Tag: eTDS return

Extension of time limits for submission of certain TDS/TCS Statements: IT Circular No. 9/2023 under section 119 of the Income-tax Act, 1961

Extension of time limits for submission of certain TDS/TCS Statements: IT Circular No. 9/2023 under section 119 of the Income-tax Act, 1961

Circular [...]

Income Tax Demand Notice under section 143(1) due to mismatch of Tax credit for the FY 2020-21 (AY 2021-22)

Income Tax Demand Notice under section 143(1) due to mismatch of Tax credit for the Financial Year 2020-21 (AY 2021-22)

O/o PCDA(O), Golibar Maid [...]

Income-Tax Deduction from Salaries during the Financial year 2022-23: IT Circular No. 24/2022

Income-Tax Deduction from Salaries during the Financial year 2022-23 under Section 192 of the Income Tax Act, 1961: CBDT IT Circular No. 24/2022

GOVE [...]

CBDT extends the due date of filing of Form 26Q for 2nd Quarter of FY 2022-23: Circular No. 21/2022

CBDT extends the due date of filing of Form 26Q for the second quarter of financial year 2022-23 from 31st of October. 2022 to 30th of November, 2022. [...]

Income Tax Demand Notice under section 143(1) due to mismatch of Tax credit for the Financial Year 2021-22 (AY 2022-23)

Income Tax Demand Notice under section 143(1) due to mismatch of Tax credit for the Financial Year 2021-22 (AY 2022-23): PCDA Advisory No. 15 dated 14 [...]

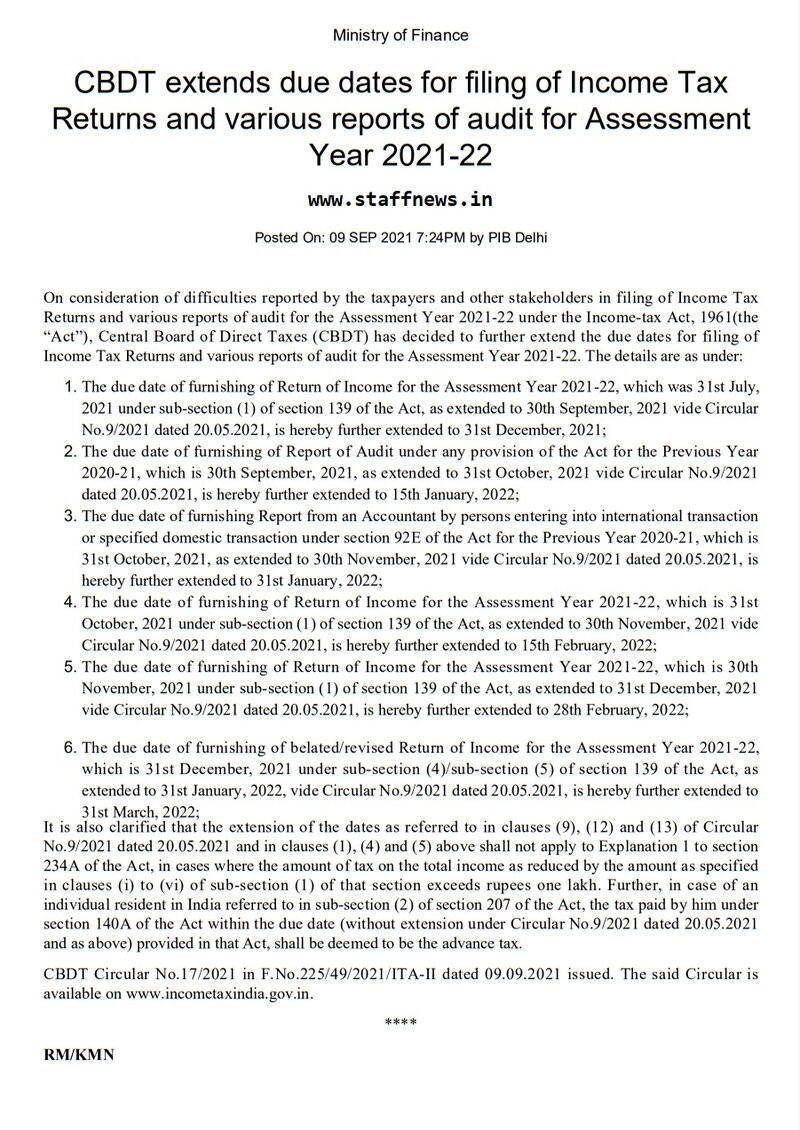

CBDT extends due dates for filing of Income Tax Returns for Assessment Year 2021-22 upto 31st December, 2021

CBDT extends due dates for filing of Income Tax Returns for Assessment Year 2021-22 upto 31st December, 2021

CBDT extends due dates for filing of Inc [...]

Income Tax Notification 83/2021: New IT Rule 130 & 131 regarding Forms, returns, reports

Income Tax Notification 83/2021: New Income Tax Rule 130 regarding Omission of certain rules and Forms and savings and Rule 131 Electronic furnishing [...]

Extension of time limits of certain compliances to provide relief to taxpayers: Income Tax Circular No 12 of 2021

Extension of time limits of certain compliances to provide relief to taxpayers in view of the severe pandemic: Income Tax

Circular No 12 of 2021

F. [...]

TDS and TCS Rules – Income-tax (17th Amendment) Rules, 2021

TDS and TCS Rules - Income-tax (17th Amendment) Rules, 2021.

MINISTRY OF FINANCE

(Department of Revenue)

(CENTRAL BOARD OF DIRECT TAXES)

NOTIFICA [...]

Extension of time limits of certain compliances to provide relief to taxpayers: CBDT Circular No. 9 dated 20.05.2021

Extension of time limits of certain compliances to provide relief to taxpayers in view of the severe pandemic: CBDT Circular No. 9 dated 20.05.2021

C [...]