Chapter 10.1 – Pension and Related Benefits of Civilian Employees

Terms of Reference of the Commission

“To examine the principles which should govern the structure of pension and other retirement benefits, including revision of pension in the case of employees who have retired prior to the date of effect of these recommendations, keeping in view that retirement benefits of all Central Government employees appointed on and after 01.01.2004 are covered by the National Pension System (NPS).”

Pensions- Constitutional Provisions and Judicial Position

government thereon and the recognition of distinctiveness in categories of pensions and pensioners has been settled.

available resources must provide that a pensioner would be able to live free from want, with decency, independence and self respect and standard

equivalent at pre-retirement level. It held that pension is not an ex-gratia payment but payment for past services rendered. At the same time in Indian

Ex-Services League & Others Vs Union of India & Others [(1991) 2 SSC 104] the Supreme Court held that the decision in the Nakara case has to be

read as one of a limited application and its ambit cannot be enlarged to cover all claims made by the pension retirees or a demand for an identical

amount of pension to every retiree from the same rank irrespective of the date of retirement, even though the reckonable emoluments for computation of

their pension be different. In the judgement in Vasant Gangaramsachandan Vs State of Maharashtra & Others [(1996) 10 SSC 148] Supreme Court

reiterated that pension is not a bounty of the State. It is earned by the employee for service rendered to fall back upon after retirement. It is

attached to the office and it cannot be arbitrarily denied.

Supreme Court in Krishna Kumar Vs Union of India and Others [(1990) 4 SSC 207] averred that it was never held that both the pension retirees and PF

retirees formed a homogenous class and that any further classification among them (viz., pension retirees and PF retirees) would be violative of

Article 14. Under the Pension Scheme, the government’s obligation does not begin until the employee retires but it begins on his/her retirement and

then continues till the death of the employee. Thus, on the retirement of an employee, government’s legal obligation under the PF account ends while

under the Pension Scheme it begins. The rules governing the PF and its contribution are entirely different from the rules governing pension. An

imaginary definition of obligation to include all the government retirees in a class was not decided and could not form the basis for any

classification for this case.

Strength of Pensioners as on 01.01.2014

Railways and Post.

51.96 lakh. The category wise break

up is shown in the pie chart below.

Pensioners

and Family Pensioners

51.96 lakh pensioners as on 01.01.2014 between pensioners and family pensioners, category wise, is as

under:

|

Central Civil

|

Railways | Post | Defence |

Defence Civilian

|

Total | |

| Pensioners | 9.37 | 10.59 | 2.28 | 13.78 | 4.11 | 40.13 |

| Family pensioners | 1.44 | 3.16 | 0.97 | 4.82 | 1.44 | 11.83 |

| Total number of pensioners | 10.81 | 13.75 | 3.25 | 18.60 | 5.55 | 51.96 |

ii. Civilian pensioners consisting of Central Government Civil, Railways and Posts, as on 01.01.2014 number 27.81 lakh while defence pensioners

(including defence civilians were 24.15 lakh. Defence pensioners (including defence family pensioners and defence civilians) constitute 47 percent of

all pensioners.

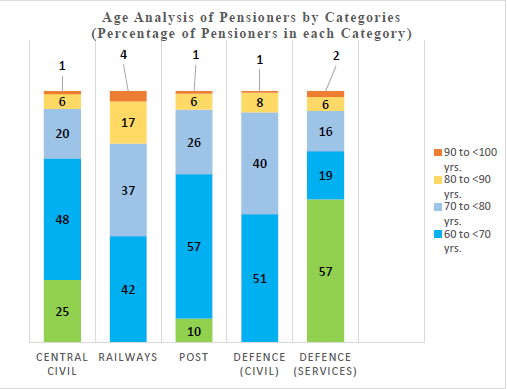

Age Analysis of Pensioners as on 01.01.2014

view to ascertain the strength in various age groups, called for information on age profile of pensioners and family pensioners. The data with regard

to pensioners in terms of various age groups, as reported to the Commission, for the five categories of pensioners’ viz., Central Civil, Railways,

Post, Defence (Civil) and Defence (Services) is as under:

| Categories |

> 60 and < 70 years

|

70 to < 80 years

|

80 to < 90 years

|

90 to <100 years

|

Others# | Total |

| Central Civil | 5,22,621 | 2,12,283 | 63,899 | 12,155 | 2,70,040@ | 10,80,998 |

| Railways^ | 5,82,847 | 5,06,543 | 2,30,409 | 55,684 | – | 13,75,483 |

| Post | 1,86,463 | 83,452 | 20,558 | 3,185 | 30,931 | 3,24,589 |

| Defence (Civil) | 2,83,638 | 2,24,435 | 43,618 | 3,006 | – | 5,54,697 |

| Defence (Services) | 3,57,725 | 2,97,402 | 1,03,132 | 42,861 | 10,59,379 | 18,60,499 |

| Total | 19,33,294 | 13,24,115 | 4,61,616 | 1,16,891 | 13,60,350 | 51,96,266 |

| As % of total pensioners | 37.21 | 25.48 | 8.88 | 2.25 | 26.18 |

# Others includes those below 60 years of age and those above 100 years.

are in the 70-80 and ‘Others’ age group. The balance 11 percent are in the 80 plus category and thus entitled to enhanced pension based on advancing

age.

years, 80-90 years, 90-100 years and Others.

percentage is in the range of 7-9 percent, in the Railways it is 21 percent.

pensioners fall in the ‘Others’ age group. Central Civil which also includes CAPFs has 25 percent in ‘Others’ age group.

