Author: Kiran Kumari

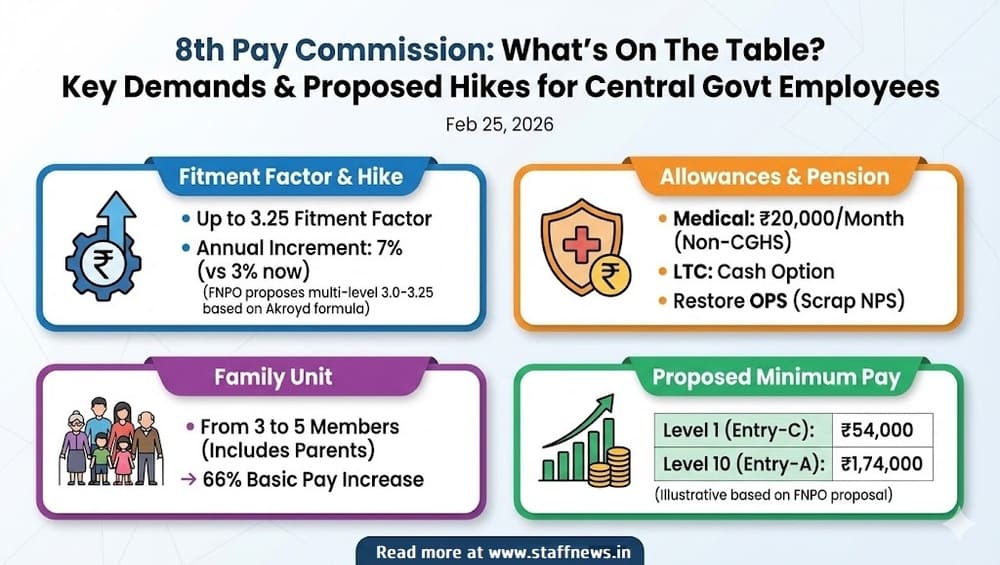

8th Pay Commission: Drafting Committee Meets Today; 3.25 Fitment Factor and 7% Annual Hike Top Agenda

8th Pay Commission: Drafting Committee Meets Today; 3.25 Fitment Factor and 7% Annual Hike Top Agenda. The process for the much-anticipated 8th Centr [...]

Recognition of Commando Training Institute (COTRAINS) at Jagadhari as a Specialized Training Institute: Railway Board Order RBE No. 16/2026

Recognition of Commando Training Institute (COTRAINS) at Jagadhari as a Specialized Training Institute: Railway Board Order RBE No. 16/2026 dated 23.0 [...]

Sharing of Subscriber Information with Pension Funds under NPS Vatsalya Scheme & Asset Allocation Flexibility: PFRDA Circular

Sharing of Subscriber Information with Pension Funds under NPS Vatsalya Scheme & Asset Allocation Flexibility: PFRDA Circular dated 23.02.2026

PE [...]

Conduct of 30% LDCE for the vacancy cycle 01.01.2025 – 31.12.2026 through CBT for Group B Promotion in Railways -Revision of Exam Date

Conduct of 30% LDCE for the vacancy cycle 01.01.2025 - 31.12.2026 through CBT for Group B Promotion in Railways -Revision of Exam Date: Railway Board [...]

