Report of Seventh Central Pay Commission

Chapter 10.2 – Pension and Related Benefits of Defence Forces Personnel

Background on Defence Pension

10.2.1 The origin of military pensions can be traced back to ancient Rome, which offered pensions to its military personnel. Initially offered on an ad-hoc basis, Augustus formalised a pension plan for veteran legionnaires in 13 BC which promised a pension upon completion of 20 years in service. Similar schemes re-emerged with the creation of the nation states in Europe in the 17th century which led to establishment of professional standing armies. On August 26, 1776, the Continental Congress enacted the first American pension law. Pension in modern Indian history can be traced to Lord Clive Military Fund, which provided benefits for European officers and other ranks of East India Company and Indian Army and their widows but not their children. A formal pension legislation called The Pensions Act, 1871 came into effect from 8 August, 1871.

10.2.2 Till 1953 the Old Pension Code formed the basis for regulating the pension structure of JCO/ORs. Effective 1.6.1953 the Post War Pension Code was introduced based on the recommendations of the Armed Forces Pension Revision Committee (AFPRC). The underlying philosophy governing the rate of pension was not to induce continuance in service to gain more pension once they ceased to be useful. Some modifications in regulation of pension were made effective 1.3.1968 based on the recommendations of the Kamath Committee. The pension and retirement benefits of defence forces personnel from the III CPC onwards have been regulated based on recommendations made by successive Pay Commissions.

Defence forces pensioners–Special characteristics

10.2.3 Defence forces personnel retire at a relatively young age. The retirement of JCOs/ ORs who constitute the bulk of defence forces personnel in the three Services is as under:

( in years)

|

Sl. No.

|

Rank |

Army |

Navy |

Air Force |

|

Term of Engagement

|

Retiring Age

|

Term of Engagement

|

Retiring Age

|

Term of Engagement

|

Retiring Age

|

| 1 |

Sepoy/ Equivalent |

19-22 |

42-48 |

15 |

52 |

17-22 |

52 |

| 2 |

Naik/ Equivalent |

24 |

49 |

19-22 |

52 |

19-24 |

49-52 |

| 3 |

Havildar/ Equivalent |

26 |

49 |

25-28 |

52 |

25-28 |

49-52 |

| 4 |

Naib Subedar/ Equivalent |

28 |

52 |

30-32 |

52 |

28-33 |

52 |

| 5 |

Subedar/ Equivalent |

30 |

52 |

34-35 |

57 |

30-35 |

52-57 |

| 6 |

Subedar Major/ Equivalent |

34 |

54 |

37 |

57 |

33-37 |

54-57 |

10.2.4 While the table above indicates the term of engagement and retiring age for JCOs/ORs, the personnel retire on completion of their term of engagement or retirement age whichever is earlier. Officers in all the three Services generally retire between the ages of 54 to 60 years.

10.2.5 Data received by the Commission indicates that 57,500 defence forces personnel retired during the year 2013-14. Of these 96 percent were JCOs/ORs. The largest number of retirements were from the ranks of Havildar and equivalent at 24,458, which constituted over 43 percent of all retirements among defence forces personnel.

10.2.6 Defence forces personnel have been exempted from the National Pension System introduced across the entire spectrum of Central Government employees, with effect from 01.01.2004. Fresh entrants to the Defence Forces are the only ones who continue to be eligible for the Defined Benefit pension regime (pay-as-you-go model). Further, in the computation of reckonable emoluments for pension for defence forces personnel, the Military Service Pay, which has been granted only to these personnel, is specifically included.

10.2.7 An option may, however, be given to the Defence forces personnel to join the NPS, should they wish to do so.

Defence Pensions in Select Countries

10.2.8 Pakistan, France, China and Germany also have ‘pay-as-you-go’ model schemes for their defence personnel, as is the case in India.

10.2.9 In the UK, all public service pension schemes (including the Armed Forces schemes) have been replaced by new schemes from April 2015. The Armed Forces Pension Scheme (AFPS 15) remains non-contributory and in the nature of a Defined Benefit scheme. It is based on career average pensionable pay, which means it will guarantee a certain level of pension. The scheme is based on a Career Average Revalued Earning (CARE) model while the earlier pension schemes were final salary/final rank based schemes. AFPS 15 will also continue to provide valuable additional benefits such as ill-health pensions and payments to family members after pensioner’s death.

10.2.10 In the US, defence pension is a non-contributory and Defined Benefit scheme but it is being financed through an accrual system. Under this system, each year the individual services transfer from their budgets into the Retirement Fund the amount necessary to fund the eventual retirement benefits earned by the entitled personnel. While such a policy has no implications for the recipient, as he would continue to receive his entitlement, the important change it brings about is that if today a policy is changed that would affect future retirement benefits for the current force, the policy maker would now see the immediate budgetary consequences of that decision in the increase in the amount to be transferred to the retirement fund.

10.2.11 Japan, post-World War II, does not have a separate pension scheme for military personnel. Defence pensioners are treated in the same way as national government employees and are covered by the same pension arrangement as national government employees. In South Korea defence pensions are financed by contributions from the military members and the government (8.5 percent of basic salary, respectively). In addition, whenever pension deficit occurs, it is to be subsidised by the government’s general budget.

10.2.12 In Australia and New Zealand, over a period of time, personnel of the Defence forces have also been brought under the Defined Contribution system. Hybrid pension schemes have been developed with a fixed contribution by the government with optional contribution by the employee.

10.2.13 In the last couple of decades, there has been increasing concern about the subtainability of unfunded pension systems in our country. In the context of Defence forces personnel, the annual addition of large numbers to the pool of retirees, the general increase in longevity, as also the proposed introduction of the One Rank One Pension scheme, will together lead to a huge increase in the government’s liability towards Defence Pensions. The government may, therefore, explore the possibility of laying down a Defined Contribution Scheme for Defence forces personnel where the employee makes a contribution and a suitable amount is contributed by the government so that a sizeable corpus is built up.

