Rules regarding quoting of PAN for specified transactions amended w.e.f. 01.01.2016

Press Information Bureau

Government of India

Ministry of Finance

15-December-2015 19:59 IST

Rules regarding quoting of PAN for specified transactions amended

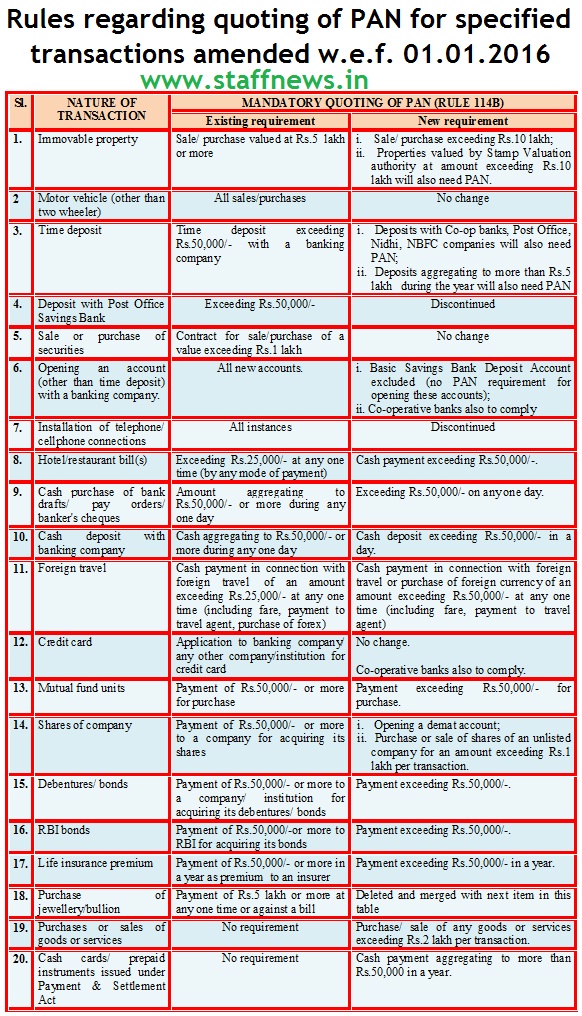

The Government is committed to curbing the circulation of black money and widening of tax base. To collect information of certain types of transactions from third parties in a non-intrusive manner, the Income-tax Rules require quoting of Permanent Account Number (PAN) where the transactions exceed a specified limit. Persons who do not hold PAN are required to fill a form and furnish any one of the specified documents to establish their identity.

|

| Click on Image for larger view |

One of the recommendations of the Special Investigation Team (SIT) on Black Money was that quoting of PAN should be made mandatory for all sales and purchases of goods and services where the payment exceeds Rs.1 lakh. Accepting this recommendation, the Finance Minister made an announcement to this effect in his Budget Speech. The Government has since received numerous representations from various quarters regarding the burden of compliance this proposal would entail. Considering the representations, it has been decided that quoting of PAN will be required for transactions of an amount exceeding Rs.2 lakh regardless of the mode of payment.

To bring a balance between burden of compliance on legitimate transactions and the need to capture information relating to transactions of higher value, the Government has also enhanced the monetary limits of certain transactions which require quoting of PAN. The monetary limits have now been raised to Rs. 10 lakh from Rs. 5 lakh for sale or purchase of immovable property, to Rs.50,000 from Rs. 25,000 in the case of hotel or restaurant bills paid at any one time, and to Rs. 1 lakh from Rs. 50,000 for purchase or sale of shares of an unlisted company. In keeping with the Government’s thrust on financial inclusion, opening of a no-frills bank account such as a Jan Dhan Account will not require PAN. Other than that, the requirement of PAN applies to opening of all bank accounts including in co-operative banks.

The changes to the Rules will take effect from 1st January, 2016.

