Category: INCOME TAX

Increasing limit for tax exemption on leave encashment to Rs.25 lakh w.e.f. 01.04.2023

Increasing limit for tax exemption on leave encashment for non-government salaried employees to Rs.25 lakh w.e.f. 01.04.2023: CBDT issues Notificati [...]

Linking of PAN with Aadhaar to be done by June 30, 2023 – PFRDA Advisory dated 02.05.2023

Linking of PAN with Aadhaar to be done by June 30, 2023 – PFRDA Advisory dated 02.05.2023

पेंशन निधि विकास प्राधिकरण

PENSION FUND REGULATORY AND DEV [...]

Deduction of TDS under Section 115BAC – Option for intended tax regime be submitted by each employee : IT Circular 04 of 2023

Deduction of TDS under Section 115BAC - Option for intended tax regime be submitted by each employee under section 192 read with sub-section (1A) of s [...]

Form No. 15C or Form No. 15D for grant of certificate for no-deduction of income-tax – Procedure, format and standards for filling an application through TRACES

Form No. 15C or Form No. 15D for grant of certificate for no-deduction of income-tax under sub-section (3) of section 195 of the Income Tax Act, 1961 [...]

Government Savings Promotion General (Amendment) Rules, 2023 – PAN and Aadhar Linking: SB Order No. 08/2023

Government Savings Promotion General (Amendment) Rules, 2023 - PAN and Aadhar Linking: SB Order No. 08/2023

SB Order No. 08/2023

F, No 113-03/2017-S [...]

Consequences of PAN becoming inoperative as per the newly substituted rule 114AAA: CBDT Circular No. 03 of 2023

Consequences of PAN becoming inoperative as per the newly substituted rule 114AAA: CBDT Circular No. 03 of 2023

Circular No. 03 of 2023

F. No. 37014 [...]

Income-tax (Fourth Amendment) Rules, 2023 – Rules 114AAA – Manner of making permanent account number inoperative: IT Notification No. 15/2023

Income-tax (Fourth Amendment) Rules, 2023 - Rules 114AAA - Manner of making permanent account number inoperative: IT Notification No. 15/2023 dated 28 [...]

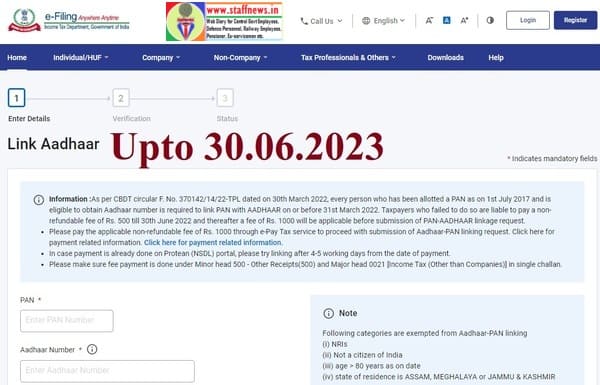

PAN-Aadhaar Linking – Last date extended to 30th June, 2023

PAN-Aadhaar Linking - Last date extended to 30th June, 2023. Last date for linking of PAN-Aadhaar extended to 30th June, 2023. Linking of PAN (Perman [...]

Linking of PAN with Aadhaar to be done by March 31, 2023: PFRDA Advisory

Linking of PAN with Aadhaar to be done by March 31, 2023: PFRDA Advisory

PENSION FUND REGULATORY AND DEVELOPMENT AUTHORITY

ADVISORY

File no.: PF [...]

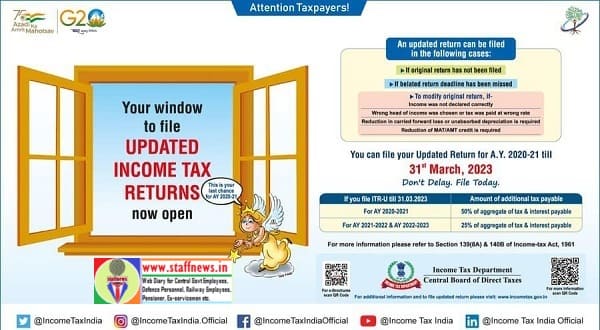

Last date to file Updated ITR for AY 2020-21 is 31.03.2023 – Kind Attention Taxpayers!

Last date to file Updated ITR for AY 2020-21 is 31.03.23

Kind Attention Taxpayers!

Last date to file Updated ITR for AY 2020-21 is 31.03.23. [...]