Category: INCOME TAX

Deduction of Income Tax on Medical Reimbursement: Clarification

Deduction of Income Tax on Medical Reimbursement: Clarification issued by Principal Chief Commissioner of Income Tax, UP(East) on a RTI requisition [...]

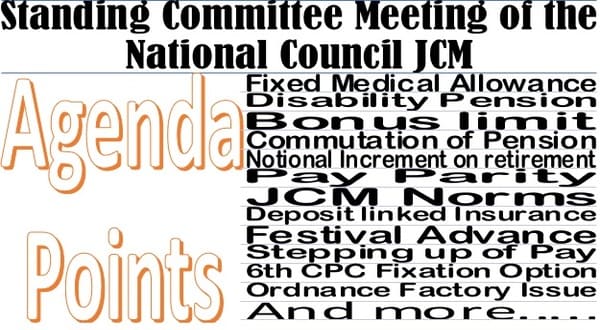

FMA, Notional Increment, Commutation Pension, Risk Allowance, 7th CPC Pay revision and more issues: Decision in Standing Committee Meeting held on 15.12.2023

FMA, Notional Increment, Commutation Pension, Risk Allowance, 7th CPC Pay revision and more issues: Decision in Standing Committee Meeting held on 15. [...]

Benefits for Senior Citizens and Super Senior Citizens under Income-tax Act,1961 – e-Brochure by Income Tax Department

Benefits for Senior Citizens and Super Senior Citizens under Income-tax Act,1961 - e-Brochure by Income Tax Department

Benefits for Senior Citizens a [...]

Clarification regarding applicability of section 194Q

Clarification regarding applicability of section 194Q - CGDA Order on new section 194Q inserted vide Finance Act, 2021, which took effect from 1st day [...]

Processing of returns up to Assessment Year 2017-18 with refund claims under section 143(1) of the Income-tax Act, 1961 – Extension of timelines till 31.01.2024: CBDT Order

Processing of returns up to Assessment Year 2017-18 with refund claims under section 143(1) of the Income-tax Act, 1961 - Extension of timelines till [...]

Option under Income Tax Section 115BAC – Old vs. New Tax Regime: Circular with format of Declaration for Old Regime

Option under Income Tax Section 115BAC - Old vs. New Tax Regime: Circular with format of Declaration for Old Regime

The Central Public Works Depart [...]

Grant of certificate for deduction of Income-tax at any lower rate or no deduction through TRACES- Procedure, format and standards for filling an application

Grant of certificate for deduction of Income-tax at any lower rate or no deduction of Income-tax under sub-section (1) of section 197 of the Income-ta [...]

Deduction of TDS on payment of PLI/RPLI policies, as applicable, under section 194DA of IT Act’ 1961 – Clarification / guidelines regarding

Deduction of TDS on payment of PLI/RPLI policies, as applicable, under section 194DA of IT Act’ 1961 - Clarification / guidelines regarding

F. No. 65 [...]

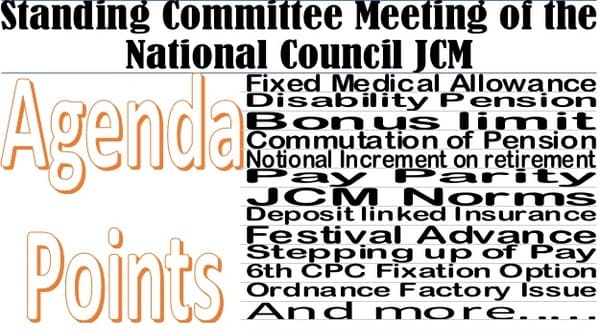

Standing Committee Meeting of the National Council JCM – Agenda points for discussion and settlement includes MACP, Notional Increment, FMA, Bonus, Festival Advance, Stepping up of Pay etc.

Standing Committee Meeting of the National Council JCM - Agenda points for discussion and settlement includes MACP, Notional Increment, FMA, Bonus, Fe [...]

Bank Account Validation Status for Refund – Income Tax Message dated 13-Sep-2023

Bank Account Validation Status for Refund - Income Tax Message dated 13-Sep-2023

Check Bank A/c validation Status For Refund.

Has your bank merged w [...]