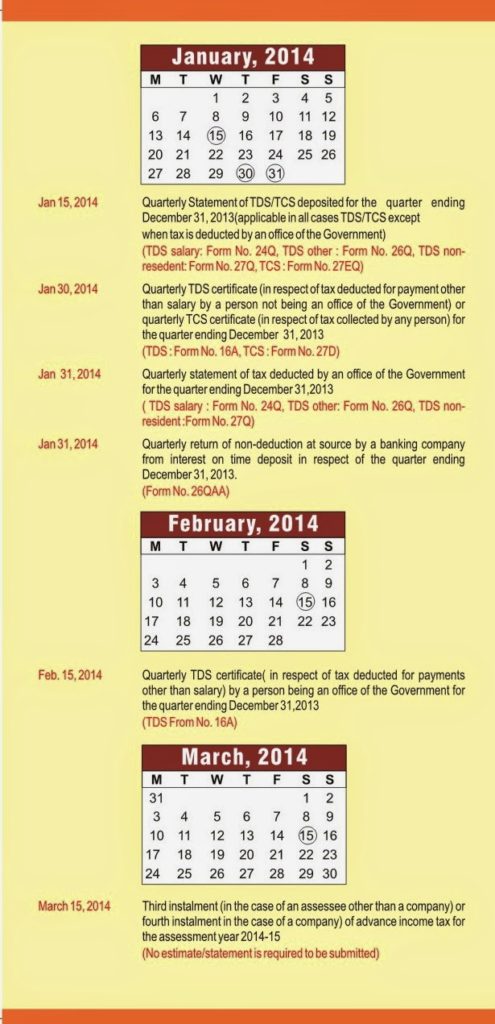

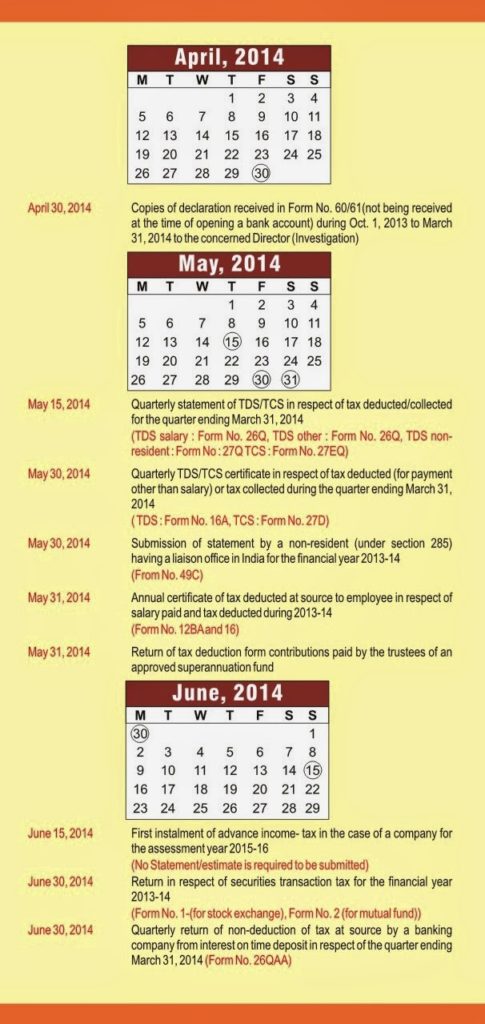

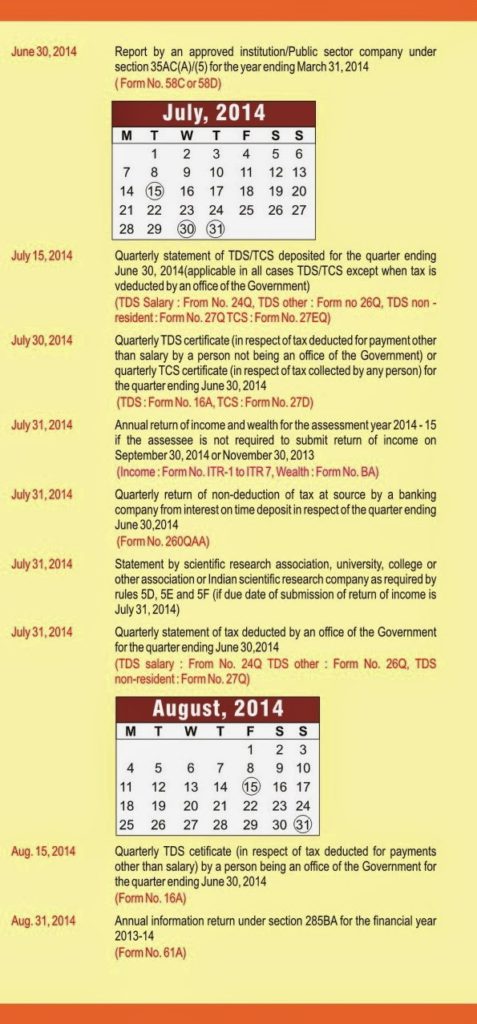

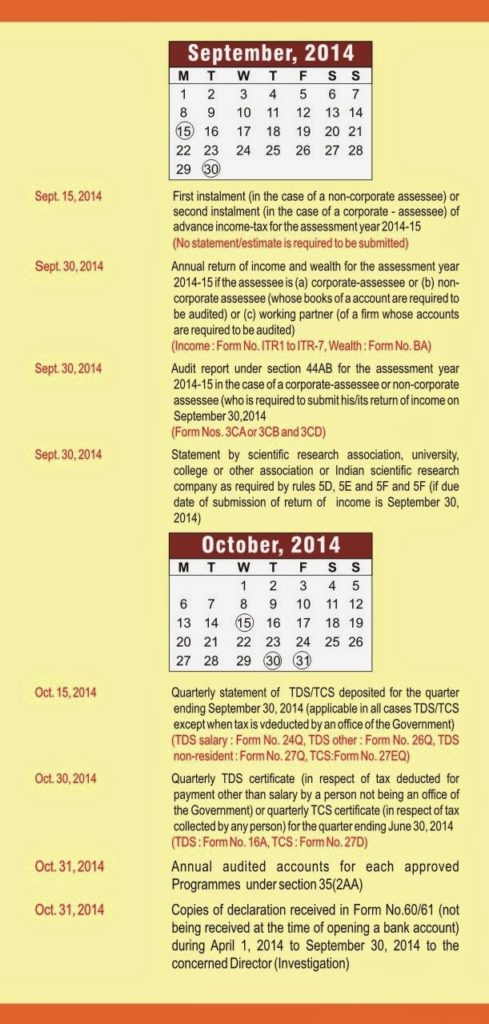

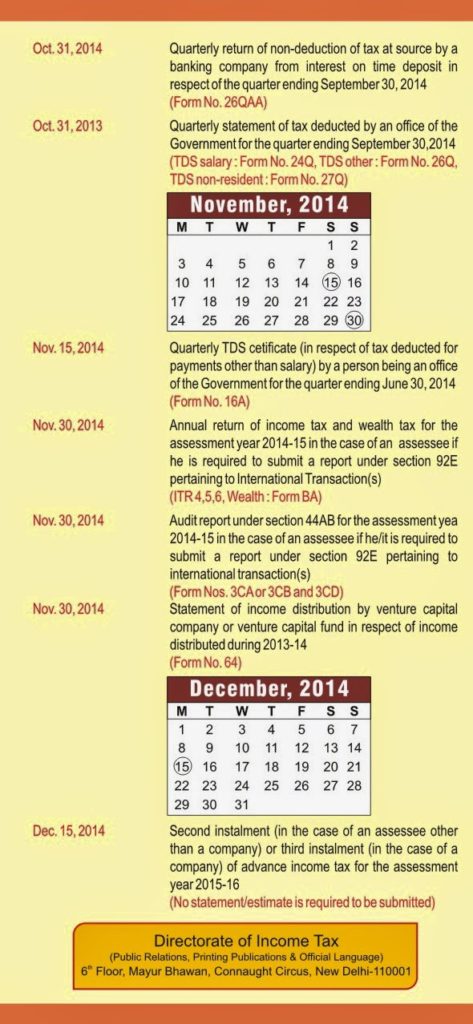

Important Dates

WHAT IS INCOME TAX?

WHO HAS TO PAY INCOME TAX?

INCOME TAX RATES

| Net income range | Income-tax rates | Surcharge | Edu cess | Sec and higher education cess |

| Up toRs.2,00,000 | Nil | Nil | Nil | Nil |

| Rs.2,00,000 –Rs.5,00,000 | 10% of (total income minus Rs.2,00,000) | Nil | 2% of income-tax | 1% of income-tax |

| Rs.5,00,000 –Rs.10,00,000 | Rs.30,000 + 20% of (total income minus Rs.5,00,000) | Nil | 2% of income-tax | 1% of income-tax |

| Rs.10,00,000 –Rs.1,00,00,000 | Rs.1,30,000 + 30% of (total income minus Rs.10,00,000) | Nil | 2% of income-tax | 1% of income-tax |

| AboveRs.1,00,00,000 | Rs.28,30,000 + 30% of (total income minus Rs.1,00,00,000) | 10% of income-tax | 2% of income-tax and surcharge | 1% of income-tax and surcharge |

