Tag: Income tax calculation

Income Tax Deduction from salaries during the F.Y. 2025-26 – Submission of Form 12BB i.e., particulars of claims for deduction of tax

Income Tax Deduction from salaries during the F.Y. 2025-26 U/s 192 of the Income Tax Act 1961 - Submission of Form 12BB i.e., particulars of claims fo [...]

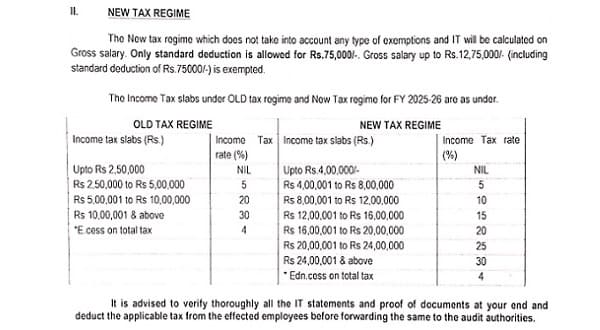

Deduction of Income Tax and Submission of IT Statements for FY 2025-26

Deduction of Income Tax and Submission of IT Statements for FY 2025-26: CDA, Secunderabad Order dated 15.09.2025

OFFICE OF THE CONTROLLER OF DEFENCE [...]

Income-Tax deduction from Salaries during the Financial Year 2024-25: IT Circular No. 3/2025

Income-Tax deduction from Salaries during the Financial Year 2024-25 under Section 192 of the Income-Tax Act, 1961: IT Circular No. 3/2025 dated 20.02 [...]

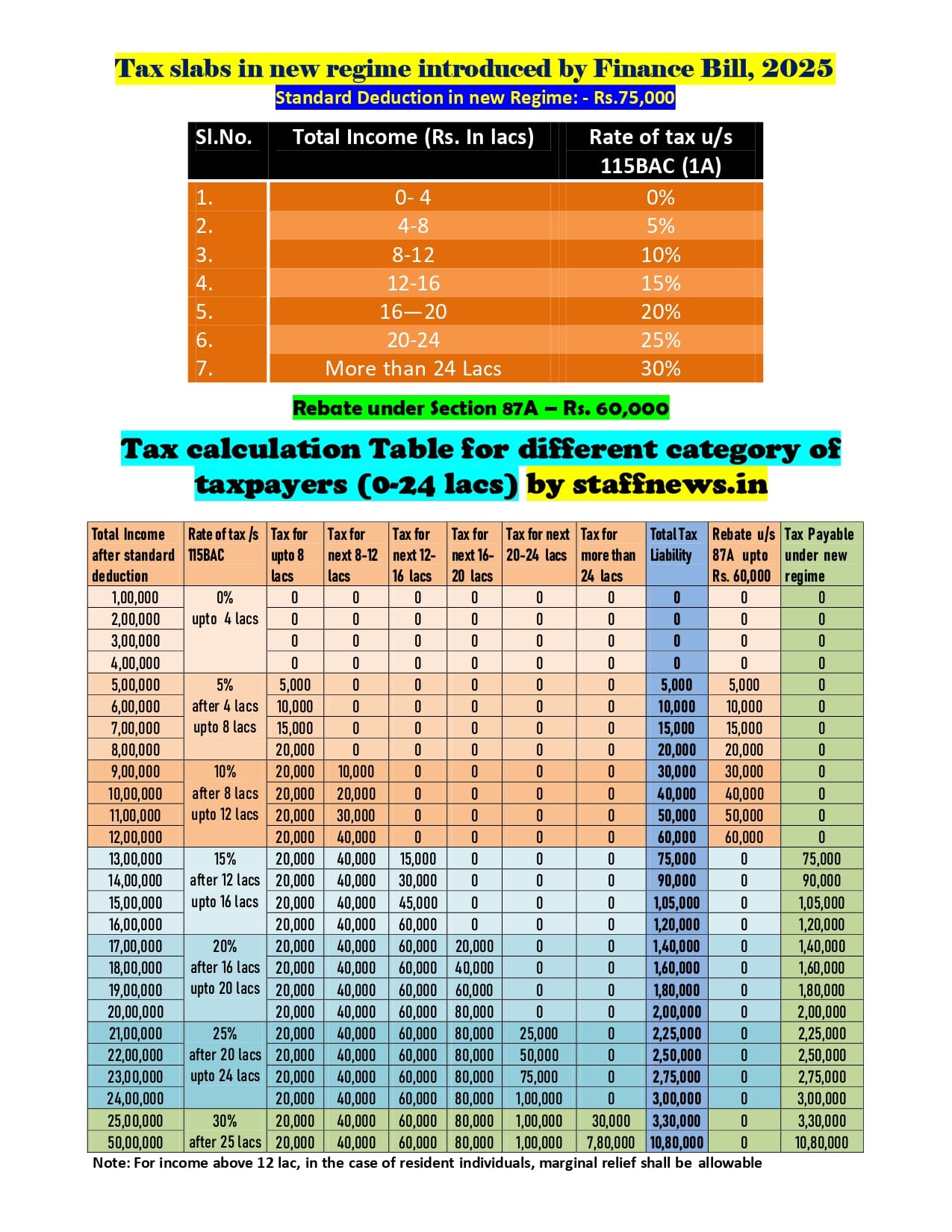

Tax Exemptions and Benefits: New Income Tax Regime, Exemptions, and Rebates Explained

Tax Exemptions and Benefits: New Income Tax Regime, Exemptions, and Rebates Explained. The Indian government provides tax exemptions and benefits to b [...]

Union Budget 2025-26: Income-Tax Benefits under New Regime explained vide FAQ

Union Budget 2025-26: Income-Tax Benefits under New Regime explained vide FAQ

FAQ.1: Personal Income-tax reforms with special focus on middle class [...]

New Tax Regime as Default for A.Y. 2024-25 – Official Income Tax Regime & Tax Calculator

New Tax Regime as Default for A.Y. 2024-25 - Official Income Tax Regime & Tax Calculator : Guidelines for Individuals, HUFs, AOPs, BOIs, and Artif [...]

Deduction of Income tax for the FY 2024-25 – Guidelines emphasizing early start, arrears, proof submission, and system automation.

Deduction of Income tax for the FY 2024-25 - Guidelines emphasizing early start, arrears, proof submission, and system automation.

Principal Controll [...]

Increase in tax rebate for individuals with income up to ₹7 lakhs, promoting compliance and robust collections.: FM

Increase in tax rebate for individuals with income up to ₹7 lakhs, promoting compliance and robust collections.: FM on Parliamentary Query

GOVERNMENT [...]

Option under Income Tax Section 115BAC – Old vs. New Tax Regime: Circular with format of Declaration for Old Regime

Option under Income Tax Section 115BAC - Old vs. New Tax Regime: Circular with format of Declaration for Old Regime

The Central Public Works Depart [...]

Income tax (Eighteenth Amendment), Rules, 2023: Perquisites – Valuation of residential accommodation provided by the employer

Income tax (Eighteenth Amendment), Rules, 2023: Perquisites - Valuation of residential accommodation provided by the employer

MINISTRY OF FINANCE

(D [...]