Expenditure on Pension and other Retirement Benefits

encashment benefits, compassionate allowance, government’s contribution for defined pension scheme for civil personnel joining on or after 01.01.2014

etc. It also includes expenditure on medical treatment of CGHS pensioners. The total expenditure of the Union Government on pensions between FY 2007-08

and 2013-14 is as under:

in crore)

| Year |

20 0 7 -08

|

20 0 8 -09

|

20 0 9 -10

|

20 1 0 -11

|

20 1 1 -12

|

20 1 2 -13

|

20 1 3 – 14 |

| 1 . Civil | 9 ,017 | 12 , 707 | 21 , 149 | 20 , 069 | 23 , 597 | 26 , 111 | 29 , 397 |

| (As % of total Pension expenditure) | (26.7) | (27.3) | (27.8) | (26.2) | (28.6) | (27.6) | (28.2) |

| (% increase over previous year) | (40.9) | (66.4) | (-5.1) | (17.6) | (10.7) | (12.6) | |

| 2 .Defence (Including Defence Civilians) |

15 , 244 | 20 , 233 | 34 , 999 | 37 , 336 | 37 , 569 | 43 , 368 | 45 , 499 |

| (As % of total Pension expenditure) | (45.1) | (43.5) | (46.0) | (48.7) | (45.5) | (45.9) | (43.7) |

| (%increase over previous year) | (32.7) | (73.0) | (6.7) | (0.6) | (15.4) | (4.9) | |

| 3 . Railways | 7 ,953 | 11 , 264 | 16 , 603 | 16 , 018 | 17 , 919 | 21 , 021 | 24 , 762 |

| (As % of total Pension expenditure) | (23.5) | (24.2) | (21.8) | (20.9) | (21.7) | (22.3) | (23.8) |

| (% increase over previous year) | (41.6) | (47.4) | (-3.5) | (11.9) | (17.3) | (17.8) | |

| 4 . Posts | 1 ,609 | 2 ,274 | 3 ,339 | 3 ,177 | 3 ,499 | 3 ,968 | 4 ,443 |

| (As % of total Pension expenditure) | (4.8) | (4.9) | (4.4) | (4.1) | (4.2) | (4.2) | (4.3) |

| (% increase over previous year) | (41.3) | (46.8) | (-4.9) | (10.1) | (13.4) | (11.7) | |

| 5 . Total Pension expenditure | 33 , 823 | 46 , 478 | 76 , 090 | 76 , 600 | 82 , 584 | 94 , 468 | 1 ,04,101 |

| (% increase over previous year) | (37.4) | (63.7) | (0.7) | (7.8) | (14.4) | (10.2) | |

| Pension expenditure as % of GDP | 0 .69 | 0 .84 | 1 .20 | 1 .00 | 0 .94 | 0 .95 | 0 .92 |

| Pension Expenditure based on Union Finance Accounts of the respective years. [GDP at market prices based on Economic Survey 2014-15] |

|||||||

aftermath of implementation of the recommendations of the VI CPC.

ratio it was 0.92 in FY 2013-14, well above the levels prior to the implementation of the Report of the VI CPC.

attributed largely to the increase in number of pensioners and additional dearness relief paid to pensioners from time to time.

expenditure of the Union Government on pensions.

Pension Regime Over Time

10.1.16 The changes in the pension payout regime in the recent decades, in terms of certain key parameters relating to pension, are listed below.

recommendations of successive CPCs/decision of Government thereon is as under:

| CPC | Minimum Pension | Maximum Pension |

| IV CPC | 375 | 4,500 |

| V CPC | 1,275 | 15,000 |

| VI CPC | 3,500 | 45,000 |

10.1.18 Minimum and Maximum Family Pension: The minimum and maximum family

pension as admissible, based on recommendations of successive CPCs/decision of Government thereon is as under:

Amount ( Rs.)

