Tag: Income Tax Exemption Limit

Deduction of Income tax for the FY 2024-25 – Guidelines emphasizing early start, arrears, proof submission, and system automation.

Deduction of Income tax for the FY 2024-25 - Guidelines emphasizing early start, arrears, proof submission, and system automation.

Principal Controll [...]

Increase in tax rebate for individuals with income up to ₹7 lakhs, promoting compliance and robust collections.: FM

Increase in tax rebate for individuals with income up to ₹7 lakhs, promoting compliance and robust collections.: FM on Parliamentary Query

GOVERNMENT [...]

Highlights of Finance Bill, 2024: Tax Rate Changes, Deductions, Faceless Scheme, TCS, and Outstanding Tax Demand Amendments

Highlights of Finance Bill, 2024: Tax Rate Changes, Deductions, Faceless Scheme, TCS, and Outstanding Tax Demand Amendments

HIGHLIGHTS OF FINANCE BIL [...]

Finance Act 2023 : Amendments of the Income Tax Act 1961 – CBDT Circular No. 1/2024

Finance Act 2023 : Amendments of the Income Tax Act 1961 – CBDT Circular No. 1/2024

CIRCULAR NO. 1/2024

F. No. 370142/38/2023

Government of Ind [...]

Benefits for Senior Citizens and Super Senior Citizens under Income-tax Act,1961 – e-Brochure by Income Tax Department

Benefits for Senior Citizens and Super Senior Citizens under Income-tax Act,1961 - e-Brochure by Income Tax Department

Benefits for Senior Citizens a [...]

Option under Income Tax Section 115BAC – Old vs. New Tax Regime: Circular with format of Declaration for Old Regime

Option under Income Tax Section 115BAC - Old vs. New Tax Regime: Circular with format of Declaration for Old Regime

The Central Public Works Depart [...]

Grant of certificate for deduction of Income-tax at any lower rate or no deduction through TRACES- Procedure, format and standards for filling an application

Grant of certificate for deduction of Income-tax at any lower rate or no deduction of Income-tax under sub-section (1) of section 197 of the Income-ta [...]

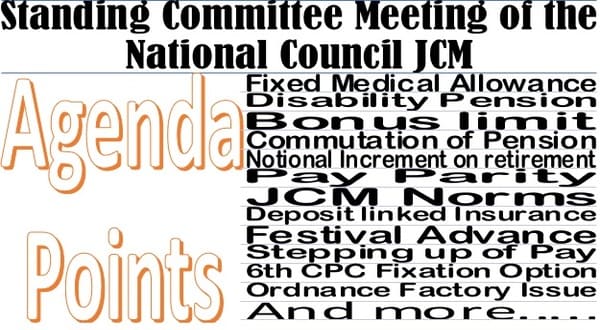

Standing Committee Meeting of the National Council JCM – Agenda points for discussion and settlement includes MACP, Notional Increment, FMA, Bonus, Festival Advance, Stepping up of Pay etc.

Standing Committee Meeting of the National Council JCM - Agenda points for discussion and settlement includes MACP, Notional Increment, FMA, Bonus, Fe [...]

Pension in respect of Gallantry Awardees – Income Tax at source is not be deducted: CPAO writes to Bank

Pension in respect of Gallantry Awardees - Income Tax at source is not be deducted: CPAO writes to Bank dt 22.08.2023

GOVERNMENT OF INDIA

MINISTRY O [...]

Income tax Amendment (Sixteenth Amendment) Rules, 2023: Computation of income tax for sum received under a life insurance policy

Income tax Amendment (Sixteenth Amendment) Rules, 2023: Computation of income tax for sum received under a life insurance policy

MINISTRY OF FINANCE

[...]