Tag: eTDS return

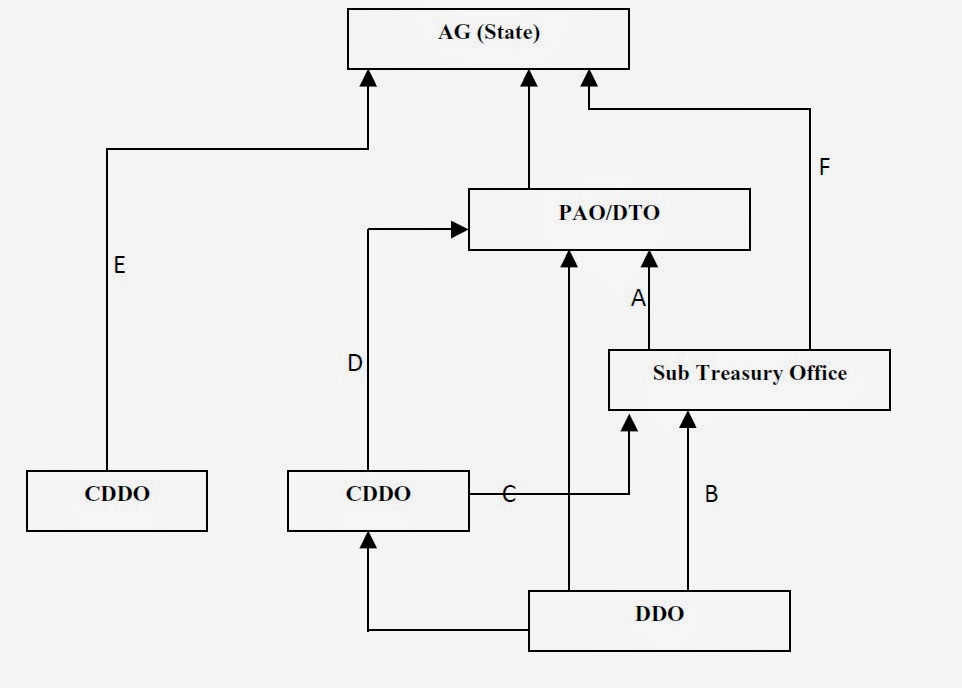

Persons responsible for Deducting Tax and their Duties: Income Tax on Salaries Circular 17/2014

4. PERSONS RESPONSIBLE FOR DEDUCTING TAX AND THEIR DUTIES:

Click to view Part I

Income Tax on Salaries - Circular No. 17/2014

[...]

Filing of Income Tax Returns (ITR) in July 2014

Filing of Income Tax Returns (ITR) in July 2014

In India, the system of direct taxation has been in force in various forms since ancient times. The [...]

