Tag: Superannuation

Processing of Death/Retirement benefits/family pension papers and Compassionate appointment in the case of deceased employees: CBDT

Processing of Death/Retirement benefits/family pension papers and Compassionate appointment in the case of deceased employees: CBDT

Office of the Pr. [...]

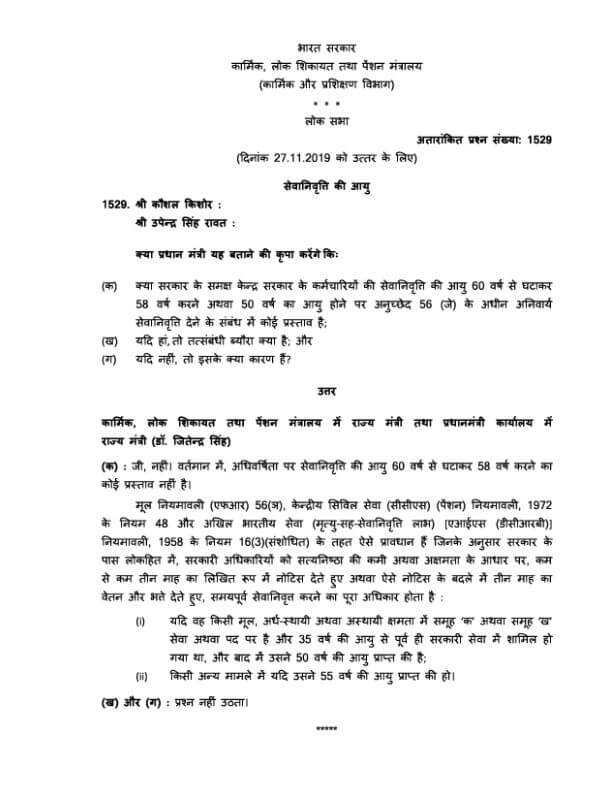

No move to reduce the retirement age of government employees सेवानिवृत्ति की उम्र घटाने का कोई प्रस्ताव नहीं

No move to reduce the retirement age of government employees सरकारी कर्मचारियों की सेवानिवृत्ति की उम्र घटाने का कोई प्रस्ताव नहीं

Press Information [...]

सरकारी कर्मचारियों की 31 मार्च 2020 को सेवानिवृत्ति Retirement of Government Servants on 31st March, 2020 in lockdown due to COVID-19: Instructions

सरकारी कर्मचारियों की 31 मार्च 2020 को सेवानिवृत्ति Retirement of Government Servants on 31st March, 2020 in lockdown due to COVID-19: Instructions

P [...]

DoPT Official Statement: Reduction of age of Retirement from 60 years to 58 years regarding

Whether there is any proposal before the Government to decrease the retirement age of Central Government employees from 60 years to 58 years or under [...]

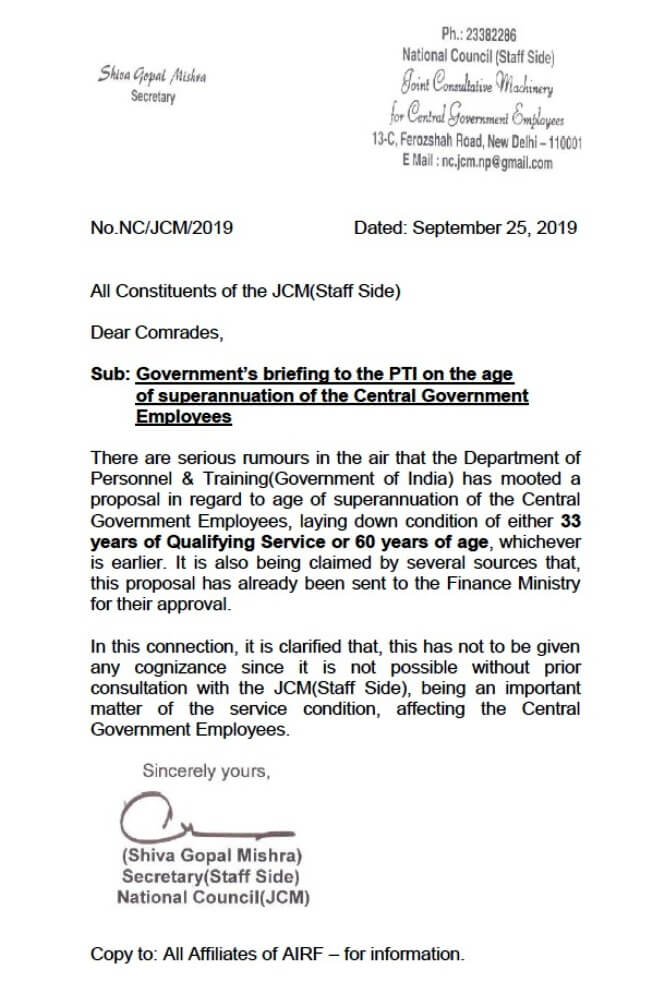

Reduction in Retirement Age or Superannuation after 33 years of CGE is not possible without JCM consultation: Secretary, Staff Side, NC JCM

Age of superannuation of the Central Government Employees, laying down condition of either 33 years of Qualifying Service or 60 years of age, it is no [...]

