One rank one pension: The arguments for and against

OROP, though promised by both the UPA and NDA, is yet to be implemented, triggering emotional, countrywide protests by ex-soldiers

OROP — or One Rank, One Pension — means that every pension-eligible soldier retiring in a particular rank gets the same pension, irrespective of his date of retirement. As of now, soldiers who retired more recently receive more pension than those who retired earlier. This is because pensions are dependent on the last salary drawn, and successive pay commissions have raised salaries. Thus, a Colonel who retired after the Sixth Pay Commission recommendations were accepted in 2006, gets more than a Colonel who retired when his salary was computed on the basis of the recommendations of the Third Pay Commission. OROP, though promised by both the UPA and NDA, is yet to be implemented, triggering emotional, countrywide protests by ex-soldiers.

Sushant Singh explains the arguments for and against OROP.

FOR OROP

Compensation for early retirement, and a national obligation.

The nation needs a young Army, necessitating early recruitments and retirements. Soldiers have short careers — a jawan retires at age 35, while a civilian can work until he is 60. To make up for their shorter working lives, without lateral absorption into another government job of the same grade and status, veterans need compensation that is comparable to what a soldier of the same rank retiring today would get from the government.

A curtailed career results in denial of longer service at higher pay and, therefore, higher pension. Soldiers are denied the opportunity to earn more increments and promotions, as well as the benefits offered by more recent pay commissions, which significantly affects their pensions. OROP can address all of this.

There is also the emotional argument. Defence forces personnel give up their best years to the service of the nation and society, suffering hardships of military life — and, at the end of their service, face limited opportunities for re-employment.

Many defence personnel, both serving and retired, feel that their contribution to the nation and society is not adequately recognised or appreciated. Their terminal benefits bear no resemblance to the realities of life in the civilian world.

A nation cannot allow its soldiers to feel that it does not care for them. OROP is essentially an obligation of the Indian nation towards its soldiers — and the price it must pay for maintaining a standing Army. OROP would send a strong emotional signal to soldiers and veterans.

AGAINST OROP

Administrative nightmare, an unbearable financial burden.

The arguments against OROP are based on administrative, financial and legal complications in implementing the scheme. In 2011, the Defence Ministry told the Koshiyari Committee that records going back further than 25 years were no longer available — a major administrative “difficulty in introducing the concept”. There are cases where soldiers who retired in the 1940s are still being paid family pensions, and it will be administrative impossible to reconcile the nearly 20 lakh cases over such a long period for OROP over any reasonable timeframe.

The Law Ministry told the committee that “if today’s pension and emoluments are passed automatically to somebody who retired 30 years ago, there will be inherent discrimination against terms and conditions of service which would lead to discrimination under the Constitution”.

A related aspect: people who retire in the same rank often earn different pensions because they may have served for longer periods in that rank. A Colonel who serves for 12 years in that rank will earn more pension than someone who served for 4 years as Colonel. Equating their pensions was unlikely to withstand a legal challenge.

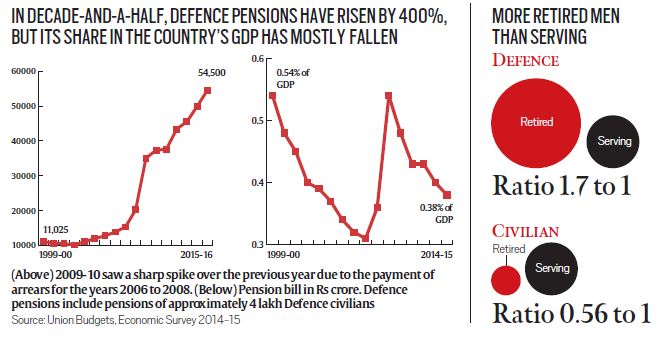

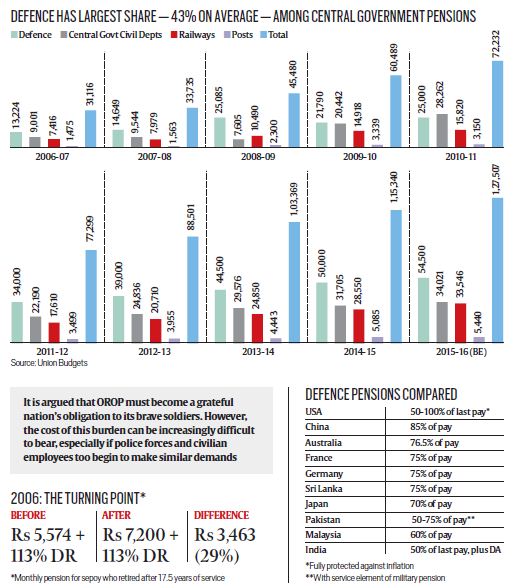

The financial argument is about the long-term cost of implementing OROP.

Defence Minister Manohar Parrikar’s estimate of Rs 8,300 crore is only a one-time payout. This amount will increase substantially every time a new pay commission makes its recommendations, with all old pensioners being paid at the new rate. There is also the likelihood of civilian employees, such as the Central Armed Police Forces and the state police forces, raising the demand for OROP. Finally, there are fears that civilian employees who moved to a contributory pension scheme in 2004 might demand a reversion to fixed pensions, thus unravelling the whole system. That, perhaps, is the strongest argument against setting a precedent with OROP.

Read at Indian Express

Stay connected with us via Facebook, Google+ or Email Subscription.

Subscribe to Central Government Employee News & Tools by Email [Click Here]

Follow us: Twitter [click here] | Facebook [click here] | Google+ [click here]

Admin

COMMENTS

Give the OROP at least to those who retired before the age of 45 and were not absorbed in government jobs.

Ex-JWO, Arya Prem,

who ever is this idiot trying to throw a spanner into the OROP issue, please note: a handicapped police man, para military person or any other govt servant is retained in service despite he is unfit to continue in service till the age of 60 years, they get full superannuation pension.where as a Military combatant person is medically boarded out of service. to maintain young blood a soldier retires by 35 to 38 years, please do not compare any other serviceses with Army, Navy, Air force. for years we are forced to stay away from our our famlies, other service people they sleep with their wives, they get home made food and every comfort, these luxuries a soldier sacrificeses for the sake of our nation, there somany such reasons which other services cannot be compared with soldiers, stop comparing others with IESM and OROP