Investment Model for NOK: Officers to utilise / invest this money in a prudent manner so that they do not face major hardships in the future.

INVESTMENT MODEL FOR NOK : OFFICERS

1. While unfortunate, it is a fact that the Indian Army loses a number of its officers as Battle casualties and Physical casualties each year. The NOK of these casualties are provided with some financial allowances to help overcome financial hardship to a considerable extent. While financial compensation cannot fill the void of loss of a bread earner, it is important that the NOK utilise / invest this money in a prudent manner so that they do not face major hardships in the future. As the amount of money available is substantial, it has to be invested in a judicious manner keeping current and future needs in mind.

2. Guidelines prepared to help this endeavour is in following parts :-

(a) NOK Categorisation.

(b) Principles of Investment.

(c) Assets available for Investment.

(d) Recommendations for Investments.

(e) Miscellaneous.

PART I NOK CATEGORISATION

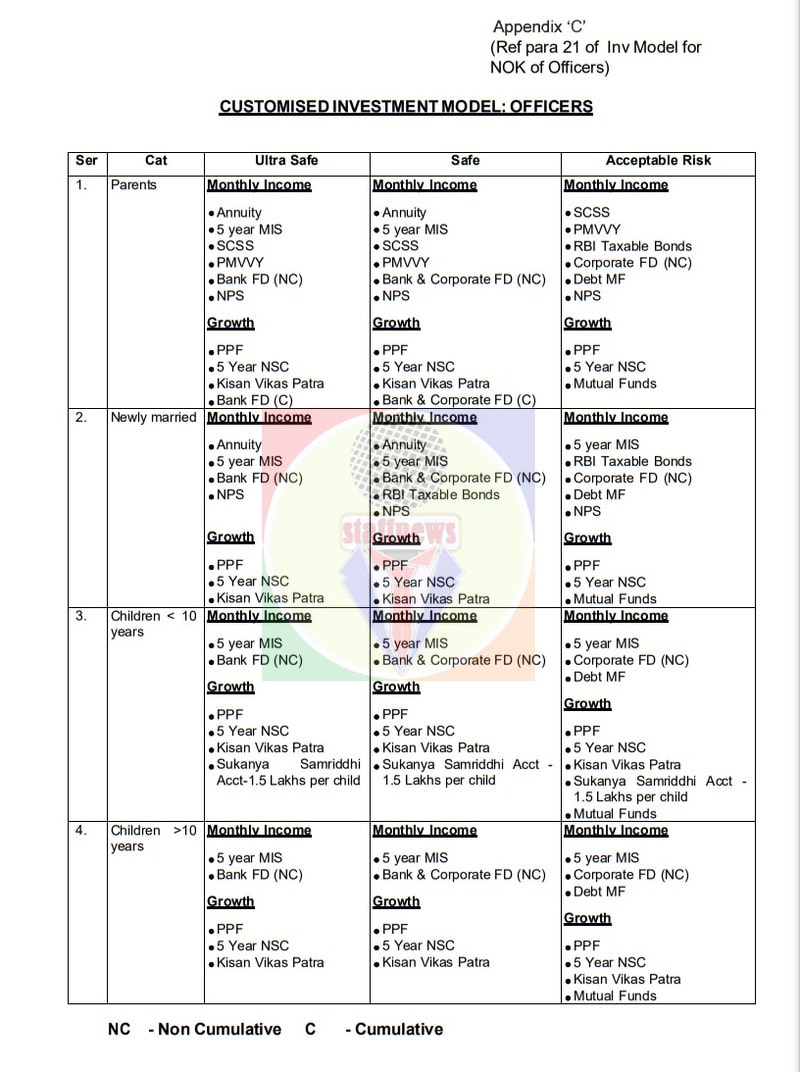

3. The NOK are being broadly categorised under the following heads from the Investment point of view :-

(a) Parents (in case of unmarried personnel).

(b) Newly married (No children).

(c) Married (with children below 10 years).

(d) Married (with children above 10 years).

4. The categorisation has been done as the goals and aspirations of the above categories would be different and thus the investment solution would also differ.

PART II PRINCIPLES OF INVESTMENT

5. A large amount becomes available to the NOK at a time when the NOK is going through a period of grief. It is important that the NOK takes charge of the financials at the earliest feasible.

6. Some of the principles of investment which should be kept in mind before investing are as under :-

(a) Safety. It is important that the investment is done keeping safety of amount invested. There should not be risk of losing the principal amount invested.

(b) Liquidity. Some portion of the money should be invested in a manner that it can be redeemed at short notice to cater for any emergency.

(c) Inflation. Inflation eats into the value of money. One should invest in financial products which have a rate of return higher than inflation.

(d) Loans. Avoid taking loans. Loans can be taken for buying a house but monthly EMI should be affordable.

7. Risk. At the outset, on must understand one’s own risk taking profile before investing. Risk taking profile implies the willingness and the ability of a person to take risks. For example, NOK Parents would have very little risk taking capacity; Unmarried NOK may have a higher capacity to take risk. Generally, higher risk investments have the potential to give higher returns but can also result in negative returns. Before investing, one must find out the risk of that investment so that it aligns with your risk taking profile.

