Revision of pension in r/o of Pre-2006 JCOs/ORs Pensioners/family pensioners, Revised Table for Army, Air-force & Navy – Arrears from 01.01.2006: Ministry of Defence Order

No 1(04)/2015(II)-D(Pen/Pol)

Government of India

Ministry of Defence

D(Pension/Policy)

New Delhi, Dated: 3rd September, 2015

To

The Chief of Army Staff

The Chief of Naval Staff

The Chief of Air Staff

Subject: – Revision of pension in r/o of Pre-2006 JCOs/ORs Pensioners/family pensioners.

Click here for Revision of pre-2006 JCOs/ORs pensioners/ Family pensioners: PCDA Circular No. 547

The undersigned is directed to refer to this Ministry’s letter No. 17(4)/2008(1)/D (Pen/Pol) dated 11.11.2008 as amended, issued for implementation of government decision on the recommendations of the Sixth CPC for revision of pension/family pension in respect of Pre-2006 Armed Forces pensioners/family pensioners. As per previsions contained in Para 5 therein, with effect from 01.01.2006, revised pension and revised ordinary family pension of all Pre-2006 Armed Forces pensioners/family pensioners determined in terms of fitment formula laid down in Para 4.1 above said letter dated 11.11.2008, shall in no case be lower than fifty percent and thirty percent respectively, of the minimum of the Pay in Pay Band plus the Grade Pay corresponding to the pre-revised scale from which the pensioner had retired/ discharged/invalided out/died including Military Service Pay and “X” group pay where applicable.

2. Now, after issue of GOI, Ministry of Personnel, PG & Pensioners, Department of Pension & Pensioners’ Welfare OM No. 38/37/08-P & PW (A) dated 30.07.2015, it has been decided that with effect from 01.01.2006 pension/family pension of Pre-2006 JCOs/ORs Pensioners/family pensioners shall be determined as fifty and thirty percent respectively of the minimum of the fitment table for the Rank in the revised Pay Band as indicated under fitment tables annexed with 1/S/2008 as amended and equivalent instructions for Navy and Air Force, plus Grade Pay corresponding to the pre-revised scale from which the pensioner had retired/discharged/invalided out/died including Military Service Pay and X group pay.

3. However, in case, the consolidated pension/family pension calculated as per Para 4.1 of this Ministry’s letter No. 17(4)/2008(1)/D(Pen/Pol) dated 11.11.2008 is higher than the pension/family pension calculated in the manner indicated above, the same (higher consolidated pension/family pension) will continue to be treated as basic pension/ family pension. However, where revised pension in terms of GO], MOD letter No.PC-10(1)/2009-D(Pen/Pol) dated 08.03.2010 and No. 1(13)/2012/D(Pen/Policy) dated 17.01.2013 is higher than the rate indicated in annexure attached with this letter then the same will continue to be treated as basic pension/family pension from 1.07.2009 and 24.09.2012 respectively.