| CPC | Minimum Family Pension | Maximum Family Pension |

| IV CPC | 375 | 1,250 |

| V CPC | 1,275 | 9,000 |

| VI CPC | 3,500 | 27,000 |

10.1.19 Gratuity:

| Limit as per | Amount (Rs. lakh) |

| IV CPC | 1.0 |

| V CPC (Interim Report) | 2.5 |

| V CPC (Final Report) | 3.5 |

| VI CPC | 10.0 |

10.1.20 Commutation: The 15 year period of restoration has been uniform through the currency of the IV, V and VI CPCs.

| CPC |

% age of Pension which can be Commuted for Civilians

|

% age of Pension which can be Commuted for Defence Personnel

|

| IV CPC | 1/3rd | 45% for JCOs/ORs and 43% for Officers |

| V CPC | 40% | |

| VI CPC | 40% | 50% |

10.1.21 Ex Gratia Lump Sum Compensation Circumstances and Amount:

| Circumstance in which Death Occurred |

V CPC | VI CPC |

| Accident while performing duties | 5 | 10 |

| Acts of violence by terrorists, anti-social elements etc. | 5 | 10 |

| Border skirmishes and action against militants, terrorists, extremists etc. (and enemy action in international war as applied by MHA) | 7.5 | 15 |

| Specified high altitude, inaccessible border post etc.# | 15 | |

| Enemy Action in international war or war like engagements notified by Ministry of Defence | 10 | 20 |

Note: # Post VI CPC

10.1.22 Leave Encashment permitted at the time of retirement:

| CPC | Earned Leave |

| IV CPC | 240 days |

| V CPC | 300 days |

| VI CPC | 300 days# |

|

# excludes 60 days EL encashment during LTC

|

|

Demands made with regard to Pension

personnel are:

i. Raising the existing rates of pension and family pension

ii. The quantum of minimum pension should equal the minimum wage

iii. Increase in the rate of additional pension and family pension to the older pensioners as also reducing the age the eligibility for its receipt

from the existing 80 years

iv. Increasing the existing time period of seven years for enhanced family pension. v. Enhancement in the gratuity ceiling of Rs.10 lakh and its

indexation

vi. Rationalisation of death gratuity

vii. Reduction in the time period for restoration of basic pension, reduced on account of commutation

viii. Ex-gratia lump sum compensation

ix. Enhancement of ceiling of Earned Leave for purposes of Leave Encashment x. Enhancement in the existing rates of Fixed Medical Allowance

xi. Enhancement in the rates of Constant Attendance Allowance xii. Parity in Pension between pre and post Seventh CPC retirees

Raising the Existing Rates of Pension and Family Pension

of 50 percent of last pay drawn, questioned the basis for determination of pension at 50 percent of last pay drawn. Similarly representations for

increasing family pension from existing 30 percent to 50 percent of the last pay drawn have been received by the Commission.

10.1.25 The Commission sought the views of the government in this regard. The Department of Pension and Pensioners Welfare stated that the VI CPC had

recommended calculation of pension @ 50 percent of last pay or the average emoluments (for last 10 months) whichever is more beneficial. The Commission

also recommended delinking of pension from qualifying service of 33 years. Effectively the dispensation on pension has already been liberalised by the

VI CPC. Further the recommendations of this Commission in relation to pay of both the civilian and defence forces personnel will lead to a significant

increase in the pay drawn and therefore in the ‘last pay drawn’/‘reckonable emoluments.’

Therefore the Commission does not recommend any further increase in the rate of pension and family pension from the existing levels.

Quantum of Minimum Pension should Equal the Minimum Wage

10.1.26 In representations/depositions before the Commission it has been stated that the existing minimum pension fixed at Rs.3,500 is low and it has

been argued that minimum pension be fixed equal to minimum pay for sustenance.

10.1.27 The Commission sought the views of the government in this regard. The Department of Pension and Pensioners Welfare stated that as per the

orders issued after V CPC, the minimum pension in the government was Rs.1,275. The normal revised consolidated pension of a pre-2006 pensioner is 2.26

of the pre-revised basic pension. The revised minimum pension of Rs.3,500 is much more than 2.26 time of the pre-revised pension of Rs.1,275. Further

the recommendations of this Commission in relation to pay of personnel will lead to a significant increase in the minimum pay from the existing

Rs.7,000 per month to Rs.18,000 per month. This, based on the computation of pension, will raise minimum pension from the existing Rs.3,500 to

Rs.9,000. The minimum pension based on the recommendations of this Commission will increase by 2.57 times over the existing level.

Increase in the Rate of Additional Pension and Family Pension to the Older Pensioners

10.1.28 In representations/depositions before the Commission, a case has been made by a number of Pensioners Bodies/Associations for lowering the

existing age slabs of old pensioners for payment of additional quantum of pension and family pension from the existing 80 years of age. Enhancing the

rates for payment of additional quantum of pension and family pension with advancing age have also been made.

Analysis and Recommendations

10.1.29 The additional pension with advancing age came into force based on the recommendations of the VI CPC. The rates as applicable for the

additional pension are as under:

- 80 years to <85 years: 20% of basic pension ·

- 85 years to <90 years: 30% of basic pension ·

- 90 years to <95 years: 40% of basic pension ·

- 95

years to <100 years: 50% of basic pension · - 100 years and more: 100% of basic pension

pension for old pensioners of the age of 80 years and above has been allowed as per the recommendations of VI CPC. However, it is felt that the same

should be allowed from 75 years onwards. The Ministry of Defence has not supported the proposal. The Commission is of the view that

the existing rates of additional pension and additional family pension are appropriate.