Analysis of Data on Defence Pensioners

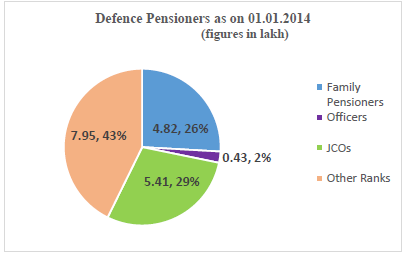

10.2.14 Defence Pensions are budgeted and accounted for under the Ministry of Defence and provide for pensionery charges in respect of retired defence personnel, including civilian employees of the three Services viz., Army, Navy and Air Force and also employees of Ordnance Factories etc. The Commission has received wide ranging data from the Controller General of Defence Accounts in relation to defence pensioners. As on 01.01.2014 there were 24.1 lakh defence pensioners: 18.6 lakh defence forces pensioners and 5.5 lakh defence civilians.

Defence Pensioners- Categories

10.2.15 Of the 18.6 lakh Defence forces pensioners on 01.01.2014 the chart below brings out the break down between Officers, JCOs and ORs and Family pensioners.

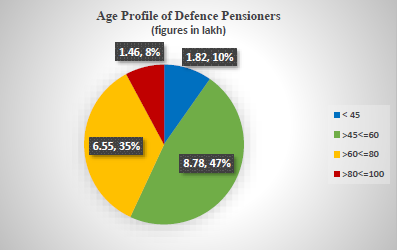

Defence pensioners, age wise

10.2.16 The variation in age of retirement of defence personnel is reflected in the age profile of defence pensioners. Unlike civil pensioners, amongst defence forces pensioners there is a large percentage of pensioners below the age of 60. The age profile of the 18.6 lakh defence pensioners as on 01.01.2014 in brought out in the following pie chart:

10.2.17 Ten percent pensioners are below the age of 45 years, while 47 percent are between 45-60 years of age. Over 1.45 lakh viz., 8 percent of defence pensioners, inclusive of family pensioners, are in age group of eighty and above. This category receives additional pension as per with prescribed slabs.

Defence Pensioners with Disability Element

10.2.18 The Commission had sought information on defence pensioners with disability element. It was informed that such data was not being maintained for pensioners who retired prior to 01.01.2006. For the seven year period 2007-08 to 2013-14, there were 37,537 pensioners who retired with disability element: 35,386 amongst JCOs /ORs and 2151 among officers.

Demands Relating to Defence Pensioners

10.2.19 The Commission has received a number of demands relating to pensions for defence forces personnel through the Joint Services Memorandum (JSM) from the Services, Pensioners Associations and Bodies including those dealing with the needs of special categories like war veterans, disability etc. The demands/representations received in the Commission have been examined under the broad categories of Retiring Pension, Family Pension, Disability Pension and Ex-gratia lump sum compensation.

Demand Relating to Retiring Pension

10.2.20 The principal demands made before the Seventh CPC in respect of retiring pensions as applicable to the defence personnel were:

i. Minimum pension should be fixed at 75 percent of reckonable emoluments for JCOs/ Other Ranks or a compulsory early retirement compensation package or lump sum amount.

ii. Additional quantum of pension with advancing age should commence at the age of 70 years for JCOs/ Other Ranks instead of 80 years as prevails today.

iii. Pre 2006 Honorary Naib Subedar may be given pension of Naib Subedar.

iv. Defence Security Corps (DSC) personnel may be granted second pension on completion of 10 years of service at par with civilians.

v. The depression in pension for qualifying service between 15 and 20 years may be removed and complete earned pension may be made admissible to Territorial Army personnel.

Minimum Pension for JCOs/ ORs

10.2.21 The Services, in the JSM, have sought enhancement of the Service Pension to 75 percent of last drawn reckonable emoluments for JCOs and ORs. In case enhancement of pension to 75 percent of last drawn reckonable emoluments is not granted for JCOs/OR, the Services have sought a compulsory early retirement compensation package or compulsory lateral absorption in government or PSU as an alternative.

Analysis and Recommendations

10.2.22 Service pension for all categories of employees has been fixed at 50 percent of the last pay drawn. The recommendations in relation to pay of both the civilian and defence forces personnel will lead to a significant increase in the pay drawn and therefore in the ‘last pay drawn’/‘reckonable emoluments.’ It is also to be noted that in the case of defence forces personnel, in particular all JCOs/ORs, the last pay drawn includes the element of Military Service Pay, which is also taken into account while reckoning pension. The Commission has also recommended an increase in Military Service Pay. The increase in pay and MSP will automatically and significantly raise the level of pension of JCOs/ORs, since pension is related to the last pay drawn/ reckonable emoluments. Therefore the Commission does not recommend any further increase in the rate of pension for JCOs/ORs.

Additional Quantum of Pension with Advancing Age

10.2.23 The Services have sought a modification in the existing old age pension scheme for JCOs/ ORs whereby the additional quantum of pension should commence at the age of 70 rather than the existing age of 80. The quantum of increase has also been sought to be raised upwards for various categories of old age pensioners.

Analysis and Recommendations

10.2.24 The scheme of additional pension and additional family pension with advancing age was introduced subsequent to recommendations of the VI CPC. The amount of pension for existing pensioners will be revised upwards in accordance with the fitment formula that has been prescribed by the Commission. No further increase in the existing rate of additional pension and additional family pension with advancing age is therefore recommended by the Commission.

Pre-2006 Honorary Naib Subedar

10.2.25 The Services have sought that the provision of grant of pension of Naib Subedar to Havildars and equivalent who are given Honorary rank of Naib Subedar after retirement, currently applicable to post 01.01.2006 retirees only, should also be extended to pre 01.01.2006, retirees. The Services have contended that the current policy has resulted in creation of two classes of pensioner’s viz., pre and post 01.01.2006, which is undesirable.

Analysis and Recommendations

10.2.26 The Commission has examined the matter. It notes that the VI CPC had recommended that the pension of all Honorary rank Naib Subedar will be payable by taking this placement as a regular promotion to the higher grade and this would applicable “hence forth.”The VICPC has been unambiguous as far as the date of effect of the benefit. This Commission does not find any merit in re-opening an issue that has been clearly settled. Therefore no change is being recommended in this regard.

Defence Security Corps (DSC) Personnel

10.2.27 The Services have sought reduction in the qualifying service for entitlement of second pension to Defence Security Corps (DSC) personnel from 15 to 10 years. To support their demand it has been contended that all employees taking up second employment in Central Government establishments earn their second pension after completing 10 years of service whereas for DSC personnel 15 years of service is mandatory.

