Circular No. 24

SUBJECT:- Revision of Pension of Pre- 2006 pensioner – inclusion of Non Practicing Allowance (NPA) for revision of pension/ ordinary family pension in respect of Medical officers of Army Medical Corps (AMC)/Army Dental Corps(ADC)/ Remount Veterinary Corps (RVC).

Update: Further Clarification by PCDA Ciruclar No. 25 dated 21 Dec 2015

Reference is invited towards Govt. of India, MOD letter No. 1(1)/99/D(Pen/ Sers) dated 07.06.1999 issued in implementation of recommendation of V CPC. As per the ibid letter the pension/family pension of all Armed Force Pensioners, irrespective of their date of retirement should not be less than 50% /30% respectively of the minimum pay in the revised scale of pay introduced w.e.f. 01.01.1996 of the rank held by the pensioner. The pension of Armed Force officers including Medical officer was revised as per the ibid letter and benefit of NPA was also allowed. However, the Govt has subsequently issued letter dated 11.09.2001, according to which, NPA granted to Medical officers does not form part of the scales of Pay. It

is a separate element and it is not to be added to the minimum of the revised scale of pay as on 01.01.1996 in case where consolidated pension/ family pension is to be stepped upto 50%/30% respectively in terms of MOD letter dated 07.06.1999.

2. Similarly, Govt. of India, MoD has issued order vide letter No. 17(4)/2008/D(Pen/Policy) dated 16.03.2010 under VI CPC , which provided that NPA element shall not be added to the emoluments to determine minimum guaranteed pension in terms of para 5 of GOI, MOD letter no. 17(4)/2008(1)/D(Pen/Sers) dated 11.11.2008 (Circulated under Circular No. 397).

3. It has been decided vide no. 38/31/11-P&PW(A)(Vol.-IV) dated 14.10.2014 and even No. dated 18.02.2015 in cases of Civilian doctors by Govt., in implementation of Hon’ble Supreme Court order dated 27.11.2013 in Civil Appeal No. 10640-46/2013, that while determining minimum guaranteed pension of past retirees from 01.01.1996 in terms of DP&PW OM dated 17.12.1998 and with effect from 01.01.2006 in terms of DP&PW OM dated 1.09.2008 and with effect from 24.09.2012 in terms of DP&PW dated 28.01.2013, the NPA element shall be added to the minimum of revised pay scale subject to the maximum ceiling prescribed from time to time.

4. Now the Govt. of India, Ministry of Defence has also issued letter NO. 1(7)/2014-D(Pen/Pol) date 31.07.2015 according to which in case of Pre 96 retired medical officers, who were drawing NPA element at the time of their retirement, NPA@ 25% shall be added to the minimum of the scale of pay as on 01.01.1996 while determining minimum guaranteed pension/family pension in terms of MOD letter No. 1(1)/99/D(Pen/Sers) dated 07.06.1999 subject to the ceiling that pay plus rank pay plus NPA should not exceed Rs. 29500/-. It has further been clarified in the ibid letter that in case of pre 2006 retiree medical officers, NPA @ 25% shall be added to the minimum of the pay in pay band plus the grade pay and MSP (subject to Max. ceiling of Rs. 85000/-), where applicable, while determining minimum guaranteed pension /family pension from 01.01.2006 in terms of para 5 of MOD letter dated 11.11.2008. Similarly, for revision of pension/family pension w.e.f. 24.09.2012, NPA @ 25% shall also be added to the minimum of the fitment table for the rank in the revised pay band as indicated under fitment tables annexure with SAI 2/S/2008 and equivalent instructions for Navy and Air Force plus Grade Pay and Military Service Pay

where applicable. The copy of Govt. letter dated 31.07.2015 is enclosed herewith as appendix 1 to this letter.

5. Govt. of India, Ministry of Defence has further issued letter NO. 1(04)/2015(I)-D(Pen/Pol) date 03.09.2015 according to which revised tables indicating minimum guaranteed pension/ ordinary family pension for Indian Commissioned officers which is annexed with GoI, MoD letter No. 1(11)/2012-D(Pen/ Policy) dated 17.01.2013 (Circulated under Circular no. 500) shall be effective from 01.01.2006 instead of 24.09.2012.

