Tag: Income tax calculation

Income Tax deduction from salaries during the Financial Year-2021-22: Railway Board Order

Income Tax deduction from salaries during the Financial Year-2021-22: Railway Board Order No. No. F(X)I-2020/23/01 dated 05.04.2022

GOVERNMENT OF IN [...]

Violation of faceless assessment procedure by IT officials

Violation of faceless assessment procedure by IT officials

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

DEPARTMENT OF REVENUE

RAJYA SABHA

UNSTARRED QU [...]

Income-Tax Deduction from Salaries during the Financial Year 2021-22: Circular No. 04/2022

Income-Tax Deduction from Salaries during the Financial Year 021-22: Circular No. 04/2022

GOVERNMENT OF INDIA MINISTRY OF FINANCE

(DEPARTMENT OF [...]

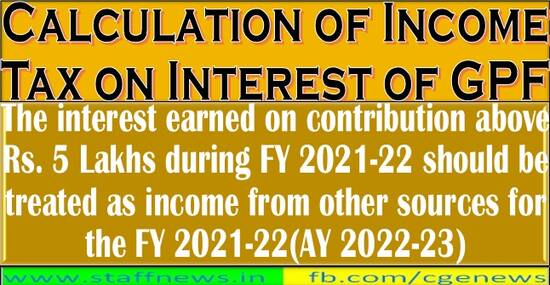

Income Tax payable on the contribution in a PF account exceeding Rs. 5 lakh per annum w.e.f financial year 2021-22: CGA, FinMin O.M.

Income Tax payable on the contribution in a PF account exceeding Rs. 5 lakh per annum w.e.f financial year 2021-22: CGA, FinMin O.M.

TA-3-07001/7/202 [...]

Guidelines under Clause (10D) Section 10 of the IT Act – Exemption on the sum received under a life insurance policy: Circular No. 2 of 2022

Guidelines under Clause (10D) Section 10 of the IT Act - Exemption on the sum received under a life insurance policy

Circular No. 2 of 2022

F. No.37 [...]

Submission of Income Tax Savings Documents for F.Y. 2021-2022, Format of Self Declaration and Rent Receipt: DAD

Submission of Income Tax Savings Documents for the Financial Year 2021-2022, Format of Self Declaration and Rent Receipt: DAD

GOVERNMENT OF INDIA

MI [...]

Income Tax Circular 2021-22: Tax Rates, Option for Tax Regime, Format for Declaration (old tax regime)

Income Tax Circular 2021-22: Tax Rates, Option for Tax Regime, Format for Declaration (old tax regime)

Directorate General Central Public Works D [...]

Furnishing of evidence of claims or deduction of tax for FY 2021-22 and AY 2022-23 – Rent Receipt, Form 12BB & Statement of Income from House Property

Furnishing of evidence of claims or deduction of tax for FY 2021-22 and AY 2022-23 - Rent Receipt, Form 12BB & Statement of Income from House Prop [...]

Income Tax Notification 83/2021: New IT Rule 130 & 131 regarding Forms, returns, reports

Income Tax Notification 83/2021: New Income Tax Rule 130 regarding Omission of certain rules and Forms and savings and Rule 131 Electronic furnishing [...]

Submission of Statement of Financial Transactions for Interest Income – SB Order No. 18/2021

Submission of Statement of Financial Transactions for Interest Income – SB Order No. 18/2021

SB Order No. 18/2021

File No. FS-10/27/2021-FS-DOP

Gov [...]