Tag: House Rent Allowance

Consolidated guidelines on Rent/HRA, Vigilance Deputation, City re-classification, DA, PRP and Casual Worker Pay in CPSEs.

Consolidated guidelines on Rent/HRA, Vigilance Deputation, City re-classification for HRA, DA Pattern, PRP and Casual Worker Pay in Central Public Sec [...]

Admissibility of House Rent Allowance in the event of non-acceptance or surrender of Railway Residential Accommodation: RBE No. 115/2025

Admissibility of House Rent Allowance in the event of non-acceptance or surrender of Railway Residential Accommodation - Delegation of Power: RBE No [...]

Revision of rental ceilings for Railway officers posted in Railway Zones and Board’s office w.e.f. Apr, 2025

Revision of rental ceilings for Railway officers posted in Railway Zones and Board’s office w.e.f. Apr, 2025: Railway Board Order dated 01.04.2025

भा [...]

18% House Rent Allowance to the staff working at Hasanparthi and Pindial Stations situated near Warangal Municipal Corporation Area(Telangana): Railway Board Order

18% House Rent Allowance to the staff working at Hasanparthi (HSP) and Pindial (PQL) Stations situated within 8 kms territorial jurisdiction of Warang [...]

Policy guidelines on occupation of Railway Rest House/Rest Rooms (Master circular) – Addendum regarding rest house occupied by Officers

Policy guidelines on occupation of Railway Rest House/Rest Rooms (Master circular) - Addendum regarding rest house occupied on residential grounds by [...]

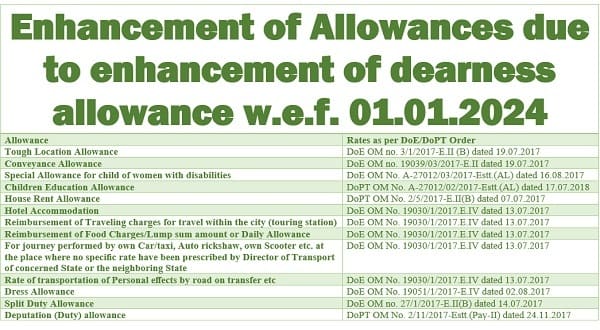

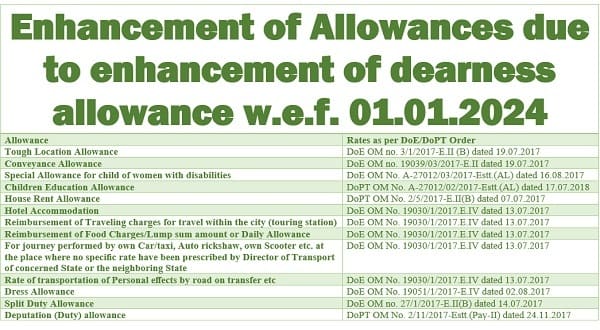

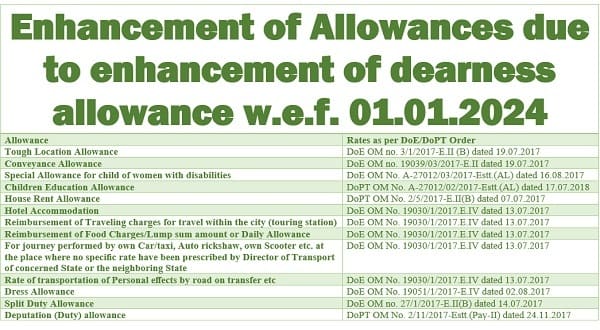

Enhancement of Allowances due to enhancement of dearness allowance w.e.f. 01.01.2024: EPFO

Enhancement of Allowances due to enhancement of dearness allowance w.e.f. 01.01.2024: EPFO

Employees Provident Fund Organisation naan

(MINISTRY OF L [...]

Enhancement of Allowances due to increased DA rates i.e. 50% w.e.f. 01.01.2024: DoT OM

Enhancement of Allowances due to increased DA rates i.e. 50% w.e.f. 01.01.2024: DoT OM

01-02(01)/2024-PAT 1/3188129/2024

No. 01-02(01)/2024-PAT

Gov [...]

Enhancement of Allowances due to enhancement of dearness allowance w.e.f. 01.01.2024 – No separate Order is required: Department of Posts

Enhancement of Allowances due to enhancement of dearness allowance w.e.f. 01.01.2024 - No separate Order is required: Department of Posts

File No.: P [...]

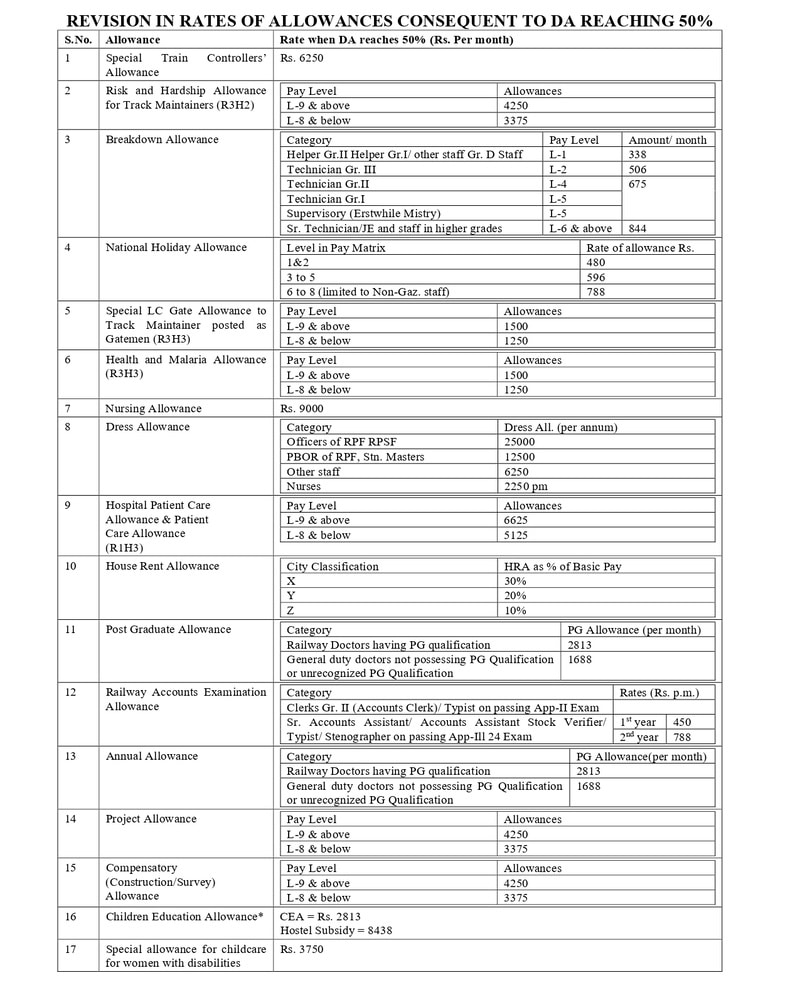

Revised Rates of various allowances upon Dearness Allowance being raised by 50%: Railway Board Order

Revised Rates of various allowances upon Dearness Allowance being raised by 50%: Railway Board Order dated 04.06.2024

GOVERNMENT OF INDIA

MINISTRY O [...]

Entitlement of HRA in case of shared accommodation: Railway Board Order

Entitlement of HRA in case of shared accommodation: Railway Board Order dated 12.04.2024

GOVERNMENT OF INDIA (भारत सरकार)

MINISTRY OF RAILWAYS (रेल [...]