Increasing the existing time period of seven years for enhanced family pension

10.1.31 The Commission has received representations seeking enhancement in the period of enhanced family pension from the existing seven years or 67

years, whichever is less, to ten years in case of death of retirees.

10.1.32 The current rates of enhanced family pension are–

i. In the case of death in service: Payable to the family of a government servant for a period of ten years from the date of death of a government

servant, without any upper age limit.

ii. In the case of death after retirement: Payable for a period of seven years or up to the date on which he would have attained 67 years had he

survived, whichever is less.

10.1.33 The Commission notes that the revision with regard to period of eligibility for the enhanced family pension of ten years was made based on recommendations of the VI CPC Report. No further change is being recommended by this Commission.

Enhancement in the Gratuity Ceiling and its Indexation

with regard to payment of service gratuity.

Analysis and Recommendations

10.1.35 Rule 49 and 50 of the CCS (Pension) Rules provides that a government servant is entitled to get retirement gratuity equal to one-fourth of his

emoluments for each completed six monthly period of qualifying service subject to a maximum of 16.5 times of the last emoluments subject to a maximum

of Rs.10 lakh.

10.1.36 The Commission sought the views of the government in this regard. The Department of Pension and Pensioners Welfare stated that the VICPC has

increased the amount of gratuity from Rs.3.5 lakh to Rs.10 lakh w.e.f. 01.01.2006. This amount, in the view of the department, is not commensurate with

emoluments that are available to senior officers at the time of retirement. The department has suggested to the Commission that a view could be taken

to index gratuity with amount of DA admissible at the time of retirement.

10.1.37 The Commission notes that there is merit in the argument advanced to index the ceiling on gratuity so that the benefits of the enhanced ceiling

are available to personnel in a manner which is more even over a time frame. The Commission recommends enhancement in the ceiling of gratuity from the existing Rs.10 lakh to Rs.20 lakh from 01.01.2016. The Commission further recommends, as has been done in the case of allowances that are partially indexed to Dearness Allowance, the ceiling on gratuity may increase by 25 percent whenever DA rises by 50 percent.

Rationalisation of Death Gratuity

10.1.38 The Commission has received representations pointing to a need for rationalization of current slabs for death gratuity, especially for the slab

of 5 to 20 years of qualifying service in which family pensioners are stated to be placed at a disadvantageous position.

Analysis and Recommendations

10.1.39 As per Rule 50 of Pension Rules, the death gratuity admissible will be as follows, subject to the maximum limit prescribed for the gratuity:

| Length of Service | Rate of Death Gratuity |

| Less than one year | 2 times of monthly emoluments |

| One year or more but less than 5 years | 6 times of monthly emoluments |

| 5 years or more but less than 20 years | 12 times of monthly emoluments |

| 20 years or more | Half month of emoluments for every complete six monthly period of qualifying service subject to a maximum of 33 times of monthly emoluments |

10.1.40 The Commission sought the views of the government in this regard. Department of Pension and Pensioners Welfare stated that it had received

similar demands from pensioners’ association and it feels a need for a review of the existing slabs for death gratuity.

| Length of Service | Rate of Death Gratuity |

| Less than one year | 2 times of monthly emoluments |

| One year or more but less than 5 years | 6 times of monthly emoluments |

| 5 years or more but less than 11 years | 12 times of monthly emoluments |

| 11 years or more but less than 20 years | 20 times of monthly emoluments |

| 20 years or more | Half month of emoluments for every complete six monthly period of qualifying service subject to a maximum of 33 times of emoluments |

Reduction in the time period for Restoration of Basic Pension

existing 15 years.

Analysis and Recommendations

their judgement dated 09.12.1986, allowed restoration of pension after 15 years. The Supreme Court in its judgement specifically stated that though the

amount is recovered in 12 years, yet since there is a risk factor and some of the states are restoring pension after 15 years, the period of

restoration is fixed at 15 years. The V CPC in its recommendation increased the percentage of commutation to 40 percent and recommended restoration

period at 12 years. But the reduction of restoration period was not accepted by the government. The VI CPC did not recommend any change in the maximum

percentage of commutation allowed or in the period of restoration. This Commission also does not recommend any change either in the maximum percentage of commutation or in the period of restoration.

Enhancement of ceiling of Earned Leave for purposes of Leave Encashment

10.1.44 The Commission has received representations seeking raising the ceiling limit of 300 days to 450 days for purposes of Leave encashment.

Analysis and Recommendations

days while in service. This is not to be deducted from the maximum number of Earned Leave of 300 days encashable at the time of retirement. The VI CPC,

therefore, has further liberalised the regime of leave encashment.

