Amendment in Civil Accounts Manual Revised Second Edition -2007 Volume-I & II regarding Income Tax on Provident Fund

F. No. TA-2-01001/1/2022-TA-CGA (E-9369) /78

Government of India /

Ministry of Finance

Department of Expenditure

Office of Controller General of Accounts

Mahalekha Niyantrak Bhawan,

GPO Complex, E-Block, INA, New Delhi-110023

Dated, the 03rd March, 2022.

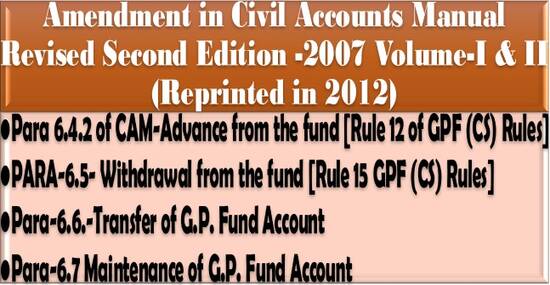

Subject: Amendment in Civil Accounts Manual Revised Second Edition -2007 Volume-I & II (Reprinted in 2012)

Correction Slip No. 26

| Page No. | CAM reference | Amendments |

|

– |

– |

The following new para namely 6.1.3 is inserted:

6.1.3 The term “balance” in this Chapter is meant for total of both taxable and non-taxable GPF account of the provident fund account of a subscriber. |

| 123 | Para 6.4.2 of CAM-Advance from the fund [Rule 12 of GPF (CS) Rules] |

The second sentence in para 6.4.2 begins with “On receipt of sanction in such cases ……… in the ledger folio” is substituted with the following: On receipt of sanction in such cases, the full particulars of the sanction shall be noted by the PAO in the relevant column of ledger folio in a manner that advance would first be debited against balance available under taxable accumulation and remaining from non-taxable accumulation on the date of payment of advance. |

| 124 | PARA-6.5- Withdrawal from the fund [Rule 15 GPF (CS) Rules]

|

The para 6.5.2 is substituted with the following:

After scrutiny of the sanction as above, they shall be entered in the of relevant column of the ledger folio in such a manner that withdrawal amount would first be adjusted against taxable accumulation and remaining from non-taxable accumulation. Payments against such sanctions will be made only after pre-check of the bill by the P.A.O. |

| 125 | Para-6.6.-Transfer of G.P. Fund Account |

(1) The second sentence of para 6.6.2 starts with “In such cases, only an extract from the ledger ……….. the following details”, is substituted with the following: “All the copies of ledger folios/cards shall be appended, duly attested by the Pay and Accounts Officer which will, inter alia, include following details: (2) In the para 6.6.2 (v) and (vi), the word “three” is deleted. |

| 126 | Para-6.7 Maintenance of G.P. Fund Account |

In the second sentence of para 6.7.7 starts with “He should take out the schedules ……………… column of the account”, the following text is inserted: Subscription will be posted first under non-taxable column of ledger folio and be continued to the subsequent months till it reaches the limit of Rs. Five lakhs in a financial year am, subsequently subscription will be posted under taxable column the ledger folio. Refund of advance will be posted under the relevant column of non taxable /taxable column of the ledger folio from which advance have been taken. In case advance constitutes both taxable and no taxable amount of the provident account then refund will be post earliest under taxable column of ledger folio till the advance on the taxable column is fully refunded and subsequently non-taxable column will be posted till the last installment of advance is fully recovered. |

| 415- 419 |

Form CAM-47 | Existing Form CAM-47 has been substituted with the new Form CAM-47 (enclosed). |

| 421- 422 |

Form CAM-49 |

Existing Form CAM-49 has been substituted with the new Form CAM-49(enclosed). |

Authority:- CGA’s (TA-III Section) U.O. No. TA-3-07001/7/2021-TA-III-Part(l)/CS-8084/ 69 dated 25-02-2022.

This issues with the approval of CGA.

(Neelakanian R.)

Senior Accounts Officer

COMMENTS