The above changes in the rules are expected to be useful in widening the tax net by non-intrusive methods. They are also expected to help in curbing black money and move towards a cashless economy.

A chart highlighting the key changes to Rule 114B of the Income-tax Act is attached.

Sl.

|

NATURE OF TRANSACTION

|

MANDATORY QUOTING OF PAN (RULE 114B)

|

|

|

Existing requirement

|

New requirement

|

||

| 1. | Immovable property | Sale/ purchase valued at Rs.5 lakh or more | i. Sale/ purchase exceeding Rs.10 lakh; ii. Properties valued by Stamp Valuation authority at amount exceeding Rs.10 lakh will also need PAN. |

| 2 | Motor vehicle (other than two wheeler) |

All sales/purchases

|

No change

|

| 3. | Time deposit | Time deposit exceeding Rs.50,000/- with a banking company | i. Deposits with Co-op banks, Post Office, Nidhi, NBFC companies will also need PAN; ii. Deposits aggregating to more than Rs.5 lakh during the year will also need PAN |

| 4. | Deposit with Post Office Savings Bank |

Exceeding Rs.50,000/-

|

Discontinued

|

| 5. | Sale or purchase of securities | Contract for sale/purchase of a value exceeding Rs.1 lakh |

No change

|

| 6. | Opening an account (other than time deposit) with a banking company. |

All new accounts.

|

i. Basic Savings Bank Deposit Account excluded (no PAN requirement for opening these accounts); ii. Co-operative banks also to comply |

| 7. | Installation of telephone/ cellphone connections |

All instances

|

Discontinued

|

| 8. | Hotel/restaurant bill(s) | Exceeding Rs.25,000/- at any one time (by any mode of payment) | Cash payment exceeding Rs.50,000/-. |

| 9. | Cash purchase of bank drafts/ pay orders/ banker’s cheques | Amount aggregating to Rs.50,000/- or more during any one day | Exceeding Rs.50,000/- on any one day. |

| 10. | Cash deposit with banking company | Cash aggregating to Rs.50,000/- or more during any one day | Cash deposit exceeding Rs.50,000/- in a day. |

| 11. | Foreign travel | Cash payment in connection with foreign travel of an amount exceeding Rs.25,000/- at any one time (including fare, payment to travel agent, purchase of forex) |

Cash payment in connection with foreign travel or purchase of foreign currency of an amount exceeding Rs.50,000/- at any one time (including fare, payment to travel agent) |

| 12. | Credit card | Application to banking company/ any other company/institution for credit card | No change. Co-operative banks also to comply. |

| 13. | Mutual fund units | Payment of Rs.50,000/- or more for purchase | Payment exceeding Rs.50,000/- for purchase. |

| 14. | Shares of company | Payment of Rs.50,000/- or more to a company for acquiring its shares | i. Opening a demat account; ii. Purchase or sale of shares of an unlisted company for an amount exceeding Rs.1 lakh per transaction. |

| 15. | Debentures/ bonds | Payment of Rs.50,000/- or more to a company/ institution for acquiring its debentures/ bonds | Payment exceeding Rs.50,000/-. |

| 16. | RBI bonds | Payment of Rs.50,000/-or more to RBI for acquiring its bonds | Payment exceeding Rs.50,000/-. |

| 17. | Life insurance premium | Payment of Rs.50,000/- or more in a year as premium to an insurer | Payment exceeding Rs.50,000/- in a year. |

| 18. | Purchase of jewellery/bullion | Payment of Rs.5 lakh or more at any one time or against a bill | Deleted and merged with next item in this table |

| 19. | Purchases or sales of goods or services |

No requirement

|

Purchase/ sale of any goods or services exceeding Rs.2 lakh per transaction. |

| 20. | Cash cards/ prepaid instruments issued under Payment & Settlement Act |

No requirement

|

Cash payment aggregating to more than Rs.50,000 in a year. |

Source: PIB

Stay connected with us via Facebook, Google+ or Email Subscription.

COMMENTS