Subject: – Implementation of Govt. decision on the recommendations of Seventh Central Pay Commission – Procedure for revision of pension in respect of Defence Civilian (including DAD, GREF and Cost Guard employees) who retired on or after 01-01-2016.

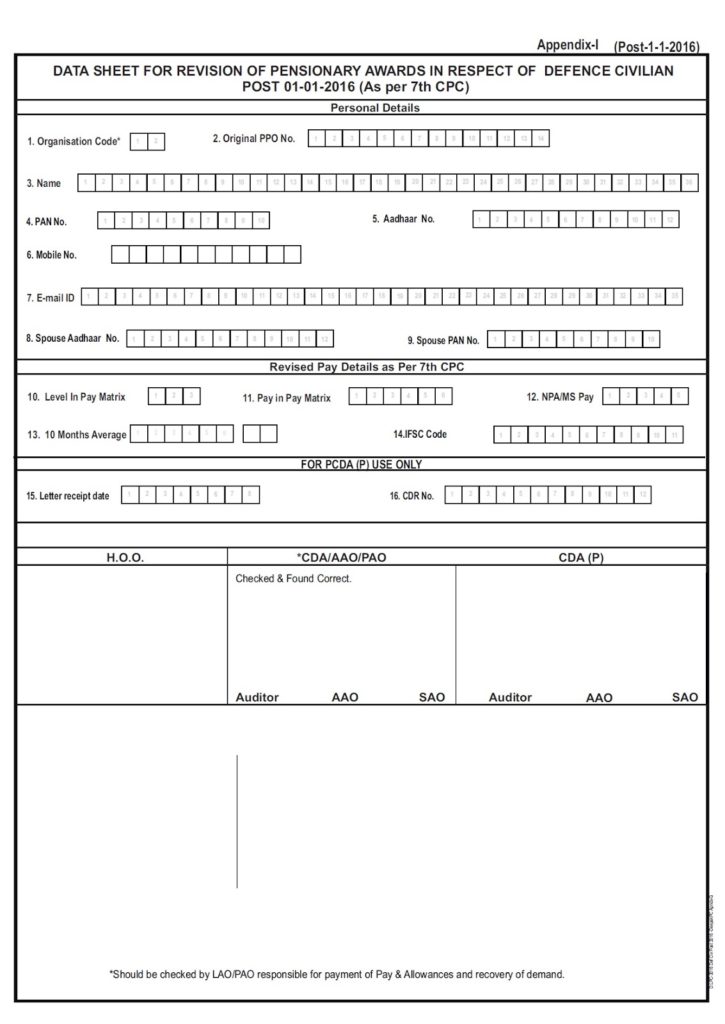

(Appendix-‘I’ Post-2016)

Column 1:- (Organisation Code)

Organisation Code will be filled with reference to the Annexure-1 to Data

Sheet.

Column 2(Original PPO No.)

It should be filled with original PPO No. of individual.

Column 3(Name)

The name of the individual as recorded in the Service Book may be filled in this

column.

One box may be left blank between first, middle and surname etc.

Column 4(PAN No.)

This column may be filled with PAN No. of the claimant

Column 5(Aadhaar No.)

This column may be filled with 12 Digit Aadhaar No. of the claimant.

Column 6(Mobile No.)

This column may be filled with Mobile No. of the claimant.

Column 7(E-Mail Id.)

This column may be filled with E-Mail Id. of the claimant.

Column 8(Spouse Aadhaar No.)

This column may be filled with 12 Digit Spouse Aadhaar No.

Column 9 (PAN No.)

This column may be filled with PAN No. of the spouse.

Column 10 (Level In Pay Matrix)

This column may be filled with Level In Pay Matrix as per

Annexure-2.

If Level In Pay Matrix is less than 3 characters it should be prefixed by

sufficient no of zeros to make it of 3 characters.

The same will be completed as under.

| O | L | 1 |

For Pay Level 13A

| A | 1 | 3 |

Column 11 (Pay in Pay Matrix)

Pay in Pay Matrix drawn in the Pay Level by the individual at the time of

retirement should be filled in this Column. In no case it should be left blank

or filled with zeroes.

Column 12 (NPA/MS Pay)

NPA/MS PAY – In case of Doctors employed as Defence Civilians, Non practicing

allowance drawn at the time of retirement should be filled in this Column. In

case of MNS LOCAL Officers, MS PAY drawn at the time of retirement should be

filled in this Column.

Column 13 (10 Months Average)

10MONTHS AVERAGE:

The average pay which includes sum of Pay in Pay Band, Grade Pay and

non-practicing allowance(NPA)/MS Pay actually drawn by the individual during the

last 10 months period preceding the date of his retirement will be shown in this

Column.

This field contains 5 boxes for rupee and 2 boxes for paisa. This field should

not be left blank.

Column 14(IFSC Code Paying Branch)

The code allotted by RBI to each bank branch. Please also attach a cancelled

cheque for verifying bank A/c No. and IFSC Code (Applied only for bank

pensioner).

| Pay Level | Pay Code |

| 1 | L01 |

| 2 | L02 |

| 3 | L03 |

| 4 | L04 |

| 5 | L05 |

| 6 | L06 |

| 7 | L07 |

| 8 | L08 |

| 9 | L09 |

| 10 | L10 |

| 11 | L11 |

| 12 | L12 |

| 13 | L13 |

| 13A | A13 |

| 14 | L14 |

| 15 | L15 |

| 16 | L16 |

| 17 | L17 |

| 18 | L18 |

| org_no | org_code |

| 01 | FYS |

| 02 | AOC |

| 03 | ENG |

| 04 | AOC |

| 05 | AOC |

| 06 | MISC |

| 07 | MISC |

| 08 | MISC |

| 09 | MISC |

| 10 | NAVY |

| 11 | AF |

| 12 | GREF |

| 13 | DAD |

| 14 | MISC |

| 15 | GREF |

| 16 | MISC |

| 17 | MISC |

| 18 | CGO |

| 19 | MISC |

| 20 | MISC |

http://pcdapension.nic.in/7cpc/Circular-c156.pdf

COMMENTS