Tag: ITR

Verification of Income Tax Return (ITR): Reduction of time limit from within 120 days to 30 days of transmitting the data of ITR electronically

Verification of Income Tax Return (ITR): Reduction of time limit from within 120 days to 30 days of transmitting the data of ITR electronically

Notif [...]

FAQs on top ten clarifications sought by the Taxpayers while filing their Income-tax returns

FAQs on top ten clarifications sought by the Taxpayers while filing their Income-tax returns

Question 1:

Self-assessment tax paid but not reflecting [...]

Compliance Check Functionality for Section 206AB & 206CCA- Income Tax Notification No. 01 of 2022: Double TDS/TCS for non-filers of IT return

Compliance Check Functionality for Section 206AB & 206CCA- Income Tax Notification No. 01 of 2022: Double TDS/TCS for non-filers of IT return

DGI [...]

Form ITR-U – Updated return of income: Income-tax (Eleventh Amendment) Rules, 2022

Form ITR-U - Updated return of income: Income-tax (Eleventh Amendment) Rules, 2022

MINISTRY OF FINANCE

(Department of Revenue)

(CENTRAL BOARD O [...]

Income-tax (5th Amendment) Rules, 2022: Form ITR-7 for A.Y. 2023-24 / F.Y. 2022-23

Income-tax (5th Amendment) Rules, 2022: Form ITR-7 for A.Y. 2023-24 / F.Y. 2022-23 vide Notification No. 23/2022-Income Tax Dated: 1st April [...]

Income Tax (fourth Amendment) Rules, 2022: ITR forms for FY 2022-23/ AY 2023-24 vide Notification No. 21/2022

Income Tax (fourth Amendment) Rules, 2022: ITR forms for FY 2022-23/ AY 2023-24 vide Notification No. 21/2022

CBDT notifies ITR Forms SAHAJ ITR-1, [...]

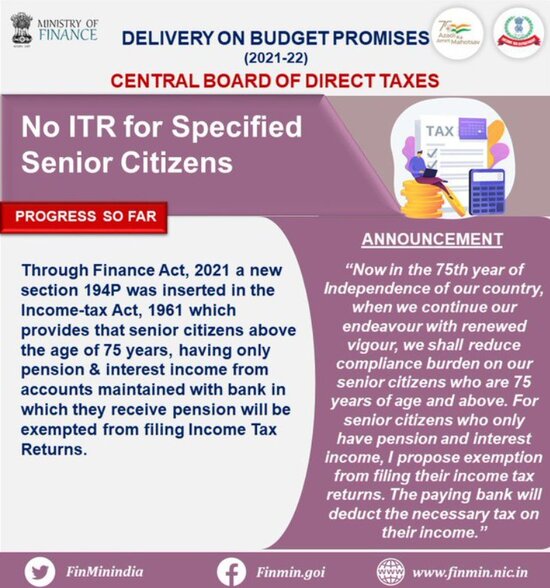

No ITR for Specified Senior Citizens: Through Finance Act 2021 a new section 194P was inserted in IT Act

No ITR for Specified Senior Citizens: Through Finance Act 2021 a new section 194P was inserted in IT Act

ITR for Senior Citizens – To give a much-nee [...]

Extension of timelines for filing of Income-tax returns and various reports of audit for the Assessment Year 2021-22: Circular No. 01/2022

Extension of timelines for filing of Income-tax returns and various reports of audit for the Assessment Year 2021-22

On consideration of difficulties [...]

Income tax-returns e-filed for the Assessment Year 2020-21, pending for verification and processing: IT Circular No. 21/2021

Income tax-returns e-filed for the Assessment Year 2020-21, pending for verification and processing - One-time relaxation for verification : Circular [...]

e-Verification Scheme, 2021: Income Tax Notification No. 137/2021

e-Verification Scheme, 2021: Income Tax Notification No. 137/2021

MINISTRY OF FINANCE

(Department of Revenue)

(CENTRAL BOARD OF DIRECT TAXES)

NOTI [...]