Tag: ITR

ITR – Income Tax Returns filing deadline extended from Dec 31 to January 10, 2021 for these taxpayers

ITR - Income Tax Returns filing deadline extended from Dec 31 to January 10, 2021 for these taxpayers

Press Information Bureau

Government of India [...]

Investment of fund moneys by Recognised Provident Funds – Rule 67 of IT Rules 1961: Amendment Notification No. 84/2020 dt 22nd October, 2020

Investment of fund moneys by Recognised Provident Funds - Rule 67 of IT Rules 1961: Amendment Notification No. 84/2020 dt 22nd October, 2020

CBDT a [...]

ITR: इनकम टैक्स रिटर्न दाखिल करने की अंतिम तारीख बढ़ी

ITR: इनकम टैक्स रिटर्न दाखिल करने की अंतिम तारीख बढ़ी

केंद्रीय प्रत्यक्ष कर बोर्ड (CBDT) ने कहा, ‘‘जिन करदाताओं के लिये आयकर रिटर्न भरने की समय-सीम [...]

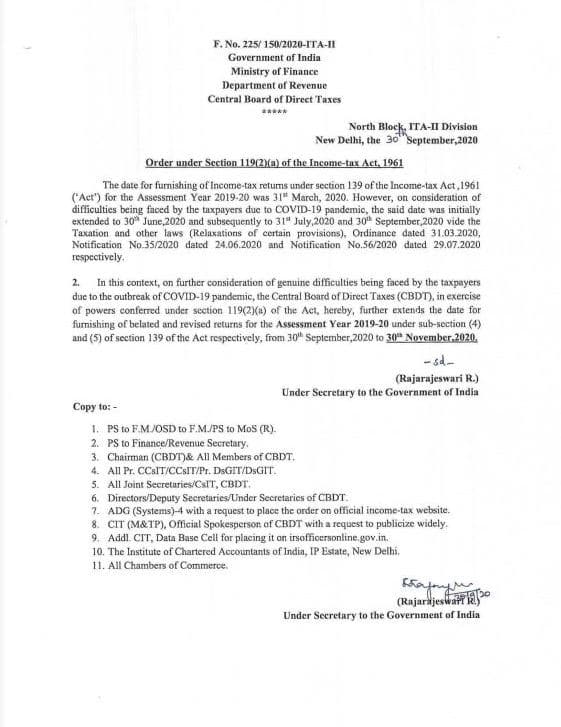

Extension of dates for filing of belated and revised ITRs for the A.Y. 2019-20: CBDT Order u/s 119 of the IT Act, 1961

Extension of dates for filing of belated and revised ITRs for the A.Y. 2019-20: CBDT Order u/s 119 of the IT Act, 1961

F. No. 225/ 150/2020-ITA-II

[...]

Income Tax Return: अब 30 सितंबर तक भर सकेंगे 2018-19 का ITR, पहले इसे 31 जुलाई तक दाखिल करना था

Income Tax Return: अब 30 सितंबर तक भर सकेंगे 2018-19 का ITR, पहले इसे 31 जुलाई तक दाखिल करना था, वित्त वर्ष 2019-20 के लिए आयकर रिटर्न भरने की तारीख प [...]

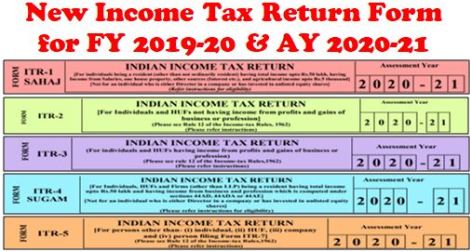

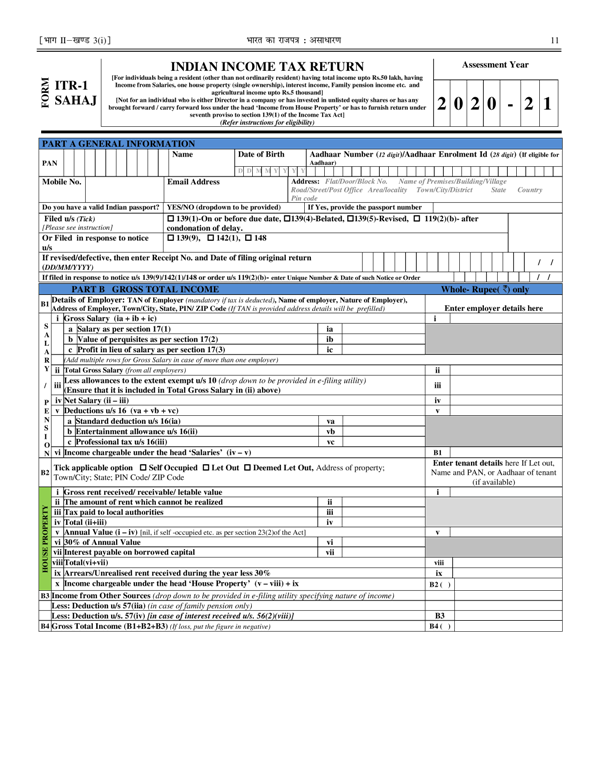

ITR Forms for F.Y. 2019-20 A.Y. 2020-21 -Notification of New ITR-1 Sahaj, ITR-2, ITR-3, ITR-4 Sugam, ITR-5, ITR-6, ITR-7, ITR-V

ITR Forms for F.Y. 2019-20 A.Y. 2020-21 -Notification of Sahaj (ITR-1), Form ITR-2, Form ITR-3, Form Sugam (ITR-4), Form ITR-5, Form ITR-6, Form ITR-7 [...]

कोविड-19 महामारी के कारण वित्त वर्ष 2019-20 के लिए आयकर रिटर्न फॉर्मों को संशोधित कर रहा है सीबीडीटी

कोविड-19 महामारी के कारण करदाताओं के हित में वित्त वर्ष 2019-20 के लिए आयकर रिटर्न फॉर्मों को संशोधित कर रहा है सीबीडीटी

पत्र सूचना कार्यालय

भारत [...]

आईटीआर फॉर्म में कई बदलाव – इस बार चार महीने पहले फार्म अधिसूचित – टैक्स सेविंग के विकल्प

आईटीआर फॉर्म में कई बदलाव - इस बार चार महीने पहले फार्म अधिसूचित - टैक्स सेविंग के विकल्प

आईटीआर फॉर्म में इन पांच बदलाव को जानना जरूरी

आयकर विभाग [...]

CBDT grants relaxation in eligibility conditions for filing of ITR Form-1 and Form-4 for AY 2020-21

CBDT grants relaxation in eligibility conditions for filing of Income-tax Return Form-1 (Sahaj) and Form-4 (Sugam) for Assessment Year 2020-21 [...]

Income Tax: ITR-1 and ITR-4 for Assessment year 2020-21

Income Tax: Notification 01/2020 CBDT notifies ITR-1 and ITR-4 for Assessment year 2020-21

MINISTRY OF FINANCE

(Department of Revenue)

(CENTRAL BO [...]