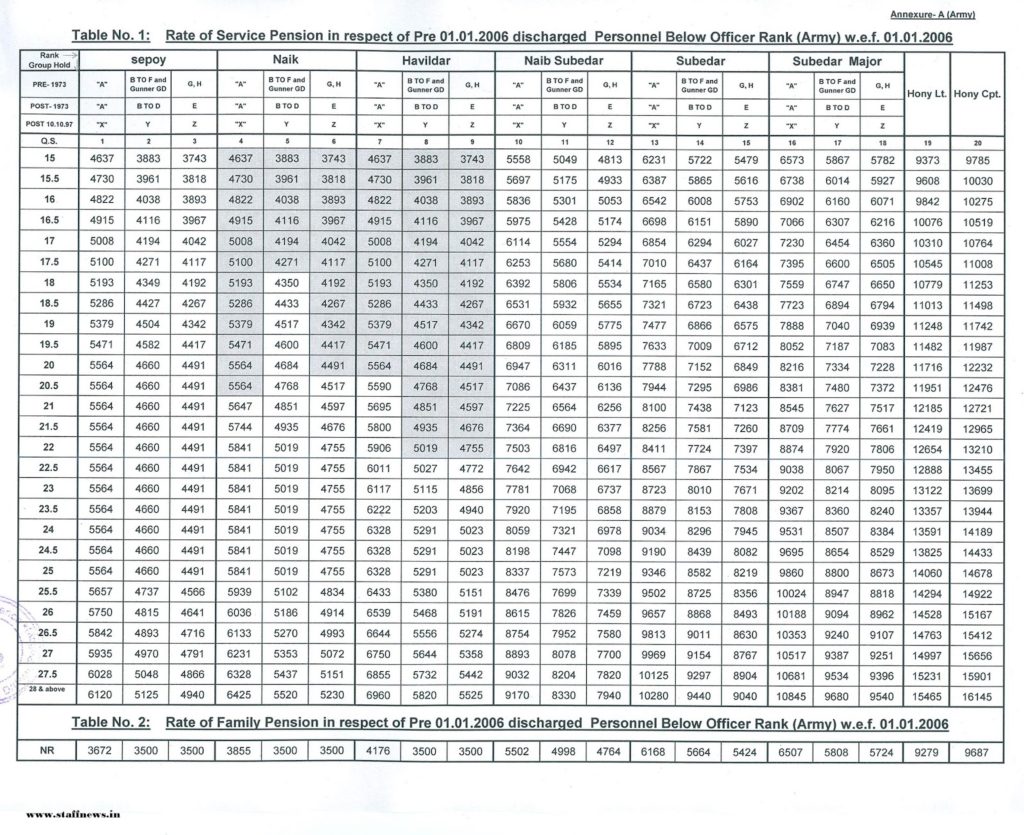

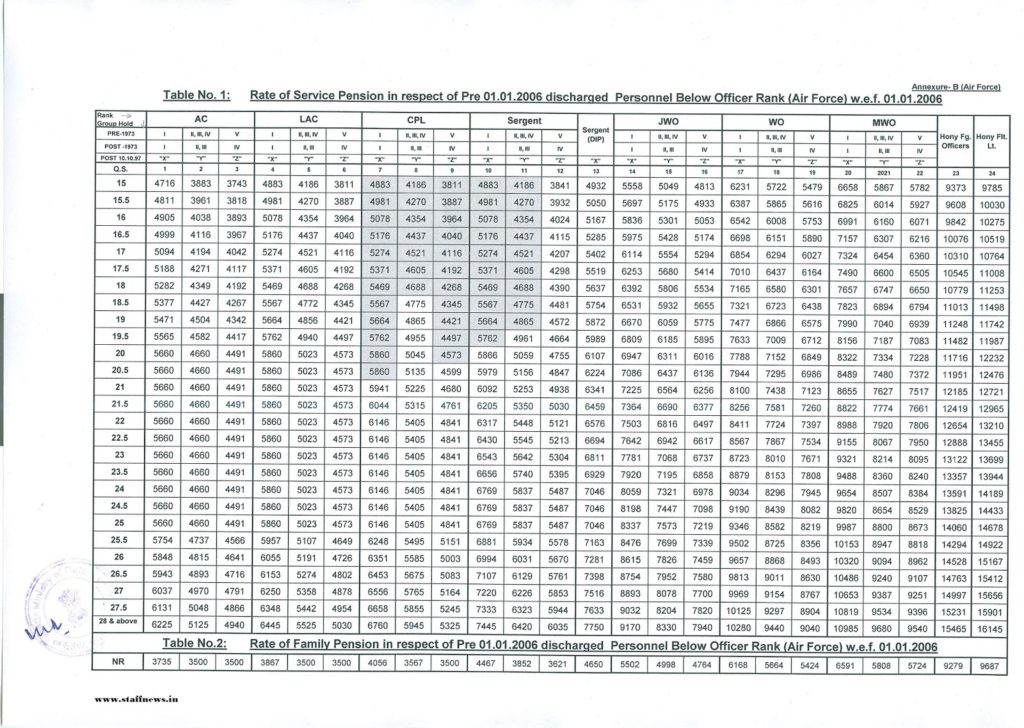

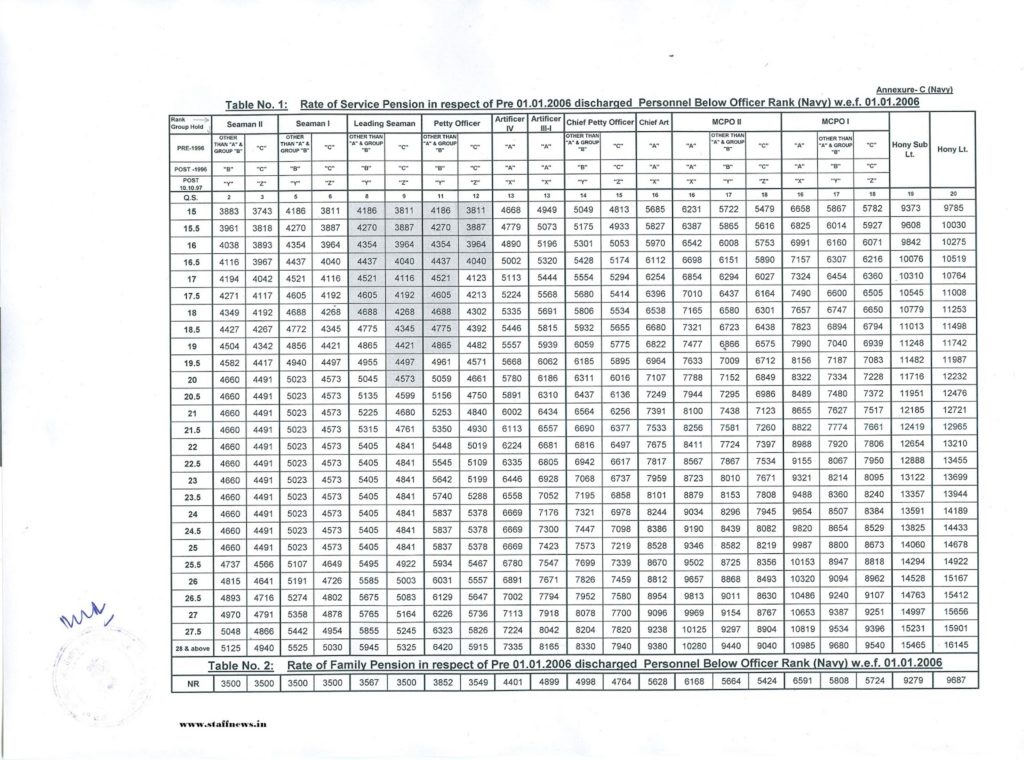

4. Accordingly, revised tables indicating minimum guaranteed pension/ Ordinary Family Pension has been annexed as annexure-A ( Army pensioners), Annexure -B (Air Force pensioners), and Annexure-C (Navy pensioners) to this letter. Pension Disbursing Authorities are hereby authorized to step up the pension/family pension of the affected pre-2006 pensioners where the existing pension being paid to the pensioners in terms of this Ministry’s above letter dated 11.11.2008 as amended, is less than the rate of pension indicated in above said annexure. Necessary implementation instructions to all concerned shall be issued by Principal CDA (Pensions), Allahabad on receipt of these orders.

5. All other terms and conditions shall remain unchanged.

6. The provisions of this letter shall take effect from 01.01.2006 and arrears, if any, shall be allowed from 01.01.2006 up to the date where revised pension/family pension in terms of 601, MOD letter No. PC 10(1)/2009-D (Pen/Pol) dated 08.03.2010 and No. 1(13)/2012/D (Pen/Pol) dated 17.01.2013 is paid.

7. This issues with concurrence of FinanceDivision of this Ministry vide their ID No. 22(5)/2015/Fin/Pen dated 25.08.2015 and Ministry of Finance, Department of expenditure vide their ID No. 1(12)/EV/2015 dated 2.9.2015.

8. Hindi version will follow.

Yours faithfully

sd/-

(R. K. Arora)

Under Secretary to the Government of India

|

| Anexure A (Army) |

|

| Annexure-B (Air Force) |

|

| Annexure-C (Navy) |

Source: http://www.desw.gov.in/sites/upload_files/desw/files/pdf/D%28pen-pol2-3-Sep-2015.pdf

Stay connected with us via Facebook, Google+ or Email Subscription.

