Circular No.C- 157

To,

———————————————

———————————————

(All Heads of Department under Min. of Defence)

Subject: – Implementation of Govt. decision on the recommendations of

Seventh Central Pay Commission – Revision of provisions regulating

pension/gratuity/commutation of pension/family pension/disability

pension/ex-gratia lump-sum compensation, etc in respect of

civilians/Defence Civilians of Ministry of Defence and their families.

*****************************

The Govt. of India, Ministry of Personnel, Public Grievances &

Pensions, Deptt. of Pension & Pensioners’ Welfare in their O.M. No

38/37/2016-P&PW (A) (i) dated, the 4th August, 2016 have issued

orders for implementing Govt’s decision on the recommendations of

Seventh CPC revising provisions of pension/family pension/gratuity

with effect from 1-1-2016. With a view to implement the Govt.

decision, the following procedural changes are made in regard to

submission of family pension claims.

Deptt. of P&PW OM dated 4th August, 2016 referred to above, it has

been decided that all Family Pension claims shall be submitted to

this office in the revised LPC Cum Data Sheets enclosed as

Appendix-‘G’, ‘H’ and ‘J’ to this circular.

the existing procedure. Data Sheet viz- Appendix-‘H’ will be used for

issue of Corrigendum PPO of family pension.

respect of Govt. servants who retired/ died on or after 01.01.2016

and in whose cases PPOs have been issued, Data sheet viz.- Appendix- ‘J’ is introduced and enclosed to this circular alongwith

details instructions for filling up of the data sheet.

given effect for implementation as soon as Pay under Seventh CPC

is fixed and H.O.O. is in a position to initiate the pension cases on

the revised formats. However, no case on the old Data-sheets will be

accepted after 30-11-2016. It may please be noted that this is an

essential requirement for expeditious notification of pension/revision

of pension.

forwarded herewith for transmission of the same to the lower

formation/unit/HOO under your control. The unit/formation declared

as H.O.O. may be instructed to use the data sheets alongwith

supporting documents as per the revised procedure. Additional

copies of data sheets and instruction, if required, may please be

prepared/printed at your end for circulation. A copy of the instruction

issued by you to your unit/formation/HOO may please be endorsed

to this office.

www.pcdapension.nic.in)

