Tag: Housing Loan

Rate of Interest on House Building Advance (HBA) for Central Government Employees for FY 2025-26: MoHUA O.M.

Rate of Interest on House Building Advance (HBA) for Central Government Employees for FY 2025-26: MoHUA O.M. dated 27.03.2025

I-17015/2(2)/2024/H.III [...]

House Building Advance (HBA) – Compliance with the terms and conditions attached with the sanction: MoHUA O.M.

Compliance with the terms and conditions attached with the sanction of House Building Advance (HBA): Ministry of Housing & Urban Affairs O.M. date [...]

Old Pension Scheme, 8th Pay Commission, Restoration of Commutation of Pension, Income Tax Exemption to Pensioners and other important issues: JCM writes to FM for consideration in Budget 2024-2025

Old Pension Scheme, 8th Pay Commission, Restoration of Commutation of Pension, Income Tax Exemption to Pensioners and other important issues: JCM writ [...]

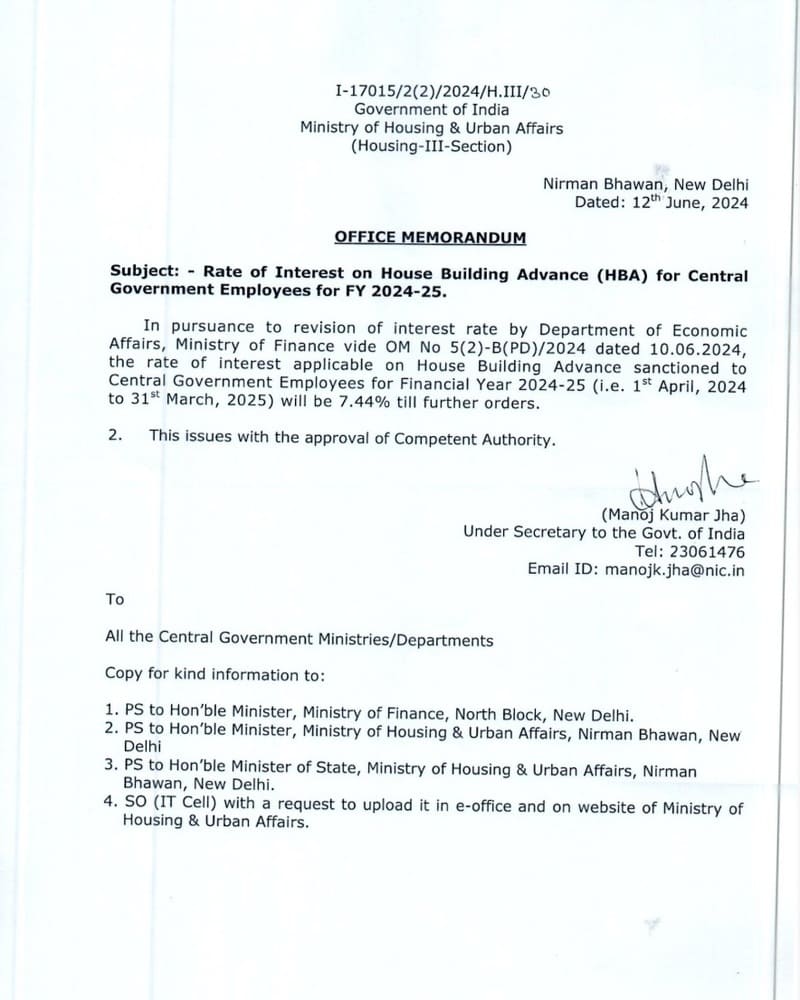

Rate of Interest on House Building Advance (HBA) for FY 2024-25 in respect of Central Government Employees: MoHUA O.M.

Rate of Interest on House Building Advance (HBA) for FY 2024-25 in respect of Central Government Employees: MoHUA O.M. dated 12.06.2024

I-17015/2(2)/ [...]