Analysis and Recommendations

10.2.28 The Commission notes that personnel in the Defence Security Corps are tasked to protect defence units/installations and defence civil establishments and they are subject to the Army Act. The personnel in the Corps are drawn from amongst JCOs and ORs retiring from active service from the three Services. The present demand is made on the premise that all employees taking up second employment in Central Government establishments earn their second pension after completing 10 years of service. This does not however hold true post 1 January, 2004. Civilian personnel joining after 1.1.2004 are covered only by the National Pension System, therefore those taking up second employment in Central Government establishments will also not be entitled to any pension, other than through the defined contribution regime. The Commission therefore does not recommend reduction in the qualifying service for entitlement of second pension to Defence Security Corps (DSC) personnel from 15 to 10 years.

Depression in Pension for Qualifying Service

10.2.29 Territorial Army personnel qualify for pension after 20 years of service. Those with qualifying service between 15 and 20 get a `depressed’ pension. The services have asked for this depression to be removed and for the complete earned pension be made admissible to Territorial Army (TA)personnel. To advance their case they have contended that TA personnel are governed by the same conditions and guidelines as are applicable to all other defence service personnel while calculating the pension. Therefore reducing their pension would create a lower category of personnel and an implied class system. The demand for this is to be done away with.

Analysis and Recommendations

10.2.30 The Commission, on perusal of the statutes governing the Territorial Army, notes that the qualifying ‘embodied’ service for a Territorial Army personnel may be continuous or rendered in broken spells. For calculating the total ‘embodied’ service, the break in service due to dis-embodiment is condoned but the period of break itself is not treated as qualifying service for pension. The five percent cut is only imposed on the pension of those JCO/ORs, whose qualifying, embodied service has been rendered in broken spells. The Commission observes that pension formulation is appropriate and finds no justification for a review of the existing arrangements with regard to pension of Territorial Army personnel.

Demand Relating to Family Pension

10.2.31 The principal demands made before the Seventh CPC in respect of family pension in respect of Defence Forces personnel are as follows:

i. Enhanced Ordinary Family Pension to be made admissible for a duration of 10 years after death of the individual, both in harness as well as after retirement.

ii. Special Family Pension at the rate of 80 percent of the last reckonable emoluments as against the existing level of 60 percent.

iii. Additional quantum of family pension with advancing age should commence at the age of 70 for JCOs/Other Ranks instead of 80 as prevails today.

iv. Inclusion of war injury element/disability element in computation of family pension for widows of ex-servicemen who were in receipt of war injury pension/disability pension and commutation of the war injury element/disability element, if already not done by the individual prior to his demise.

Enhanced Ordinary Family Pension

10.2.32 The Services have sought that the enhanced rate of ordinary family pension should be continued to be paid at a rate equal to service/ retiring pension and made admissible for a duration of 10 years after death of the individual, both in harness as well as after retirement. In addition, the existing cap of minimum service of seven years for being eligible for this pension be removed.

Analysis and Recommendations

10.2.33 The Commission has considered the issue. It notes that the regime of enhanced rate of ordinary family pension applies to both civil and defence pensioners. No change is being recommended by the Commission for either civilian or defence pensioners.

10.2.34 The Services have sought that the Special Family Pension be enhanced and be paid at the rate of 80 percent of last drawn reckonable emoluments from the existing rate of 60 percent. Increase in rate, it is contended, is justified as the widow is not extended government employment unlike widow of civilian Central Government servant, when the spouse dies in service.

Analysis and Recommendations

10.2.35 The recommendations of the Commission in relation to pay of defence forces personnel will lead to a significant increase in the pay drawn and therefore in the ‘last pay drawn.’ No further increase in the existing rate of Special Family Pension is therefore recommended by the Commission.

Additional Quantum of Family Pension with Advancing Age

10.2.36 The Services have sought a modification in the existing old age pension scheme for JCOs/ORs whereby the additional quantum of pension should commence at the ageof70 rather than the existing age of 80. The quantum of increase has also been sought to be raised upwards for various categories of old age pensioners.

Analysis and Recommendations

10.2.37 The scheme of additional pension and additional family pension with advancing age was introduced subsequent to recommendations of the VI CPC. The amount of pension for existing pensioners will be revised upwards in accordance with the fitment formula that has been prescribed by the Commission. No further increase in the existing rate of additional pension and additional family pension with advancing age is therefore recommended by the Commission.

Inclusion of War Injury Element/Disability Element in Computation of Family Pension

10.2.38 War Injury Pension/Disability Pension for defence personnel on invalidment/ retirement/ superannuation has two elements- (i) service and (ii) war injury/disability. As per the existing orders on the death of the said personnel the widow is entitled to a family pension on account of the service element only. The demand is for continuance of the War Injury Pension/Disability Pension received by the personnel upon invalidment/retirement/ superannuation to the widow of the defence service personnel, in addition to the family pension fixed at 30 percent of reckonable emoluments. Commutation of the war injury element/ disability element, if already not done by the individual prior to his demise has also been sought.

10.2.39 The recommendations of the Commission in relation to pay of defence forces personnel will lead to a significant increase in the pay table and therefore in the ‘last pay drawn’/ ‘reckonable emoluments.’ In view of the enhancement in pay the Commission is not recommending any further change in the existing provisions with regard toinclusion of war injury element/disability element in the computation of family pension. The demand made with the regard to commutation of war injury element/disability element is also not being recommended.

Demands Relating to Disability and War Injury Pension

Disability Pension

10.2.40Theorders regulating grant of disability pension in the case of defence forces personnel are detailed in view of the circumstances in which they operate. Disability pension is granted in two broad categories- (a) Non Battle cases and (b) War Injury cases.

10.2.41 Armed forces personnel retired with disability attributable to or aggravated by such service and assessed at 20 percent or more are awarded disability pension. Those invalided out with any disability attributable to or aggravated by such service are also awarded disability pension.

10.2.42 The regime of disability element for non-battle cases has, over time, moved from fixed slab rates to one based on percentage of reckonable emoluments. This shift was recommended by the VI CPC.