6. In view of the above, the pension of all pre 96 and pre 2006 retired medical officers of

Army Medical Corps (AMC)/Army Dental Corps(ADC)/ Remount Veterinary Corps (RVC), who were in receipt of NPA at the time of retirement, is required to be revised after allowing NPA as mentioned above. Therefore, the following Circulars issued earlier on the subject are superseded with this Circular.

(i) Imp. Circular No. 1 dated 20.05.2002 issued from File No. G-1/M/01/NPA

(ii) Imp. Circular No. 2 dated 20.05.2002 issued from File No. G-1/M/01/ NPA

(iii) Imp. Circular No. 3 dated 12.06.2002 issued from File No. G-1/M/01/NPA

(iv) Imp. Circular No. 4 dated 17.07.2002 issued from File No. G-1/M/01/NPA

(v) Imp. Circular No. 5 dated 29.01.2009 issued from File No. G-1/M/01/NPA

(vi) Imp. Circular No. 18 dated 14.02.2014 issued from File No. G-1/M/01/NPA

7. The Pension disbursing officers are requested to identify the affected cases of Medical officers of Armed Forces of Army Medical Corps (AMC)/Army Dental Corps(ADC)/ Remount Veterinary Corps (RVC) who were in receipt of NPA. The minimum guaranteed pension / family pension will be revised by the Pension Disbursing Agencies (PDA’s) in affected cases as indicated in the corresponding tables as per their respective rank and qualifying service. The tables for minimum pension guaranteed pension of different categories of pensioners are enclosed as per the following Annexures:-

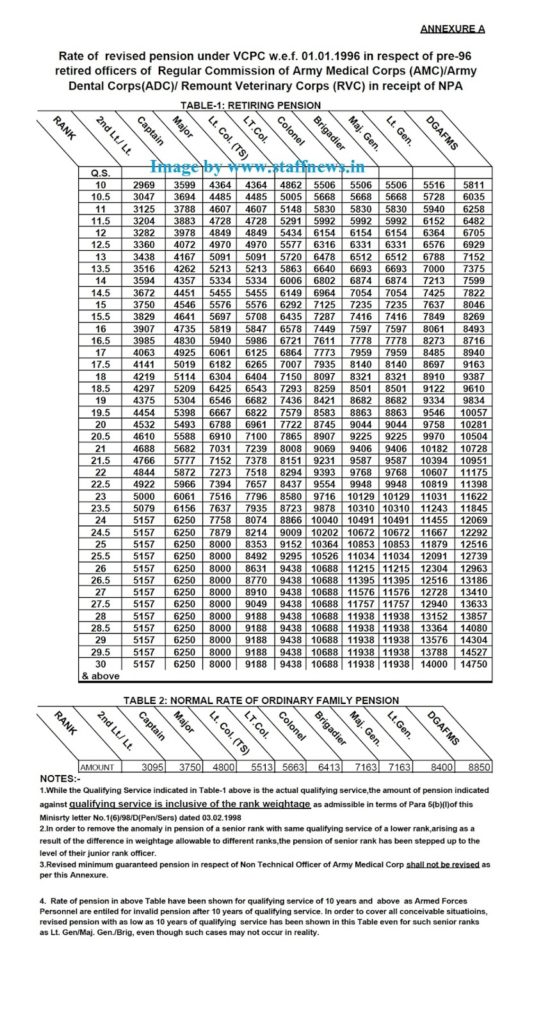

| 1. | Annexure-A |

For revised pension under VCPC w.e.f. 01.01.1996 in respect of officers of Regular Commission AMC/ADC/RVC in receipt of NPA

