No .12011/07(i)/2011-Estt(AL)

Government of India

Ministry of Personnel, Public Grievances and Pension

Department of Personnel & Training

Government of India

Ministry of Personnel, Public Grievances and Pension

Department of Personnel & Training

New Delhi, 21-02-2012.

OFFICE MEMORANDUM

Subject: Children

Education Allowance-Clarification–

Education Allowance-Clarification–

The undersigned is directed to

refer to Department of Personnel & Training’s O.M.

No.12011/03/2008—Estt.(Allowance) dated 2nd September, 2008, and subsequent

clarifications issued from time to time on the subject cited above, and to

state that various Ministries / Departments have been seeking clarifications on

various aspects of the Children Education Allowance / Hostel Subsidy. The

doubts raised by various authorities are clarified as under:

refer to Department of Personnel & Training’s O.M.

No.12011/03/2008—Estt.(Allowance) dated 2nd September, 2008, and subsequent

clarifications issued from time to time on the subject cited above, and to

state that various Ministries / Departments have been seeking clarifications on

various aspects of the Children Education Allowance / Hostel Subsidy. The

doubts raised by various authorities are clarified as under:

|

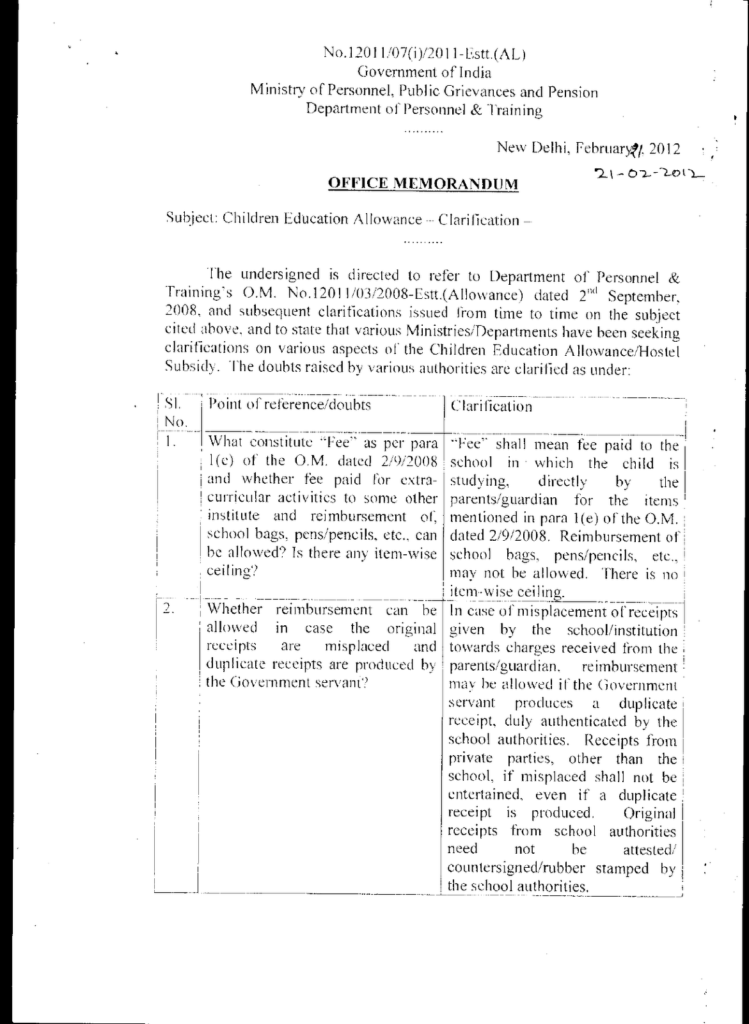

Sl. No

|

Point of reference/doubts

|

Clarification

|

|

1.

|

What constitute “Fee” as per

para l (e) of the O.M. dated 2/9/2008 and whether fee paid for extra-curricular activities to some other institute and reimbursement of, school bags, pens/pencils, etc., Can be allowed? Is there any item-wise ceiling? |

