Retention of Departmental Laptop under the “Information Technology Procurement, Obsolescence and Disposal Policy-Laptop of 2015” after the retirement on superannuation/ Leaving the organization

Office of the Principal Chief Commissioner of Income Tax,

Andhra Pradesh & Telangana,

10th Floor, D Block, Income tax Towers,

AC Guards, Hyderabad.

F.No. Pr.CCITAP&TS /ITO(Wel)/ LaptopReten./ 2023-24

Date: 30.08.2023.

OFFICE MEMORANDUM

Sub: – Retention of Departmental Laptop under the “Information Technology Procurement, Obsolescence and Disposal Policy-Laptop of 2015” after the retirement on superannuation/ Leaving the organization-Regarding

Ref:-1.F.No.DIT(Infra)/Unit-II/PM21/2012-13/Vol-I, Dated 10.02.2015.

2.F.No.ADG(Infra)/Taskforce/Laptop/2019-20/Vol-1/1002,Dated 09.01.2023.

In view of the above references, the laptops had been provided by the Income Tax Department AP & TS, Hyderabad to its officers of the level of ITO and above for enhancing their efficiency and promoting a system-driven business environment in the Department. The guidelines for retention’ of Departmental laptop under the present policy are mentioned below:-

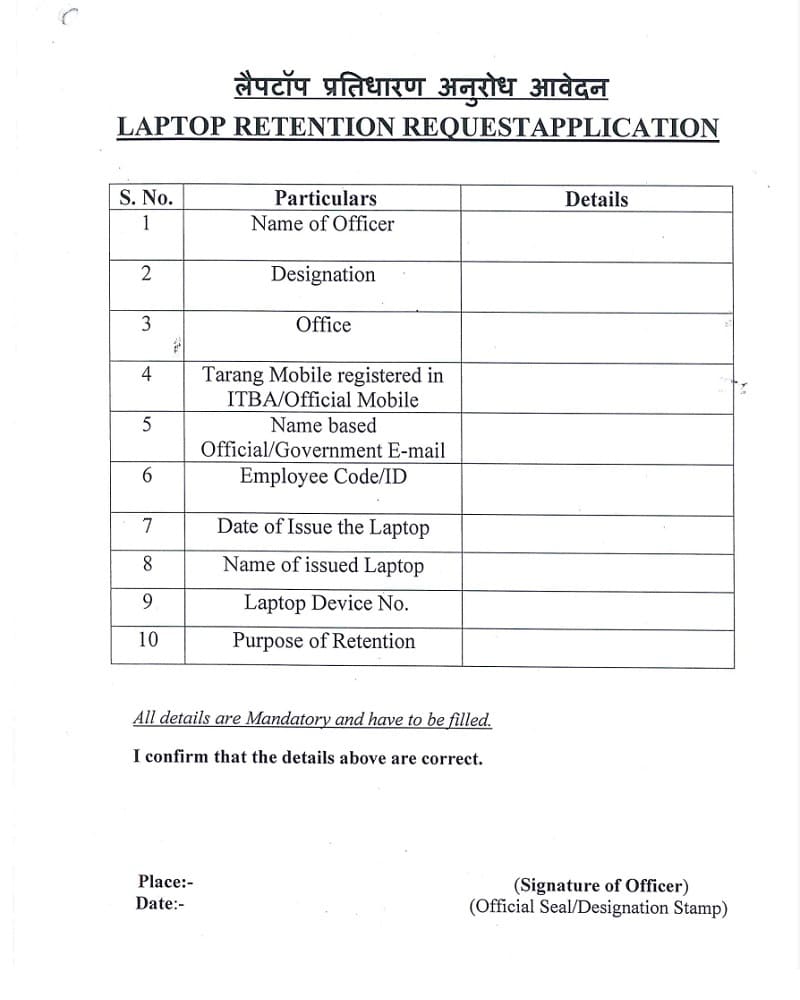

- Retention request application (with device ) should be submitted to the undersigned office prior to One Month from Superannuation / Leaving the Organization for cleaning off all utility software purchased as separate items.

- The ownership of Licensed Operating System software will remain with the Income-Tax Department.

- Cost of laptop (without bag) will be considered as per book value of provided laptop.

- The Depreciation of laptop will be calculated @ 25% per annum on SLM or present applicable rate of Income Tax Act 1961.

- The depreciation of laptop will be computed from the Date of issue of laptop to the allotted officer and computed year-wise commencing from the Date of issue. Pro-rata depreciation of laptop will also be calculated (part of month will be considered as full month).

- The depreciated value will be ‘the price of the laptop hardware and accessories including.

- The residual value (complete nearest value of Rs.10) of laptop will be made into Head of Account under “Other Receipts” through Challan No. 263. After payment of challan Retention Order will be released with device and No Dues Certificate.

Note:-

- Application received after the stipulated time will be cancelled without any correspondence.

- During pending requisitions of laptop, retention request will not be entertained and directed to submit the laptop immediately without any delay.

- No request of returning the laptop in any case would be considered if the retention order is issued.

(M.KRISHNA MOHAN)

Income Tax Officer (Hqrs)(Wel)

COMMENTS