|

|

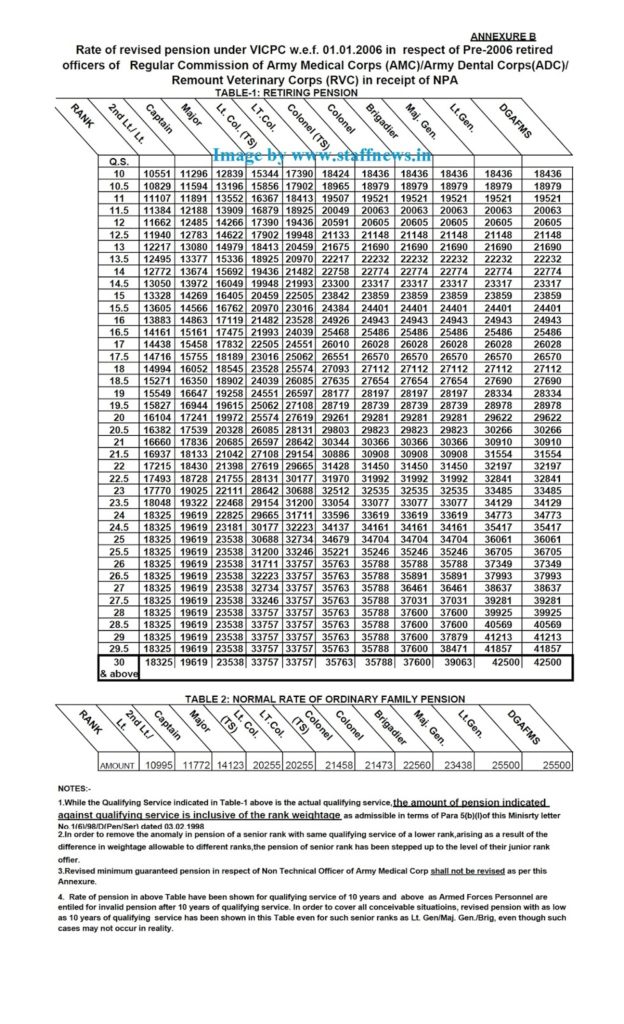

2.

|

Annexure-B

|

For revised pension under VICPC w.e.f. 01.01.2006 in respect of officers of Regular Commission of AMC/ADC/RVC in receipt of NPA

|

|

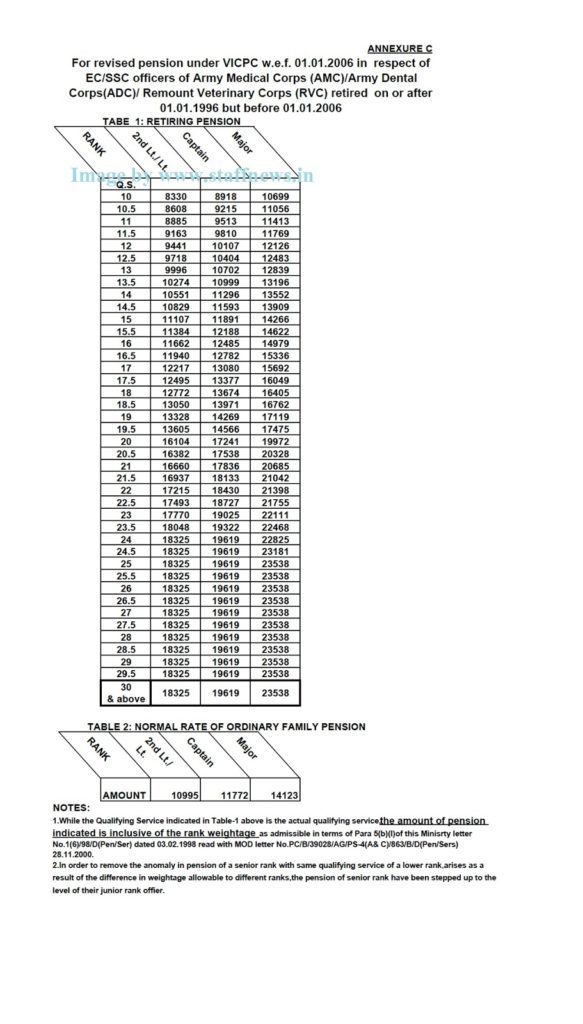

4.

|

Annexure-C

|

For revised pension under VICPC w.e.f. 01.01.2006 in respect of EC/SSC officers of AMC/ ADC / /RVC retired on or after 01.01.1996 but prior to 01.01.2006

|

8. The pension under respective Annexure has been calculated after adding weightage admissible to actual qualifying service and shown against the qualifying service. Therefore, PDAs are not to allow any additional benefit of weightage in qualifying service.

The revised pension shown in Annexure is admissible only to medical officers of AMC/ ADC/ RVC who were in receipt of NPA at the time of retirement. The non technical officers of AMC/ADC/ RVC are

not entitled to above revision. The Pension of PSU absorbee’s medical officer of AMC/ADC/ RVC will

not be revised as per these tables but cases be referred to this office for further action.