“Fee” shall mean fee paid to

the school in which the child is studying, directly by the parents/ guardian for the items mentioned in para l (e) of the O.M. dated 2/9/2008. Reimbursement of school bags, pens/pencils, etc., may not be allowed. There is no item-wise ceiling. |

|

2.

|

Whether reimbursement can be

allowed in case the original receipts are misplaced and duplicate receipts are produced by the Government servant? |

In case of misplacement of

receipts given by the school/institution towards charges received from the parents/guardian, reimbursement may be allowed if the Government servant produces a duplicate receipt, duly authenticated by the school authorities. Receipts from private parties, other than the school, if misplaced shall not be entertained, even if a duplicate receipt is produced. Original receipts from school authorities need not be attested/ countersigned/ rubber stamped by the school authorities. |

|

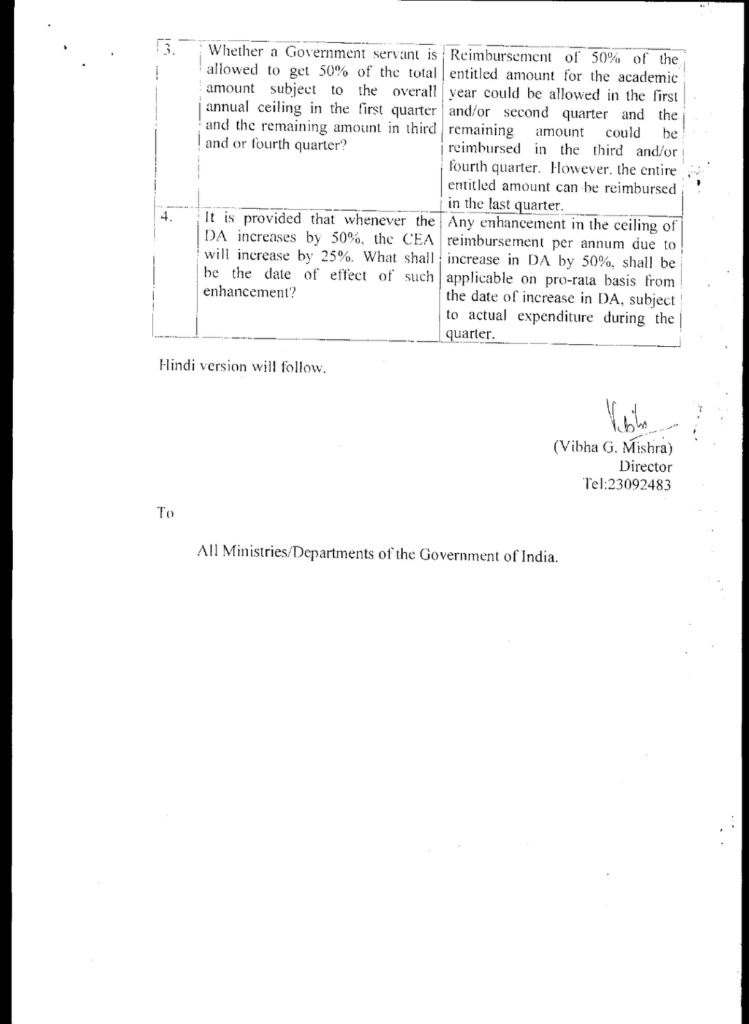

3.

|

Whether a Government servant

is allowed to get 50% of the total amount subject to the overall annual ceiling in the first quarter and the remaining amount in third and or fourth quarter? |

Reimbursement of 50% of the

entitled amount for the academic year could be allowed in the first and/or second quarter and the remaining amount could be reimbursed in the third and/or fourth quarter. However the entitled amount can be reimbursed in the last quarter. |

|

4.

|

It is provided that whenever

the DA increases by 50% the CEA will increase by 25%. What shall be the date of effect of such enhancement? |

Any enhancement in the ceiling

of reimbursement per annum due to increase in DA by 50%, shall be applicable on pro-data basis from the date of increase in DA, subject to actual expenditure during the quarter. |

Source:www.persmin.gov.in

COMMENTS

Sir,can provide children education allowance to state government employees