10.2.43 Non Battle Cases: In Non Battle cases there are two categories–(i) Cases Attributable/ Aggravated to service and (ii) Cases Neither Attributable/ Nor Aggravatable to service. The manner in which these cases are being currently regulated is as under:

|

Neither Attributable Nor Aggravated ( NANA) |

Attributable or Aggravated by Military Service

|

| Invalided Out |

Qualifying Service < 10 Years: Only Invalid Gratuity is paid. |

Qualifying Service ≥ 10 Years: Invalid pension equal to 50% of last RE is being paid. |

Disability Pension comprising (i) Service Element (SE) equal to 50% of last Reckonable Emoluments (RE) and Disability Element (DE) equal to 30% of last RE is paid for 100% disability. Determination of DE is done as per broadbanding principle which is as follows: |

|

Percentage of Disability |

Percentage of RE to be reckoned for DE |

|

| Less than 50 |

50 |

| 50-75 |

75 |

| 76-100 |

100 |

| Retired with Disability |

Pension equal to 50% of last RE is being paid. |

Disability Pension comprising (i) Service Element (SE) equal to 50% of last RE and Disability Element (DE) equal to 30% of last RE for 100% disability is being paid. Determination of DE is done as per broadbanding principle, at rates above, for disability ≥ 20%. There is no DE for disability <20%. |

| Premature/ Voluntary Retirees |

Pension equal to 50% of last RE is being paid. |

Disability Pension comprising (i) Service Element (SE) equal to 50% of last RE and Disability Element (DE) equal to 30% of last RE for 100% disability is being paid. For lesser percentage of disability, the amount of DE is reduced pro-rata. There is no DE for disability <20%. |

10.2.44 War Injury Cases: Currently in War Injury cases there are two distinct categories- (i) those invalided out and (ii) those retained in service. In case of those invalided out the pension paid is 50 percent of reckonable emoluments, subject to a minimum of Rs.7,020. This is in addition to 100 percent of reckonable emoluments for those with 100 percent disability and on pro rata basis for those with lesser disability. For personnel suffering war injury but who are retained in service, the pension paid out is 50 percent of reckonable emoluments in addition to 60 percent of reckonable emoluments for those with 100 percent disability and on pro rata basis for those with lesser disability.

10.2.45 The principal demands made before the Seventh CPC in respect of disability pensions as applicable for defence forces personnel were:

i. In the case of disability pension, an upward revision from the existing rate of 30 percent to 50 percent of last pay drawn, in cases of 100 percent disability.

ii. Enhancing the cover of Disability.

iii. Additional old age pension should be applicable for disability/ war injury pension.

iv. All cases of invalidment due to disability Neither Attributable Nor Aggravated (NANA) to service, be awarded Disability Pension.

v. Enhancement in the rate of war injury pension where individual is retained in service. vi. Ex-gratia lump sum compensation to invalided out defence personnel.

vii. Ex-gratia award for 100 percent disability be made equal to the stipend being paid to Cadets.

viii. The need to empanel well established civil prosthetic centres so as to make facilities for good quality repairs and replacement of artificial limbs easily accessible.

ix. Ex-gratia lump sum compensation.

Enhancement of the Rate of Disability Pension

10.2.46 The Services have sought enhancement of the rate of disability pension for 100 percent disability from the existing level of 30 percent of the last drawn reckonable emoluments to 50 percent. For lower percentages of disability, the amount of disability element is sought to be pro-rated.

Analysis and Recommendations

10.2.47 The regime of disability element for non-battle cases has moved from fixed slab rates to a percentage of reckonable emoluments. The rates of disability element for 100 percent disability as admissible over the years, is indicated in the table below:

Rate of Disability Element for 100 Percent Disability (in Rs. per month)

| Rank |

Pre III

CPC

|

After III

CPC

|

After IV

CPC

|

After V

CPC

|

After VI CPC

|

|

Pre 2006*

|

Post 2006@

|

| Officers |

170.00

|

200

|

750

|

2600

|

9,279- 27,000

|

8,100- 27,000

|

Honorary

Commissioned

Officers |

142.50

|

170

|

| Subedar Major |

105.00

|

110

|

550

|

1900

|

4,764- 6,591

|

4,650- 12,900

|

| Subedar |

90.00

|

| Naib Subedar |

65.00

|

| Havildar |

48.00

|

60

|

450

|

1550

|

3,510- 4,899

|

3,138- 7,920

|

| Naik |

40.00

|

| Sepoy |

35.00

|

45

|

Notes: Rates as per Defence Pension Payment Instructions, CGDA

* The disability element shall not be less than 30 percent of minimum of fitment table for rank in revised pay structure issued for implementation of recommendation of VI CPC corresponding to pre revised scale held by armed forces personnel at time of retirement/discharge/ invalidment for 100 percent disability.

@ It is as per VI CPC pay structure as accepted by government for armed forces personnel.

# While Rs.34,800 is top of the scale for PB 2, the highest stage that an MWO has reached in the IAF is Rs.24,690.

10.2.48 The ratio of maximum to minimum disability pension for officers and ORs across various points in time is detailed below:

|

Pre III CPC |

After III CPC |

After IV CPC |

After V CPC |

After VI CPC |

| Ratio of maximum to minimum |

4.85 |

4.44 |

1.66 |

1.67 |

8.60 |

10.2.49 The notable facts about the disability payout regime are:

a. There was a gradual rationalisation in the number of slabs from eight, prior to III CPC to three after the IV CPC.

b. The ratio of maximum to minimum quantum of compensation for disability across the ranks witnessed a decline from 4.85 prior to the III CPC to 1.67 post V CPC. As a consequence of the implementation of the recommendations of the percentage based system based on the VI CPC Report the ratio of the maximum to minimum was reversed and now stands at 8.60.

c. Implementation of the VI CPC recommendations resulted in a substantial increase in the disability element. For 100 percent disability, at the minimum level ie., for ORs, it went up from Rs.1,550 to Rs.3,138, ie., a little over double and at highest level amongst officers from Rs.2,600 to Rs.27,000, ie., by 10.38 times.

d. Disability pension consists of two elements viz., service element and disability element. While the service element was linked with the qualifying service, disability element was not. Therefore, for the same level of disability, the service officer invalided out and one who served on and retired in due course, got the same quantum of disability element.

