Salient features of the 11th Bipartite Settlement: D.A, HRA, Pay Scales, Special Pay, Stagnation Increments, FPP, and Other Allowances

ALL INDIA BANK EMPLOYEES’ ASSOCIATION

Salient features of the 11th Bipartite Settlement

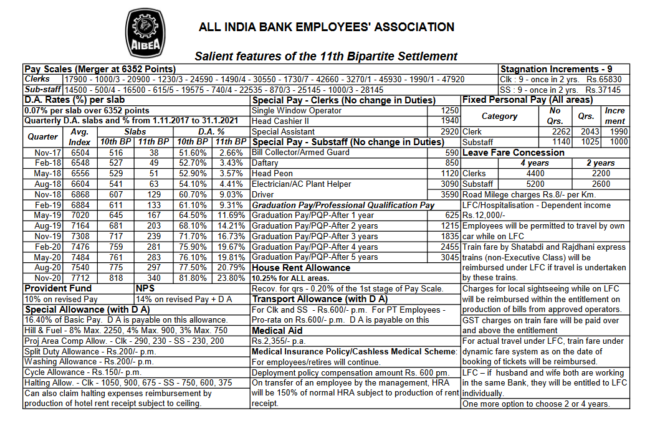

| Pay Scales (Merger at 6352 Points | Stagnation Increments – 9 | ||||||||||||

| Clerks | 17900 – 1000/3 – 20900 – 1230/3 – 24590 – 1490/4 – 30550 – 1730/7 – 42660 – 3270/1 – 45930 – 1990/1 – 47920 | Clk : 9 – once in 2 yrs. Rs.65830 | |||||||||||

| Sub-staff | 14500 – 500/4 – 16500 – 615/5 – 19575 – 740/4 – 22535 – 870/3 – 25145 – 1000/3 – 28145 | SS : 9 – once in 2 yrs. Rs.37145 | |||||||||||

| D.A. Rates (%) per slab | Special Pay – Clerks (No change in Duties) | Fixed Personal Pay (All areas) | |||||||||||

| 0.07% per slab over 6352 points | Single Window Operator | 1250 | Category | No Qrs. | Qrs. | Incre ment | |||||||

| Quarterly D.A. slabs and % from 1.11.2017 to 31.1.2021 | Head Cashier II | 1940 | |||||||||||

| Quarter | Avg. Index | Slabs | D.A. % | Special Assistant | 2920 | Clerk | 2262 | 2043 | 1990 | ||||

| 10th BP | 11th BP | 10th BP | 11th BP | Special Pay – Substaff (No change in Duties) | Substaff | 1140 | 1025 | 1000 | |||||

| Nov-17 | 6504 | 516 | 38 | 51.60% | 2.66% | Bill Collector/Armed Guard | 590 | Leave Fare Concession | |||||

| Feb-18 | 6548 | 527 | 49 | 52.70% | 3.43% | Daftary | 850 | 4 years | 2 years | ||||

| May-18 | 6556 | 529 | 51 | 52.90% | 3.57% | Head Peon | 1120 | Clerks | 4400 | 2200 | |||

| Aug-18 | 6604 | 541 | 63 | 54.10% | 4.41% | Electrician/AC Plant Helper Driver | 3090 | Substaff | 5200 | 2600 | |||

| Nov-18 | 6868 | 607 | 129 | 60.70% | 9.03% | 3590 | Road Milege charges Rs.8/- per Km. | ||||||

| Feb-19 | 6884 | 611 | 133 | 61.10% | 9.31% | Graduation Pay/Professional Qualification Pay | LFC/Hospitalisation- Dependent income Rs.12,000/- | ||||||

| May-19 | 7020 | 645 | 167 | 64.50% | 11.69% | Graduation Pay/POP-After 1 year | 625 | ||||||

| Aug-19 | 7164 | 681 | 203 | 68.10% | 14.21% | Graduation Pay/POP-After 2 years | 1215 | Employees will be permitted to travel by own car while on LFC | |||||

| Nov-19 | 7308 | 717 | 239 | 71.70% | 16.73% | Graduation Pay/POP-After 3 years | 1835 | ||||||

| Feb-20 | 7476 | 759 | 281 | 75.90% | 19.67% | Graduation Pay/POP-After 4 years | 2455 | Train fare by Shatabdi and Rajdhani express trains (non-Executive Class) will be reimbursed under LFC if travel is undertaken by these trains. | |||||

| May-20 | 7484 | 761 | 283 | 76.10% | 19.81% | Graduation Pay/POP-After 5 years | 3045 | ||||||