10.1.46

The recommendations in relation to pay of both the civilian and defence forces personnel will also lead to a significant increase in the pay drawn and therefore in the total

amount of leave encashment available for an employee. Therefore raising the present ceiling of 300 days is not recommended by the Commission.

Ex-gratia lump sum compensation

ex-gratia lump sum compensation for Next-of-Kin (NoK) of CAPF, Assam

Rifles and defence forces personnel who die in harness in performance of their bona fide official duties.

Fixed Medical Allowance

10.1.49 The Commission has received representations seeking enhancement in Fixed Medical Allowance, currently payable at the rate of Rs.500 per month

for pensioners not covered under Central Government Health Service (CGHS).

10.1.50 The Commission has examined the matter in Chapter 8.17.

Constant Attendance Allowance

10.1.52 The Commission has examined the matter in Chapter 8.17.

Parity in Pension between Pre and Post Seventh CPC Retirees

10.1.53 This Commission has received a number of representations on the issue of disparities in pensions between past pensioners and existing

pensioners. The JCM-Staff Side, has in its memorandum, stated that the pay of every pre-Seventh CPC retiree should be notionally re-determined

(corresponding to the post from which he or she retired and not corresponding to the scale from which he or she retired) as if he or she is not retired

and then the pension be computed under the revised liberalised rules which are to be applicable to the post Seventh CPC retirees. A similar view has

been expressed by a number of other Associations/Bodies representing Central Government pensioners. Further, certain groups of pensioners have

contended that based on the recommendations of the VI CPC, the new pay structure consisting of Pay Bands and Grade Pays has led to bunching of a number

of pre revised pay scales into a particular Pay Band. This, in their view, has placed pre-01.01.2006 pensioners in certain pay scales/Pay Bands at a

disadvantage not only compared to the post 01.01.2006 pensioners in the corresponding pay scales but also in comparison to post 01.01.2006 retirees of

lower pay scales.

10.1.54 The Commission is of the view that the issue of parity in pensions is extremely important from the viewpoint of inter-temporal equity and

merits a careful examination.

10.1.55 Treatment of Existing and Past Pensioners over time: The concerns of pensioners’

associations and of individual pensioners on the issue of disparities in pensions amongst broadly comparable retirees, has been dealt with in reports

of successive CPCs and also by the government. This is detailed in the succeeding paragraphs.

10.1.56 Till the III CPC, it was a general view that past and future pensioners cannot be treated at par and the practice was that benefit of

improvement in the pension would be available to newly retiring pensioners from a prospective date. In fact the III CPC took the view that serving

government employees and pensioners could not be treated at par as regards grant of DA at the same rate. A significant change in the paradigm for

treatment of pensioners, past and future, emerged from the judicial pronouncement in D.S. Nakara vs Union of India in 1982 (AIR 1983 SC 130), based on

which, for the first time, improvements in pensionery benefits were extended to pensioners who had retired prior to the date from which improvements

became effective.

10.1.57 The IV CPC recommended, for both civil and defence pensioners, additional relief in terms of a percentage increase in amount of pension subject

to a certain minimum increase. Separate rates were applicable to pensioners drawing pension upto Rs.500 per mensem and those above Rs.500 per mensem.

10.1.58 The V CPC made a definitive shift in the treatment of past pensioners. The Commission took the view that the process of bridging the gap in

pension of past pensioners, set into motion by the IV CPC by grant of additional relief in addition to consolidation of pension, needed to be continued

so as to achieve complete parity over a period of time. It, accordingly, recommended that pension of all the pre-1986 retirees maybe updated by

notional fixation of their pay as on 1 January, 1986 by adopting the same formula as for the serving employees. The consolidated pension so arrived at

was to be not less than 50 percent of the minimum pay, as revised by V CPC, of the scale of the pensioner at the time of retirement. This principle by

which past pensioners are brought up to the minimum of the scale which replaced the scale in which the pensioner retired has been termed as modified

parity. This consolidated amount of pension was to be the basis for grant of dearness relief in future.

10.1.59 The VI CPC noted that modified parity had already been conceded between pre and post 1 January, 1996 pensioners. It also observed that full

neutralisation of price rise on or after 1 January, 1996 had also been extended to all the pensioners. Therefore, the Commission felt that no further

changes in the extant rules were necessary. To maintain the existing modified parity between present and future retirees, it recommended that those who

retired before 01.01.2006 be given the same fitment benefit as was recommended for the existing government employees.

10.1.60 The above points to a distinct transition in the view taken by successive CPCs and the government, beginning with the III CPC. The V CPC, by

recommending that pension of all the pre-1986 retirees should be updated by notional fixation of their pay, made a landmark advancement in the regime

for past pensioners. In principle, the VI CPC proposed provision of the same modified parity as was envisaged in by the VCPC. However, the new pay

structure introduced by the VI CPC, based on running Pay Bands and Grade Pays, led to the bunching of a number of pre revised pay scales into a

particular Pay Band, thereby diminishing the benefit of the intended modified parity. This naturally led to several representations following which

certain corrective orders were issued by the government, some of which were based on the orders of various Courts.