Subscribe to Central Government Employee News & Tools by Email [Click Here]

Follow us: Twitter [click here] | Facebook [click here] | Google+ [click here]

Admin

COMMENTS

On what logic x group sub/man or a MWO looses his trade . Secondly After serving 38to 39 of service why my pension is fixed at par with one who has served 28 or29 years and retired as honorary captain what logic or what justification this is no idea please rectify

Bijendra

Sir ,

According to PCDA pension circular No 547 and clarification No 549 arrears is not credited .the deffirences of pension is RS 2646 /+DA for 42 month Rank of Subedar Y gp . Pension wef -01-01-1006 as per 6 CPC RS -9324/-and Revised pension such as notional wef -01-07 -2009 RS 11970/-kindly credit the arrears asper above order.

Retired in June 2005 15 Yrs 8 Months Air Force Sergeant Y Group. Jan 2006 was 3721 and Jul 2009 was 4955 and At present 5416. But I got only 6881 as arrear. Please any one clarify. My Mobile 9416426760. And I also asked one sergeant retired in 2003 he got 80000 in OBC Account. My account Canara.

I am Sergeant of Y Group retired in Jun 2005. I was getting 3721 from 01.01.2006 and 4955 from 01.07.2009 and 5416 from 24.09.2012. Now will I get something then how and what. Can someone explain…

Dear Sir, Please note that MOD Revision above table is wrong for Navy PBOR. I have retired as PO (ME) in 31/01/1997 and as per the Revision 2012 I am getting Rs. 5301 as Pension and I was getting from 2006 Rs 4840. In MOD Circular above says my pension is Rs 4188 for 15 years served as PO. Something is wrong with calculation. Please clarify on my mail if possible as [email protected]

ONE RANK ONE PENSION is for a standard of living in the remaining life in the same manner ,