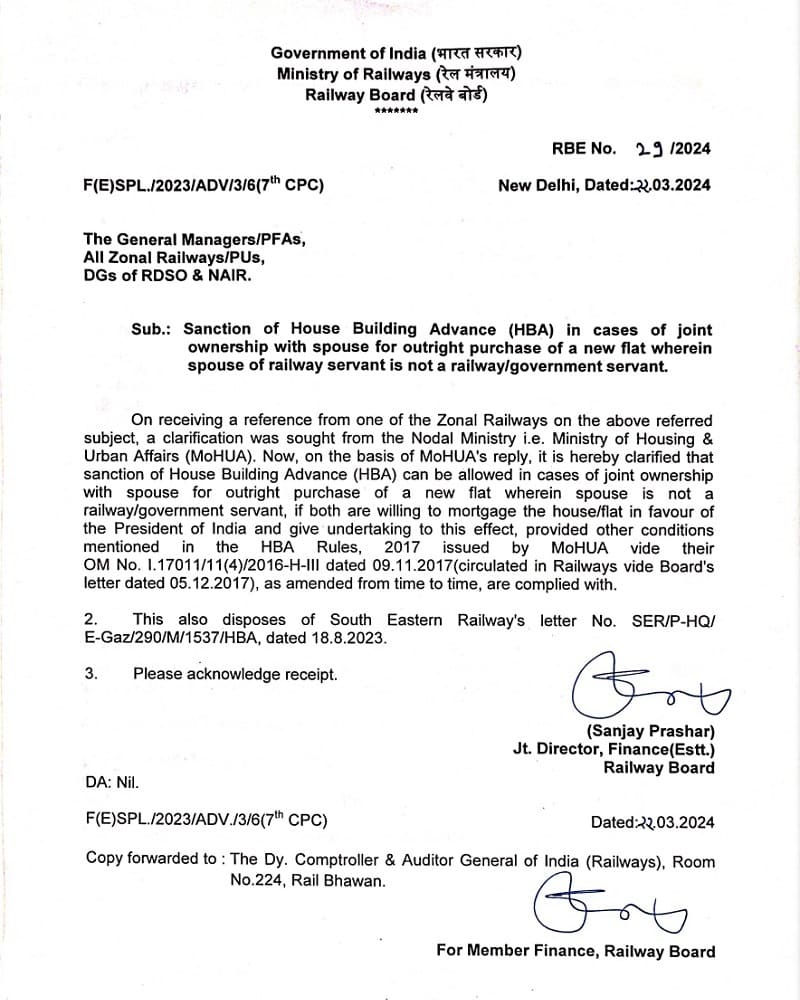

Sanction of HBA in cases of joint ownership with spouse wherein spouse of railway servant is not a railway/government servant: RBE No. 29/2024

Sanction of HBA in cases of joint ownership with spouse for outright purchase of a new flat wherein spouse of railway servant is not a railway/governm [...]

House Building advance to Defence Service Personnel (Army, Navy and Air Force) – MoD Order

House Building advance to Defence Service Personnel (Army, Navy and Air Force) - MoD Order dated 19.06.2023

F No. 15(1)/2017/D(Pay/Services)

Governm [...]

Naval Officers Retirement Homes (NORHOMES) – A few dwelling units has come up change of ownership

Naval Officers Retirement Homes (NORHOMES) - A few dwelling units has come up change of ownership in view of their original owners not being in a posi [...]

Furnishing of evidence of claims or deduction of tax for FY 2021-22 and AY 2022-23 – Rent Receipt, Form 12BB & Statement of Income from House Property

Furnishing of evidence of claims or deduction of tax for FY 2021-22 and AY 2022-23 - Rent Receipt, Form 12BB & Statement of Income from House Prop [...]

Interest rate on House Building Advance (HBA) @ 7.9% from 01.10.2020 to 31.03.2022

Interest rate on House Building Advance (HBA) to Central Government Employees @ 7.9% from 01.10.2020 to 31.03.2022

No.I-17015/1/2021/H.III

[...]

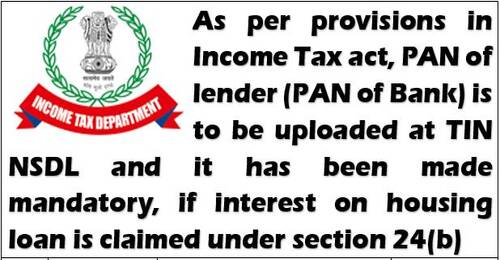

PAN of lender (PAN of Bank) required, if interest on housing loan is claimed under Section 24(b) of Income Tax for FY 2020-21

PAN of lender (PAN of Bank) required, if interest on housing loan is claimed under Section 24(b) of Income Tax for FY 2020-21

Principal Controller of [...]