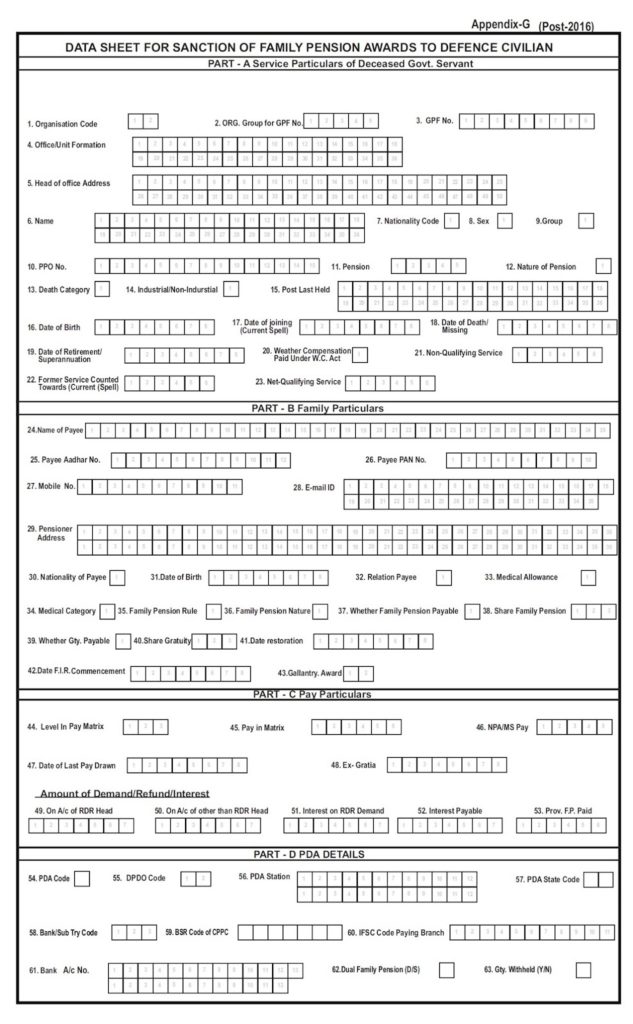

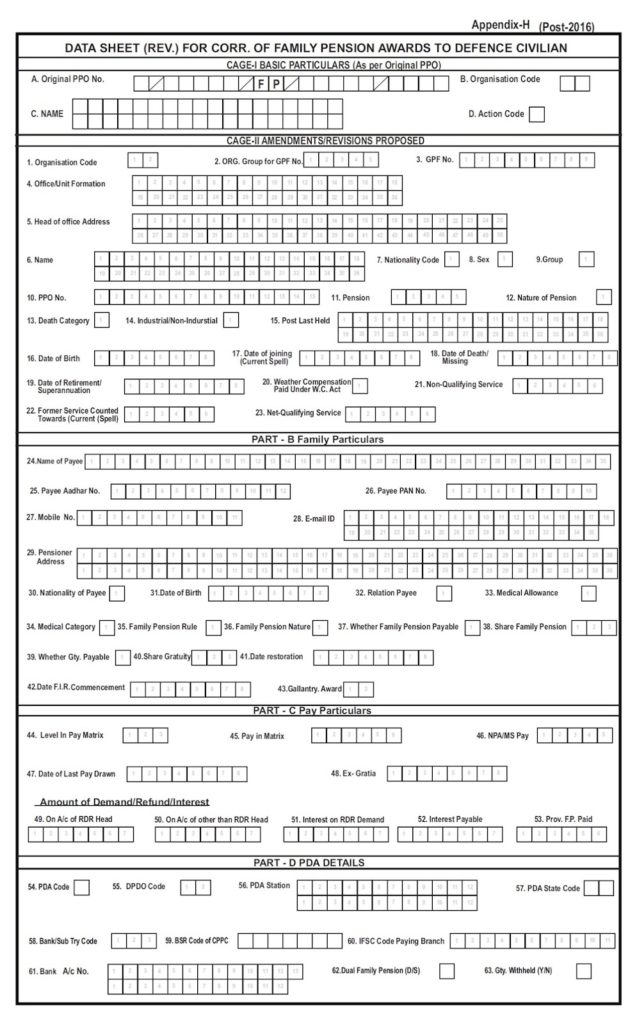

Appendix H (Post-2016)

