Tag: Income Tax Exemption Limit

Income Tax Exemption Limit in the Budget 2015-16

Income Tax Exemption Limit in the Budget 2015-16:

Press Information Bureau

Government of India

Ministry of Finance

28-February-2015 13:10 [...]

Mutual Fund linked retirement plans (MFLRP) – MFs push for changes in retirement plans in Budget

MFs push for changes in retirement plans in Budget: Financial Express

The 12-lakh-crore Indian mutual fund industry is expecting finance minst [...]

Personal Income Tax exemption may go up to Rs 5 lakh: Financial Express

Personal Income Tax exemption may go up to Rs 5 lakh

The Budget FY16 may carry an assurance, possibly fortified by a new insertion into the Income Tax [...]

Income Tax Expectations – Assocham Survey: Here’s What India Wants

Income Tax Expectations: Here's What India Wants - NDTV

A survey carried out by industry body Assocham has found that a majority of salaried employe [...]

NMC urges FM to raise IT exemption limit to Rs 5 lakh, exclude DA from IT calculation, Merge DA in Basic Pay & Pension etc.

JAMMU: The National Mazdoor Conference today asked Union Finance Minister Arun Jaitley to raise the income tax exemption limit to Rs 5 lakh.

"We urg [...]

Budget 2015: Income tax expectations for the salaried from PM Narendra Modi’s government

Budget 2015: Income tax expectations for the salaried from PM Narendra Modi's government

The Narendra Modi government is all set to present its s [...]

3-year bank FDs may get tax exemption

3-year bank FDs may get tax exemption: Economic Times

The government may consider the demand of banks to make fixed deposits for three years and mor [...]

What not to do for tax exemptions, deductions to stay

What not to do for tax exemptions, deductions to stay: Financial Express

The Income tax Act, 1961 (the Act), provides for certain deductions [...]

Incomes not included under the Head Salaries (Exemptions) – Income Tax on Salaries Circular 17/2014

5.3 INCOMES NOT INCLUDED UNDER THE HEAD "SALARIES" (EXEMPTIONS)

Any income falling within any of the following clauses shall not be included in compu [...]

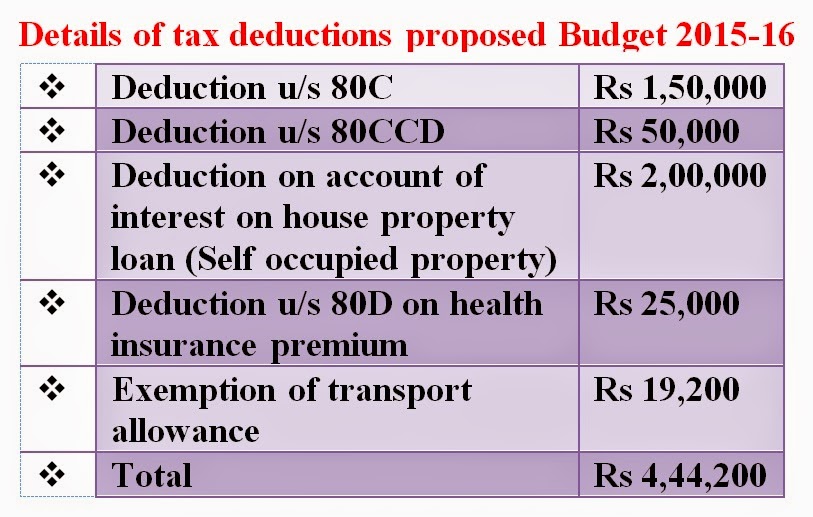

Deduction u/s 16, Chapter VI-A : Income Tax on Salaries Circular No. 17/2014

Deduction u/s 16, Chapter VI-A(80-C, 80CCC, 80CCD, 80CCG, 80D, 80DD, 80U, 80DDB, 80E, 80EE, 80GG, 80GGA, 80TTA) & 87A: Income Tax on Salaries Cir [...]