Tag: Budget 2024-25

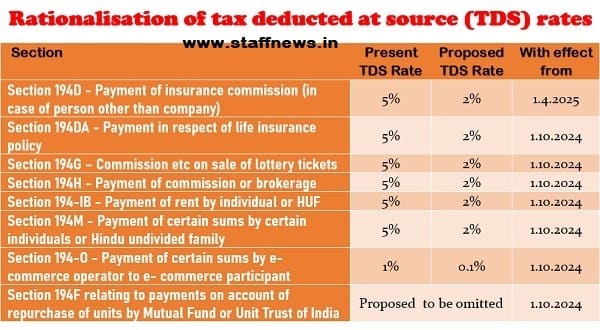

Simplification and Rationalisation of tax deducted at source (TDS) rates: Union Budget 2024-25

Simplification and Rationalisation of tax deducted at source (TDS) rates, Widening and deepening of tax base and anti-avoidance and Tax Administration [...]

3 Schemes for Employment Linked Incentive under EPFO as part of the Prime Minister’s Package: Union Budget 2024-25 Announcement

3 Schemes for Employment Linked Incentive under EPFO as part of the Prime Minister's Package: Union Budget 2024-25 Announcement

Ministry of Finance

[...]

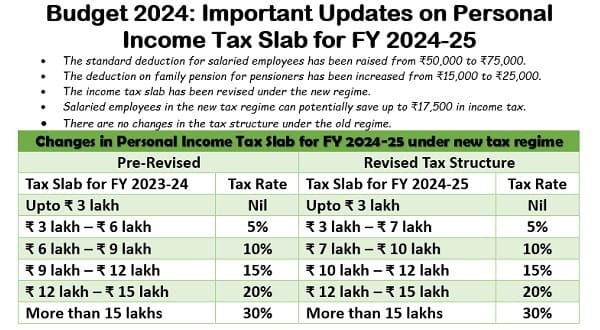

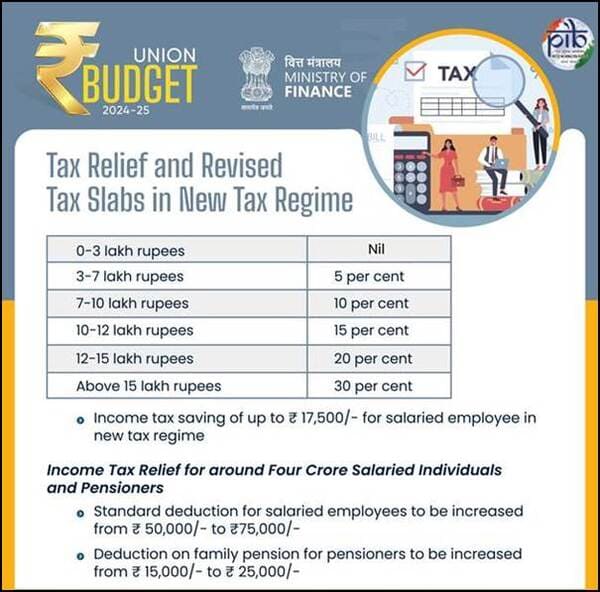

Tax Relief and Revised Tax Slabs in New Tax Regime – Union Budget 2024-25

Tax Relief and Revised Tax Slabs in New Tax Regime - Union Budget 2024-25 - Changes in Income Tax Slab under New Tax Regime, Increase in Standard Dedu [...]

Income Tax Day 2024: A Journey of Transformation – Budget 2024-25 Introduces Enhanced Deductions and Revised Tax Slabs

Income Tax Day 2024: A Journey of Transformation - Budget 2024-25 Introduces Enhanced Deductions and Revised Tax Slabs

Ministry of Finance

[...]

8th Pay Commission, Scrap NPS, Income Tax rebate, Job Creation etc. – CTU’s viewpoints on issues to be considered for framing the budget for 2024-2025

8th Pay Commission, Scrap NPS, Income Tax rebate, Job Creation etc. - CTU's viewpoints on issues to be considered for framing the budget for 2024-2025 [...]

Highlights of Finance Bill, 2024: Tax Rate Changes, Deductions, Faceless Scheme, TCS, and Outstanding Tax Demand Amendments

Highlights of Finance Bill, 2024: Tax Rate Changes, Deductions, Faceless Scheme, TCS, and Outstanding Tax Demand Amendments

HIGHLIGHTS OF FINANCE BIL [...]

Interim Union Budget 2024-25 allocates Rs. 2,52,000 Crore for Railways, focuses on three major corridors, modernizes 40,000 coaches.

Interim Union Budget 2024-25 allocates Rs. 2,52,000 Crore for Railways, focuses on three major corridors, modernizes 40,000 coaches.

Union Railwa [...]

Interim Union Budget 2024-25 retains tax rates, grants relief for direct tax demands, benefiting nearly 1 crore taxpayers.

Interim Union Budget 2024-25 retains tax rates, grants relief for direct tax demands, benefiting nearly 1 crore taxpayers.

INTERIM BUDGET PROPOSE [...]

Interim Union Budget 2024-25: Rs 6.21 trillion for Defence, focus on infrastructure, tech, self-reliance; visionary ‘Viksit Bharat.’

Interim Union Budget 2024-25: Rs 6.21 trillion for Defence, focus on infrastructure, tech, self-reliance; visionary 'Viksit Bharat.'

Record over [...]

Summary of the Interim Union Budget 2024-25: 7.3% GDP growth, increased capital expenditure, 5.1% fiscal deficit, youth empowerment, inclusive development.

Summary of the Interim Union Budget 2024-25: 7.3% GDP growth, increased capital expenditure, 5.1% fiscal deficit, youth empowerment, inclusive develop [...]