|

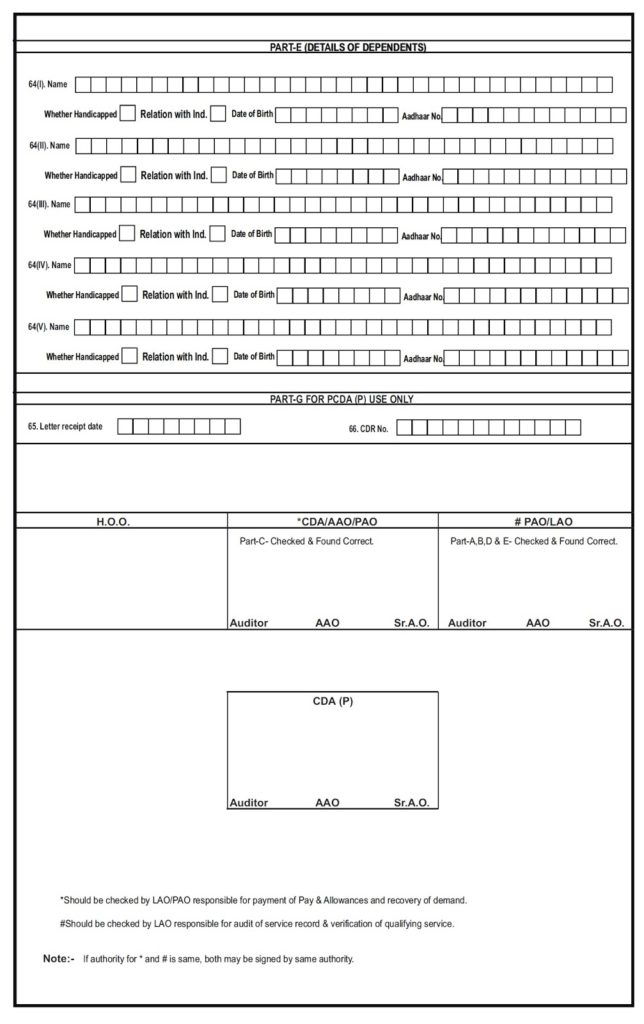

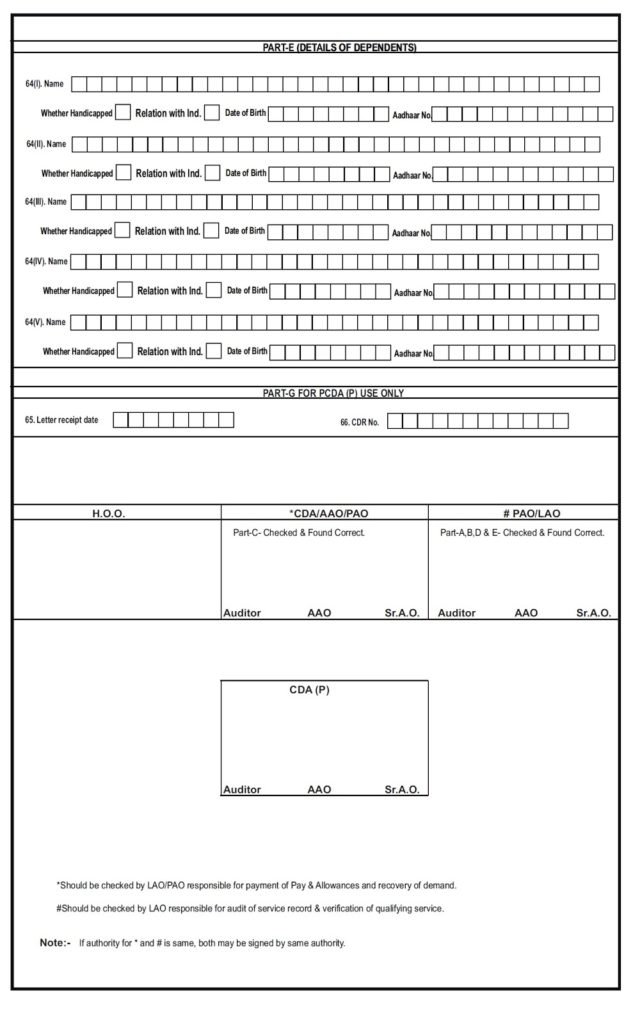

| Appendix H (Post-2016) Part E |

|

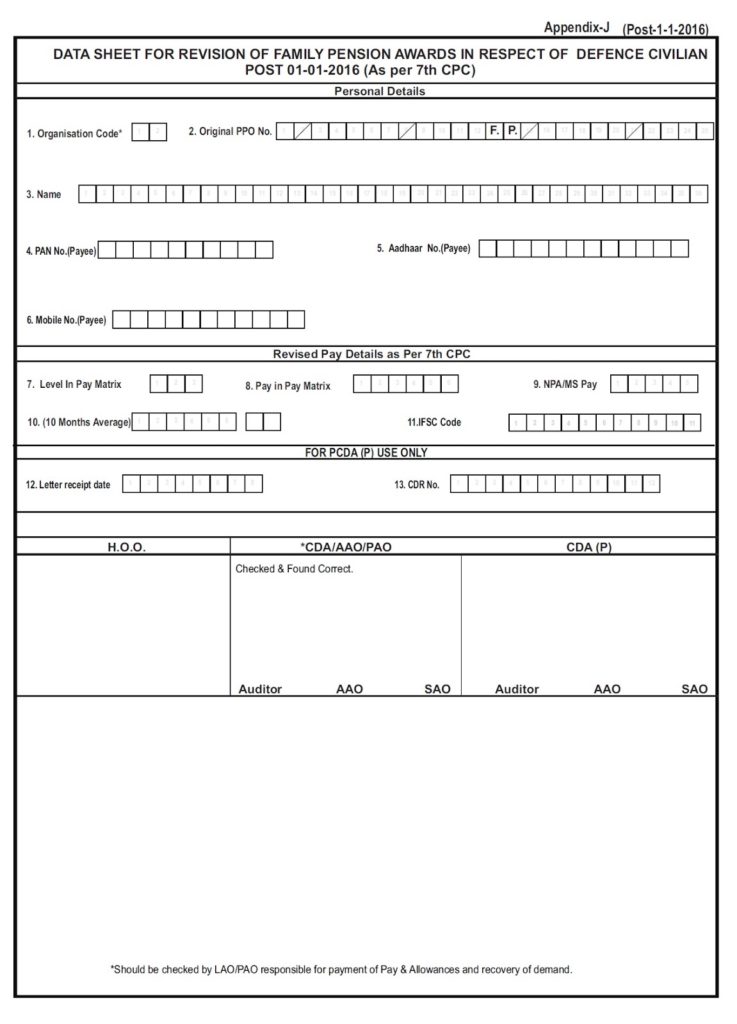

| Appendix J (Post-2016) |

COLUMN WISE INSTRUCTIONS FOR FILLING UP OF LPC CUM DATA

(Appendix-‘G’ Post-2016) SHEET FOR FAMILY PENSION AWARDS TO

DEFENCE CIVILIANS

Data Sheet.

Column 3(GPF-NO.)

GPF NO. is less than 9 characters it should be prefixed by sufficient no of

zeros to make it of 9 characters.

individual.

in this column. One box may be left blank between first, middle and

surname etc.

officer/staff, ‘C’ for Group C staff.

cases, where the death occurs after the date of retirement.

pensioner from the original PPO/Corr. PPO (for post retiree cases.)

with the Annexure –3 ( for the post retiree cases)

| Category | Code |

| For ordinary F.P. | A |

| For F.P. under E.O.P. rules |

E |

| For FP under liberalised Pensionary | L |

| Awards in Special cases | |

| For FP in r/o missing employee |

M |

| For F.P. in cases of death after retirement |

R |

box may be left blank between first middle and Last .

birth is not available therein, the matriculation certificate may be relied

upon for this information.

| 0 | 5 | 0 | 2 | 2 | 0 | 0 | 8 |

column.

