Category: INCOME TAX

Benefits for Senior Citizens and Super Senior Citizens under Income Tax Act, 1961: MoD (Army) HQ Order

Benefits for Senior Citizens and Super Senior Citizens under Income Tax Act, 1961: MoD (Army) HQ Order for awareness of veterarns/ dependents

C/7099/ [...]

Sr. Citizen Savings Scheme holders complain about April 2024 TDS deductions and direction by Deptt. of Posts

Sr. Citizen Savings Scheme Account Holders complaints raised regarding deduction of TDS in the month of April 2024 - Direction for refund the same by [...]

Guidelines for compulsory selection of returns of Income Tax for Complete Scrutiny during the Financial Year 2024-25 — Procedure: CBDT

Guidelines for compulsory selection of returns of Income Tax for Complete Scrutiny during the Financial Year 2024-25 — procedure for compulsory select [...]

Clarification regarding admissibility of interest on GPF subscription over and above the threshold limit of Rupees Five lakhs deducted towards GPF: DoPPW OM dated 02.05.2024

Clarification regarding admissibility of interest on GPF subscription over and above the threshold limit of Rupees Five lakhs deducted towards GPF: Do [...]

Consequences of PAN becoming inoperative as per rule 114AAA of IT Rules, 1962 – Partial Modification: Circular No. 06/2024

Consequences of PAN becoming inoperative as per rule 114AAA of the Income-tax Rules, 1962 - Partial Modification of Circular No. 3 of 2023 dt 28.03.20 [...]

Income-tax (Fifth Amendment) Rules, 2024 for FORM ITR-V Income Tax Verification and Acknowledgement Form

Income-tax (Fifth Amendment) Rules, 2024 for FORM ITR-V Income Tax Verification and Acknowledgement Form: IT Notification No. 37/2024 dated 27.03.2024 [...]

Deduction of Income tax for the FY 2024-25 – Guidelines emphasizing early start, arrears, proof submission, and system automation.

Deduction of Income tax for the FY 2024-25 - Guidelines emphasizing early start, arrears, proof submission, and system automation.

Principal Controll [...]

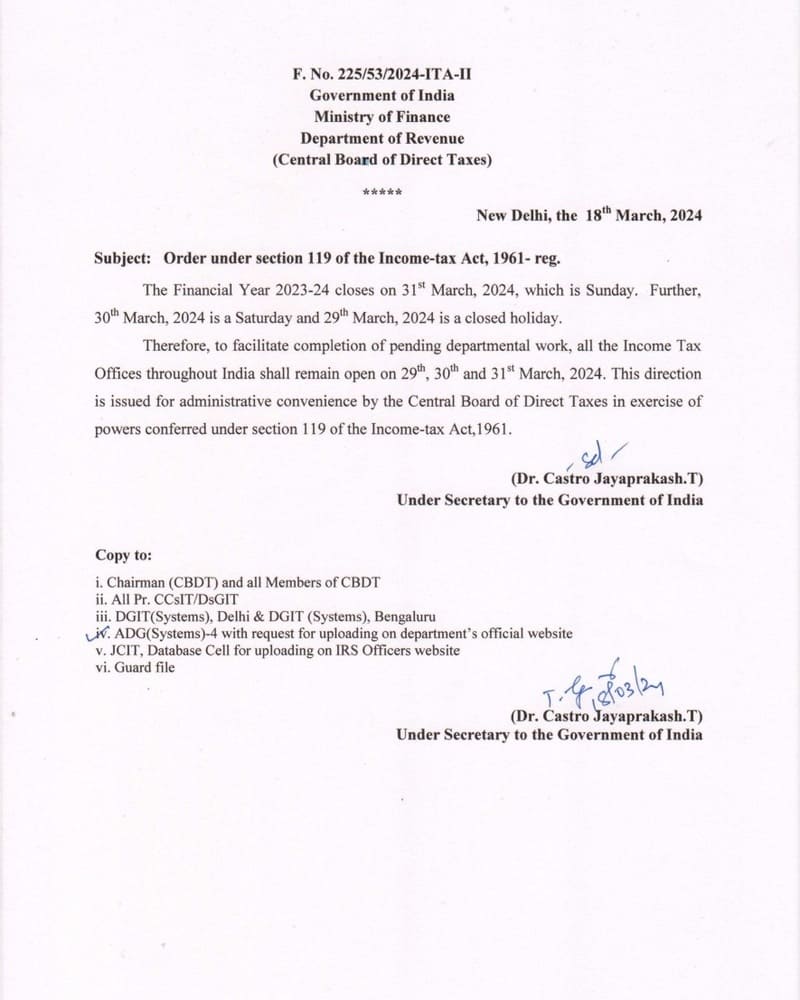

Order under section 119 of IT Act to Open Income Tax Offices on March 29-31, 2024

Order under section 119 of the Income-tax Act, 1961 to Open Income Tax Offices on March 29-31, 2024:

F, No. 225/53/2024-ITA-II

Government of India

[...]

Income-tax (Third Amendment) Rules, 2024 – Notification of ITR Form-7 for AY 2024-2025

Income-tax (Third Amendment) Rules, 2024 - Notification of ITR Form-7 for AY 2024-2025

MINISTRY OF FINANCE

(Department of Revenue)

(CENTRAL BOARD O [...]

Processing of returns of income for AY 2021-22 e-filed returns with valid refund claims till 30.04.2024: CBDT Order under Section 119

Processing of returns of income for AY 2021-22 e-filed returns with valid refund claims till 30.04.2024: CBDT Order under Section 119 dated 01.03.2024 [...]