Category: INCOME TAX

Aadhaar Number Intimation Deadline by December 31, 2025 for PAN Holders: Income Tax Notification No. 25/2025 & 26/2025

Aadhaar Number Intimation Deadline by December 31, 2025 for PAN Holders: Income Tax Notification No. 25/2025 & 26/2025. On April 3, 2025, the Cent [...]

THE FINANCE ACT, 2025 – An Act to give effect to the financial proposals for the financial year 2025-2026

THE FINANCE ACT, 2025 - An Act to give effect to the financial proposals of the Central Government for the financial year 2025-2026: Notification date [...]

Waiver of Interest Charges for Delayed Tax Credit Due to Technical Issues: Income-tax Order under section 119 – Circular No. 5/2025

Waiver on levy of interest under section 201(1A)(ii)/ 206C(7) of the Act, as the case maybe, in specific cases - Order under section 119: IT Circular [...]

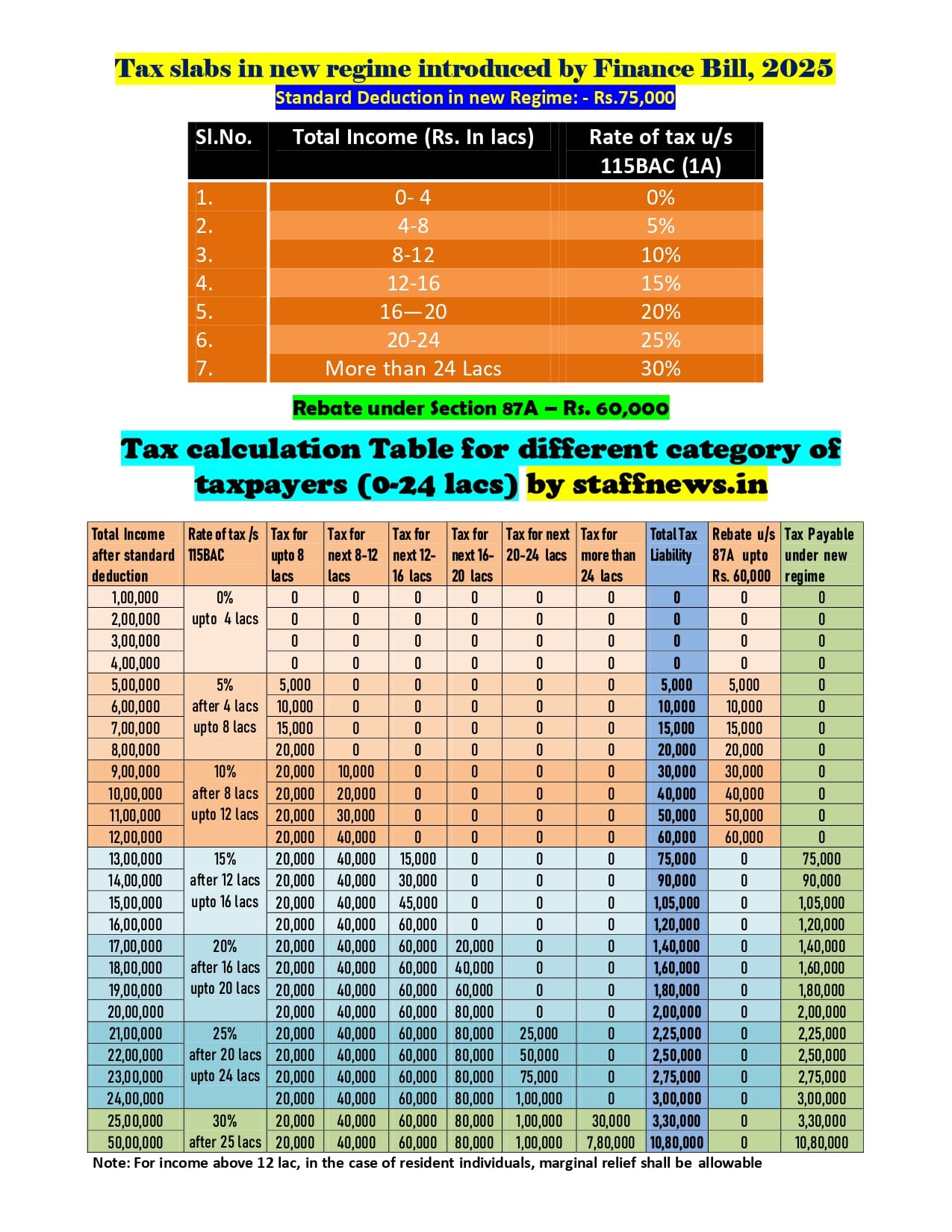