in this column. In case of missing employee the date of missing as shown in the

FIR should be filled in this column.

paid, then this column is to be filled in as “Y” otherwise “N”.

be verified from the Service Book.

pensionary benefits may be filled in this column

and 12 days; the same will be completed as under.

| 0 | 1 | 0 | 3 | 1 | 2 |

Service Book. On space may invariably be left blank between first,

middle and last portions of the name.

| Nationality | Code |

| Indian | I |

| Nepalese | N |

| Bhutanese | B |

may be entered in this column. The data will be filled as under:

| Relation | Code |

| Wife | W |

| Husband | H |

| Son | S |

| Daughter | D |

| Divorced Daughter | R |

| Unmarried Daughter | U |

| Widowed Daughter | V |

| Mother | M |

| Father | F |

| Brother | B |

| Sister | T |

filled with alphabetical code “H”.

then it should be filled as

| 1 | 0 | 3 |

| 2 | 0 | 3 |

| 1 | 0 | 1 |

continuance of F.P. In case of missing pensioners/employee the date of

F.I.R. and in case of continuance of family pension the date of

commencement of family pension should be filled in this column. In other

cases this Column should be left blank.

different Gallantry Awards in Annexure-5 to the Data Sheet. In first box

gallantry awards code and in second box bar code will be filled.

