Know your PENSION PROCESS ROADMAP

PENSION PROCESS ROADMAP

UPON ENTRY INTO SERVICE : Service Book in prescribed Format to be maintained to record every step in your official life. It must contain Family Details and Nominations for Retirement/Death Gratuity and GPF.

EVERY YEAR: You must check your Service Book so as to verify correctness of entries made therein.

AFTER EIGHTEEN YEARS OF SERVICE: Issue of Service Verification Certificate of your Qualifying Service by Head of Office.

FIVE YEARS BEFORE RETIREMENT : Verification of your Qualifying Service, five years before retirement by Head of Office.

ONE YEAR BEFORE RETIREMENT: 1. Head of Office should write to Directorate of Estate for issue of No Demand Certificate in respect of period of preceding eight months before the date of your retirement, in case you occupy or occupied Govt. Accommodation

2. In case of employees who have never occupied government accommodation, No Demand Certificate should be issued by the Administrative Authority concerned.

3. List of persons retiring in next one year is sent to the PAO by Head of Office.

NOT LATER THAN EIGHT MONTHS BEFORE RETIREMENT: Head of Office will issue you a certificate regarding length of Qualifying Service proposed to be admitted for purpose of pension and gratuity and as to emoluments and average emoluments for purpose of reckoning of retirement gratuity and pension for your acceptance. Head of Office will issue you Form 5 for completion.

NOT LATER THAN SIX MONTHS BEFORE RETIREMENT: You may submit objection with reason and relevant documents for non acceptance of qualifying service/emoluments communicated to you by Head of Office.

You may submit Form 5 duly completed in all respects to the Head of the Office. You may also exercise your option for commutation of pension in Form 5.

NOT LATER THAN THREE MONTHS BEFORE RETIREMENT: Head of Office shall ensure completion of Part-I of Form 7 and he shall forward the pension papers to the PAO.

NOT LATER THAN THREE MONTHS BEFORE RETIREMENT: You may apply for commutation of pension in Form I-A to the Head of Office (if not applied for in Form 5) for onward transmission to the PAO. You may please ensure that your DDO has stopped making GPF recoveries in your case.

NOT LATER THAN TWO MONTHS BEFORE RETIREMENT: Head of Office shall communicate to the PAO, Govt dues recoverable from DCRG in your case.

ONE MONTH BEFORE RETIREMENT: After checking of your Pension case received from your Head of Office, Pay & Accounts Officer shall issue PPO & authority for Gratuity.

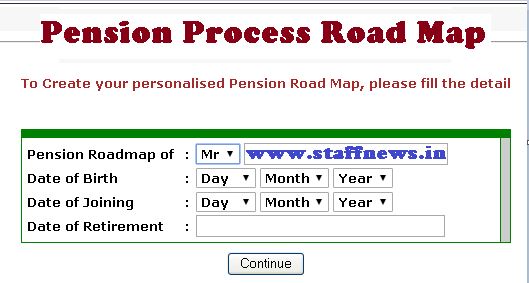

To know your dates of Retirement Process Roadmap go to: http://pensionersportal.gov.in/roadmap/road.asp

Set reminders or take a print of above roadmap and place it under table-glass for reminder:

Source: http://pensionersportal.gov.in

COMMENTS

I am really sorry my dear sir, I just now realised that you are not issued with your PPO and you are denied ex-Serviceman status, I think !!!. Let me know your details like, date when you were out, last unit, etc, immediately.

Hon,ble Armed Forces Tribunal(RB-Mumbai) IN ITS ORDER IN oa-32/18, dated 22Dec2mber, had ordered Union Of India, to issue PPO within 4 months with respect to 50% disability , for life. for unhealed multiple tear injury sustained in 1990 during OP Rhino in NE and further worsened in OP Rakshak (J&K) where I operated till 1995 with wrongly diagnosed and inappropriately treated/managed operational injury under influence of pain killers and steroid injections in injury with devastating side effects.

2. I am not able to get the feed back of progress of processing of my case for release of PPO. I live in pain and financial discomfort and not able to undergo surgical intervention for my operational injury since 2017.

3. None of the numbers of AG/PS-legal/pension of MP-5B and offr record respond and e mails also do not get attended.

4. When Hon’ble AFT had ordered for conduct of Re-assessment Medical Board within 3 months vide its order dated 12Apri;2022 on OA32/18, military authorities too 7 months. We therefore apprehend delays and neglect.

WARM REGARDS

I am really sorry my dear sir, I just now realised that you are not issued with your PPO and you are denied ex-Serviceman status, I think !!!. Let me know your details like, date when you were out, last unit, etc, immediately.

BHEL pension

I retired as Investigator (Statistics) on 31.01.2003 from Ministry of Health & Family Welfare in the scale of Rs. 6500-200-10500 with Rs. 9900/- as last drwan pay. My pension was fixed at Rs. 4900/- w.e.f. 01.02.2003. My pension has been revised to Rs.29300/- as per seventh CPC. I have made a lots of representations to the said Ministry for revision of my pension as per Department of Pension and Pensioners’ Welfare Office memornadum No. 38/33/12- P&PW(A) dated the 4th January, 2019 and 9th July, 2019, but all the times they have turned a deaf ear to all my requests.

Sir how many years will get family pension

Dear Sir, SUVIGYA software is not functioning properly. I tried it many times, but it does not do its function well. KIndly do the needful to do it functional for the information of all Ex-servicemen. Thanking you.

PCDA(P)software SUVIGYA is not functioning properly. I tried it many times but it is not calculating the penmsion of ESM properly. PLease do the needful so that it can be functional for the ESM. Thanking you.

Hony Capt KIL Saini, Panchkula.

Sir, I would like to know that Is an ex-serviceman who retired on 31-10-2008 is entitled to get the benefit of revised rate of pension wef 24-09-2012. Kindly inform the same for the information of many ESM. Thanks a lot.

Hony Capt KL Saini, Panchkula

Is a serviceman who retired on 31-10-2008, entitled to the benefit of pension revised w.e.f. 24-09-2012. Thanks a lot.

We all ESM appreciate PCDA(P) efforts to place the important Circulars on the internet for each and every ESM. I would like to know that Is an ex-serviceman who retired on 31-10-2008 entitled to take the benefit of pension revised w.e.f. 24-09-2012. Thanks a lot.

if an employee dies and his dues are handed over to nominees after two or three months. Obviously the dues are in lakhs and were invested by the office. If the dues are to be paid with interest or the interest is calculated and restricted upto the date of death of employee?

What is the procedure for fixing of basic pension for pre 2006 pensioners for doctors of central health services. Is nonpractising allowance which is part of basic pay cosidered for fixatio?

Every retire govt employees suffering from economical hardship due to delayed starting of pension i.e. after three months from retirement which is inconvenience and unjustifiable. Can central govt implement the financial disbursement at an earliest?

Dr. Pralhad R. Chavan

Lazy people in admin and accounts. Behaves as if they are paying from their pocket. They never start processing of pension papes 4 months before superannuation. Even they never bother to get vigilance clearance the HOD. After relieving they start working that too after begging by the pensioner. They fail to discharge their duties for which they are appointed. They hide their flaws later by blaming the official who is retired. They should be compulsorily retired under 56J.

After superannuation its taking at least 3 months period to start pension which inconvenience to retired govt employe. After retirement he is suffering poor economical circumstances up to first three months which is not justifiable.

pension benifit should be provided to cpf personnel joined after 2004