Tag: Swavalamban

Investment Guidelines for NPS Schemes (Other than Govt. Sector (CG &SG), Corporate CGI NPS Lite and APY) w.e.f. 10th September, 2015

Investment Guidelines for NPS Schemes (Other than Govt. Sector (CG &SG), Corporate CGI NPS Lite and APY) w.e.f. 10th September, 2015

PENSION FUN [...]

Timelines of contribution processing under APY: PFRDA Circular

Timelines of contribution processing under APY: PFRDA Circular

Pension Fund Regulatory

& Development Authority

1st Floor, ICADR Building,

Pl [...]

National Pension System for Non Resident Indians – NPS for NRIs – Frequently Asked Questions

NPS for NRIs – Frequently Asked Questions

FREQUENTLY ASKED QUESTIONS

NATIONAL PENSION SYSTEM for NON RESIDENT INDIANS

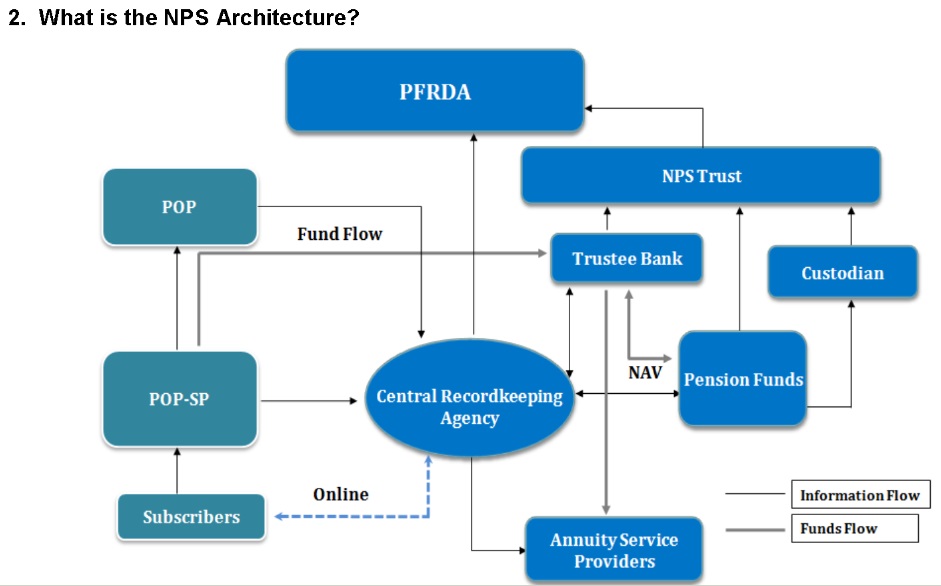

About NPS

1. What is Nat [...]

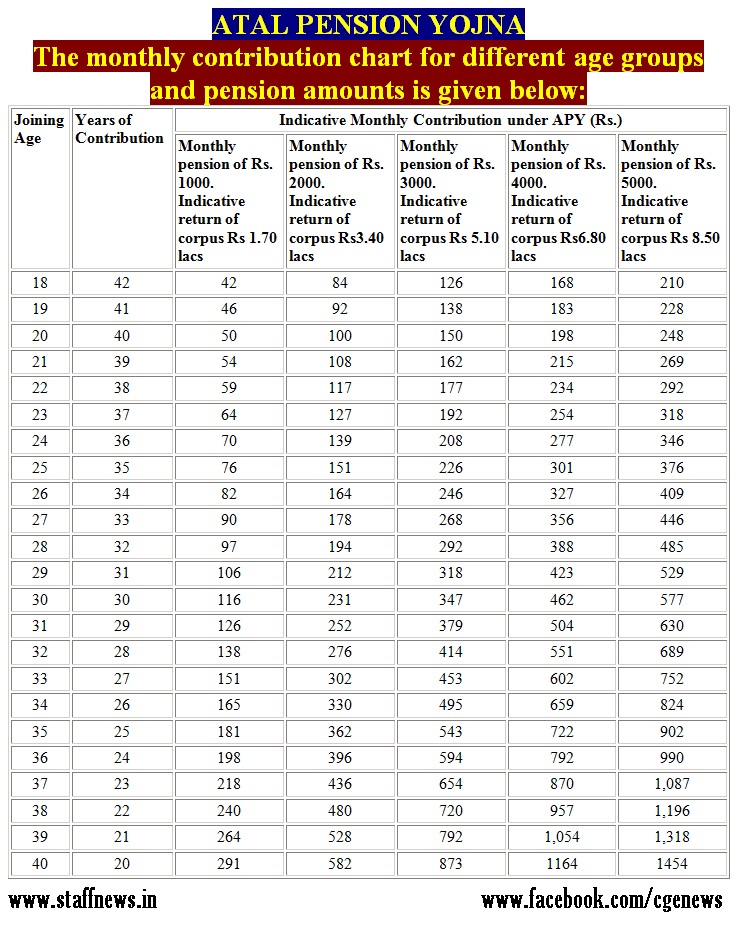

Atal Pension Yojna – Features and Benefits Table

ATAL PENSION YOJANA – FEATURES AND BENEFITS TABLE

Pension Fund Regulatory and Development Authority

First Floor, ICADR Buildin [...]

PFRDA – Exit and Withdrawals under the National Pension System Regulation, 2015

PFRDA - Exit and Withdrawals under the National Pension System Regulation, 2015

Chapter 1 - Preliminary

Chapter 2 - Exit from National Pension System [...]

Investment guidelines for NPS Schemes w.e.f, 10th June, 2015

Investment guidelines for NPS Schemes (Applicable to Scheme CG, Scheme SG, Corporate CG and NPS Lite schemes of NPS and Atal Pension Yojana) w.e.f, 1 [...]

Incentive for mobilization and registration of subscribers under Atal Pension Yojana

Incentive for mobilization and registration of subscribers under Atal Pension Yojana: PFRDA Order

PENSION FUND REGULATORY AND DEVELOPMENT AUTHORITY [...]

Enhancement of initial subscriber registration charges for POP under NPS for all subscribers under Corporate & All Citizen Model

Enhancement of initial subscriber registration charges for POP under NPS for all

subscribers under Corporate & All Citizen Model

PFRDA

PENSION [...]

Revised Investment Guidelines for NPS schemes: Amendment from 01.04.2015

PF Regulatory and Development Authority has issued Amendment with effect from 01.04.2015 to revised investment guidelines for NPS Schemes Appli [...]

NPS – Simplification of Withdrawal process and Documentary requirement for the Government subscriber

Simplification of Withdrawal process and Documentary requirement for the Government subscriber: PFRDA's Instructions

PENSION FUND REGULATORY [...]