If Level In Pay Matrix is less than 3 characters it should be prefixed by

sufficient no of zeros to make it of 3 characters.

| L | 0 | 1 |

| A | 1 | 3 |

of retirement should be filled in this Column. In no case it should be left

blank or filled with zeroes.

practicing allowance drawn at the time of retirement should be filled in this

Column. In case of MNS LOCAL Officers, MS PAY drawn at the time of

retirement should be filled in this Column.

individual.

Interest on RDR Demand)

pensionary benefits.

disbursing agencies.

| PDA | CODE |

| DPDO | 1 |

| Post Office | 2 |

| Treasury | 3 |

| Indian Embassy, Nepal | 4 |

| PAO | 5 |

| Directorate of Accounts, Panaji, Goa | 6 |

| Finance Secretary, Gangtok | 7 |

| Political Officer, Thimpu | 8 |

| Public Sector Banks | 9 |

i.e. the officer desires to draw his pension from DPDO. A list of codes for

all the DPDOs is given in the Annexure-6 to the Data Sheet. The

appropriate code for the DPDO concerned may be ascertained and filled

in this column.

DPDO, Gurgaon Column 30 will be filled as under

| 1 | 8 |

desires to draw his pension from a Sub Treasury, then it should be filled Sub

between Sub Treasury name and PDA station.

| M | E | J | A | A | L | L | A | H | A | B | A | D |

entered in this column. Alphabetic codes assigned to various states as

per Annexure-7 to the Data Sheet may be used to fill up this column.

shown in Annexure-8 to the Data Sheet may be used to fill up this

column. Abbreviation of sub treasury as SUB may filled up in this

column, if the individual desires to draw his pension from a sub treasury.

cheque for verifying Bank A/c no. and IFSC code.

column. Example: If the account number of the officer is SB/4502 It

should be filled as under

filled in this field otherwise the code ‘S’ should be filled in this field. ‘D’ denotes

for Double and ‘S’ for single.

the Dual family pension will not be notified/processed through Civil

pension Data Sheets. Such cases will be processed through Civil F. P. Data

sheets. Where employee retired before 24/09/2012, before processing of

Dual F. P. case through civil pension Data sheets it may be ensured that the

individual was alive on 23/09/2012.

this column Ý’ should be filled otherwise it should be filled with ‘N’.

gratuity is not to be withheld for the purpose of recovery of outstanding

Government dues.

columns. One box may be left blank between first middle and surname

etc.

child otherwise it should always be filled with “N” and in no case it should

be left blank.

| RELATION | RELATIONSHIP CODE |

| Son | S |

| Daughter | D(less 25 year) |

| Divorced | Daughter R |

| Unmarried Daughter | U(above 25 year) |

| Widowed Daughter | V |

| Mother | M |

| Father | F |

| Brother | B |

| Sister | T |

COLUMN WISE INSTRUCTIONS FOR FILLING UP OF LPC CUM

DATA(Appendix-‘H’ Post-2016) SHEET FOR CORR FOR FAMILY PENSION OF

DEFENCE CIVILIANS

(organisation Code) and Column C (name of pensioner) will be invariably completed in

all cases while initiating a Corr claim on data sheet.