10.1.61 Judicial Pronouncements on the Issue: The issue of pension has been a matter of debate in a large number of

cases before the Hon’ble Supreme Court of India. One of the early leading judgments on the subject is the case of D.S. Nakara V/S Union of India &

Ors. [1983] 1 SSC 305. In this case, it was held that pensioners form a class as a whole and cannot be micro-classified by an arbitrary, unprincipled

and unreasonable eligibility criteria for grant of revised pension. This ratio further came up for consideration before another constitutional bench in

the case of Krishan Kumar V/S Union of India & Ors. [(1990 4 SCC 207)]. This constitutional bench distinguished the D.S. Nakara (supra) and held

that it has limited application. The D.S. Nakara case again came up for discussion in the case of Indian Ex-Services League V/S Union of India &

Ors [(1991) 2 SCC 104)]. This constitutional bench further considered the case of D.S. Nakara and held that this case has limited application and its

ambit cannot be enlarged to cover all claims made by pensioners retirees or a demand for an identical amount of pension to every retiree from the same

rank irrespective of the date of retirement, even though the reckonable emoluments for computation of their pension be different. The decision of D.S. Nakara came up for consideration in two successive constitutional benches and they did not approve the ratio enunciated

in the case D.S. Nakara (Supra). Subsequently, the case of D.S. Nakara (Supra) has been followed by some benches and some have distinguished it. A

large number of cases have been summed up recently in the decision given in the case of State of Punjab V/S Amar Nath Goyal [(2005) 6 SCC 754)]. In

this case, all cases on the subject were reviewed and it was laid down that the government can make distinction in the matter of payment of pension

between two classes of pensioners. Various decisions, including the aforesaid two constitutional benches i.e., Krishan Kumar (Supra) and Indian

Ex-Services League (Supra) and the judgement given in D.S. Nakara (Supra) were considered. Decisions given in the case of Action Committee South

Eastern Railway Pensioners V/S Union of India [(1991 Supp. (2) SCC 544)] was also referred to. In this case also, it was accepted that distinction can

be made between two pensioners. Similarly in the case of State of Rajasthan V/S Amrat Lal Gandhi [(1997) 2 SCC 342)], it was held that financial

implication can be a consideration for making two classes of the pensioners though similarly placed. Similarly in the case of State of Punjab V/S Buta

Singh [(2000) 3 SCC 733)], the Supreme Court held that the position that emoluments of persons holding the same status who retired after a notified

date must be treated to be the same cannot be accepted. In the case of State of Punjab V/S G.L. Gupta [(2003) 3 SCC 736)] it was held that for grant of

additional benefits that had financial implications, the prescription of a specific future date for conferment of additional benefits could not be

considered arbitrary. However, the Apex Court has also taken a contrary view in some cases relying on D.S. Nakara’s case.

10.1.62 In the case of Dhanraj & Ors. V/S State of J&K and others [(1994) 4 SCC 30)], it was held with reference to government order of

J&K, that the distinction between pre and post retires of June 1981 in payment of pension cannot be justified and it is violative of Article 14 of

Constitution. Similarly, in a recent judgement of Hon’ble Court given in the case of Union of India & Anr. V/S SPS Vains (Retd.) & Ors. [(2008)

2 SCC (LS 838)], the case of D.S. Nakara (Supra) was followed and it was held that the disparity created within the same class i.e., two officers both

retired as Major Generals one prior to 1.1.1996 and other after that date but getting different amounts of pension was arbitrary and that the same also

offends Article 14 of the Constitution of India.

10.1.63 The legal position that emerges from the aforesaid decision of the Apex Court is that classification should be founded on a rational basis

while distinguishing one class from other. It should not be discriminatory or violative of Article 14 of the Constitution. The Apex Court has examined

each case on its merit and wherever they have found that distinction between similarly placed classes is discriminatory then the same has been struck

down.

10.1.64 Pension Payout to Personnel in the Central Government: The preceding paragraphs bring out the

evolution of the pension regime over time and the role of the Judiciary in settling the law on the subject. There is clear evidence that governments

have progressively moved towards a liberalised regime for past pensioners. The VI CPC has further provided for additional pension with advancing age.

