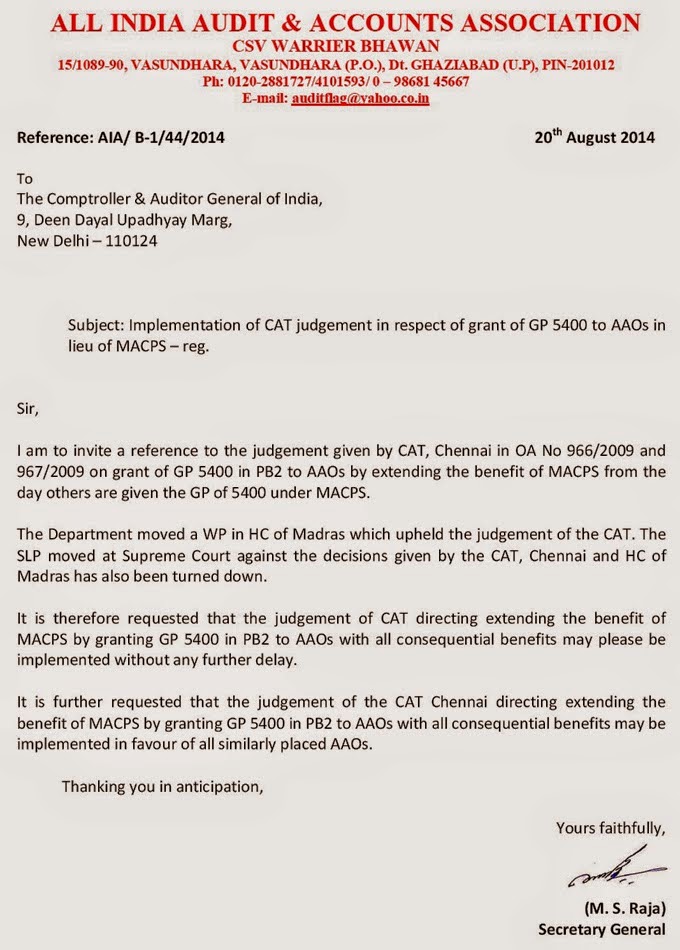

Implementation of CAT Judgement in respect of grant of GP 5400 to AAOs in lieu of MACPS – Regarding:

ALL INDIA AUDIT & ACCOUNTS ASSOCIATION

C SV WARRIER BHAWAN

Reference: AIAI 34/44/2014

20th August 2014

To

The Comptroller & Auditor General of India,

9, Deen Dayal Upadhyay Marg,

New Delhi – 110124

Subject: Implementation of CAT judgement in respect of grant of GP 5400 to AAOs in lieu of MACPS – reg.

Sir,

I am to invite a reference to the judgement given by CAT, Chennai in OA No 966/2009 and 967/2009 on grant of GP 5400 in PB2 to AAOs by extending the benefit of MACPS from the day others are given the GP of 5400 under MACPS.

The Department moved a WP in HC of Madras which upheld the judgement of the CAT. The SLP moved at Supreme Court against the decisions given by the CAT, Chennai and HC of Madras has also been turned down.

It is therefore requested that the judgement of CAT directing extending the benefit of MACPS by granting GP 5400 in PB2 to AAOs with all consequential benefits may please be implemented without any further delay.

It is further requested that the judgement of the CAT Chennai directing extending the benefit of MACPS by granting GP 5400 in PB2 to AAOs with all consequential benefits may be implemented in favour of all similarly placed AAOs.

Thanking you in anticipation,

Yours faithfully,

(M. S. Raja)

Secretary General

Source: http://auditflag.blogspot.in/

Similar communication by National Audit Federation:-

NATIONAL AUDIT FEDERATION

(Recognised by C&AG of India vide No. 193/NGE(JCM)27-2006 dated 08.06.2007)

K-42, B.K. Dutt Colony, Jorbagh Lodi Colony, New Delhi – 3

No. NAF/2014-16/25

Dated : 05 September 2014

To

The Comptroller and Auditor General of India,

9 – Deen Dayal Upadyay Marg, New Delhi – 110124

Sub: Implementation of CAT, Chennai Bench orders – extending benefit of MACP scheme to applicants – fixing of Grade Pay at `5400 to applicants – reg.

Ref: Pr.AG(A&E)/Estt.I/Gl.VI/2014-15/194 dated 28-08-2014 of Pr. AG(A&E), Tamil Nadu, Chennai.

Sir,

Kind attention is invited to the reference cited wherein it was ordered to extend the benefit of MACP scheme by fixing the Grade Pay of the applicants in OAs 966 and 967 filed at Central Administrative Tribunal (CAT), Chennai Bench in 2009 at `5400 with effect from 1-09-2008, the date on which any one of the private respondents in the said OAs was placed in GP of `5400 under MACP scheme.

