Tag: tax

Tax on Interest Earned on PF Contribution – Budget Proposal

Tax on Interest Earned on PF Contribution - Budget Proposal

GOVERNMENT OF INDIA

MINISTRY OF FINANCE DEPARTMENT OF REVENUE

RAJYA SABHA

UNSTARRED QU [...]

Income Tax due dates : CBDT extends various limitation dates – Notification no. 10/2021 in S.O. 966 (E) dated 27/02/2021

Income Tax due dates : CBDT extends various limitation dates - Notification no. 10/2021 in S.O. 966 (E) dated 27/02/2021

Date for passing of assessme [...]

Quantum of tax exemption available to an eligible BSNL VRS-2019 optee under Section 10(10C) of IT Act, 1961

Quantum of tax exemption available to an eligible BSNL VRS-2019 optee under Section 10(10C) of the Income Tax Act, 1961 (“the Act”) read with Rule 2BA [...]

Filing of Income Tax Returns: Relaxations by Govt. due to pandemic condition

Filing of Income Tax Returns: Relaxations by Govt. due to pandemic condition

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

LOK SABHA

UNSTARRED QUESTION [...]

Option for Calculation of Income Tax under Old Tax Regime or New Tax Regime: Clarification by PCDA – Message No. 04/2021

Option for Calculation of Income Tax under Old Tax Regime or New Tax Regime: Clarification by PCDA - Message No. 04/2021

Message No. 04/2021

Opt [...]

TDS deduction on payment of medical bills of Retired Employees

TDS deduction on payment of medical bills of Retired Employees

BHARAT SANCHAR NIGAM LIMITED

[A Government of India Enterprise]

CORPORATE OFFICE,TAX [...]

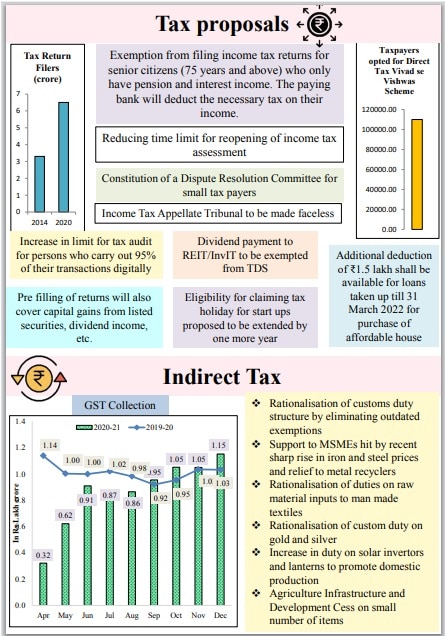

Union Budget 2021-22: कर प्रस्ताव, वरिष्ठ नागरिकों को राहत, लाभांश पर राहत, आयकर फाइलिंग का सरलीकरण एवं अन्य मुख्य बातें

Union Budget 2021-22: कर प्रस्ताव, वरिष्ठ नागरिकों को राहत, लाभांश पर राहत, आयकर फाइलिंग का सरलीकरण एवं अन्य मुख्य बातें

कर प्रस्तावः

निवेश बढ़ाने [...]

ITR filing date extended for these taxpayers- Income Tax Notification No. 93/2020

ITR filing date extended for these taxpayers- Income Tax Notification No. 93/2020

NOTIFICATION

New Delhi, the 31st December, 2020

S.O. 4805(E).—In [...]

ITR – Income Tax Returns filing deadline extended from Dec 31 to January 10, 2021 for these taxpayers

ITR - Income Tax Returns filing deadline extended from Dec 31 to January 10, 2021 for these taxpayers

Press Information Bureau

Government of India [...]

CBDT amends jurisdiction of 67 Income tax Authorities vide Jurisdiction Order No. 3/2020

CBDT amends jurisdiction of 67 Income tax Authorities vide Jurisdiction Order No. 3/2020

Office of the Principal Chief Commissioner of Income Tax (In [...]