit token number is generated and displayed. There is no need to submit copy of provisional receipt of regular e-TDS statement/return, physical Form 27A and SSR in online upload. Deductor/DDO can view the status of e-TDS statement/return on TIN website.

5. For FAQs and further details, Deductors/DDOs are advised to log on website www.tin-nsdl.com

Para 2. Rates of Income-Tax as per Finance Act, 2013 [click here]

Para 3: Method of Tax Calculation – Broad Scheme of Tax Deduction at Source from Salaries

Stay connected with us via Facebook, Google+ or Email Subscription.

Subscribe to Central Government Employee News & Tools by Email [Click Here]

Follow us: Twitter [click here] | Facebook [click here] | Google+ [click here]

Admin

COMMENTS