Tag: Income Tax Exemption Limit

Income Tax Deduction from salaries during the F.Y. 2025-26 – Submission of Form 12BB i.e., particulars of claims for deduction of tax

Income Tax Deduction from salaries during the F.Y. 2025-26 U/s 192 of the Income Tax Act 1961 - Submission of Form 12BB i.e., particulars of claims fo [...]

Deduction of Income Tax and Submission of IT Statements for FY 2025-26

Deduction of Income Tax and Submission of IT Statements for FY 2025-26: CDA, Secunderabad Order dated 15.09.2025

OFFICE OF THE CONTROLLER OF DEFENCE [...]

Tax Relief to Senior Citizens of age 70 by exemptions ceiling to 25 lakhs – No plan under consideration at present: Clarification by FinMin

Tax Relief to Senior Citizens of age 70 by exemptions ceiling to 25 lakhs - No plan under consideration at present: Clarification by FinMin in Lok Sab [...]

Tax Treatment under Unified Pension Scheme: Railway Board Order RBE No. 90/2025

Tax Treatment under Unified Pension Scheme: Railway Board Order RBE No. 90/2025 dated 28.08.2025

RBE No.90/2025.

GOVERNMENT OF INDIA (BHARAT SARKAR) [...]

Income tax (Twenty Second Amendment) Rules, 2025 – ₹4 Lakh/₹8 Lakh – The New Perquisite Tax Thresholds: Notification

Income tax (Twenty Second Amendment) Rules, 2025 - ₹4 Lakh/₹8 Lakh - The New Perquisite Tax Thresholds: Notification dated 18.08.2025. It introduces t [...]

Income Tax Exemptions and Liabilities of serving and retired personnel from the Defence Forces, CAPFs, Paramilitary Forces etc.

Income Tax Exemptions and Liabilities of serving and retired personnel from the Defence Forces, CAPFs, Paramilitary Forces, and other security agencie [...]

Tax Treatment under Unified Pension Scheme – Central Board of Direct Taxes O.M.

Tax Treatment under Unified Pension Scheme - CBDT O.M. dated 02.07.2025 forwarded by Department of Financial Services vide O.M. No. FX-11/16/2025-PR d [...]

Exemption from Tax Deduction on Withdrawals under Section 80CCA – Income Tax Notification No. 27/2025

Exemption from Tax Deduction on Withdrawals under Section 80CCA - Income Tax Notification No. 27/2025 dated 04.04.2025

The Gazette of India

CG-DL-E- [...]

THE FINANCE ACT, 2025 – An Act to give effect to the financial proposals for the financial year 2025-2026

THE FINANCE ACT, 2025 - An Act to give effect to the financial proposals of the Central Government for the financial year 2025-2026: Notification date [...]

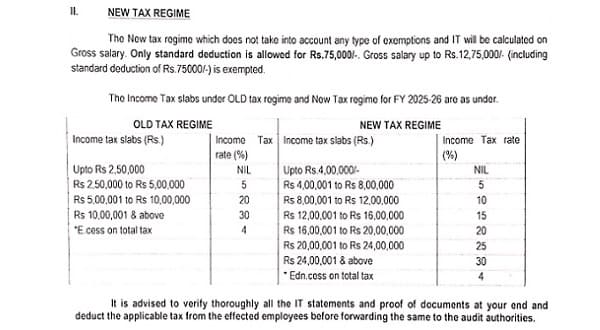

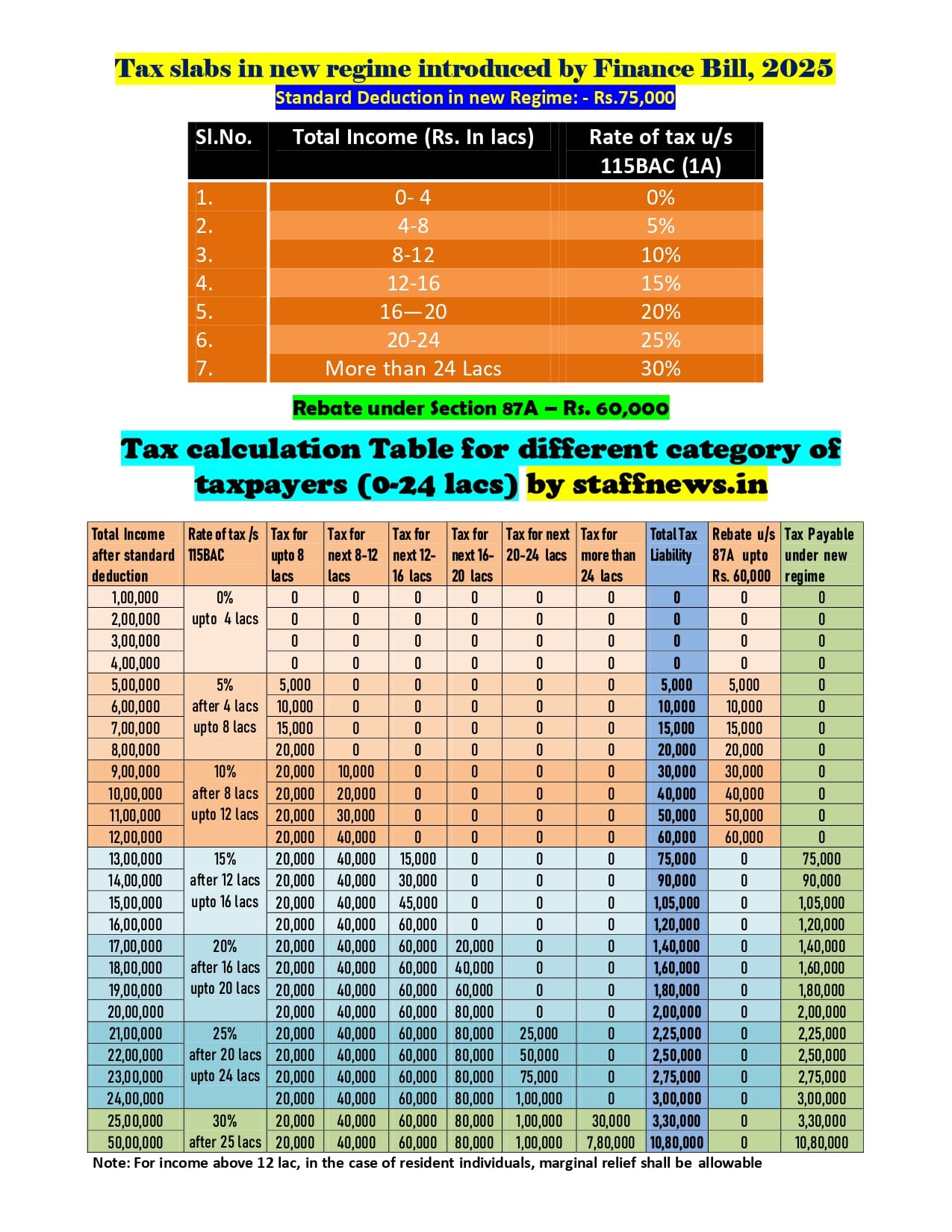

Reduction of Tax Rates for Salaried Individuals – Insights into Finance Bill 2025

Reduction of Tax Rates for Salaried Individuals - Insights into Finance Bill 2025. The Finance Bill 2025 proposes a revised tax structure aimed at pro [...]