IT Circular No. 4 – No extension in due date for filing Income Tax Return

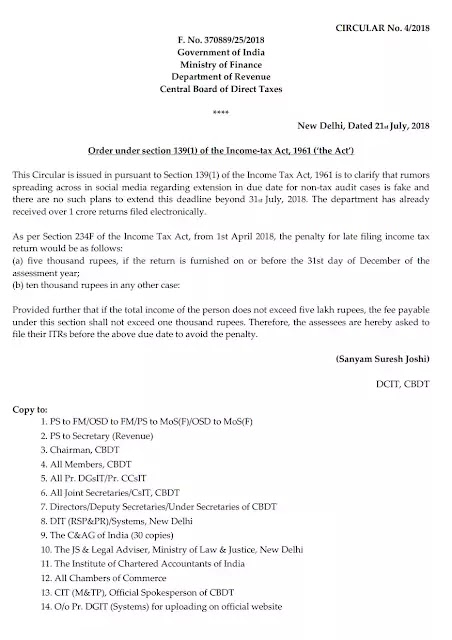

CIRCULAR No.4/2018

F.No.370889/25/2018

Government of India

Ministry of Finance

Department of Revenue

Central Board of Direct Taxes

New Delhi,

Dated 21st July, 2018

Order under section 139(1) of the Income-tax Act, 1961 (‘the Act’)

This Circular is issued in pursuant to 139(1) of the Tax Act, 1961 is to clarify that rumours spreading across in media regarding extension in due date for non-tax audit is fake and no such plans to extend this deadline beyond 31st July, 2018. The department already received over 1 crore returns filed electronically.

As per Section 234F of the Income Tax Act, from 1st April 2018, the penalty for late filing income tax return would be as

(a) five thousand rupees, if the return is furnished on or the 31st day of December of the assessment year;

(b) ten thousand rupees in any other case:

Provided further that if the total income of the person not exceed five lakh rupees, the fee payable under this section shall not exceed one thousand rupees. Therefore, the assessees are hereby asked to file their ITRs before the due date to avoid the penalty.

(Sanyam Suresh Joshi)

DCIT, CBDT

COMMENTS