Tag: Exemption from Return Filing

Grant of certificate for deduction of Income-tax at any lower rate or no deduction through TRACES- Procedure, format and standards for filling an application

Grant of certificate for deduction of Income-tax at any lower rate or no deduction of Income-tax under sub-section (1) of section 197 of the Income-ta [...]

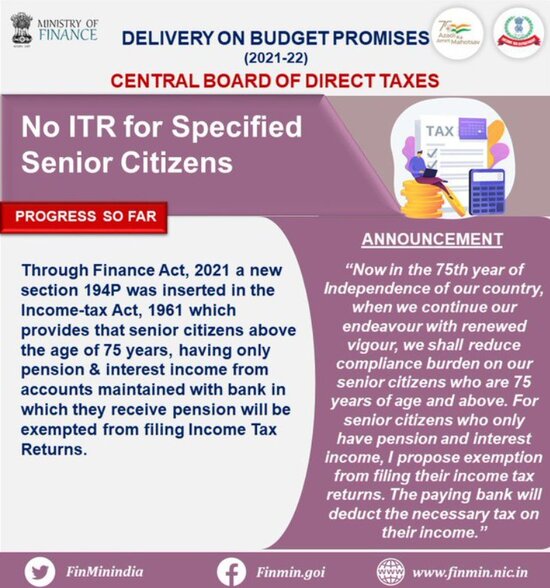

No ITR for Specified Senior Citizens: Through Finance Act 2021 a new section 194P was inserted in IT Act

No ITR for Specified Senior Citizens: Through Finance Act 2021 a new section 194P was inserted in IT Act

ITR for Senior Citizens – To give a much-nee [...]

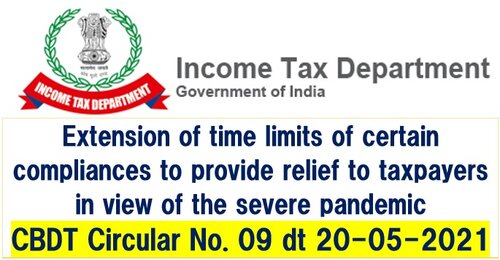

Extension of time limits of certain compliances to provide relief to taxpayers: CBDT Circular No. 9 dated 20.05.2021

Extension of time limits of certain compliances to provide relief to taxpayers in view of the severe pandemic: CBDT Circular No. 9 dated 20.05.2021

C [...]

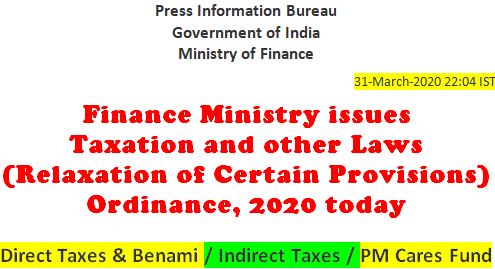

COVID-19 Outbreak: Finance Ministry issues Taxation and other Laws (Relaxation of Certain Provisions) Ordinance, 2020

COVID-19 Outbreak - Finance Ministry issues Taxation and other Laws (Relaxation of Certain Provisions) Ordinance, 2020 outlined Direct Taxes & Ben [...]

Exemption from Quoting Aadhaar / Enrolment ID to certain individuals – Notification No. 37/2017

Exemption from Quoting Aadhaar / Enrolment ID to certain individuals - Notification No. 37/2017

Press Information Bureau

Government of India

Minist [...]

Mandatory Quoting of Aadhaar for PAN Applications & Filing Return of Income w.e.f. 1st July, 2017

Mandatory Quoting of Aadhaar for PAN Applications & Filing Return of Income

Press Information Bureau

Government of India

Ministry of Finance

[...]

New Income Tax Return Forms for AY 2017-18: Introduces one page simplified ITR Form-1(Sahaj)

New Income Tax Return Forms for AY 2017-18: Introduces one page simplified ITR Form-1(Sahaj)

Press Information Bureau

Government of India

Ministr [...]

Income Tax – New disclosure Norms in IT Return

Income Tax – New disclosure Norms in IT Return

Know the new disclosure norms in income tax return forms

Amendments in the ITR forms are a move [...]

Form No.15G & 15H – Simplification of procedure

Simplification of procedure for Form No.15G & 15H - regarding CBDT Notification No.4/2015

F.No.: DGIT(S)/CPC(TDS)/DCIT/15GH/2015-16/14425-556 [...]

Income Tax: E-filing of newly notified ITRs to begin soon

New Delhi, Jun 24 (PTI) Taxpayers wanting to file online I-T returns for assessment year 2015-16, using the newly notified ITR-2 or ITR-2A forms, wil [...]