9. The normal rate of family pension will be revised by PDAs as indicated in Annexure. The enhanced rate of family pension will also be revised and the amount of enhanced rate will be the same as retiring pension corresponding to the service rendered by the officer. However, in cases of death-in-service of officer, the enhanced rate of family pension will be revised equal to the amount of retiring pension shown against the qualifying service of 30 years and above. The period of payment of enhanced rate may be verified before making any payment. The amount of enhanced rate of family pension will not be less than the amount of normal rate of ordinary family pension indicated in the table.

10. The tables of minimum guaranteed pension/family pension circulated under this office Circulars No. 397 dated 18.11.2008 as amended vide circulars No. 452 dated 21.02.2011, No. 453 dated 22.02.2011, 500 dated 17.01.2013 and 536 dated 05.02.2015 stand modified in respect of Medical officers of Army Medical Corps (AMC)/Army Dental Corps(ADC)/ Remount Veterinary Corps (RVC). For officers other than medical officer of Army Medical Corps (AMC)/Army Dental Corps (ADC)/ Remount Veterinary Corps (RVC) including non technical officer of AMC separate instructions will be issued to allow revised rate of pension as mentioned in Govt. letter dated 17.01.2013 with effect from 01.01.2006.

11. The pension will not be revised to the disadvantage of a pensioner. Such cases and other doubtful cases will be referred to this office by making a reference to the following officer with the details of PPO No., Name of officer, personal No., PDA details alongwith A/c No. and address of correspondence.

Sri R.B. Sharma, Sr. A.O.(P)

Office of the PCDA (Pension)

G-1/M/ Section, Draupadi Ghat

Allahabad-211014

12. The PDAs will prepare due – drawn statement and the amount of pension already paid is to be adjusted in full before making any payment of arrear. Any overpayment coming to the notice of PDA’s or under recovery may be recovered from arrear due.

13. All other subsidiary payment instructions will be the same as already circulated vide this office circulars quoted under reference.

14. It is also requested that a copy of this circular may please be circulated to all the PDAs under your jurisdiction in order to ensure prompt action for the revision of pension/family pension.

15. This circular has been uploaded on PCDA (P) website www.pcdapension.nic.in for dissemination across the Defence pensioners and PDAs.

No. G-1/M/01/ICOS/NPA/ Vol.-III

Date: 11 .09.2015

TABLE-1: RETIRING PENSION

| RANK | 2nd Lt./ Lt. | Captain | Major | Lt. Col. (TS) | LT.Col. | Colonel | Brigadier | Maj. Gen. | Lt. Gen. | DGAFMS |