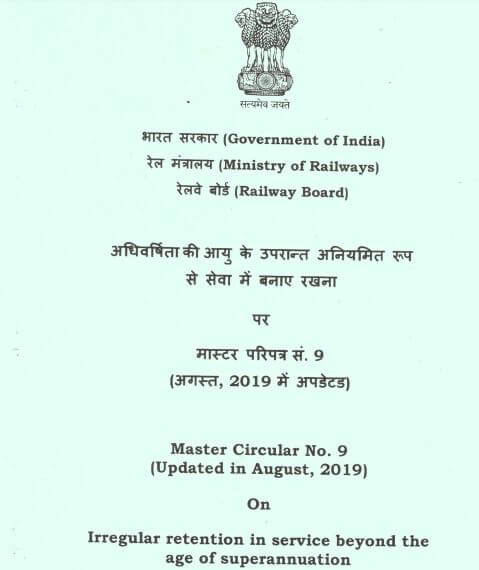

Irregular retention in service beyond the age of superannuation: Railway Board Master Circular No. 9

Irregular retention in service beyond the age of superannuation: Railway Board Master Circular No. 9

Government of India

Ministry of Railw [...]

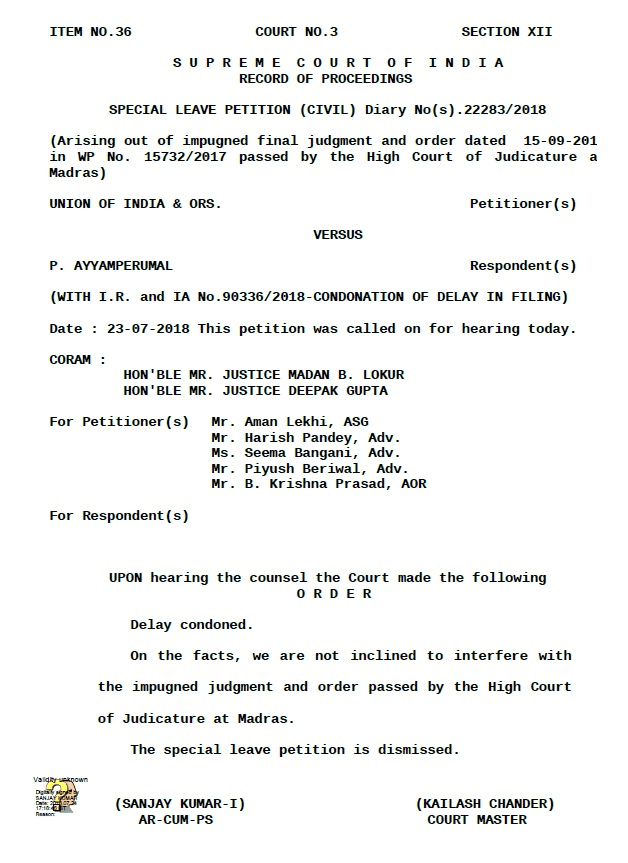

Retired on 30th June is eligible for increment due on 1st July for Pensionary Benefit: Supreme Court dismisses Govt SLP against Madras HC Judgement

Supreme Court dismisses SLP filed by Govt against Madras HC Judgement granting Pensionary Benefits of Increment Due On 01.07 To Those Superannuated [...]

Superannuated on 30th June is eligible for increment due on 1st July notionally for Pensionary Benefits: High Court

Superannuated on 30th June is eligible for increment due on 1st July notionally for Pensionary Benefits: High Court

IN THE HIGH COURT OF JUDICATU [...]

7th CPC Pension Benefit – Retired from service on one day prior to 1.1.2016 – Important Judgement

7th CPC Pension Benefit – Retired from service on one day prior to 1.1.2016 – Important Judgement

Central Administrative Tribunal

Principal [...]

Age of superannuation i.r.o. Doctors shall be 62 years unless they exercise the option for teaching, clinical, patient care etc.: Amendment in FR 56 Gazette Notification

Age of superannuation i.r.o. Doctors shall be 62 years unless they exercise the option for teaching, clinical, patient care etc.: Amendment in FR 56 [...]