Category: INCOME TAX

Relaxation of time limit for processing of returns of income filed electronically which were incorrectly invalidated by CPC: IT Circular No. 10/2025

Relaxation of time limit for processing of returns of income filed electronically which were incorrectly invalidated by CPC: IT Circular No. 10/2025 d [...]

Consequences of PAN becoming inoperative as per Rule 114AAA of the Income-tax Rules, 1962 – Partial Modification: IT Circular No. 9/2025

Consequences of PAN becoming inoperative as per Rule 114AAA of the Income-tax Rules, 1962 - Partial Modification of Circular No. 3 of 2023 dated 28.03 [...]

Tax Treatment under Unified Pension Scheme – Central Board of Direct Taxes O.M.

Tax Treatment under Unified Pension Scheme - CBDT O.M. dated 02.07.2025 forwarded by Department of Financial Services vide O.M. No. FX-11/16/2025-PR d [...]

Waiver on levy of interest under section 201(1A)(ii)/ 206C(7) of the Income-tax Act, 1961, as the case may be, in specific cases: IT Circular No. 8/2025

Waiver on levy of interest under section 201(1A)(ii)/ 206C(7) of the Income-tax Act, 1961, as the case may be, in specific cases: IT Circular No. 8/20 [...]

Processing of valid Income Tax returns filed electronically on or before 31.03.2024 and relaxation of time limit upto 31.03.2026 for sending intimation: IT Circular No. 07/2025

Processing of valid Income Tax returns filed electronically on or before 31.03.2024 and relaxation of time limit upto 31.03.2026 for sending intimatio [...]

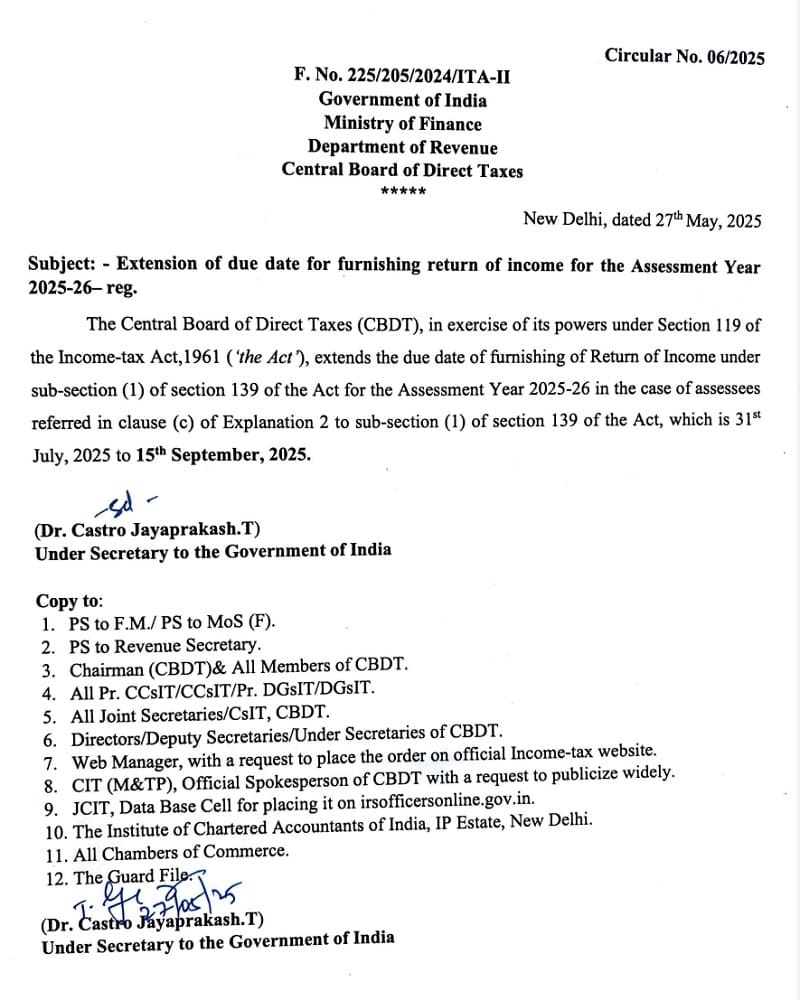

Return of income for the Assessment Year 2025-26 (F.Y. 2024-25) – Extension of due date upto 15.09.2025: Income Tax Circular No. 06/2025

Return of income for the Assessment Year 2025-26 (F.Y. 2024-25) - Extension of due date upto 15.09.2025 for furnishing of return: Income Tax Circular [...]

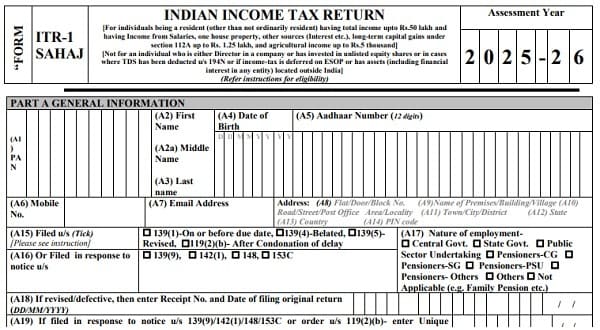

Income-tax (twelfth Amendment) Rules, 2025 – ITR Forms No. 1 Sahaj and No. 4 (Sugam) for AY 2025-26: Notification

Income-tax (twelfth Amendment) Rules, 2025 - ITR Forms No. 1 Sahaj and No. 4 (Sugam) for AY 2025-26: Notification No. 40/25 dated 29.04.2025

MINISTR [...]

Income-tax (Eleventh Amendment) Rules, 2025: TCS on sale goods of the value exceeding ten lakh rupees: Notification

Income-tax (Eleventh Amendment) Rules, 2025: TCS on sale Wrist Watch, Painting, antiques, sculpture, coin, stamp, yacht, rowing boat, canoe, helicopte [...]

Exemption from Tax Deduction on Withdrawals under Section 80CCA – Income Tax Notification No. 27/2025

Exemption from Tax Deduction on Withdrawals under Section 80CCA - Income Tax Notification No. 27/2025 dated 04.04.2025

The Gazette of India

CG-DL-E- [...]

Amendments related to Tax Deduction at Source (TDS) deductions notified in the Finance Act 2025 w.e.f. 01 April, 2025: SB Order No. 06/2025

Amendments related to Tax Deduction at Source (TDS) deductions under various sections of Income Tax Act 1961 notified in the Finance Act 2025 w.e.f. 0 [...]