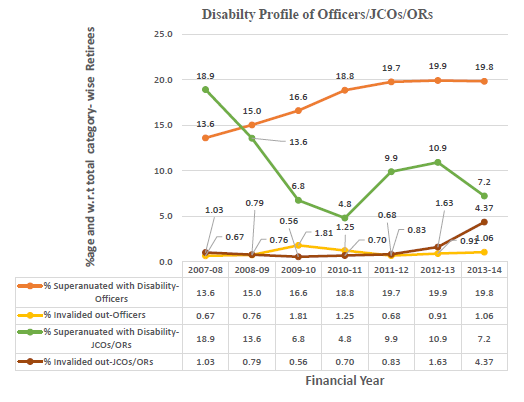

10.2.50 To examine the recent trends in disability cases, the Commission sought data and further clarifications with regard to all cases of pensioners with disability element. The total number of pensioners superannuating with disability element, each year, from 2007-08 to 2013-14, as provided by the Controller General of Defence Accounts (CGDA) is tabulated below:

| Financial Year |

JCOs/ORs |

Commissioned Officers |

Total |

Total JCO/OR Retirees |

Total Officer Retirees |

| 2007-08 |

9,355 |

285 |

9,640 |

49396 |

2096 |

| (18.9 ) |

(13.6 ) |

(18.7 ) |

| 2008-09 |

6,908 |

318 |

7,226 |

50913 |

2118 |

| (13.6) |

( 15.0) |

( 13.6) |

| 2009-10 |

2,644 |

284 |

2,928 |

39133 |

1712 |

| (6.8 ) |

( 16.6) |

(7.2) |

| 2010-11 |

1,840 |

316 |

2,156 |

38209 |

1678 |

| (4.8 ) |

( 18.8) |

( 5.3) |

| 2011-12 |

4,765 |

321 |

5,086 |

48201 |

1626 |

| (9.9 ) |

(19.7) |

(10.2 ) |

| 2012-13 |

5,837 |

327 |

6,164 |

53446 |

1643 |

| (10.9 ) |

( 19.9) |

(11.2 ) |

| 2013-14 |

4,037 |

318 |

4,355 |

55901 |

1606 |

| (7.2 ) |

(19.8 ) |

( 7.6) |

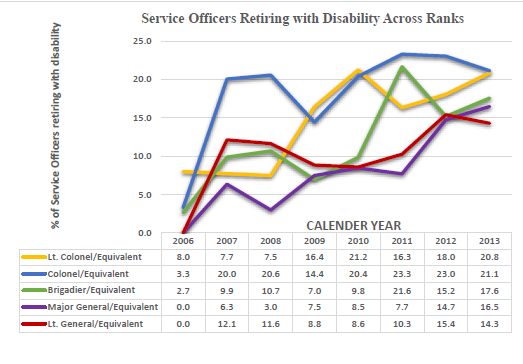

10.2.51 From above data, the following trends are discernible:

a. As a percentage of the total officer retirees, the number of officers retiring with disability has increased in 2013-14, as compared to 2007-08 (13.6 percent to 19.8 percent).

b. The percentage of JCOs/ORs retiring with disability is, on the other hand, decreasing (18.9 percent to 7.2 percent).

c. The percentage of officers retiring with disability is considerably higher than JCO/ORs retiring with disability.

10.2.52 It is observed that there has been an upward trend in the personnel superannuating with disability element at senior levels.

10.2.53 Data on personnel invalided out of service has also been made available to the Commission in respect of officers.

Officers Invalided Out

|

Year

Rank

|

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

| Major/equivalent |

16 |

15 |

19 |

16 |

10 |

10 |

7 |

5 |

1 |

| Lt Col/equivalent |

12 |

15 |

14 |

18 |

13 |

4 |

4 |

4 |

1 |

| Col/equivalent |

10 |

9 |

5 |

5 |

10 |

3 |

3 |

0 |

1 |

| Brig/equivalent |

3 |

1 |

1 |

3 |

4 |

0 |

0 |

0 |

0 |

| Major General/ equivalent |

1 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

| Lt General/ equivalent |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

10.2.54 While the number of officers retiring with disability element has shown a significant increase at levels of Brigadier and above in recent years, it is notable that since 2010-11, no officer in these ranks has been invalided out.

10.2.55 The feature that stands out when the historical evolution of the regime relating to disability pension is studied is the shift from slab based system to a percentage based disability pension regime consequent to the implementation of the VI CPC’s recommendations. This move has been contrary to the tenets of equity insofar as treatment of disability element between Officers and JCOs/ORs is concerned borne out by the fact that the ratio of maximum to minimum quantum of compensation for disability across the ranks is now disproportionately high at 8.6. The Commission is therefore of the considered view that the regime implemented post VICPC needs to be discontinued, and recommends a return to the slab based system. The slab rates for disability element for 100 percent disability would be as follows:

| Rank |

Levels |

Rates (in Rs. per month) |

| Service Officers |

10 and above |

27,000 |

| Honorary Commissioned Officers |

| Subedar Major/ Equivalent |

6 to 9 |

17,000 |

| Subedar/ E quivalent |

| Naib Subedar/ Equivalents |

| Havildar/ Equivalents |

5 and below |

12,000 |

| Naik/ Equivalents |

| Sepoy/ Equivalents |

Enhancing the Cover of Disability

10.2.56 The Services have sought that disability element should be made admissible to personnel on retirement as well as invalidment in the event of his/her acquiring any amount of disability (presently Nil in case of Disability less than 20 percent) that is attributable to/ aggravated by military service or otherwise.

10.2.57 The issue of how disability element should be determined for personnel retiring with disability, as distinct from those being invalided out, has been the subject matter of judicial pronouncements in the recent past. In Ram Avatar vs Union of India, the Supreme Court has held that personnel retiring on attaining the age of superannuation or on completion of tenure of engagement, if found to be suffering from some disability which is attributable to/ aggravated by military service, would be entitled to the benefit of ‘rounding’ of disability pension for disability greater than 20 percent. The Commission has also noted that the government has decided to implement the benefit of broadbanding of disability (‘rounding’ of disability pension) w.e.f. 01.01.2015 for all eligible cases except premature cases/voluntary retirement cases. The Commission, keeping in view the above, recommends broadbanding of disability for all personnel retiring with disability, including premature cases/ voluntary retirement cases for disability greater than 20 percent. This will ensure uniformity in treatment of disability cases as far as determination of disability element is concerned and bring the regime at par with those invalided out for disability greater than 20 percent.

Additional old age Pension should be Applicable for Disability/War Injury Pension

10.2.58 The Services have sought that the clauses of additional old age pension be made applicable to both the elements of disability/war injury pension.

10.2.59 The scheme of additional pension and additional family pension with advancing age was introduced subsequent to recommendations of the VI CPC. The amount of pension for existing pensioners will be revised upwards in accordance with the fitment formula that has been prescribed by the Commission. No further enhancement by inclusion of elements of disability/war injury pension is therefore recommended by the Commission.

