Consumption of Role-specific online courses – 51 Courses identified by DoP&T

Consumption of Role-specific online courses - 51 Courses identified by DoP&T vide O.M. dated 29.01.2025

F.No. T-22012/8/2024-IST/IIPA

Governmen [...]

8th Central Pay Commission Terms of Reference- Suggestions by Secretary Staff Side NC (JCM) including Merger of DA/DR and Immediate Relief

8th Central Pay Commission Terms of Reference - Suggestions by Secretary Staff Side NC (JCM) including Merger of DA/DR and Immediate Relief

Shiva Gop [...]

Revised Module for Refresher Course for JEs/SSEs of Diesel organization: Railway Board RBE No. 03/2025

Revised Module for Refresher Course for JEs/SSEs of Diesel organization: Railway Board RBE No. 03/2025 dated 15.01.2025

RBE No. 03/2025

GOVERNMENT O [...]

Periodicity of Refresher Course of Chief Loco Inspector (CLIs) – Railway Board RBE No. 02/2025

Periodicity of Refresher Course of Chief Loco Inspector (CLIs) - Railway Board RBE No. 02/2025 dated 06.01.2025

RBE NO. 02/2025

भारत सरकार GOVERNMEN [...]

State Railway Provident Fund-Rate of interest during the 4th Quarter of financial year 2024-25 (1st January, 2025 — 31st March, 2025)

State Railway Provident Fund-Rate of interest during the 4th Quarter of financial year 2024-25 (1st January, 2025 — 31st March, 2025): Railway Board O [...]

8th Pay Commission Terms of Reference: केंद्रीय बलों द्वारा संदर्भ शर्तों पर सुझाव 3 फरवरी तक आमंत्रित

8th Pay Commission Terms of Reference: केंद्रीय बलों द्वारा संदर्भ शर्तों पर सुझाव 3 फरवरी तक आमंत्रित

8th Pay Commission: वेतन आयोग की संदर्भ शर्तों [...]