For a resident senior citizen (who is 60 years or more at any time during the previous year but less than 80 years on the last day of the previous year, i.e., born during April 1, 1934 and March 31, 1954

| Net income range | Income-tax rates | Surcharge | Edu cess | Sec and higher education cess |

| Up toRs.2,50,000 | Nil | Nil | Nil | Nil |

| Rs.2,50,000 –Rs.5,00,000 | 10% of (total income minus Rs.2,50,000) | Nil | 2% of income-tax | 1% of income-tax |

| Rs.5,00,000 –Rs.10,00,000 | Rs.25,000 + 20% of (total income minus Rs.5,00,000) | Nil | 2% of income-tax | 1% of income-tax |

| Rs.10,00,000 –Rs.1,00,00,000 | Rs.1,25,000 + 30% of (total income minus Rs.10,00,000) | Nil | 2% of income-tax | 1% of income-tax |

| AboveRs.1,00,00,000 | Rs.28,25,000 + 30% of (total income minusRs.1,00,00,000) | 10% of income-tax | 2% of income-tax and surcharge | 1% of income-tax and surcharge |

Super Senior Citizen

For a resident super senior citizen (who is 80 years or more at any time during the previous year, i.e., born before April 1, 1934)

| Net income range | Income-tax rates | Surcharge | Edu cess | Sec and higher education cess |

| Up toRs.5,00,000 | Nil | Nil | Nil | Nil |

| Rs.5,00,000 –Rs.10,00,000 | 20% of (total income minus Rs.5,00,000) | Nil | 2% of income-tax | 1% of income-tax |

| Rs.10,00,000 –Rs.1,00,00,000 | Rs.1,00,000 + 30% of (total income minus Rs.10,00,000) | Nil | 2% of income-tax | 1% of income-tax |

| AboveRs.1,00,00,000 | Rs.28,00,000 + 30% of (total income minus Rs.1,00,00,000) | 10% of income-tax | 2% of income-tax and surcharge | 1% of income-tax and surcharge |

Co-operative Societies

Assessment year 2014-15

Co-operative societies – The following rates are applicable to a Co-operative Society for the assessment years 2013-14 and 2014-15.

| Net income range | Income-tax rates |

| Up to Rs.10,000 | 10% |

| Rs.10,000 – Rs.20,000 | 20% |

| Rs.20,000 and above | 30% |

Firms

Assessment year 2014-15 –

A firm is taxable at the rate of 30 per cent for the assessment years 2013-14 and 2014-15.

Specified Income Tax rates for other income

Check the rates of other taxable income such as: short-term capital gains, long-term capital gains, etc. for the Assessment year 2014-15

TAX CALCULATION AND PAYMENT

The Income Tax Department has developed an online Tax calculator.

FILING INCOME TAX RETURNS

As per Taxation Rules, it is mandatory for an earning individual/entity to file a return irrespective of the fact that tax has been deducted at source by his/her employer or not, and whether he/she is eligible for a refund or not.

Note: The CBDT has, vide notification dated 1-05-2013, made E-filing of Return compulsory for Assessment Year 2013-14 for persons having total assessable income exceeding Five lakh rupees.

Note:- All Forms are in PDF

Note:- All Forms are in PDF

Indian Individual Income tax Return

SAHAJ

(ITR-1)

SAHAJ and SUGAM forms are coloured forms with standard

features. Taxpayers can download the forms from the website and print using a

colour printer on an A4 size white paper.

Please read the instructions

for SAHAJ before filling the form.

Individuals and HUFs not having income from Business or

Profession

ITR

2

Read instructions

for ITR 2

For Individuals/HUFs being partners in firms and not carrying out

business or profession under any proprietorship

ITR

3

Read instructions

for ITR 3

Sugam – Presumptive Business Income tax Return

SUGAM

(ITR-4S)

Please read the instructions

for SUGAM before filling the form.

For individuals and HUFs having income from a proprietary business or

profession

ITR

4

Read instructions

for ITR 4

For firms, AOPs and BOIs

ITR

5

Read instructions

for ITR 5

For Companies other than companies claiming exemption under section

11

ITR

6

Read instructions

for ITR 6

For persons including companies required to furnish return under

section 139(4A) or section 139(4B) or section 139(4C) or section

139(4D)

ITR

7

Read

instructions for ITR 7

Acknowledgement for e-Return and non e-Return

Acknowledgement

Further instructions and forms for previous years can be found here.

E-FILING OF INCOME TAX RETURNS

TAX DEDUCTION AT SOURCE (TDS)

Stay connected with us via Facebook, Google+ or Email Subscription.

Subscribe to Central Government Employee News & Tools by Email [Click Here]

Follow us: Twitter [click here] | Facebook [click here] | Google+ [click here]

Admin

COMMENTS