| Aug-20 | 7540 | 775 | 297 | 77.50% | 20.79% | House Rent Allowance | |||||||

| Nov-20 | 7712 | 818 | 340 | 81.80% | 23.80% | 10.25% for ALL areas. | |||||||

| Provident Fund | NPS | Recov. for qrs – 0.20% of the 1st stage of Pay Scale. | Charges for local sightseeing while on LFC will be reimbursed within the entitlement on production of bills from approved operators. | ||||||||||

| 10% on revised Pay | 14% on revised Pay + D A | Transport Allowance (with D A) | |||||||||||

| Special Allowance (with D A) | For Clk and SS – Rs.600/- p.m. For PT Employees – Pro-rata on Rs.600/- p.m. D A is payable on this | ||||||||||||

| 16.40% of Basic Pay. D A is payable on this allowance. | GST charges on train fare will be paid over and above the entitlement | ||||||||||||

| Hill & Fuel – 8% Max. 2250, 4% Max. 900, 3% Max. 750 | Medical Aid | ||||||||||||

| Proj Area Comp Allow. – Clk – 290, 230 – SS – 230, 200 | Rs.2,355/- p.a. | For actual travel under LFC, train fare under dynamic fare system as on the date of booking of tickets will be reimbursed. | |||||||||||

| Split Duty Allowance – Rs.200/- p.m. | Medical Insurance Policy/Cashless Medical Scheme: For employees/retires will continue. | ||||||||||||

| Washing Allowance – Rs.200/- p.m. | |||||||||||||

| Cycle Allowance – Rs.150/- p.m. | Deployment policy compensation amount Rs. 600 pm. | LFC – if husband and wife both are working in the same Bank, they will be entitled to LFC individually. | |||||||||||

| Halting Allow. – Clk – 1050, 900, 675 – SS – 750, 600, 375 | On transfer of an employee by the management, HRA will be 150% of normal HRA subject to production of rent receipt. | ||||||||||||

| Can also claim halting expenses reimbursement by production of hotel rent receipt subject to ceiling. | |||||||||||||

| One more option to choose 2 or 4 years. | |||||||||||||

Also View: 11th BI-Partite Settlement Dtd. 11 Nov 2020- Clerical and Subordinate Staff: Wage revision etc. w.e.f 1st Nov, 2017

Salient features of the 11th Bipartite Settlement

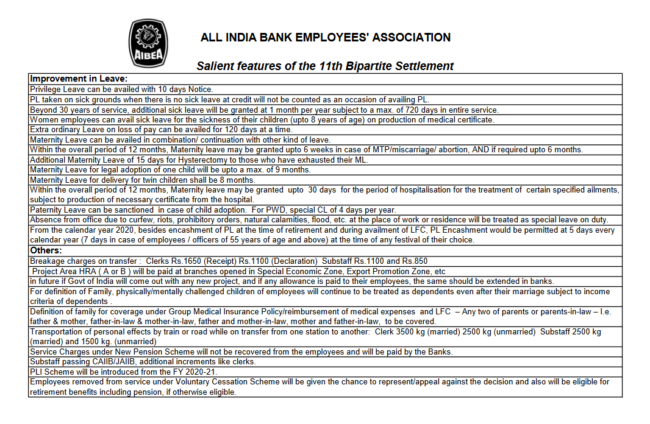

| Improvement in Leave: |

| Privilege Leave can be availed with 10 days Notice. |

| PL taken on sick grounds when there is no sick leave at credit will not be counted as an occasion of availing PL. |

| Beyond 30 years of service, additional sick leave will be granted at 1 month per year subject to a max. of 720 days in entire service. |

| Women employees can avail sick leave for the sickness of their children (upto 8 years of age) on production of medical certificate. |

| Extra ordinary Leave on loss of pay can be availed for 120 days at a time. |

| Maternity Leave can be availed in combination/ continuation with other kind of leave. |

| Within the overall period of 12 months, Maternity leave may be granted upto 6 weeks in case of MTP/miscarriage/ abortion, AND if required upto 6 months. |

| Additional Maternity Leave of 15 days for Hysterectomy to those who have exhausted their ML. |

| Maternity Leave for legal adoption of one child will be upto a max. of 9 months. |

| Maternity Leave for delivery for twin children shall be 8 months. |

| Within the overall period of 12 months, Maternity leave may be granted upto 30 days for the period of hospitalisation for the treatment of certain specified ailments, subject to production of necessary certificate from the hospital. |

| Paternity Leave can be sanctioned in case of child adoption. For PWD, special CL of 4 days per year. |

| Absence from office due to curfew, riots, prohibitory orders, natural calamities, flood, etc. at the place of work or residence will be treated as special leave on duty. |