reproduced in cage II with suitable changes here and there. It should be kept in mind

for strict compliance that only affected Column (s) in cage II will be filled while initiating

a Corrigendum Claim. All other column should be left blank

COLUMN WISE INSTRUCTIONS FOR FILLING UP OF LPC CUM

DATA(Appendix-‘J’ Post-2016) SHEET FOR REVISION OF PENSIONARY

AWARDS IN R/O OF FAMILY PENSION OF DEFENCE CIVILIANS POST 01-01-2016 (AS PER 7TH CPC)

Sheet.

this column. One box may be left blank between first, middle and

surname etc.

sufficient no of zeros to make it of 3 characters.

| L | 0 | 1 |

| A | 1 | 3 |

of retirement should be filled in this Column. In no case it should be left

blank or filled with zeroes.

practicing allowance drawn at the time of retirement should be filled in this

Column. In case of MNS LOCAL Officers, MS PAY drawn at the time of

retirement should be filled in this Column.

non-practicing allowance(NPA)/MS Pay actually drawn by the individual

during the last 10 months period preceding the date of his retirement will

be shown in this Column.

should not be left blank.

cheque for verifying bank A/c No. and IFSC Code (Applied only for bank

pensioner)

Annexure-1

| org_no | org_code |

| 01 | FYS |

| 02 | AOC |

| 03 | ENG |

| 04 | AOC |

| 05 | AOC |

| 06 | MISC |

| 07 | MISC |

| 08 | MISC |

| 09 | MISC |

| 10 | NAVY |

| 11 | AF |

| 12 | GREF |

| 13 | DAD |

| 14 | MISC |

| 15 | GREF |

| 16 | MISC |

| 17 | MISC |

| 18 | CGO |

| 19 | MISC |

| 20 | MISC |

Annexure-2

| organisation | grp_code |

| AIR FORCE | AF |

| ARMY HEAD QUARTERS | AHQ |

| ARMY SUPPLY CORPS | ASC |

| COAST GUARD | CGO |

| DEFENCE ACCOUNTS DEPARTMENT | DAD |

| ELECTRICAL MECHANICAL ENG | EME |

| FACTORIES | FYS |

| GREF | GREF |

| MILITARY ENGINEERING SERVICES | MES |

| MISCELLANEOUS | MISC |

| MNS(LOCAL) | MNS |

| NAVY | NAVY |

| NCC(OFFICERS) | NCC |

| ORDNANCE DEPOT | AOC |

| PRE COMPULSORY(GPF UPTO 65999) | COMP |

| RESEARCH AND DEVELOPMENT | RDE |

| TECHNICAL DEVELOPMENT EST | TDE |

Annexure-3

| DEPTCODE_V | NATUREOFPENSION_V |

| A | COM ALLOWANCE |

| C | COMPULSORY |

| D | DISCIPLAINARY |

| E | SUP (EXTENDED) |

| G | COMPENSATION |

| I | INVALID |

| K | RETIRING |

| L | SUP(LATE) |

| P | PRO RATA |

| Q | RETIRING |

| R | RETIRING |

| S | SUPERANNUATION |

| V | VOLUNTARY |

ANNEXURE A4

| Pay Level | Pay Code |

| 1 | L01 |

| 2 | L02 |

| 3 | L03 |

| 4 | L04 |

| 5 | L05 |

| 6 | L06 |

| 7 | L07 |

| 8 | L08 |

| 9 | L09 |

| 10 | L10 |

| 11 | L11 |

| 12 | L12 |

| 13 | L13 |

