Category: INCOME TAX

Income Tax (fourth Amendment) Rules, 2022: ITR forms for FY 2022-23/ AY 2023-24 vide Notification No. 21/2022

Income Tax (fourth Amendment) Rules, 2022: ITR forms for FY 2022-23/ AY 2023-24 vide Notification No. 21/2022

CBDT notifies ITR Forms SAHAJ ITR-1, [...]

Manner of making Permanent Account Number (PAN) inoperative: IT Circular No. 7 of 2022

Manner of making Permanent Account Number (PAN) inoperative: IT Circular No. 7 of 2022

Circular No. 7 of 2022

F.No. 370142/14/2022-TPL

Government o [...]

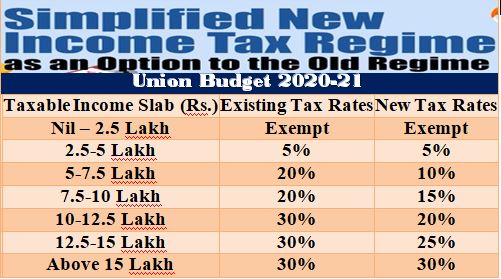

Rationalisation of Income Tax Slabs : Those in the higher income brackets contribute more to the Nation’s development.

Rationalisation of Income Tax Slabs : Those in the higher income brackets contribute more to the Nation’s development.

GOVERNMENT OF INDIA

MINISTRY [...]

Violation of faceless assessment procedure by IT officials

Violation of faceless assessment procedure by IT officials

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

DEPARTMENT OF REVENUE

RAJYA SABHA

UNSTARRED QU [...]

Income-Tax Deduction from Salaries during the Financial Year 2021-22: Circular No. 04/2022

Income-Tax Deduction from Salaries during the Financial Year 021-22: Circular No. 04/2022

GOVERNMENT OF INDIA MINISTRY OF FINANCE

(DEPARTMENT OF [...]

Income Tax payable on the contribution in a PF account exceeding Rs. 5 lakh per annum w.e.f financial year 2021-22: CGA, FinMin O.M.

Income Tax payable on the contribution in a PF account exceeding Rs. 5 lakh per annum w.e.f financial year 2021-22: CGA, FinMin O.M.

TA-3-07001/7/202 [...]

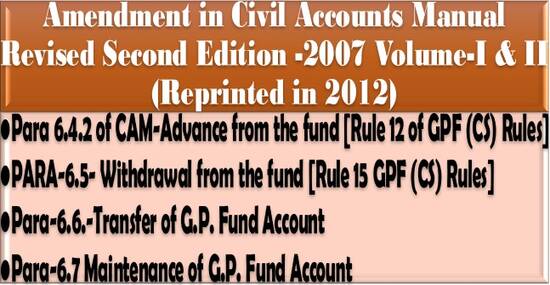

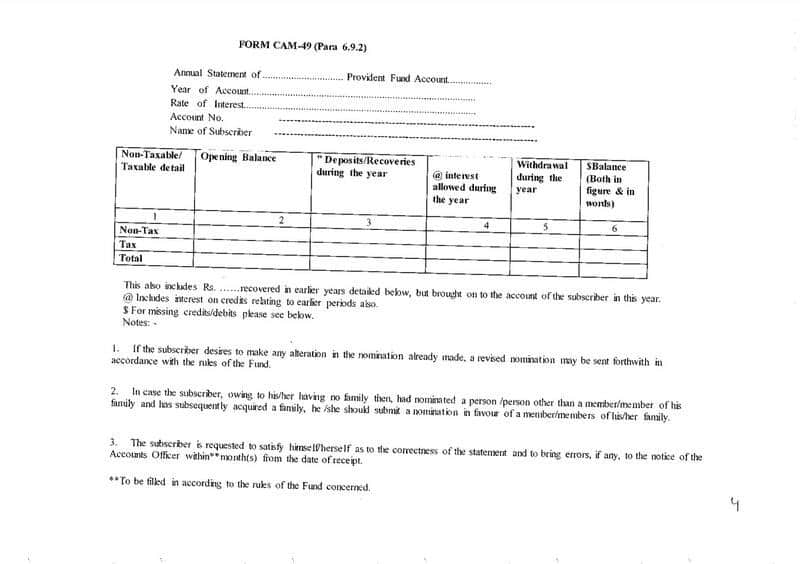

Amendment in Civil Accounts Manual Revised Second Edition -2007 Volume-I & II regarding Income Tax on Provident Fund

Amendment in Civil Accounts Manual Revised Second Edition -2007 Volume-I & II regarding Income Tax on Provident Fund

F. No. TA-2-01001/1/2022-TA- [...]

Calculation of taxable interest relating to contribution in a provident fund w.e.f F.Y 2021-22: CGA, FinMin

Calculation of taxable interest relating to contribution in a provident fund w.e.f F.Y 2021-22: CGA, FinMin

No. TA-3-07001/7/2021-TA-III-Part(1)/cs80 [...]

Timely completion of APARs as per the timelines of the DoPT by Group A & Group B Officers of the Income Tax Department

Timely completion of APARs as per the timelines of the DoPT by Group A & Group B Officers of the Income Tax Department

APAR / SPARROW

URGENT

GO [...]

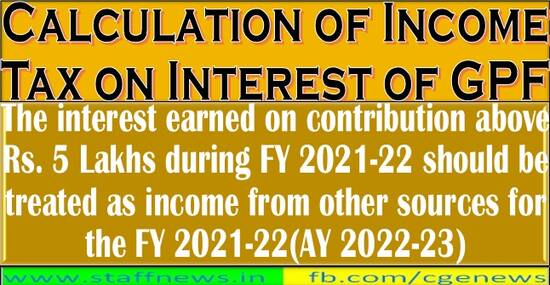

Calculation of Income Tax on Interest of GPF on contribution above Rs. 5 Lakhs

Calculation of Income Tax on Interest of GPF on contribution above Rs. 5 Lakhs

Defence Accounts Department (DAD) Headquarters

Ulan Batar Road, Palam [...]