Neither Attributable Nor Aggravated (NANA) cases, be awarded Disability Pension

10.2.60 The Services have sought the discontinuation of Invalid Pension and Gratuity in all cases of invalidment due to disability Neither Attributable Nor Aggravated (NANA) by service; instead, they have sought award of Disability Pension for all such cases.

10.2.61 As per existing regulations in cases of disability Neither Attributable Nor Aggravated(NANA) by service for personnel with less than ten years’ service the individual is entitled to invalid gratuity only, payable at half a month’s last drawn reckonable emoluments plus dearness allowance for every six months of service. Those having more than ten years of service are entitled to invalid pension payable at fifty percent of last reckonable emoluments. The Commission, taking note of the legal position settled by the Supreme Court, is of the view that a member of the armed forces is presumed to be in a sound physical and mental condition at the time of his entry into the service if there is no note or record to the contrary made at the time of such entry. Therefore in the event of his subsequent discharge from service on medical grounds any deterioration in his health is presumed to be attributable to military service. The Commission therefore recommends that while the existing regulations involving disability Neither Attributable Nor Aggravated (NANA) by service may continue, it is for the authorities to establish, in each case, through a reasoned order that disability was Neither Attributable Nor Aggravated (NANA) by military service.

War Injury Pension where Individual is Retained in Service

10.2.62 For cases of war injury where the individual is retained in service, the Services have sought that the war injury element should be enhanced and awarded at the rate of 80 percent of last drawn reckonable emoluments for 100 percent disability. For lesser percentage of disability, the amount of disability element be reduced pro-rata.

10.2.63 The Commission notes that the war injury element as per existing regime is calculated at 60 percent of the last drawn reckonable emoluments for cases of 100 percent disability. For lower percentages of disability, the amount of Disability Element is reduced pro-rata. The pay of all defence forces personnel as per the recommendations of the Commission are being enhanced. This will itself translate into enhancement of payout to those retiring with war injury and retained in service. In view of the foregoing the Commission does not recommend any change in the existing regime of payouts for those with war injury and retained in service.

Ex-gratia Lump Sum Compensation to Invalided out Defence Personnel

10.2.64 The Services have sought application of broad banding principle for determining the extent of disability for payment of Ex-gratia award to service personnel boarded out on account of disability/war injury attributable to or aggravated by military service.

10.2.65 The existing orders involve payment of ex-gratia lump sum compensation of Rs.9 lakh for 100 percent disability. For disability/war injury lower than 100 percent but not less than 20 percent, the amount of ex-gratia compensation is proportionately reduced. No ex-gratia compensation is payable for disability/war injury less than 20 percent. The Commission is recommending an increase in the existing lump sum compensation of Rs.9 lakh for 100 percent disability to Rs.20 lakh. However it finds no justification to recommend broadbanding for payment of Ex-gratia award to service personnel boarded out on account of disability/war injury attributable to or aggravated by military service.

10.2.66 The Services have sought enhancement of ex-gratia disability award equal to stipend paid to cadets from the existing Rs.6,300 per month for 100 percent disability. In support of their demand it has been contended that training of cadets is extremely demanding and a cadet is susceptible to injuries. Therefore there is a need to indemnify a cadet against any disability which may occur during the period of training.

10.2.67 The Commission notes that cadets are not considered on duty during training and therefore cannot be treated at par with serving defence forces personnel. The Commission, however, keeping in views the facts relating to cadets recommends an increase ex-gratia disability award from the existing Rs.6,300 per month to Rs.16,200 per month for100 percent disability.

Empanelment of Well-established Civil Prosthetic Centres

10.2.68 In the case of pensioners with disabilities one of the submissions made before the Commission was that all disabled ex-servicemen have to travel to Artificial Limb Centre (ALC), Pune for repair and replacement of their prosthetic fittings. In addition to ALC there are only five sub-centres in the entire country and they are ill-equipped and unable to carry out even minor repairs. A case has therefore been made for empanelment of well-established civil prosthetic centres to make facilities for good quality repair and replacement of artificial limbs easily accessible to disabled ex-servicemen.

10.2.69 In view of the hardships faced by disabled ex-servicemen the Commission recommends that the government may empanel well established civil prosthetic centres where retired pensioners can avail the facility.

Ex-gratia Lump Sum Compensation

10.2.70 The Commission has received representations seeking enhancement in Ex-gratia lump sum compensation for Next of Kin (NoK)of CAPF, Assam Rifles and defence forces personnel who die in harness in performance of their bona fide official duties.

10.2.71 The circumstances in which the Ex-gratia lump sum compensation is currently admissible and the quantum in each category are as under:

|

Sl. No.

|

Circumstances |

Quantum (Rs.)

|

Remarks |

| 1. |

Death occurring due to accidents in course of performance of duties |

10 lakh |

Identical provisions for Defence and CAPF personnel |

| 2. |

Death in the course of performance of duties attributable to acts of violence by terrorists, anti-social elements etc. |

10 lakh |

| 3. |

Death occurring in border skirmishes and action against militants, terrorists, extremists, etc. |

15 lakh |

Provision for CAPF personnel |

| Death occurring in enemy action in international war |

| 4. |

Death occurring while on duty in the specified high altitude, inaccessible border posts, etc on account of natural disasters, extreme weather conditions |

15 lakh |

Identical provisions for Defence and CAPF personnel |

| 5. |

Death occurring during enemy action in international war or such war like engagements, which are specifically notified by Ministry of Defence |

20 lakh |

Applicable only for Defence forces personnel |

10.2.72 As may be seen, there are four circumstances listed for payment of Ex-gratia lump sum compensation in case of Next-of-Kin (NoK) for CAPF/Assam Rifles personnel while there are five circumstances listed for such payout to NoK in the case of defence forces personnel.

10.2.73 The Ministry of Home Affairs has sought the doubling of Ex-gratia lump sum payable to the Next of Kin (NoK) of CAPF and Assam Rifles personnel from the existing Rs.10 lakh to Rs.20 lakh and from the existing Rs.15 lakh to Rs.30 lakh, depending on the circumstances.

