Tag: Income Tax Exemption Limit

Tax Exemptions and Benefits: New Income Tax Regime, Exemptions, and Rebates Explained

Tax Exemptions and Benefits: New Income Tax Regime, Exemptions, and Rebates Explained. The Indian government provides tax exemptions and benefits to b [...]

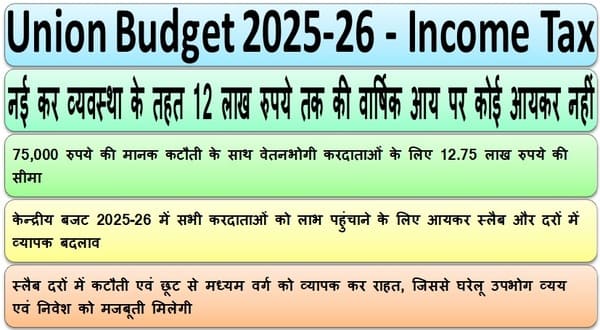

केंद्रीय बजट 2025-26: 12 लाख रुपये तक की आय पर कोई आयकर नहीं, 75,000 रुपये की मानक कटौती

केंद्रीय बजट 2025-26: 12 लाख रुपये तक की आय पर कोई आयकर नहीं, 75,000 रुपये की मानक कटौती

वित्त मंत्रालय

नई कर व्यवस्था के तहत 12 लाख रुपये तक की [...]

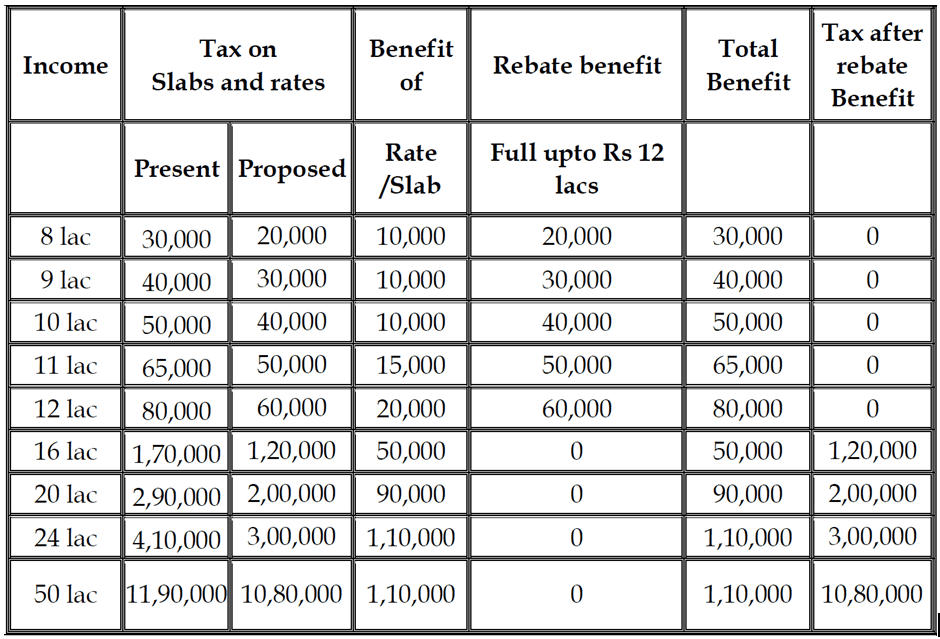

Union Budget 2025-26: Rs. 12 Lakh Income Tax-Free, Standard Deduction Increased to Rs. 75,000 for Salaried Individuals

Union Budget 2025-26: Rs. 12 Lakh Income Tax-Free, Standard Deduction Increased to Rs. 75,000 for Salaried Individuals

Ministry of Finance

NO INCO [...]

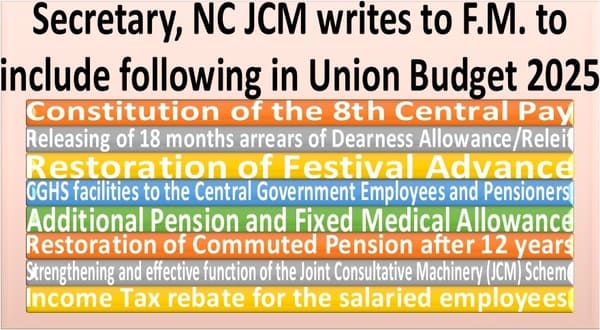

8th Central Pay Commission, 18 months DA/DR Arrear, Festival Advance, Additional Pension, Fixed Medical Advance, Commuted Pension, IT Rebate etc: NC JCM demands to include in Union Budget

8th Central Pay Commission, Releasing of 18 months DA/DR Arrear, Restoration of Festival Advance, Additional Pension/Fixed Medical Advance Enhancement [...]

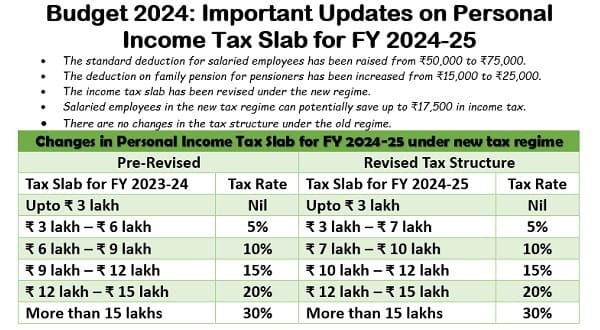

Tax Relief and Revised Tax Slabs in New Tax Regime – Union Budget 2024-25

Tax Relief and Revised Tax Slabs in New Tax Regime - Union Budget 2024-25 - Changes in Income Tax Slab under New Tax Regime, Increase in Standard Dedu [...]

8th Pay Commission, Scrap NPS, Income Tax rebate, Job Creation etc. – CTU’s viewpoints on issues to be considered for framing the budget for 2024-2025

8th Pay Commission, Scrap NPS, Income Tax rebate, Job Creation etc. - CTU's viewpoints on issues to be considered for framing the budget for 2024-2025 [...]

Old Pension Scheme, 8th Pay Commission, Restoration of Commutation of Pension, Income Tax Exemption to Pensioners and other important issues: JCM writes to FM for consideration in Budget 2024-2025

Old Pension Scheme, 8th Pay Commission, Restoration of Commutation of Pension, Income Tax Exemption to Pensioners and other important issues: JCM writ [...]

Income Tax Exemption on Allowances available to Armed Forces

Income Tax Exemption on Allowances available to armed forces u/s Section 10(14) r.w.r. 2BB

Allowances available to armed forces [Section 10(14) r.w.r [...]

Benefits for Senior Citizens and Super Senior Citizens under Income Tax Act, 1961: MoD (Army) HQ Order

Benefits for Senior Citizens and Super Senior Citizens under Income Tax Act, 1961: MoD (Army) HQ Order for awareness of veterarns/ dependents

C/7099/ [...]

Clarification regarding admissibility of interest on GPF subscription over and above the threshold limit of Rupees Five lakhs deducted towards GPF: DoPPW OM dated 02.05.2024

Clarification regarding admissibility of interest on GPF subscription over and above the threshold limit of Rupees Five lakhs deducted towards GPF: Do [...]