Tag: IT Return

Waiver of interest payable under section 220(2) due to late payment of demand, in certain cases – Order under Section 119: Income Tax Circular No. 13/2025

Waiver of interest payable under section 220(2) due to late payment of demand, in certain cases - Order under Section 119: Income Tax Circular No. 13/ [...]

Relaxation of time limit for processing of returns of income filed electronically which were incorrectly invalidated by CPC: IT Circular No. 10/2025

Relaxation of time limit for processing of returns of income filed electronically which were incorrectly invalidated by CPC: IT Circular No. 10/2025 d [...]

Waiver on levy of interest under section 201(1A)(ii)/ 206C(7) of the Income-tax Act, 1961, as the case may be, in specific cases: IT Circular No. 8/2025

Waiver on levy of interest under section 201(1A)(ii)/ 206C(7) of the Income-tax Act, 1961, as the case may be, in specific cases: IT Circular No. 8/20 [...]

Processing of valid Income Tax returns filed electronically on or before 31.03.2024 and relaxation of time limit upto 31.03.2026 for sending intimation: IT Circular No. 07/2025

Processing of valid Income Tax returns filed electronically on or before 31.03.2024 and relaxation of time limit upto 31.03.2026 for sending intimatio [...]

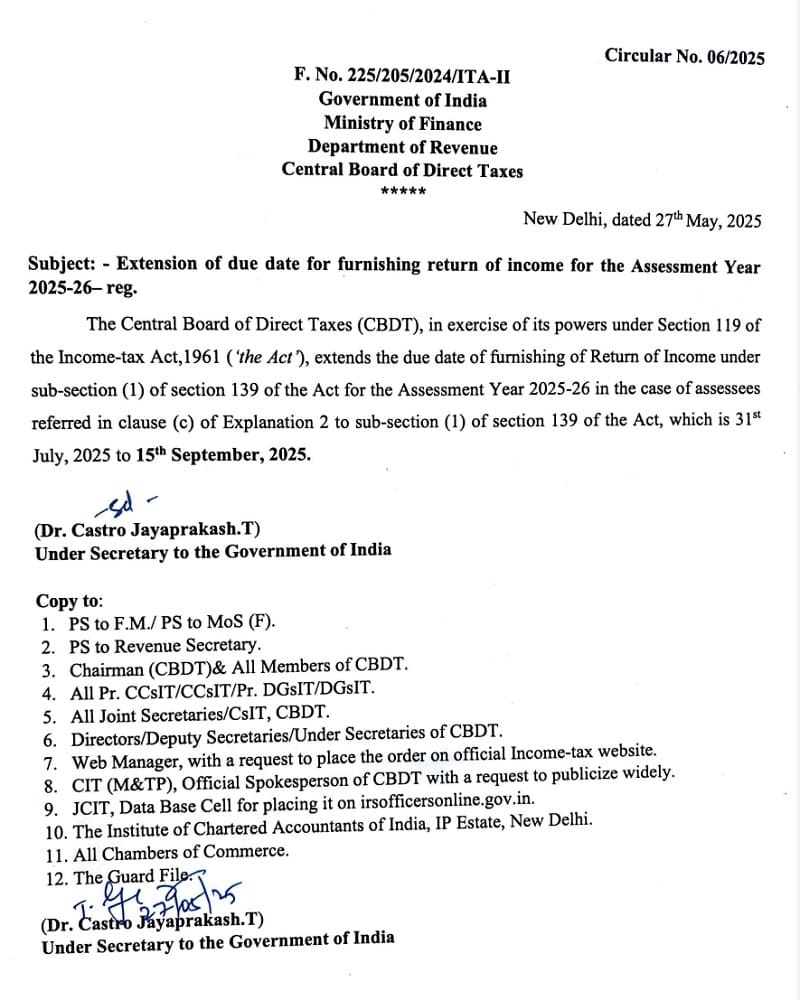

Return of income for the Assessment Year 2025-26 (F.Y. 2024-25) – Extension of due date upto 15.09.2025: Income Tax Circular No. 06/2025

Return of income for the Assessment Year 2025-26 (F.Y. 2024-25) - Extension of due date upto 15.09.2025 for furnishing of return: Income Tax Circular [...]

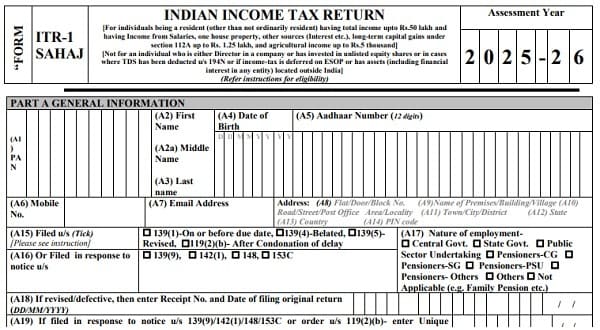

Income-tax (twelfth Amendment) Rules, 2025 – ITR Forms No. 1 Sahaj and No. 4 (Sugam) for AY 2025-26: Notification

Income-tax (twelfth Amendment) Rules, 2025 - ITR Forms No. 1 Sahaj and No. 4 (Sugam) for AY 2025-26: Notification No. 40/25 dated 29.04.2025

MINISTR [...]

Waiver of Interest Charges for Delayed Tax Credit Due to Technical Issues: Income-tax Order under section 119 – Circular No. 5/2025

Waiver on levy of interest under section 201(1A)(ii)/ 206C(7) of the Act, as the case maybe, in specific cases - Order under section 119: IT Circular [...]

Extension of due date for furnishing belated/revised return of income for the Assessment Year 2024-25 in certain cases: IT Circular No. 21/2024

Extension of due date for furnishing belated/revised return of income for the Assessment Year 2024-25 in certain cases: IT Circular No. 21/2024 dated [...]

Extension of timelines for filing of various reports of audit for the Assessment Year 2024-25: IT Circular No. 10/2024

Extension of timelines for filing of various reports of audit for the Assessment Year 2024-25: Income Tax Circular No. 10/2024 dated 29.09.2024

Circu [...]

Understanding Income Tax Notices: A Detailed Overview

Understanding Income Tax Notices: A Detailed Overview

An income tax notice is a formal communication issued by tax authorities to taxpayers, whether [...]