| 13A | A13 |

| 14 | L14 |

| 15 | L15 |

| 16 | L16 |

| 17 | L17 |

| 18 | L18 |

Annexure-5

| gall_code | gall_award_name |

| A0 | Ashok Chakra |

| A1 | Ashok Chakra with one Bar |

| A2 | Ashok Chakra with two Bar |

| A3 | Ashok Chakra with three Bar |

| G0 | Sena medal for gallantry |

| G1 | Sena medal for gallantry with One B |

| G2 | Sena medal for gallantry with Two B |

| G3 | Sena medal for gallantry with Three |

| K0 | Kirti Chakra |

| K1 | Kirti Chakra with one Bar |

| K2 | Kirti Chakra with two Bar |

| K3 | Kirti Chakra with three Bar |

| M0 | Maha Vir Chakra |

| M1 | Maha Vir Chakra with one Bar |

| M2 | Maha Vir Chakra with two Bar |

| M3 | Maha Vir Chakra with three Bar |

| P0 | Param Vir Chakra |

| P1 | Param Vir Chakra with one Bar |

| P2 | Param Vir Chakra with two Bar |

| P3 | Param Vir Chakra with three Bar |

| S0 | Shaurya Chakra |

| S1 | Shaurya Chakra with one Bar |

| S2 | Shaurya Chakra with two Bar |

| S3 | Shaurya Chakra with three Bar |

| T0 | Tat Rakshak Medal |

| T1 | President Tatrakshak Medal |

| V0 | Vir Chakra |

| V1 | Vir Chakra with one Bar |

| V2 | Vir Chakra with two Bar |

| V3 | Vir Chakra with three Bar |

| FS | FIRE SERVICE MEDAL |

Annexure-6

| dpdoCode | dpdoName |

| 1 | CHANDIGARH |

| 2 | RED-FORT-I |

| 3 | RED-FORT-II |

| 4 | BRAR SQUARE |

| 5 | HYDERABAD |

| 6 | SECUNDERABAD |

| 7 | PALAMPUR |

| 8 | HAMIRPUR |

| 9 | DHARAMSHALA |

| 10 | YOL |

| 11 | MANDI |

| 12 | SIMLA |

| 13 | KARNAL |

| 14 | AMBALA |

| 15 | BHIWANI |

| 16 | JHAJHAR |

| 17 | SONEPAT |

| 18 | GURGAON |

| 19 | ROHTAK |

| 20 | NARNAUL |

| 21 | HISSAR |

| 22 | REWARI |

| 23 | AKHNOOR ROAD JAMMU |

| 25 | JAMMU-CANTT(SHASTRI NAGAR) |

| 26 | UDHAMPUR |

| 27 | SRINAGAR |

| 28 | RAJOURI |

| 29 | LEH |

| 30 | BANGLORE |

| 31 | ERNAKULAM |

| 32 | KOTTAYAM |

| 33 | TRICHUR |

| 34 | TRIVENDRUM |

| 35 | KOLLAM |

| 36 | AMRITSAR |

| 37 | KAPUTHALA |

| 38 | BATALA |

| 39 | LUDHIANA |

| 40 | MOGA |

| 41 | JULLUNDHER |

| 42 | JAGRAON |

| 43 | PATIALA |

| 44 | BHATINDA |

| 45 | ROPAR |

| 46 | HOSHIARPUR |

| 47 | FEROZEPUR |

| 48 | SANGRUR |

| 49 | PATHANKOT |

| 50 | GURDASPUR |

| 51 | JAIPUR |

| 52 | CHENNAI |

| 53 | VELLORE |

| 54 | MEERUT |

| 55 | KANPUR |

| 56 | GORAKHPUR |

| 57 | ALLAHABAD |

| 58 | KOLKATA |

| 59 | UNA |

| 60 | PATHANAMTHITTA |

| 61 | JHUNJHUNU |

| 62 | DASUYA |

| 63 | VISHAKHAPATNAM |

| 64 | DEHRADUN |

| 65 | SUBTRO PARK |

| 66 | KANNUR |

Annexure-7

| state_code | state_name |

| AN | ANDAMAN & NICOBAR ISLA |

| AP | ANDHRA PRADESH |

