CSD Purchasing Process, Eligibility FAQ – AFD Items Car, Motorcycle, TV, Refrigerator, Washing machine etc.

AGAINST FIRM DEMAND (AFD)

Can I purchase all models of AFD-I items (TV, refrigerator, AC etc) through CSD Depots?

No, only models listed in CSD are available through CSD.

A new bike/car/television/refrigerator model was launched yesterday.

Can I buy it through CSD? If not, how long will it take for the item to

become available through CSD?

Can I buy it through CSD? If not, how long will it take for the item to

become available through CSD?

All items available in CSD stores go through a strict evaluation process to

ensure quality and optimum pricing. Unfortunately, this means that

newly-launched products will not be immediately available through CSD.

However, the item will be available in CSD stores after a minimum time

period of three to four months.

ensure quality and optimum pricing. Unfortunately, this means that

newly-launched products will not be immediately available through CSD.

However, the item will be available in CSD stores after a minimum time

period of three to four months.

How often can I buy a new television/refrigerator/washing machine

etc?

etc?

All CSD consumers can purchase these items once in three years.

I am an Ex-Serviceman – am I eligible to buy a 4 wheeler through

CSD?

CSD?

Yes, CSD welcomes the patronage of ex-servicemen under certain conditions.

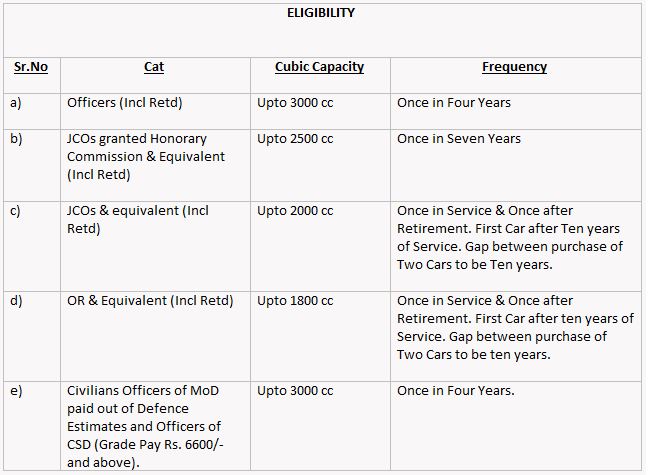

What are the conditions for purchasing a 4 wheeler through CSD?

The following conditions must be met for purchasing a 4 wheeler through

CSD:

CSD:

Are all military personnel entitled to purchase 2 wheelers?

Certainly, CSD offers 2 wheelers to every category of the Armed Forces.

However, a 2 wheeler can only be purchased every three years.

However, a 2 wheeler can only be purchased every three years.

Do I need any special sanctions in order to purchase a 2 or 4

wheeler?

wheeler?

If so, how do I obtain them? For the convenience of the CSD consumer, no

sanction has been placed on the purchase of 2 wheelers. The centralised Car

sanction by CS Dte has been discontinued w.e.f. 20 Jul 2015.

sanction has been placed on the purchase of 2 wheelers. The centralised Car

sanction by CS Dte has been discontinued w.e.f. 20 Jul 2015.

Why does the same item have differing costs in different CSD

depots?

depots?

Unfortunately, CSD is unable to keep costs consistent throughout the

country due to differing tax structures of different states.

country due to differing tax structures of different states.

Are tax benefits available to CSD customers in all states?

Unfortunately, tax benefits are not available in all states. Some states

have granted full exemption while others have given certain concessions.

have granted full exemption while others have given certain concessions.

Which states offer full tax exemption on VAT?

The states of Gujarat, Tamil Nadu, Jharkhand and Uttar Pradesh have granted

full tax exemption to CSD while the Punjab, Haryana, Madhya Pradesh etc

have granted certain tax concessions.

full tax exemption to CSD while the Punjab, Haryana, Madhya Pradesh etc

have granted certain tax concessions.

COMMENTS

no, your registration process will only tell you wrong grossery card. & you will fail to crate login id, finally you will end-up with cash purchase…

I am a civilian Defence Pensioner & holding smart csd card.let me know if I can buy two wheeler from canteen and procedure. Who will verify & sign documents may also please be clarified .

Is this correct way to

http://foujiadda.com/2018/06/16/procedure-to-buy-car-through-csd-canteen/

buy CAR FROM CSD.

Respected Sir

Whether MES Civilians employees are entitled for these facilities

I have the same question