| Q.S. | ||||||||||

| 10 | 2969 | 3599 | 4364 | 4364 | 4862 | 5506 | 5506 | 5506 | 5516 | 5811 |

| 10.5 | 3047 | 3694 | 4485 | 4485 | 5005 | 5668 | 5668 | 5668 | 5728 | 6035 |

| 11 | 3125 | 3788 | 4607 | 4607 | 5148 | 5830 | 5830 | 5830 | 5940 | 6258 |

| 11.5 | 3204 | 3883 | 4728 | 4728 | 5291 | 5992 | 5992 | 5992 | 6152 | 6482 |

| 12 | 3282 | 3978 | 4849 | 4849 | 5434 | 6154 | 6154 | 6154 | 6364 | 6705 |

| 12.5 | 3360 | 4072 | 4970 | 4970 | 5577 | 6316 | 6331 | 6331 | 6576 | 6929 |

| 13 | 3438 | 4167 | 5091 | 5091 | 5720 | 6478 | 6512 | 6512 | 6788 | 7152 |

| 13.5 | 3516 | 4262 | 5213 | 5213 | 5863 | 6640 | 6693 | 6693 | 7000 | 7375 |

| 14 | 3594 | 4357 | 5334 | 5334 | 6006 | 6802 | 6874 | 6874 | 7213 | 7599 |

| 14.5 | 3672 | 4451 | 5455 | 5455 | 6149 | 6964 | 7054 | 7054 | 7425 | 7822 |

| 15 | 3750 | 4546 | 5576 | 5576 | 6292 | 7125 | 7235 | 7235 | 7637 | 8046 |

| 15.5 | 3829 | 4641 | 5697 | 5708 | 6435 | 7287 | 7416 | 7416 | 7849 | 8269 |

| 16 | 3907 | 4735 | 5819 | 5847 | 6578 | 7449 | 7597 | 7597 | 8061 | 8493 |

| 16.5 | 3985 | 4830 | 5940 | 5986 | 6721 | 7611 | 7778 | 7778 | 8273 | 8716 |

| 17 | 4063 | 4925 | 6061 | 6125 | 6864 | 7773 | 7959 | 7959 | 8485 | 8940 |

| 17.5 | 4141 | 5019 | 6182 | 6265 | 7007 | 7935 | 8140 | 8140 | 8697 | 9163 |

| 18 | 4219 | 5114 | 6304 | 6404 | 7150 | 8097 | 8321 | 8321 | 8910 | 9387 |

| 18.5 | 4297 | 5209 | 6425 | 6543 | 7293 | 8259 | 8501 | 8501 | 9122 | 9610 |

| 19 | 4375 | 5304 | 6546 | 6682 | 7436 | 8421 | 8682 | 8682 | 9334 | 9834 |

| 19.5 | 4454 | 5398 | 6667 | 6822 | 7579 | 8583 | 8863 | 8863 | 9546 | 10057 |

| 20 | 4532 | 5493 | 6788 | 6961 | 7722 | 8745 | 9044 | 9044 | 9758 | 10281 |

| 20.5 | 4610 | 5588 | 6910 | 7100 | 7865 | 8907 | 9225 | 9225 | 9970 | 10504 |

| 21 | 4688 | 5682 | 7031 | 7239 | 8008 | 9069 | 9406 | 9406 | 10182 | 10728 |

| 21.5 | 4766 | 5777 | 7152 | 7378 | 8151 | 9231 | 9587 | 9587 | 10394 | 10951 |

| 22 | 4844 | 5872 | 7273 | 7518 | 8294 | 9393 | 9768 | 9768 | 10607 | 11175 |

| 22.5 | 4922 | 5966 | 7394 | 7657 | 8437 | 9554 | 9948 | 9948 | 10819 | 11398 |

| 23 | 5000 | 6061 | 7516 | 7796 | 8580 | 9716 | 10129 | 10129 | 11031 | 11622 |

| 23.5 | 5079 | 6156 | 7637 | 7935 | 8723 | 9878 | 10310 | 10310 | 11243 | 11845 |

| 24 | 5157 | 6250 | 7758 | 8074 | 8866 | 10040 | 10491 | 10491 | 11455 | 12069 |

| 24.5 | 5157 | 6250 | 7879 | 8214 | 9009 | 10202 | 10672 | 10672 | 11667 | 12292 |

| 25 | 5157 | 6250 | 8000 | 8353 | 9152 | 10364 | 10853 | 10853 | 11879 | 12516 |

| 25.5 | 5157 | 6250 | 8000 | 8492 | 9295 | 10526 | 11034 | 11034 | 12091 | 12739 |

| 26 | 5157 | 6250 | 8000 | 8631 | 9438 | 10688 | 11215 | 11215 | 12304 | 12963 |

| 26.5 | 5157 | 6250 | 8000 | 8770 | 9438 | 10688 | 11395 | 11395 | 12516 | 13186 |

| 27 | 5157 | 6250 | 8000 | 8910 | 9438 | 10688 | 11576 | 11576 | 12728 | 13410 |

| 27.5 | 5157 | 6250 | 8000 | 9049 | 9438 | 10688 | 11757 | 11757 | 12940 | 13633 |

| 28 | 5157 | 6250 | 8000 | 9188 | 9438 | 10688 | 11938 | 11938 | 13152 | 13857 |

| 28.5 | 5157 | 6250 | 8000 | 9188 | 9438 | 10688 | 11938 | 11938 | 13364 | 14080 |

| 29 | 5157 | 6250 | 8000 | 9188 | 9438 | 10688 | 11938 | 11938 | 13576 | 14304 |

| 29.5 | 5157 | 6250 | 8000 | 9188 | 9438 | 10688 | 11938 | 11938 | 13788 | 14527 |