| AR | ARUNACHAL PRADESH |

| AS | ASSAM |

| BH | BHUTAN |

| BI | BIHAR |

| CG | CHHATTIS GARH |

| CH | CHANDIGARH |

| DE | DELHI |

| DN | DADAR & NAGAR HAVELI |

| GD | GOA, DAMAN & DIU |

| GU | GUJARAT |

| HA | HARYANA |

| HP | HIMACHAL PRADESH |

| JK | JAMMU & KASHMIR |

| JR | JHARKHAND |

| KA | KARNATAKA |

| KE | KERALA |

| LD | LANKSHADWEEP |

| MA | MAHARASHTRA |

| ME | MEGHALAYA |

| MN | MANIPUR |

| MP | MADHYA PRADESH |

| MZ | MIZORAM |

| NA | NAGALAND |

| NE | NEPAL |

| OR | ORISSA |

| PB | PUNJAB |

| PO | PONDICHERY |

| RS | RAJASTHAN |

| SK | SIKKIM |

| TL | TELANGANA |

| TN | TAMILNADU |

| TR | TRIPURA |

| UP | UTTAR PRADESH |

| UR | UTTARAKHAND |

| WB | WEST BENGAL |

Annexure-8

| bankCode | bankName |

| ALB | ALLAHABAD BANK |

| ANB | ANDHRA BANK |

| BOB | BANK OF BARODA |

| BOI | BANK OF INDIA |

| BOM | BANK OF MAHARASHTRA |

| CBI | CENTRAL BANK OF INDIA |

| CNB | CANARA BANK |

| COB | CORPORATION BANK |

| DEB | DENA BANK |

| HDF | HDFC BANK |

| ICI | ICICI BANK |

| IDB | IDBI BANK |

| INB | INDIAN BANK |

| IOB | INDIAN OVERSEAS BANK |

| OBC | ORIENTAL BANK OF COMMERCE |

| PNB | PUNJAB NATIONAL BANK |

| PSB | PUNJAB AND SINDH BANK |

| SBB | STATE BANK OF BIKANER AND JAIPUR |

| SBD | STATE BANK OF INDORE |

| SBH | STATE BANK OF HYDERABAD |

| SBI | STATE BANK OF INDIA |

| SBM | STATE BANK OF MYSORE |

| SBP | STATE BANK OF PATIALA |

| SBS | STATE BANK OF SAURASHTRA |

| SBT | STATE BANK OF TRAVANCORE |

| SYB | SYNDICATE BANK |

| UBI | UNION BANK OF INDIA |

| UCO | UNITED COMMERCIAL BANK |

| UTB | AXIS BANK |

| UTI | UNITED BANK OF INDIA |

| VJB | VIJAYA BANK |

Annexure-9

| LINK_BSR | bankCode |

| 0004464 | SBI |

| 0004465 | SBI |

| 0004466 | SBI |

| 0004467 | SBI |

| 0004468 | SBI |

| 0004469 | SBI |

| 0004470 | SBI |

| 0004471 | SBI |

| 0004472 | SBI |

| 0004473 | SBI |

| 0004475 | SBI |

| 0004476 | SBI |

| 0004477 | SBI |

| 0010385 | SBI |

| 0111009 | SBH |

| 0120689 | SBM |

| 0130772 | SBP |

| 0150908 | SBT |

| 0170878 | SBB |

| 0203244 | BOB |

| 0212424 | ALB |

| 0223222 | BOI |

| 0231471 | BOM |

| 0242962 | CNB |

| 0261721 | INB |

| 0272409 | IOB |

| 0283760 | CBI |

| 0293137 | UBI |

| 0306377 | PNB |

| 0306378 | PNB |

| 0306379 | PNB |

| 0306380 | PNB |

| 0306381 | PNB |

| 0306382 | PNB |

| 0306383 | PNB |

| 0306384 | PNB |

| 0306385 | PNB |

| 0306386 | PNB |

| 0311690 | UTI |

| 0322345 | UCO |

| 0332440 | SYB |

| 0341400 | ANB |

| 0351119 | COB |

| 0391167 | VJB |

| 0510645 | HDF |

| 6360002 | UTB |

COMMENTS