What this has effectively translated into is testified by examples 36 of pension fixation of personnel across groups who have retired in the past decades. For example a Secretary to the Government of India

retiring on 31 August, 1992 was in receipt of a basic pension of Rs.4,000 per month. The basic pension after implementation of the V and VI CPC got

revised to Rs.13,000 and Rs.40,000 respectively. With the benefit of dearness relief 37 this pensioner is on date entitled to a total payout in terms of

pension and dearness relief of Rs.87,600. Further, as a pensioner who is over 80 years of age he is entitled to an additional pension equivalent to 20

percent of basic pension. In effect the pensioner is in receipt of a total payout of Rs.105,120 per month as on date. Similarly, a Director (in GP 8700

as per VI CPC) retiring on 30 September, 1994 with a basic pension of Rs.2,556 per month got revised basic pension of Rs.7,042 and Rs.22,701 per month

after implementation of the V and VI CPC respectively. With the benefit of dearness relief38 the pensioner is on date entitled to a total payout in

terms of pension and dearness relief of Rs.49,715 per month. The basic pension for a Group `C’ official retiring on 30 September, 1991 from the scale

of Rs.950- 1500 was fixed at Rs.717 per month. His basic pension, after implementation of the V and VI CPC, got revised to Rs.2,188 and Rs.4,946

respectively. With dearness and pensionery increase due beyond 80 years the pensioner is in receipt of a total payout of Rs.12,998 per month.

10.1.66 Recommendations of the Commission: For employees joining on or after 01.01.2004, the concept of pension, so far as

Civilian employees including CAPFs are concerned, has undergone a complete change. After the enactment of the Pension Fund Regulatory and Development

Act, 2013, it is not the exclusive liability of the government to pay the pension. As per the new dispensation the employee and the government are to

make equal matching contribution towards their pension. This dispensation is not applicable to the defence forces personnel. They continue to get the

defined benefit pension as before. In this section the Commission is dealing with Civilian pensioners under the old pension scheme, i,e, those who

joined before 01.01.2004.

10.1.67 The Commission recommends the following pension formulation for civil employees including CAPF personnel, who have retired before 01.01.2016:

i) All the civilian personnel including CAPF who retired prior to 01.01.2016 (expected date of implementation of the Seventh CPC recommendations) shall first be fixed in the Pay Matrix being recommended by this Commission, on the basis of the Pay Band and Grade Pay at which they retired, at the minimum of the corresponding level in the matrix. This amount shall be raised, to arrive at the notional pay of the retiree, by adding the number of increments he/she had earned in that level while in service, at the rate of three percent. Fifty percent of the total amount so arrived at shall be the re vised pension.

36 Actual cases as obtained from Central Pension Accounting Office (CPAO) etc.

37 Dearness Relief of 119 percent, as effective from 1 July, 2015.

iii) Pensioners may be given the option of choosing whichever formulation is beneficial to them.

10.1.69 Illustration on fixation of pension based on recommendations of the Seventh CPC.

Case I

Rs.67,000 to 79,000:

| Amount in Rs. | ||

| 1. | Basic Pension fixed in VI CPC | 39,500 |

| 2. | Initial Pension fixed under Seventh CPC (using a multiple of 2.57) |

1,01,515-Option 1

|

| 3. | Minimum of the corresponding pay level in 7 CPC | 1,82,200 |

| 4. | Notional Pay fixation based on 3 increments | 1,99,100 |

| 5. | 50 percent of the notional pay so arrived |

99,550-Option 2

|

| 6. | Pension amount admissible (higher of Option 1 and 2) | 1,01,515 |

Case II

Rs.3000-100-3500-125-4500:

| Amount in Rs. | ||

| 1. | Basic Pension fixed in IV CPC | 1,940 |

| 2. | Basic Pension as revised in VI CPC | 12,543 |

| 3. | Initial Pension fixed under Seventh CPC (using a multiple of 2.57) |

32,236 Option 1

|

| 4. | Minimum of the corresponding pay level in 7 CPC | 67,700 |

| 5. | Notional Pay fixation based on 9 increments | 88,400 |

| 6. | 50 percent of the notional pay so arrived |

44,200 Option 2

|

| 7. | Pension amount admissible (higher of Option 1 and 2) | 44,200 |

Stay connected with us via Facebook, Google+ or Email Subscription.

Subscribe to Central Government Employee News & Tools by Email [Click Here]

Follow us: Twitter [click here] | Facebook [click here] | Google+ [click here]

Admin

COMMENTS

Sir, The Fin Ministry DOE in its OM. F.No. 6/37/98-IC date 21-4-2004 UPGRADED THE SCALE OF PAY FROM RS. 5500-9000 to. Rs. 6500-10500 WITH PROSPECTIVE EFFECT FOR INSPECT,PREVENTIVE OFFICER WORKING UNDER FIN.MIN CBOEC . .IT MEANS THOSE WHO RETIRED IN THE PAY SCALE OF 5500-9000 THEIR PENSION WILL BE CALCULATED IN THIS SCALE. THOSE WHO RETIRED AFTER THE ISSUE OF ABOVE OM UPGRADING THE SCALE OF THE SAME CADRE WILL BE CALCULATED IN THE SCALE OF RS. 6500-10500.(21-4-2004) IS IT CORRECT AS PER THE HON. SUPREME COURT ORDER IN D.S.NAKARA. WHEREIN IT HAD BEEN EXPLAINED THAT THERE CANOT BE TWO CLASSOF PENSIONERS IE. CLASS WITHIN THE CLASS WHICH IS AGAINST ARTICLE 14. OF THE CONSTITUTION OF INDIA. THE DOPT IN THEIR OM NO. 22011/10/84-Estt. D 04–02–1992 HAVE CLARFIED THAT THE UGRADATION OF SCALE OF WILL TAKE EFFECT FROM THE DATE OF EFFECT OF THE PAY COMMISSION . BUT. THE ADMINISTRATIVE MINISTRY DID NOT REVISE THE PENSION OF THOSE EMPLOYEES RETIRED PRIOR TO 21–4–2004 . HENCE IT NEEDS BROAD CLARIFICATION

