Category: INCOME TAX

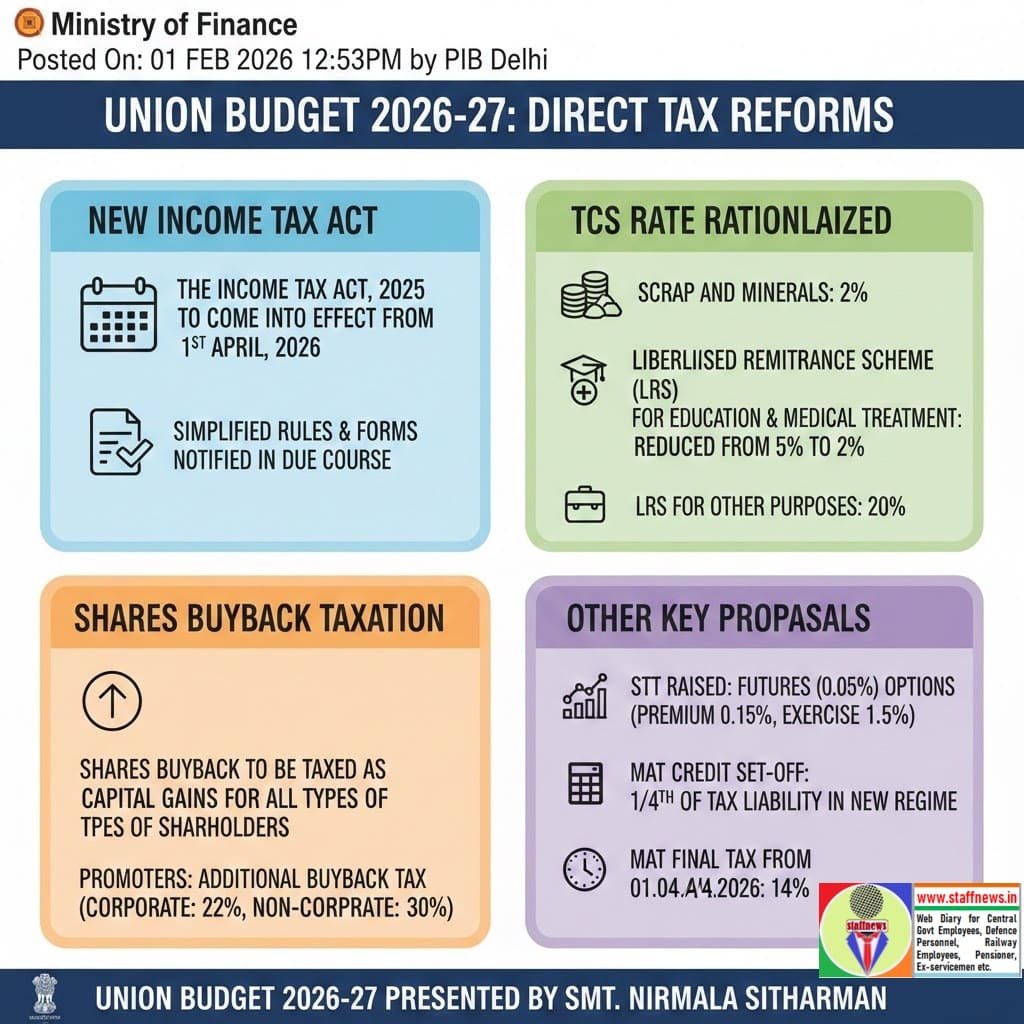

Union Budget 2026-2027 – Tax reforms: Income Tax Act, 2025 w.e.f. 01 Apr 2026, TCS Rates, Share buyback etc

Union Budget 2026-2027 - Tax reforms: Income Tax Act, 2025 w.e.f. 01 Apr 2026, TCS Rates, Share buyback etc: Ministry of Finance

Ministry of Finance

[...]

Changes in accounting of POSB TDS transactions – SB Order No. 16/2025

Changes in accounting of POSB TDS transactions - SB Order No. 16/2025 dated 02.12.2025

SB Order No. 16/2025

No. FS-16/2/2024-FS-DOP

Government of I [...]

Income Tax Deduction from salaries during the F.Y. 2025-26 – Submission of Form 12BB i.e., particulars of claims for deduction of tax

Income Tax Deduction from salaries during the F.Y. 2025-26 U/s 192 of the Income Tax Act 1961 - Submission of Form 12BB i.e., particulars of claims fo [...]

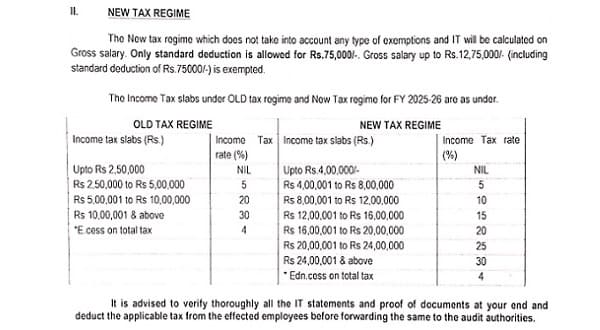

Deduction of Income Tax and Submission of IT Statements for FY 2025-26

Deduction of Income Tax and Submission of IT Statements for FY 2025-26: CDA, Secunderabad Order dated 15.09.2025

OFFICE OF THE CONTROLLER OF DEFENCE [...]

Waiver of interest payable under section 220(2) due to late payment of demand, in certain cases – Order under Section 119: Income Tax Circular No. 13/2025

Waiver of interest payable under section 220(2) due to late payment of demand, in certain cases - Order under Section 119: Income Tax Circular No. 13/ [...]

Tax Relief to Senior Citizens of age 70 by exemptions ceiling to 25 lakhs – No plan under consideration at present: Clarification by FinMin

Tax Relief to Senior Citizens of age 70 by exemptions ceiling to 25 lakhs - No plan under consideration at present: Clarification by FinMin in Lok Sab [...]

Tax Treatment under Unified Pension Scheme: Railway Board Order RBE No. 90/2025

Tax Treatment under Unified Pension Scheme: Railway Board Order RBE No. 90/2025 dated 28.08.2025

RBE No.90/2025.

GOVERNMENT OF INDIA (BHARAT SARKAR) [...]

THE INCOME-TAX ACT, 2025 Bill No. 30 of 2025 dated 21.08.2025

THE INCOME-TAX ACT, 2025 Bill No. 30 of 2025 dated 21.08.2025 come into force on the 1st April, 2025 issued by Ministry of Law and Justice, Legislat [...]

Income tax (Twenty Second Amendment) Rules, 2025 – ₹4 Lakh/₹8 Lakh – The New Perquisite Tax Thresholds: Notification

Income tax (Twenty Second Amendment) Rules, 2025 - ₹4 Lakh/₹8 Lakh - The New Perquisite Tax Thresholds: Notification dated 18.08.2025. It introduces t [...]

Income Tax Exemptions and Liabilities of serving and retired personnel from the Defence Forces, CAPFs, Paramilitary Forces etc.

Income Tax Exemptions and Liabilities of serving and retired personnel from the Defence Forces, CAPFs, Paramilitary Forces, and other security agencie [...]