10.2.74 The Defence Services, in their memorandum, have sought quadrupling of the amount of lump sum compensation. They have also suggested inclusion of some additional categories in the list of identified circumstances in which Ex-gratia lump sum compensation is paid. The proposal of the Services in this regard is summarised below:

|

Sl. No.

|

Circumstances |

Ex isting (Rs.)

|

Sought (Rs.)

|

New Categories proposed by the Services

|

| 1. |

Death occurring due to accidents in course of performance of duties. |

10 lakh |

40 lakh |

– |

| 2. |

Death in the course of performance of duties attribute to acts of violence by terrorists, anti-social elements etc. |

10 lakh |

40 lakh |

– |

| 3. |

Death occurring in border skirmishes and action against militants, terrorists, etc. |

15 lakh |

60 lakh |

Death occurring in action against sea pirates |

| 4. |

Death occurring while on duty in the specified high altitude, inaccessible border posts, etc on account of natural disasters, extreme weather conditions. |

15 lakh |

60 lakh |

Death occurring while on duty in fire/blasts/explosions on board ships/submarines/aircrafts, death while handling the indigenised weapons/machinery and on account of natural disasters, extreme weather/sea conditions |

| 5. |

Death occurring during enemy action in international war or war like engagements, specifically notified by Ministry of Defence. |

20 lakh |

80 lakh |

Death occurring during evacuation of Indian Nationals from a war-torn zone in foreign country etc. |

Analysis and Recommendations

10.2.75 The Commission has considered the existing regime regulating the Ex-gratia lump sum compensation and the demands made before the Commission and observes that while the set of circumstances in which defence forces personnel and those in CAPFs and Assam Rifles are accorded Ex-gratia payment are broadly similar, some variations do exist. In this regard, the Commission is of the view that as far as possible these should apply identically to all the personnel covered by these orders.

10.2.76 As regards the new categories sought to be added by the Defence Services to the existing circumstances, the Commission recommends the following:

| Addition asked for |

Recommendation |

| Death occurring while on duty in fire/ blasts/explosions on board ships/ submarines/ aircrafts |

Not recommended for inclusion as a separate category. It may be included in the existing circumstance ‘Death occurring due to accidents in course of performance of duties’ |

| Death occurring in action against sea pirates |

May be included in the existing circumstance ‘Death occurring in border skirmishes and action against militants, terrorists, extremists’ |

| Death while handling the indigenised weapons/machinery |

Not recommended for inclusion as a separate category. It may be included in the existing circumstance ‘Death occurring due to accidents in course of performance of duties’ |

| Death on account of natural disasters, extreme weather/sea conditions |

Not recommended for inclusion as a separate category. It may be included in the existing circumstance ‘Death occurring due to accidents in course of performance of duties’ |

| Death during evacuation of Indian Nationals from a war-torn zone in foreign country etc. |

May be included in the existing circumstance ‘Death occurring during enemy action in international war or such war like engagements, which are specifically notified by Ministry of Defence.’ |

10.2.77 The Commission recommends a common regime for payment of Ex-gratia lump sum compensation for civil and defence forces personnel, payable to the Next of Kin at the following rates:

( Rs. in lakh)

| Circumstances |

Existing |

Proposed |

| Death occurring due to accidents in course of performance of duties. |

10 lakh |

25 lakh |

| Death in the course of performance of duties attribute to acts of violence by terrorists, anti-social elements etc. |

10 lakh |

25 lakh |

| Death occurring in border skirmishes and action against militants, terrorists, extremists, sea pirates |

15 lakh |

35 lakh |

| Death occurring while on duty in the specified high altitude, inaccessible border posts, on account of natural disasters, extreme weather conditions |

15 lakh |

35 lakh |

| Death occurring during enemy action in war or such war like engagements, which are specifically notified by Ministry of Defence# and death occurring during evacuation of Indian Nationals from a war-torn zone in foreign country |

20 lakh |

45 lakh |

# If any CAPF/ A ssam Rifles/ Coast Guard personnel is killed in an area notified by Ministry of Defence in war or such war like engagements, the Next of Kin in his case shall receive the same ex-gratia lump sum as NOK of defence personnel i n the same circumstances.

Parity in pension between pre and post Seventh CPC defence forces retirees

10.2.78 The differential in pension between past and new retirees from the defence forces has been an issue that has engaged the attention of the government and various Parliamentary Committees. A number of committees and bodies have been appointed to examine the issue. This differential arises on account of the fact that computation of pension depends upon the pay scale of the person at the time of retirement. With the passage of time and revision of pay scales by successive Pay Commission, the pay and therefore the pension, of those retiring in later years undergoes a change.

10.2.79 The Estimates Committee (1980-81), in its report on resettlement of Ex-Servicemen, noted that the disparity in pension between past and present pensioners of equal rank was inequitable and recommended that the matter should be examined and a just solution found.

10.2.80 The IV CPC, on the other hand, observed that the amount of pension undergoes changes as and when the pay scales are revised. Any attempt to equalise pension with reference to revised scale of pay would, in fact, amount to the retrospective application of these scales of pay.

10.2.81 In 1991 the government set up a High Level Empowered Committee which recommended a One Time Increase (OTI) in pension from 01.01.1992. All pre-1973 pensioners (JCOs/ORs/ Commissioned officers) were brought to the level of post-1973 retirees. Graded addition with reference to post-1973 rates of pension was also made to determine OTI in rates to bridge the gap to some extent up to post 1986 level.

10.2.82 The V CPC, after taking into account the historical background including the recommendations of High Level Committees, recommended that total parity may be brought between pre 01.01.1986 and post 01.01.1986 retirees. Thereafter, for all pre 01.01.1996 retirees, their pension was consolidated as per the specified fitment formula. If the resultant figure fell short of the pension applicable to the post 01.01.1996 retirees for the same rank, it was to be stepped up to the minimum pension prescribed for the same rank (Para 165.8). It went on to state that every Pay Commission gives certain benefits in pay which are over and above the impact of inflation, either due to upgradation of recruitment qualifications or change in job contents. The benefits accorded on this account need not necessarily be passed on to the pensioners. Thus, the additional benefits suggested by them for future pensioners would not be fully available to the pre 01.01.1996 retirees. It, however, recommended partial parity known as modified parity in respect of pre and post–01.01.1996 pensioners. This provided that in case the revised consolidated pension of a person was less than 50 percent of the minimum of the revised pay scale, it would be stepped up to that level.

