Category: INCOME TAX

Income Tax Circular 2021-22: Tax Rates, Option for Tax Regime, Format for Declaration (old tax regime)

Income Tax Circular 2021-22: Tax Rates, Option for Tax Regime, Format for Declaration (old tax regime)

Directorate General Central Public Works D [...]

Clarification on taxability of payments made to retired employees and nominees of deceased employees: BSNL

Clarification on taxability of payments made to retired employees and nominees of deceased employees: BSNL

BHARAT SANCHAR NIGAM LIMITED

[A Governmen [...]

Furnishing of evidence of claims or deduction of tax for FY 2021-22 and AY 2022-23 – Rent Receipt, Form 12BB & Statement of Income from House Property

Furnishing of evidence of claims or deduction of tax for FY 2021-22 and AY 2022-23 - Rent Receipt, Form 12BB & Statement of Income from House Prop [...]

Central Government relaxes provisions of TDS u/s 194A of the Income-tax Act, 1961 in view of section of 10(26) of the Act

Central Government relaxes provisions of TDS u/s 194A of the Income-tax Act, 1961 in view of section of 10(26) of the Act

MINISTRY OF FINANCE

(Depar [...]

Deduction of Income Tax at Source for the AY-2022-23 – Exercise of option reg

Deduction of Income Tax at Source for the AY-2022-23 – Exercise of option reg

Office of the Controller Of Defence Accounts

No.1 Staff Road [...]

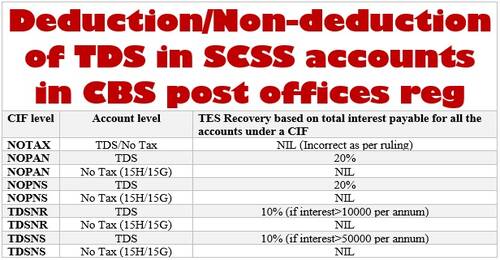

Deduction/Non-deduction of TDS in SCSS accounts in CBS post offices

Deduction/Non-deduction of TDS in SCSS accounts in CBS post offices – Deptt. of Posts order dated 15.09.2021

No. FS-13/7/2020-FS

Government of India [...]

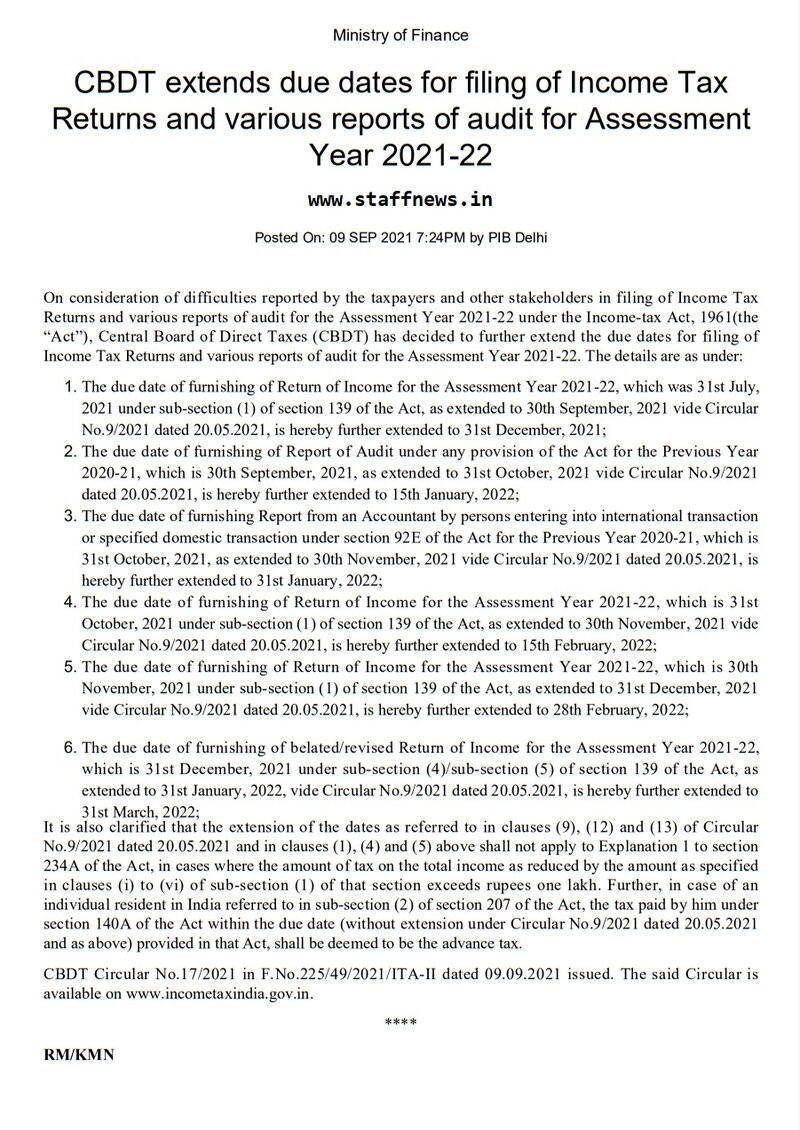

CBDT extends due dates for filing of Income Tax Returns for Assessment Year 2021-22 upto 31st December, 2021

CBDT extends due dates for filing of Income Tax Returns for Assessment Year 2021-22 upto 31st December, 2021

CBDT extends due dates for filing of Inc [...]

Furnishing of declaration and evidence of claims by specified senior citizen under section 194P, Form No. 12BBA, Form No. 16 & Form No. 24Q

Furnishing of declaration and evidence of claims by specified senior citizen under section 194P, Form No. 12BBA, Form No. 16 & Form No. 24Q: Incom [...]

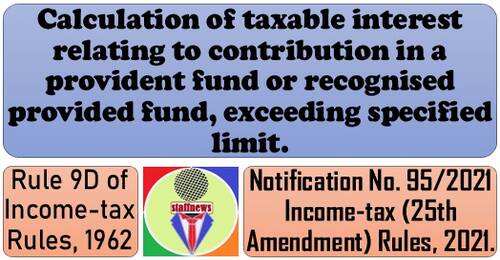

Calculation of taxable interest relating to contribution in a provident fund: Rule 9D of Income-tax Rules, 1962 – IT 25th Amendment Rules 2021

Calculation of taxable interest relating to contribution in a provident fund: Rule 9D of Income-tax Rules, 1962 - IT 25th Amendment Rules 2021

MINIST [...]

Extension of time lines for electronic filling of various Forms under the Income-tax Act,1961: IT Circular No. 16/2021

Extension of time lines for electronic fill of various Forms under the Income-tax Act,1961

Circular No. 16/2021

F NO.225/49/2021/ITA-T

Government o [...]