| From the calendar year 2020, besides encashment of PL at the time of retirement and during availment of LFC, PL Encashment would be permitted at 5 days every calendar year (7 days in case of employees I officers of 55 years of age and above) at the time of any festival of their choice. |

| Others: |

| Breakage charges on transfer : Clerks Rs.1650 (Receipt) Rs.1100 (Declaration) Substaff Rs.1100 and Rs.850 |

| Project Area HRA ( A or B ) will be paid at branches opened in Special Economic Zone, Export Promotion Zone, etc |

| in future if Govt of India will come out with any new project, and if any allowance is paid to their employees, the same should be extended in banks. |

| For definition of Family, physically/mentally challenged children of employees will continue to be treated as dependents even after their marriage subject to income criteria of dependents . |

| Definition of family for coverage under Group Medical Insurance Policy/reimbursement of medical expenses and LFC – Any two of parents or parents-in-law – I.e. father & mother, father-in-law & mother-in-law, father and mother-in-law, mother and father-in-law, to be covered. |

| Transportation of personal effects by train or road while on transfer from one station to another: Clerk 3500 kg (married) 2500 kg (unmarried) Substaff 2500 kg (married) and 1500 kg. (unmarried) |

| Service Charges under New Pension Scheme will not be recovered from the employees and will be paid by the Banks. |

| Substaff passing CAllB/JAllB, additional increments like clerks. |

| PLI Scheme will be introduced from the FY 2020-21. |

| Employees removed from service under Voluntary Cessation Scheme will be given the chance to represent/appeal against the decision and also will be eligible for retirement benefits including pension, if otherwise eligible. |

View: Revision of Salary DA Increments HRA and Other Allowances Bank Officers w.e.f 1st Nov 2017: 11th BI-Partite Settlement Dtd. 11 Nov 2020

Salient features of the 11th Bipartite Settlement

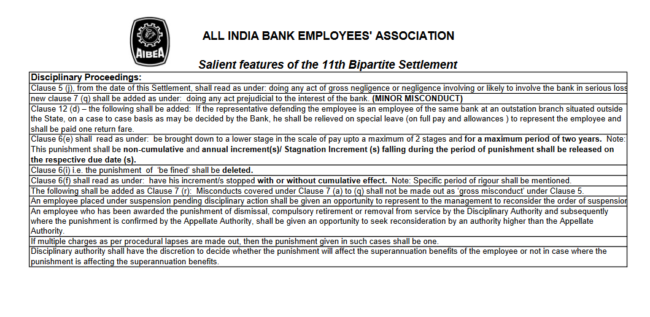

| Disciplinary Proceedings: |

| Clause 5 U), from the date of this Settlement, shall read as under: doing any act of gross negligence or negligence involving or likely to involve the bank in serious loss. |

| new clause 7 (q) shall be added as under: doing any act prejudicial to the interest of the bank. (MINOR MISCONDUCT). |

| Clause 12 (d) – the following shall be added: If the representative defending the employee is an employee of the same bank at an outstation branch situated outside the State, on a case to case basis as may be decided by the Bank, he shall be relieved on special leave (on full pay and allowances ) to represent the employee and shall be paid one return fare. |

| Clause 6(e) shall read as under: be brought down to a lower stage in the scale of pay upto a maximum of 2 stages and for a maximum period of two years. Note: This punishment shall be non-cumulative and annual increment(s)/ Stagnation Increment (s) falling during the period of punishment shall be released on the respective due date (s). |

| Clause 6(i) i.e. the punishment of ‘be fined’ shall be deleted. |

| Clause 6(f) shall read as under: have his incremenUs stopped with or without cumulative effect. Note: Specific period of rigour shall be mentioned. |

| The following shall be added as Clause 7 (r): Misconducts covered under Clause 7 (a) to (q) shall not be made out as ‘gross misconduct’ under Clause 5. |

| An employee placed under suspension pending disciplinary action shall be given an opportunity to represent to the management to reconsider the order of suspensio1 |

| An employee who has been awarded the punishment of dismissal, compulsory retirement or removal from service by the Disciplinary Authority and subsequently where the punishment is confirmed by the Appellate Authority, shall be given an opportunity to seek reconsideration by an authority higher than the Appellate Authority. |

| If multiple charges as per procedural lapses are made out, then the punishment given in such cases shall be one. |

| Disciplinary authority shall have the discretion to decide whether the punishment will affect the superannuation benefits of the employee or not in case where the punishment is affecting the superannuation benefits. |

COMMENTS

sir,i retired on 30-06-2019 with basic 42020-(old 8th stag) reached in may-2017.will i get (new 9th stag) as per 11th bps? if so how can i know whether benefit of 9th stag has been given to me in arrears and revised basic pension.please help by mail. thanks