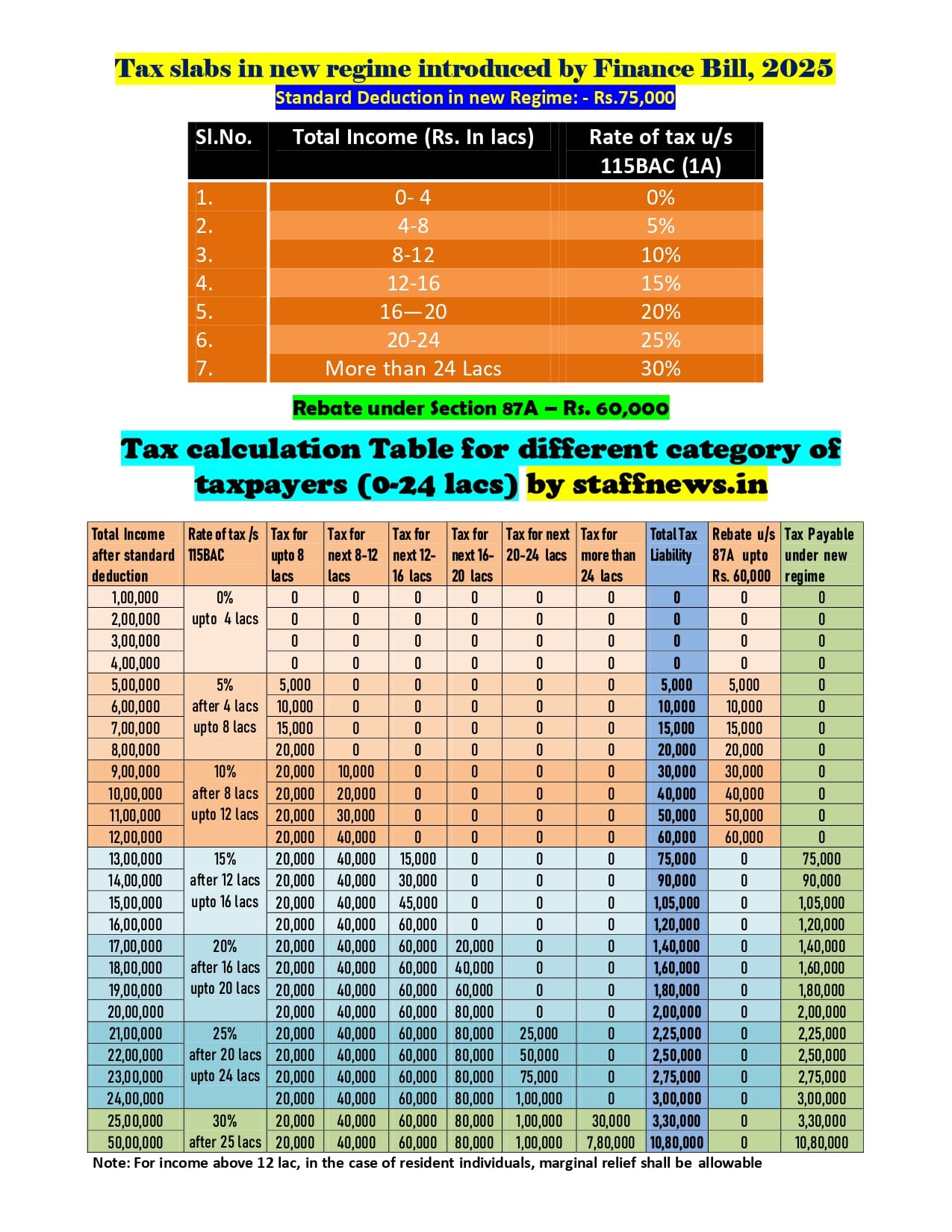

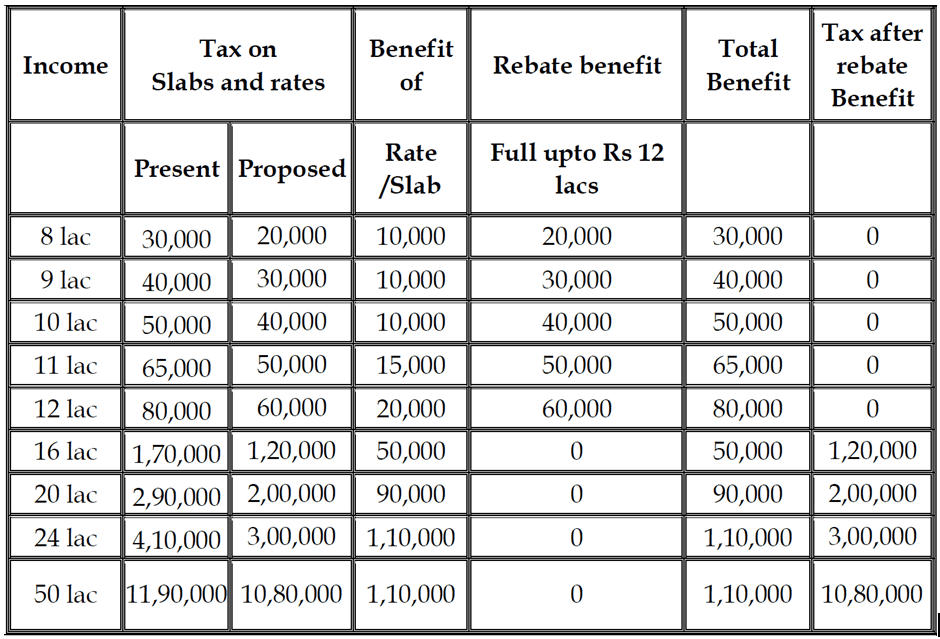

Union Budget 2025-26: Income-Tax Benefits under New Regime explained vide FAQ

Union Budget 2025-26: Income-Tax Benefits under New Regime explained vide FAQ

FAQ.1: Personal Income-tax reforms with special focus on middle class [...]

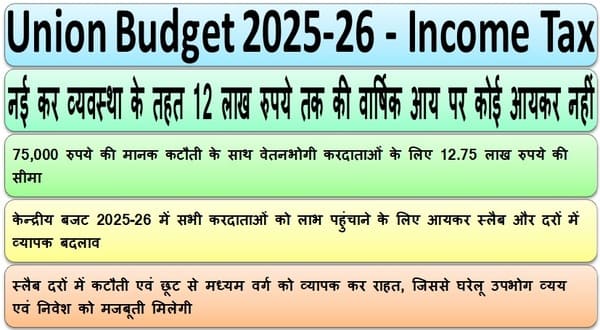

केंद्रीय बजट 2025-26: 12 लाख रुपये तक की आय पर कोई आयकर नहीं, 75,000 रुपये की मानक कटौती

केंद्रीय बजट 2025-26: 12 लाख रुपये तक की आय पर कोई आयकर नहीं, 75,000 रुपये की मानक कटौती

वित्त मंत्रालय

नई कर व्यवस्था के तहत 12 लाख रुपये तक की [...]

Union Budget 2025-26: Rs. 12 Lakh Income Tax-Free, Standard Deduction Increased to Rs. 75,000 for Salaried Individuals

Union Budget 2025-26: Rs. 12 Lakh Income Tax-Free, Standard Deduction Increased to Rs. 75,000 for Salaried Individuals

Ministry of Finance

NO INCO [...]

HIGHLIGHTS OF UNION BUDGET 2025-26

HIGHLIGHTS OF UNION BUDGET 2025-26

Posted On: 01 FEB 2025 1:29PM by PIB Delhi

PART A

Union Minister for Finance and Corporate Affairs Smt Nirmala [...]