Tag: ITR

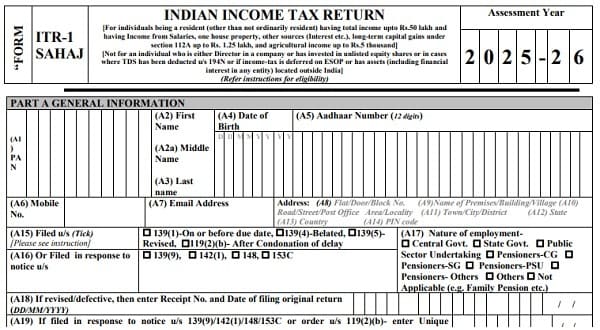

Income-tax (twelfth Amendment) Rules, 2025 – ITR Forms No. 1 Sahaj and No. 4 (Sugam) for AY 2025-26: Notification

Income-tax (twelfth Amendment) Rules, 2025 - ITR Forms No. 1 Sahaj and No. 4 (Sugam) for AY 2025-26: Notification No. 40/25 dated 29.04.2025

MINISTR [...]

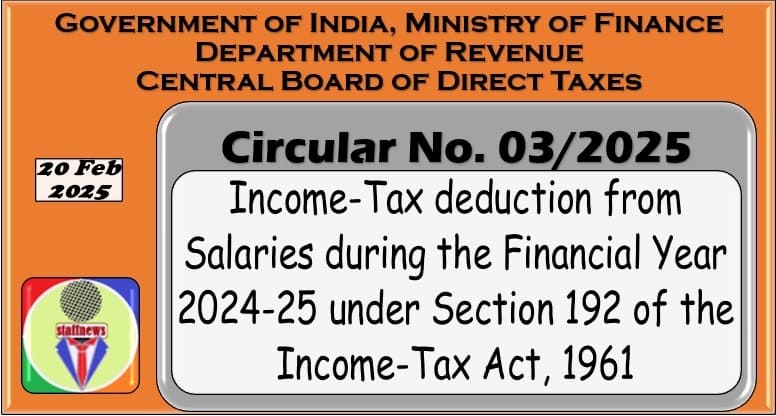

Income-Tax deduction from Salaries during the Financial Year 2024-25: IT Circular No. 3/2025

Income-Tax deduction from Salaries during the Financial Year 2024-25 under Section 192 of the Income-Tax Act, 1961: IT Circular No. 3/2025 dated 20.02 [...]

Income-tax (Third Amendment) Rules, 2024 – Notification of ITR Form-7 for AY 2024-2025

Income-tax (Third Amendment) Rules, 2024 - Notification of ITR Form-7 for AY 2024-2025

MINISTRY OF FINANCE

(Department of Revenue)

(CENTRAL BOARD O [...]

Income-tax (Amendment) Rules, 2024 – Revision of Form ITR-2, ITR-3 & ITR-5 for AY 2024-25

Income-tax (Amendment) Rules, 2024 - Revision of Form ITR-2, ITR-3 & ITR-5 for AY 2024-25

MINISTRY OF FINANCE

(Department of Revenue)

(CENTRAL [...]

Income-tax (First Amendment) Rules, 2024 – Notification No. 16/2024

Income-tax (First Amendment) Rules, 2024: Income Tax Notification No. 16/2024/ F.No. 370142/49/2023-TPL

MINISTRY OF FINANCE

(Department of Revenue)

[...]

Form ITR-1 SAHAJ for AY 2024-25: CBDT Notification No. 105/2023

Form ITR-1 SAHAJ for AY 2024-25: CBDT Notification No. 105/2023 dated 22.12.2023

MINISTRY OF FINANCE

(Department of Revenue)

(CENTRAL BOARD OF DIRE [...]

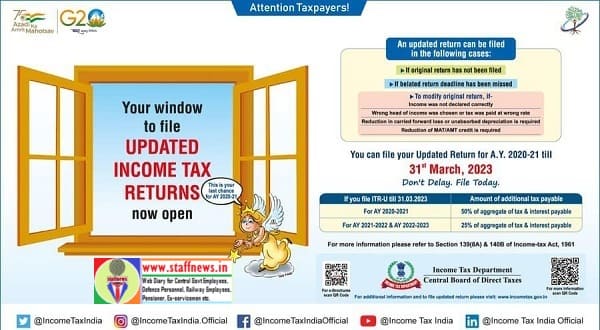

Last date to file Updated ITR for AY 2020-21 is 31.03.2023 – Kind Attention Taxpayers!

Last date to file Updated ITR for AY 2020-21 is 31.03.23

Kind Attention Taxpayers!

Last date to file Updated ITR for AY 2020-21 is 31.03.23. [...]

Income-tax (First Amendment) Rules, 2023 – Forms ITR-1 SAHAJ, ITR-2, ITR-3, ITR-4 SUGAM, ITR-5, ITR-6, ITR-V and I-ITR Acknowledgement for AY 2023-2024 notified

Income-tax (First Amendment) Rules, 2023 - Forms ITR-1 SAHAJ, ITR-2, ITR-3, ITR-4 SUGAM, ITR-5, ITR-6, ITR-V and I-ITR Acknowledgement for AY 2023-202 [...]

Filing of Income Tax Return by 18-35 Age group: Gross taxes paid before claim of refund is Rs 93,318 crore

Filing of Income Tax Return by 18-35 Age group: Gross taxes paid before claim of refund is Rs 93,318 crore

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

[...]

Co-Browser FAQs – The co-browsing (collaborative browsing) feature of the IT Portal

Co-Browser FAQs - The co-browsing (collaborative browsing) feature of the IT Portal is now available to income-tax payers

Co-Browser FAQs

Wha [...]