10.2.83 The Commission notes that a number of improvements have been brought about aimed at narrowing the gap between past and current pensioners. These include:

a. All pre 1997 PBOR pensioners have been brought at par with post 1997 pensioners.

b. Pension of all pre 2006 PBOR pensioners has been reckoned with reference to notional maximum pay in post 01.01.2006 revised pay structure corresponding to the maximum pre VI CPC pay scales as per fitment table of each rank with enhanced weightage awarded by the group of Ministers.

c. A separate pay scale of Rs.67,000–79,000 was created to address the issue of disparity in pension of pre and post 01.01.2006 pensioners at the level of Lieutenant General and equivalent in the other two services to enable them to get pension at the rate of Rs.36,500 and

d. Linkage of full pension with 33 years of qualifying service has been removed w.e.f. 01.01.2006 instead of 01.09.2008 in case of commissioned officers.

10.2.84 Pension payout to defence forces personnel over time: The evolution of the pension regime over time and the role of the Judiciary in settling the law on the subject has been detailed in Chapter10.1. There is clear evidence that governments have, over time, progressively moved towards a liberalised regime for past pensioners. The VI CPC has further provided for additional pension with advancing age. In the case of defence forces personnel particularly, a number of improvements have been effected after implementation of the VI CPC recommendations. Two Committees were set up, one in 2009 and another in 2012, under the Chairmanship of the Cabinet Secretary. Based on recommendations made by them, changes in the pension rules were notified in years 2010 and 2013. Each notification went a step further in bridging the gap between pre 2006 and post 2006 pensioners. What this has effectively translated into is testified by examples of pension fixation of defence forces personnel across groups who have retired in the past decades. For example, a Lt Colonel (in GP of Rs.8,000 in VI CPC, retired on 31 July, 1990 with a basic pension of Rs.2,703 per month. The basic pension got revised to Rs.7,550 and Rs.25,700 per month after implementation of the V and VI CPC respectively. The basic pension was further revised in September 2012 to Rs.26,265. With the benefit of dearness relief39, the pensioner is on date entitled to total payout in terms of pension and dearness relief of Rs.57,520 per month. Similarly, a Subedar (in GP of Rs.4600 in VI CPC, retiring on 30 June, 1991 with a basic pension of Rs.1,300 per month got revised to Rs.6,188 and Rs.9,325 per month after implementation of the V and VI CPC respectively. After further revision, the basic pension of the Officer was fixed at Rs.11,970 per month. With the benefit of dearness relief, the pensioner is on date entitled to total payout in terms of pension and dearness relief of Rs.26,214 per month.

10.2.85 The illustrations point to a substantial increases in pension, across various categories of defence pensioners.

10.2.86 Recommendations: The concept of pension, so far as Civilian employees including CAPFs are concerned, has undergone a complete change. Entrants on or after 01.01.2004 on the civilian side are covered under the National Pension System. In the case of defence forces personnel however, the government has continued with the Defined Benefits pension regime. This regime, as far as past pensioners is concerned, has also witnessed significant improvements with a view to establishing parity between old and new pensioners. The Commission has dwelt on the judicial pronouncements regulating the regime of pensions in detail in Chapter 10.1.

10.2.87 The Commission recommends the following with regard to fixation of pension for past defence forces personnel retirees:

i. All the Defence Forces who retired prior to 01.01.2016 (expected date of implementation of the Seventh CPC recommendations) shall first be fixed in the Pay Matrix being recommended by this Commission, on the basis of the Pay B and and Grade Pay at which they retired, at the minimum of the corresponding level in the matrix. This amount shall be raised to arrive at the notional pay of the retiree by adding the number of increments he/she had earned in that level while in service, at the rate of three percent. Military Service Pay shall be added to the amount which is arrived at after notionally fitting him in the Seventh CPC matrix. Fifty percent of the total amount so arrived at shall be the revised pension.

ii. The second calculation to be carried out is as follows. The pension, as had been fixed at the time of implementation of the VI CPC recommendations, shall be multiplied by 2.57 to arrive at an alternate value for the revised pension.

iii. Pensioners shall b e entitled to the higher of the two.

It is recognised that the fixation of the pension as per the above formulation ( i ) above may take a little time since the records of each pensioner will have to be checked to ascertain the number of increments earned in the retiring level. It is, therefore, recommended that in the first instance the pension, may be fixed in terms of formulation (ii) above, till final fixation of the pension under the Seventh CPC matrix is undertaken.

—————-

39 Dearness Relief of 119 percent, as effective from 1 July, 2015.

10.2.88 Illustration on fixation of pension for defence forces personnel based on recommendations of the Seventh CPC

Case I

10.2.89 Pensioner ‘A’ retired at last pay Rs.46,310 in PB-4 with GP 8700 on 31 March, 2006 under the VI CPC regime, having drawn one increment in the V CPC pay scale Rs.15,100-450-17,350.

|

|

Amount in Rs. |

| 1. |

Basic Pension fixed in VI CPC |

30,505 |

| 2. |

Initial Pension fixed under Seventh CPC (using a multiple of 2.57) |

78,398 Option 1 |

| 3. |

Minimum of the corresponding pay level in 7 CPC |

1,25,500 |

| 4. |

Notional Pay fixation based on one increment |

1,29,300 |

| 5. |

Notional Pay after adding Military Service Pay of Rs.15,500 |

1,44,800 |

| 6. |

50 percent of the notional pay in pay level so arrived and Military Service Pay |

72,400 Option 2 |

| 7. |

Pension amount admissible (higher of Option 1 and 2) |

78,398 |

Case II

10.2.90 Pensioner ‘B’ retired at last pay Rs.13,100 in GP 2800 on 31 May, 2015 under the VI CPC regime, having drawn two increments in PB-1.

|

|

Amount in Rs. |

| 1. |

Basic Pension fixed in VI CPC |

8,950 |

| 2. |

Initial Pension fixed under Seventh CPC (using a multiple of 2.57) |

|

| 3. |

Minimum of the corresponding pay level in 7 CPC |

35,400 |

| 4. |

Notional Pay fixation based on 2 increments |

37,600 |

| 5. |

Notional Pay after adding Military Service Pay of Rs.5,200 |

42,800 |

| 6. |

50 percent of the notional pay in pay level so arrived and Military Service Pay |

|

| 7. |

Pension amount admissible (higher of Option 1 and 2) |

23,002 |

Stay connected with us via Facebook, Google+ or Email Subscription.

COMMENTS

Please do remember that it is the defence forces which are willing to take molten lead on their living flesh in defence of our country

This is a calculated move to dilute the hard earned and much publicized "OROP