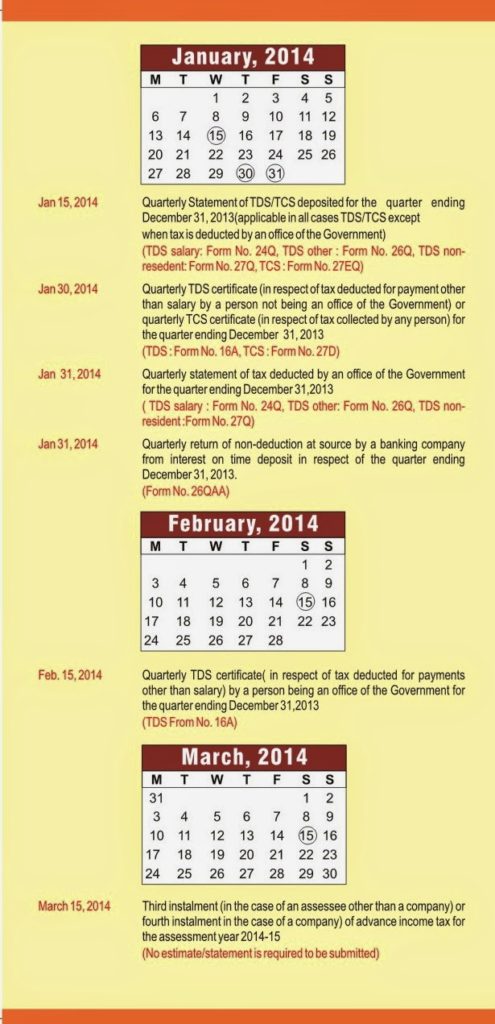

Ex-post facto extension of due date extended to 31.03.2014 for filing TDS/TCS statements for FYs 2012-13 and 2013-14

Circular No. 07/2014

F. No. 275/27/2013-IT(B)

Government of India

Ministry of Finance

Department of Revenue

Central Board of Direct Taxes

New D [...]

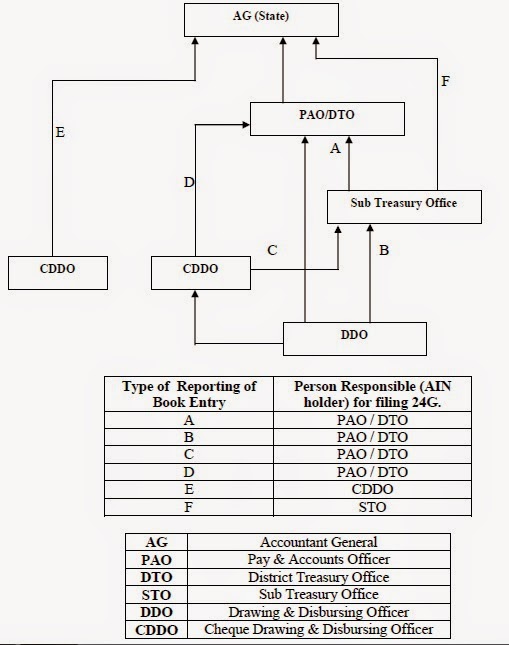

TDS Return – Person Responsible Tax Deduction and their Duties: Income Tax on Salaries : IT Circular 8/2013 Part 4

4. PERSONS RESPONSIBLE FOR DEDUCTING TAX AND THEIR DUTIES:

4.1. As per section 204(i) of the Act, the "persons responsible for paying" for the pu [...]

Deduction of TDS at the time payment of quarterly interest from SCSS accounts, withdrawal from NSS-87 accounts, Payment of Commission to Agents and issue of TDS Certificate in Form I6A

Deduction of TDS at the time payment of quarterly interest from SCSS accounts, withdrawal from NSS-87 accounts, Payment of Commission to Agents and i [...]

Income Tax Return e-Filing – Do’s & Don’ts

e-Filing - Do's & Don't

Impact of Errors made while filing returns

Returns can be classified as defective u/s 139 (9) and in some scenarios t [...]

Issuance of Form 16: New Procedure for F.Y. 2012-13

CIRCULAR NO. 04/2013

F.No 275/34/2011-IT(B)

Government of India

Ministry of Finance

Department of Revenue

Central Board of Direct T [...]

Central Processing of Statements of Tax Dectuded at Source

CENTRALISED PROCESSING OF STATEMENTS OF TAX DEDUCTED AT SOURCE SCHEME, 2013

NOTIFICATION NO. 3/2013[F.NO.142/39/2012-SO(TPL)], DATED 15-1-2013

In [...]

Deduction of Tax at Source – Salary: For Financial Year 2012-13 – ITD Circular No. 8/2012

SECTION 192 OF THE INCOME-TAX ACT, 1961 - DEDUCTION OF TAX AT SOURCE - SALARY - INCOME-TAX DEDUCTION FROM SALARIES UNDER SECTION 192 DURING THE FINANC [...]

Important PIB Release about TDS obligations and panelty

Ministry of Finance

10-July, 2012

Deductors Must Comply with their Obligations to Ensure Correct Credit to Persons from Whose Income Tax is Deduc [...]