| 30 & above |

5157 | 6250 | 8000 | 9188 | 9438 | 10688 | 11938 | 11938 | 14000 | 14750 |

TABLE 2: NORMAL RATE OF ORDINARY FAMILY PENSION

| RANK | 2nd Lt./ Lt. | Captain | Major | Lt. Col. (TS) | LT.Col. | Colonel | Brigadier | Maj. Gen. | Lt. Gen. | DGAFMS |

| Q.S. | 3095 | 3750 | 4800 | 5513 | 5663 | 6413 | 7163 | 7163 | 8400 | 8850 |

NOTES:-

1.While the Qualifying Service indicated in Table-1 above is the actual

qualifying service,the amount of pension indicated against qualifying service is inclusive of the rank weightage as admissible in terms of Para 5(b)(I)of this

Minisrty letter No.1(6)/98/D(Pen/Sers) dated 03.02.1998

2.In order to remove the anomaly in pension of a senior rank with same qualifying service of a lower rank,arising as a result of the difference in weightage allowable to different ranks, the pension of senior rank has been stepped up to the level of their junior rank officer.

3.Revised minimum guaranteed pension in respect of Non Technical Officer of Army Medical Corp shall not be revised as per this Annexure.

4. Rate of pension in above Table have been shown for qualifying service of 10 years and above as Armed Forces Personnel are

entitled for invalid pension after 10 years of qualifying service. In order to cover all conceivable

situations, revised pension with as low as 10 years of qualifying service has been shown in this Table even for such senior ranks as Lt. Gen/Maj. Gen./Brig, even though such cases may not occur in reality.

TABLE-1: RETIRING PENSION

| RANK | 2nd Lt./ Lt. | Captain | Major | Lt. Col. (TS) | LT.Col. | Colonel (TS) | Colonel | Brigadier | Maj. Gen. | Lt.Gen. | DGAFMS |

| Q.S. | |||||||||||

| 10 | 10551 | 11296 | 12839 | 15344 | 17390 | 18424 | 18436 | 18436 | 18436 | 18436 | 18436 |

| 10.5 | 10829 | 11594 | 13196 | 15856 | 17902 | 18965 | 18979 | 18979 | 18979 | 18979 | 18979 |

| 11 | 11107 | 11891 | 13552 | 16367 | 18413 | 19507 | 19521 | 19521 | 19521 | 19521 | 19521 |

| 11.5 | 11384 | 12188 | 13909 | 16879 | 18925 | 20049 | 20063 | 20063 | 20063 | 20063 | 20063 |

| 12 | 11662 | 12485 | 14266 | 17390 | 19436 | 20591 | 20605 | 20605 | 20605 | 20605 | 20605 |

| 12.5 | 11940 | 12783 | 14622 | 17902 | 19948 | 21133 | 21148 | 21148 | 21148 | 21148 | 21148 |

| 13 | 12217 | 13080 | 14979 | 18413 | 20459 | 21675 | 21690 | 21690 | 21690 | 21690 | 21690 |

| 13.5 | 12495 | 13377 | 15336 | 18925 | 20970 | 22217 | 22232 | 22232 | 22232 | 22232 | 22232 |

| 14 | 12772 | 13674 | 15692 | 19436 | 21482 | 22758 | 22774 | 22774 | 22774 | 22774 | 22774 |

| 14.5 | 13050 | 13972 | 16049 | 19948 | 21993 | 23300 | 23317 | 23317 | 23317 | 23317 | 23317 |

| 15 | 13328 | 14269 | 16405 | 20459 | 22505 | 23842 | 23859 | 23859 | 23859 | 23859 | 23859 |

| 15.5 | 13605 | 14566 | 16762 | 20970 | 23016 | 24384 | 24401 | 24401 | 24401 | 24401 | 24401 |

| 16 | 13883 | 14863 | 17119 | 21482 | 23528 | 24926 | 24943 | 24943 | 24943 | 24943 | 24943 |

| 16.5 | 14161 | 15161 | 17475 | 21993 | 24039 | 25468 | 25486 | 25486 | 25486 | 25486 | 25486 |

| 17 | 14438 | 15458 | 17832 | 22505 | 24551 | 26010 | 26028 | 26028 | 26028 | 26028 | 26028 |