Some of the Assistant Accounts Officers drawing Grade Pay of `4800, aggrieved on granting of Grade Pay of `5400 to Senior Accountants subordinate to them in the Principal Accountant General (A&E), Chennai, Tamil Nadu by virtue of the implementation of Modified Assured Career Progression scheme introduced in the year 2008 approached the Honorable CAT, Chennai Bench to quash the office memorandum wherein such benefit was extended to the private respondent. Honorable CAT, observed that ‘the private respondents who are functioning inferior than the applicants and who are not even qualified to be promoted to the post held by the applicants are given higher pay scale in the guise of implementation of the scheme which is unsustainable in law’. Further both the OAs were disposed in the terms that; “There will be a direction to the respondents to grant the revised pay to the applicants by extending the benefit of MACP Scheme in favour of the applicants by fixing their grade pay at Rs.5400/- from the date on which the said benefit was extended to the private respondents and to disburse the accrued arrears, if any, to the applicants within a period of four weeks from the date of receipt of copy of this order”. The directions of CAT were upheld by the Honorable High Court of Madras and later on the SLP filed by CAG at the Apex Court was also dismissed and hence the office order cited was issued.

The Assistant Accounts Officers of Chennai office had expended huge amounts for arbitration upto the Supreme Court of India. By making the said judgment applicable to the original applicants only, similarly placed employees may be constrained to approach Courts of Law for getting the benefits extended to them also. Several judgments have been pronounced by the Hon’ble Supreme Court of India to avoid multiplicity of litigation. Some of such judgments are cited below for kind information:-

(i) The Apex court in the case of Amrit Lal Berry v. CCE, (1975) 4 SCC, held as under:-

“We may, however, observe that when a citizen aggrieved by the action of a government department has approached the Court and obtained a declaration of law in his favour, others, in like circumstances, should be able to rely on the sense of responsibility of the department concerned and to expect that they will be given the benefit of this declaration without the need to take their grievances to court”.

(ii) In Inder Pal Yadav v. Union of India, (1985) 2 SCC 648, the Apex Court has held as under:-

“….. those who could not come to the court need not be at a comparative disadvantage to those who rushed in here. If they are otherwise similarly situated, they are entitled to similar treatment, if not by anyone else at the hands of the Court”.

(iii) The V Central Pay Commission in its recommendation, in regard to extension of benefit of court judgment to similarly situated, held as under:-

“126.5 – Extending judicial decisions in matters of a general nature to all similarly placed employees. – We have observed that frequently, in cases of service litigation involving many similarly placed employees, the benefit of judgment is only extended to those employees who had agitated the matter before the Tribunal/Court. This generates a lot of needless litigation. It also runs contrary to the judgment given by the Full Bench of Central Administrative Tribunal, Bangalore in the case of C.S. Elias Ahmed and others v. UOI & others (O.A. No. 451 and 541 of 1991), wherein it was held that the entire class of employees who are similarly situated are required to be given the benefit of the decision whether or not they were parties to the original writ. Incidentally, this principle has been upheld by the Supreme Court in this case as well as in numerous other judgments like G.C. Ghosh v. UOI, [(1992) 19 ATC 94 (SC)], dated 20-07-1998; K.I. Shepherd v. UOI [(JT 1987 (3) SC 600)]; Abid Hussain v. UOI [(JT 1987 (1) SC 147], etc. Accordingly, we recommend that decisions taken in one specific case either by the judiciary or the Government should be applied to all other identical cases without forcing the other employees to approach the court of law for an identical remedy or relief. We clarify that this decision will apply only in cases where a principle or common issue of general nature applicable to a group or category of Government employees is concerned and not to matters relating to a specific grievance or anomaly of an individual employee”.

(iv) In the case of Uttaranchal Forest Rangers’ Association (Direct Recruit) v. State of U.P., (2006) 10 SCC 346, the Apex court has referred to the decision in the case of State of Karnataka v. C Lalitha (2006) 2 SCC 747 as under:-

“29. Service jurisprudence evolved by this Court from time to time postulates that all persons similarly situated should be treated similarly. Only because one person has approached the court that would not mean that persons similarly situated should be treated differently”.

I, therefore, request the Honorable Comptroller and Auditor General of India to issue directions to implement the above judgment in its letter and spirit to all similarly placed Officers in IA&AD with effect from 1-09-2008 in order to uphold the observations of the Apex Court, another Constitutional Authority, on the above well settled law point. This will also help the employees to avoid unnecessary litigations, expenditure and to concentrate on their assigned duties.

Yours faithfully,

(LS Sujith Kumar)

Secretary General

www.naf.zoomshare.com/0.html

Stay connected with us via Facebook, Google+ or Email Subscription.

Subscribe to Central Government Employee News & Tools by Email [Click Here]

Follow us: Twitter [click here] | Facebook [click here] | Google+ [click here]

Admin

COMMENTS