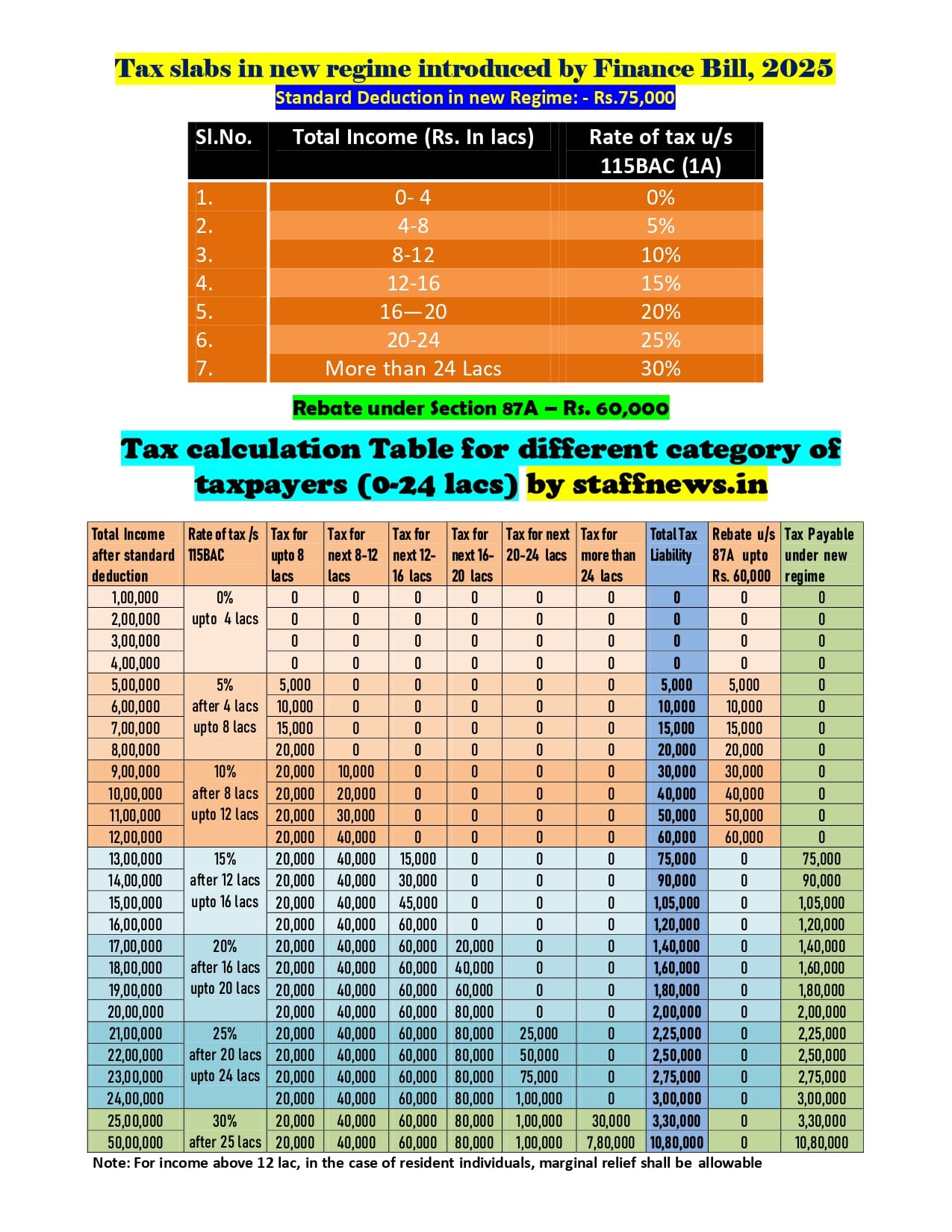

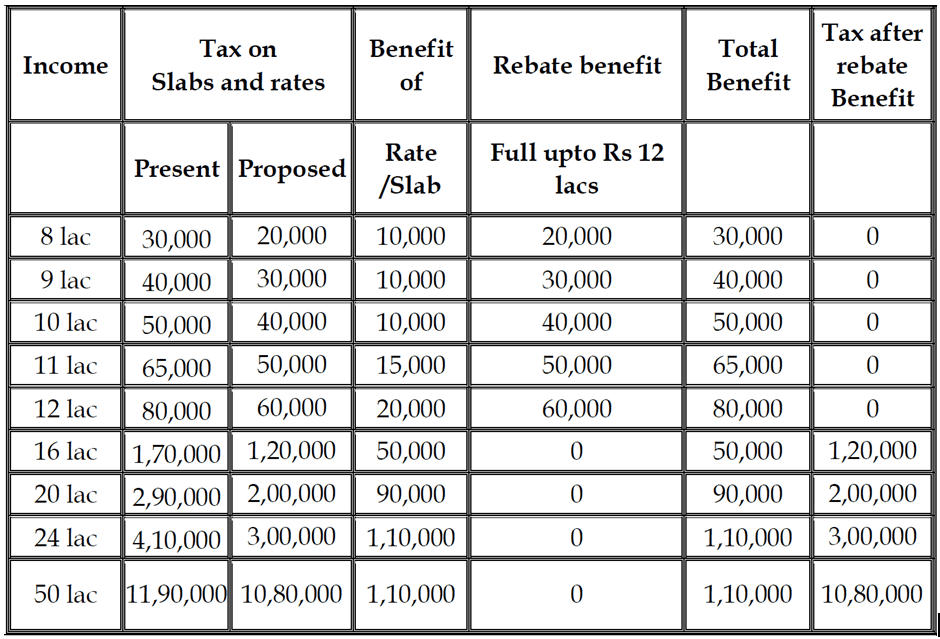

Reduction of Tax Rates for Salaried Individuals – Insights into Finance Bill 2025

Reduction of Tax Rates for Salaried Individuals - Insights into Finance Bill 2025. The Finance Bill 2025 proposes a revised tax structure aimed at pro [...]

Income-Tax deduction from Salaries during the Financial Year 2024-25: IT Circular No. 3/2025

Income-Tax deduction from Salaries during the Financial Year 2024-25 under Section 192 of the Income-Tax Act, 1961: IT Circular No. 3/2025 dated 20.02 [...]

Income-tax Act, 2025 – BILL No. 24 OF 2025 – View/Download PDF

Income-tax Act, 2025 - BILL No. 24 OF 2025 - View/Download PDF

The Gazette of India

CG-DL-E-13022025-261003

EXTRAORDINARY

PART II — Section 2

PUB [...]

Tax Exemptions and Benefits: New Income Tax Regime, Exemptions, and Rebates Explained

Tax Exemptions and Benefits: New Income Tax Regime, Exemptions, and Rebates Explained. The Indian government provides tax exemptions and benefits to b [...]

Union Budget 2025-26: Income-Tax Benefits under New Regime explained vide FAQ

Union Budget 2025-26: Income-Tax Benefits under New Regime explained vide FAQ

FAQ.1: Personal Income-tax reforms with special focus on middle class [...]

केंद्रीय बजट 2025-26: 12 लाख रुपये तक की आय पर कोई आयकर नहीं, 75,000 रुपये की मानक कटौती

केंद्रीय बजट 2025-26: 12 लाख रुपये तक की आय पर कोई आयकर नहीं, 75,000 रुपये की मानक कटौती

वित्त मंत्रालय

नई कर व्यवस्था के तहत 12 लाख रुपये तक की [...]

Union Budget 2025-26: Rs. 12 Lakh Income Tax-Free, Standard Deduction Increased to Rs. 75,000 for Salaried Individuals

Union Budget 2025-26: Rs. 12 Lakh Income Tax-Free, Standard Deduction Increased to Rs. 75,000 for Salaried Individuals

Ministry of Finance

NO INCO [...]