| 17.5 | 14716 | 15755 | 18189 | 23016 | 25062 | 26551 | 26570 | 26570 | 26570 | 26570 | 26570 |

| 18 | 14994 | 16052 | 18545 | 23528 | 25574 | 27093 | 27112 | 27112 | 27112 | 27112 | 27112 |

| 18.5 | 15271 | 16350 | 18902 | 24039 | 26085 | 27635 | 27654 | 27654 | 27654 | 27690 | 27690 |

| 19 | 15549 | 16647 | 19258 | 24551 | 26597 | 28177 | 28197 | 28197 | 28197 | 28334 | 28334 |

| 19.5 | 15827 | 16944 | 19615 | 25062 | 27108 | 28719 | 28739 | 28739 | 28739 | 28978 | 28978 |

| 20 | 16104 | 17241 | 19972 | 25574 | 27619 | 29261 | 29281 | 29281 | 29281 | 29622 | 29622 |

| 20.5 | 16382 | 17539 | 20328 | 26085 | 28131 | 29803 | 29823 | 29823 | 29823 | 30266 | 30266 |

| 21 | 16660 | 17836 | 20685 | 26597 | 28642 | 30344 | 30366 | 30366 | 30366 | 30910 | 30910 |

| 21.5 | 16937 | 18133 | 21042 | 27108 | 29154 | 30886 | 30908 | 30908 | 30908 | 31554 | 31554 |

| 22 | 17215 | 18430 | 21398 | 27619 | 29665 | 31428 | 31450 | 31450 | 31450 | 32197 | 32197 |

| 22.5 | 17493 | 18728 | 21755 | 28131 | 30177 | 31970 | 31992 | 31992 | 31992 | 32841 | 32841 |

| 23 | 17770 | 19025 | 22111 | 28642 | 30688 | 32512 | 32535 | 32535 | 32535 | 33485 | 33485 |

| 23.5 | 18048 | 19322 | 22468 | 29154 | 31200 | 33054 | 33077 | 33077 | 33077 | 34129 | 34129 |

| 24 | 18325 | 19619 | 22825 | 29665 | 31711 | 33596 | 33619 | 33619 | 33619 | 34773 | 34773 |

| 24.5 | 18325 | 19619 | 23181 | 30177 | 32223 | 34137 | 34161 | 34161 | 34161 | 35417 | 35417 |

| 25 | 18325 | 19619 | 23538 | 30688 | 32734 | 34679 | 34704 | 34704 | 34704 | 36061 | 36061 |

| 25.5 | 18325 | 19619 | 23538 | 31200 | 33246 | 35221 | 35246 | 35246 | 35246 | 36705 | 36705 |

| 26 | 18325 | 19619 | 23538 | 31711 | 33757 | 35763 | 35788 | 35788 | 35788 | 37349 | 37349 |

| 26.5 | 18325 | 19619 | 23538 | 32223 | 33757 | 35763 | 35788 | 35891 | 35891 | 37993 | 37993 |

| 27 | 18325 | 19619 | 23538 | 32734 | 33757 | 35763 | 35788 | 36461 | 36461 | 38637 | 38637 |

| 27.5 | 18325 | 19619 | 23538 | 33246 | 33757 | 35763 | 35788 | 37031 | 37031 | 39281 | 39281 |

| 28 | 18325 | 19619 | 23538 | 33757 | 33757 | 35763 | 35788 | 37600 | 37600 | 39925 | 39925 |

| 28.5 | 18325 | 19619 | 23538 | 33757 | 33757 | 35763 | 35788 | 37600 | 37600 | 40569 | 40569 |

| 29 | 18325 | 19619 | 23538 | 33757 | 33757 | 35763 | 35788 | 37600 | 37879 | 41213 | 41213 |

| 29.5 | 18325 | 19619 | 23538 | 33757 | 33757 | 35763 | 35788 | 37600 | 38471 | 41857 | 41857 |

| 30 & above |

18325 | 19619 | 23538 | 33757 | 33757 | 35763 | 35788 | 37600 | 39063 | 42500 | 42500 |