8. Insurance. Married NOK having children should preferably take an Insurance plan. This is to cater for unforeseen contingencies and to ensure that the children do not suffer because of the same. One should buy a simple online term insurance plan.

9. Tax. It is essential that Tax planning is dovetailed into the Investment plan. The taxes can be reduced by investing in such instruments which are covered under Section 80C of the Income Tax Act.

10. Before investing in a particular product, do check for the following :-

(a) Does this product fit into my risk profile?

(b) Is this achieving any goal for me?

(c) What is the cost involved in buying and holding the product?

(d) What is the likely return potential? Is it fixed or variable? Is there likelihood of loss of capital?

(e) Does the product have a lock-in period? If yes, is it acceptable to you?

(f) What is the taxation on the product?

PART III ASSETS AVAILABLE FOR INVESTMENT

11. The money needs to be invested in a manner that it generates additional monthly income as also caters for financial goals such as children education, marriage, purchase of house etc.

12. The assets available for generating monthly income (in addition to family pension) are as under :-

(a) Post Office Monthly Income Scheme.

(b) Senior Citizens Savings Scheme.

(c) PM Vaya Vandana Yojna.

(d) Bank Fixed Deposits.

(e) RBI Taxable Bonds.

(f) Corporate Fixed Deposits.

(g) National Pension Scheme.

(h) Debt Mutual Funds.

13. The assets available for generating growth of available corpus for goals which are some time away are as under :-

(a) Mutual Funds.

(b) National Savings Certificate.

(c) Kisan Vikas Patra.

(d) Public Provident Fund.

(e) Bank Fixed Deposits.

(f) Sukanya Samriddhi Account (for girl child below 10 years).

(g) Sovereign Gold Bond.

14. More details of the above schemes have been given at Appendix ‘A’.

15. Mutual Funds. Mutual Funds are a category of investment which can be used for both growth and monthly income requirements. Mutual funds invest in the equity market and the debt market in the country. One should invest in Mutual Funds only if one fully understands the product or if the same is recommended by a Financial Advisor. Mutual Funds carry the risk of loss of capital with the potential of giving higher returns. One can invest a lump sum amount or periodically through Systematic Investment Plan. Mutual Funds under the Equity Linked Savings Scheme (ELSS) category are eligible for Section 80C deduction for tax.

16. Gold. Gold is an important investment asset in our society. Keeping physical Gold in house is very risky from safety point of view. It is recommended that investments in Gold should be done through Sovereign Gold Bonds issued by the Government.

17. Avoiding Fraud. It is important that the NOK does not lose money due to fraud. The NOK is likely to get incorrect advice by people with vested interests due to the large amount available. NOK should be careful about the following aspects :-

(a) Do not invest in Chit funds.

(b) Do not give Power of Attorney to anyone.

(c) Be wary of fraud calls.

(d) Be wary of people who promise extremely high returns. These are generally without any guarantee and are unsecured.

(e) Do not give loan to relatives/ local persons.

18. Tax. Investments eligible under Section 80 C and other relevant Sections of the Income Tax Act are given in a separate table at Appendix ‘B’.

PART IV RECOMMENDATIONS FOR INVESTMENT

19. These recommendations are broad recommendations. Each individual case may be different. These recommendations will act as a good start point before finalising one s investments.

20. Three options have been given for each category of NOK. These are Ultra Safe, Safe and Acceptable Risk. Ultra Safe model is for those who do not want to take any risk and do not have basic understanding about financial products. Safe model is for those who have basic knowledge about financial products and want their money to grow safely. Acceptable Risk is for those who have adequate knowledge about financial products and can take decisions based on their risk taking capacity.

21. Customised Investment Model. Investment options available have been tabulated to enable the NOK to make a considered choice based on their category and risk taking ability. This list is not exhaustive. NOK can choose other products if they meet their requirements. Details of the same are given in Appendix .

PART V MISCELLANEOUS

22. The NOK has to be sensible in utilising the money in a safe manner. It is likely that the NOK would need to get in touch with someone for financial advice. It will have to be a person whom he/she can trust and who will give financial advice without any vested interest.

23. Selecting a Financial Advisor. A financial advisor is a person who is a registered individual with SEBI and has the requisite qualifications to guide the NOK to make investments based on his/her requirements. These are generally available in major towns across India. The NOK must preferably use the services of a Financial Advisor, if available. It is advisable to get a Financial Plan made through a SEBI registered investment advisor which caters to the specific requirements of the NOK. List of some advisers is available at https://www.sebi.gov.in/sebiweb/other/OtherAction.do?doRecognisedFpi=yes&intmId=13.

24. It is important for the NOK to balance between money required on a monthly basis with investing money for requirements at an older age.

25. Saving for Children Education. The NOK must invest money required for their children education in a manner that the investment matures when they have to go for their higher studies.

CONCLUSION

26. It is very important that the NOK carries out due diligence before investing the money. While safety of capital is of primary importance, it is also essential to ensure prudent investment such that returns atleast caters for prevailing inflation. One time

rifice. Safeguarding it and investing it wisely to build a better financial portion for self and family is one way to show gratitude for the departed soul. Following the above mentioned principles and advice should lead to a sound strategic investment plan.

Appendix-‘A’

(Ref para 14 of Inv Model

for NOK of Officers)

COMMENTS