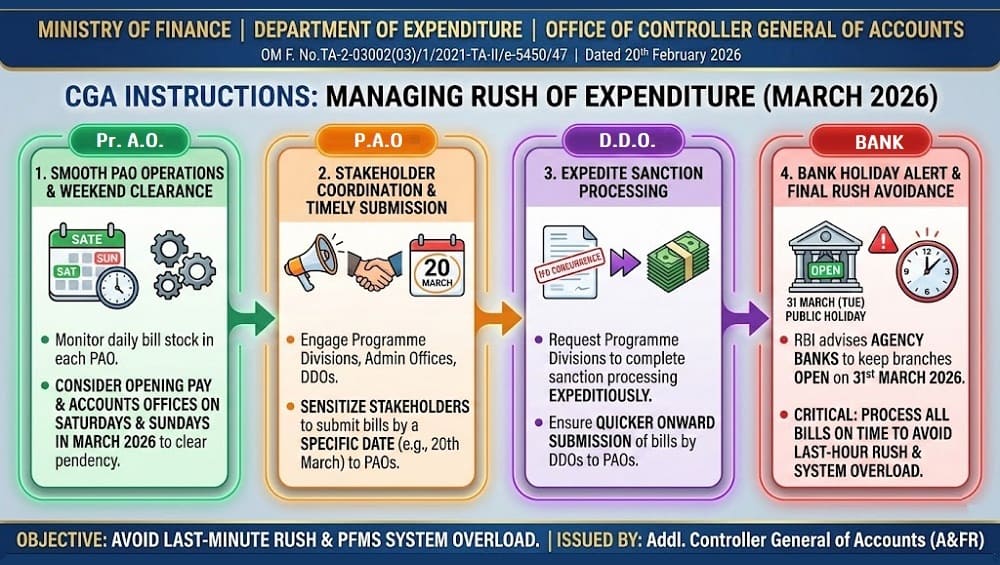

Rush of expenditure in March, 2026 – Opening of Pay and Accounts Office on Saturdays and Sundays falling in March 2026: CGA

Rush of expenditure in March, 2026 - Opening of Pay and Accounts Office on Saturdays and Sundays falling in March 2026 to clear the pendency of bills [...]

Maintenance of reservation roster on HRMS – Railway Board Orders to complete creation of rosters till 30.06.2026

Maintenance of reservation roster on HRMS - Railway Board Orders to complete creation of remaining rosters not later than 30.06.2026 vide Order dated [...]

PwBD candidates applying to Government Employers/Institutions – Revised Advisory and SOP on Processing Applications

Revised Advisory and Standard Operating Procedure (SOP) to handle the cases of PwBD candidates applying for jobs or admission with Government Employer [...]

Compliance Handbook for Employers Under the Four Labour Codes (Central Government Sphere)

Compliance Handbook for Employers Under the Four Labour Codes (Central Government Sphere) issued by Ministry of Labour and Employment

Compliance Ha [...]

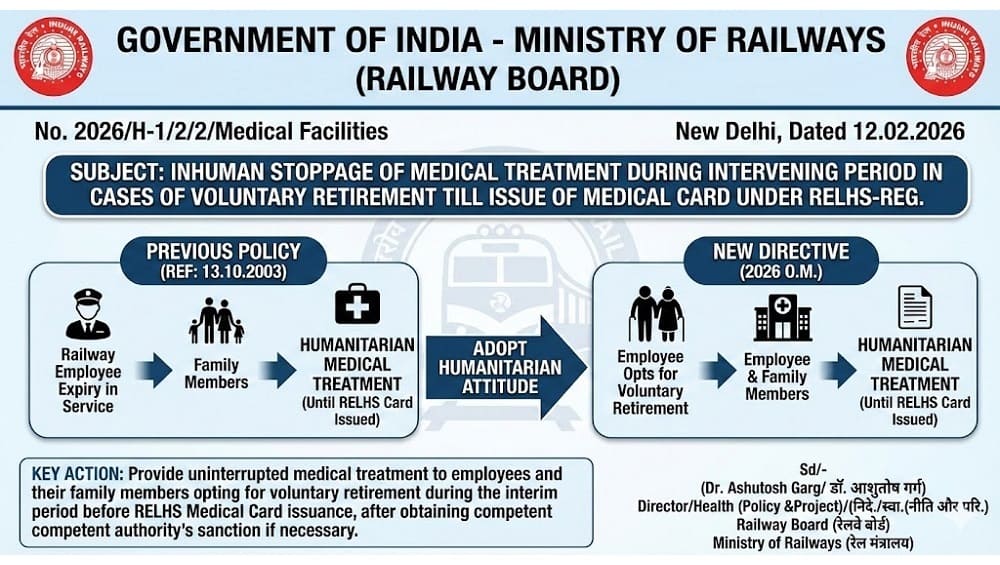

Inhuman stoppage of medical treatment after voluntary retirement till issue of Medical Card under RELHS

Inhuman stoppage of medical treatment during intervening period in cases of voluntary retirement till issue of Medical Card under RELHS: Railway Board [...]

Empanelment of Private AYUSH Day Care Therapy Centres/Hospitals under CGHS – Revised Guidelines for minimum space requirement

Empanelment of Private AYUSH Day Care Therapy Centres/Hospitals under CGHS – Revised Guidelines for minimum space requirement: CGHS Corrigendum dated [...]