TABLE 2: NORMAL RATE OF ORDINARY FAMILY PENSION

| RANK | 2nd Lt./ Lt. | Captain | Major | Lt. Col. (TS) | LT.Col. | Colonel (TS) | Colonel | Brigadier | Maj. Gen. | Lt.Gen. | DGAFMS |

| AMOUNT | 10995 | 11772 | 14123 | 20255 | 20255 | 21458 | 21473 | 22560 | 23438 | 25500 | 25500 |

NOTES:-

1.While the Qualifying Service indicated in Table-1 above is the actual qualifying service,

the amount of pension indicated against qualifying service is inclusive of the rank weightage as admissible in terms of Para 5(b)(I)of this Minisrty letter

No.1(6)/98/D(Pen/Ser) dated 03.02.1998

2.In order to remove the anomaly in pension of a senior rank with same qualifying service of a lower rank, arising as a result of the difference in weightage allowable to different ranks, the pension of senior rank has been stepped up to the level of their junior rank

officer.

3.Revised minimum guaranteed pension in respect of Non Technical Officer of Army Medical Corp shall not be revised as per this Annexure.

4. Rate of pension in above Table have been shown for qualifying service of 10 years and above as Armed Forces Personnel are entiled for invalid pension after 10 years of qualifying service. In order to cover all conceivable situatioins, revised pension with as low as 10 years of qualifying service has been shown in this Table even for such senior ranks as Lt. Gen/Maj. Gen./Brig, even though such cases may not occur in reality

indicated is inclusive of the rank weightage

TABLE-1: RETIRING PENSION

| RANK | 2nd Lt./ Lt. | Captain | Major |

| Q.S. | |||

| 10 | 8330 | 8918 | 10699 |

| 10.5 | 8608 | 9215 | 11056 |

| 11 | 8885 | 9513 | 11413 |

| 11.5 | 9163 | 9810 | 11769 |

| 12 | 9441 | 10107 | 12126 |

| 12.5 | 9718 | 10404 | 12483 |

| 13 | 9996 | 10702 | 12839 |

| 13.5 | 10274 | 10999 | 13196 |

| 14 | 10551 | 11296 | 13552 |

| 14.5 | 10829 | 11593 | 13909 |

| 15 | 11107 | 11891 | 14266 |

| 15.5 | 11384 | 12188 | 14622 |

| 16 | 11662 | 12485 | 14979 |

| 16.5 | 11940 | 12782 | 15336 |

| 17 | 12217 | 13080 | 15692 |

| 17.5 | 12495 | 13377 | 16049 |

| 18 | 12772 | 13674 | 16405 |

| 18.5 | 13050 | 13971 | 16762 |

| 19 | 13328 | 14269 | 17119 |

| 19.5 | 13605 | 14566 | 17475 |

| 20 | 16104 | 17241 | 19972 |

| 20.5 | 16382 | 17538 | 20328 |

| 21 | 16660 | 17836 | 20685 |

| 21.5 | 16937 | 18133 | 21042 |

| 22 | 17215 | 18430 | 21398 |

| 22.5 | 17493 | 18727 | 21755 |

| 23 | 17770 | 19025 | 22111 |

| 23.5 | 18048 | 19322 | 22468 |

| 24 | 18325 | 19619 | 22825 |

| 24.5 | 18325 | 19619 | 23181 |

| 25 | 18325 | 19619 | 23538 |

| 25.5 | 18325 | 19619 | 23538 |

| 26 | 18325 | 19619 | 23538 |

| 26.5 | 18325 | 19619 | 23538 |

| 27 | 18325 | 19619 | 23538 |

| 27.5 | 18325 | 19619 | 23538 |

| 28 | 18325 | 19619 | 23538 |

| 28.5 | 18325 | 19619 | 23538 |

| 29 | 18325 | 19619 | 23538 |

| 29.5 | 18325 | 19619 | 23538 |

| 30& above | 18325 | 19619 | 23538 |

TABLE 2: NORMAL RATE OF ORDINARY FAMILY PENSION

| RANK | 2nd Lt./ Lt. | Captain | Major |

| AMOUNT | 10995 | 11772 | 14123 |

NOTES:

Source: http://pcdapension.nic.in/6cpc/Circular-24.pdf

Subscribe to Central Government Employee News & Tools by Email [Click Here]

Follow us: Twitter [click here] | Facebook [click here] | Google+ [click here]

Admin

COMMENTS