SINCE THE TREATMENT IS CLASS WITHIN THE CLASS OF PENSIONERS. RETIRED IN THE SAME CADRE AND SAME SCALE OF PAY BUT UPGRADED IN A PARTICULAR DATE. GIVING BENEFIT OF UPGRADATION PROSPECTIVE EFFECT NEGLECTING THE PENSIONERS RETIRED EALIER TO 21-4-2004.

My name is Elizabeth forbes from united states. I want to thank Mr Johnson who helped me to get a loan. For the past three months, I have been searching for a loan to settle my debts, everyone I met scammed and took my money until I met Mr Johnson Snowberger. He was able to give me a loan of $15,000US Dollars. He can also help you. He has also helped some other colleagues of mine. If you need any financial help, kindly contact his company through email: [email protected] ( +16104555553 ) I believe he can help you. Contact him to get help just as he helped me. He doesn't know that I am doing this this by spreading his goodwill towards me but I feel I should share this with you all to free yourself from scammers, please beware of impersonators and contact the right loan company.

Good morning Yesterday i received a copy of PPO OF MY father who had retired as HAVILDAR Clk/Gd AOC 6847581 after serving 18 years combatant service in the army in DEC,1965 immediately joined as an AUDITOR in DAD CGDA being Graduate passed SAS Pt.1 exam and pensioned wef 16 JAN,1979 for both services combined pension of 31 years Original PPO NO.C/DAD/337/1987 , 6CPC PPO NO.192/2016 after a long struggle writing to RM / PMO PG/E/2016/0074617 & DOPPW/E/2016/02424 latest G-1 C OFFICE COPY PHOPO COPY with a remark NOT FOR PAYMENT showing notional pay scale 1200-30-1560-40-2040 thus revised pension wef 1/1/2006 as 4920 where as in 5CPC AUDITOR PAY SCALE WAS 4500-125 MIN PENSION 5585/- as i know and above that if he had not got both services combined must be getting pension of military HAV 7655/- FOR 18 YEARS as per OROP Table besides civil pension SO HUGE LOSS TO MILITARY PERSON WHO DID MORE SERVICE THAT TOO AT HIGHER POST 18+13=31 YEARS, So my request is to consider like him very few persons to give TWO PENSIONS or at least which ever is more as and when during that persons life , since both were sanctioned for life and even recently SUPREME COURT has accepted it that purpose for which it was got combined, does not meet the purpose as on today by seeing above example. He is trying hard at the age of 88 writing every one but no one applies their mind to mitigate his problem of being paid less pension than even first sanctioned in 1965 for less years & low post JAY HIND

Number of years served in the last pay grade.the fixation of the pension should be based on this simple formula.

The calculation of pension need to be considered as an algebraic equation considering all variables (pay bands , basic pay and years of service etc. to arrive the payment applicable) and divide it by 2 to achieve the net pension. The arithmetical example and explanation there in is likely to create confusion ambiguities. These can be avoided altogether if the calculation is based on an equation which is directly proportional to the length of service(number of years) in each pay band. It is most important in the case of Military personal.

I totally agree with the views of Sri Raghunathan.The number of increments earned should be determined from the minimum of the pay scale to the last pay drawn as raised by the rate of increment.

Fixation of Pension : Para 10.1.67 , Sub para (i) of 7th CPC Recommendations

The Number of Increments Earned by the Retiree in the PAY SCALE at the time of Retirement

SHOULD be Determined based on the LAST PAY drawn in the PAY SCALE. The Number of

STAGES in the PAY SCALE ( at the time of Retirement) from the STARTING of the PAY SCALE

Up To the LAST PAY drawn DETERMINES the Number of Increments GAINED in the PAY SCALE

by the Retiree.

Illustration on Fixation of Pension shown in Case 2 of Para 10.1.71 is relevant in Support of

my Views.

The above Views may please be given Wide Publicity and CIRCULATION

Para 10.1.67 , sub para (i) of 7th CPC Report

The Number of Increments Earned by the Retiree SHOULD be Determined based on the LAST PAY

drawn in the PAY SCALE at the time of his Retirement. The Number of STAGES in the PAY SCALE

from the STARTING of the PAY SCALE Up To the LAST PAY drawn DETERMINES the Number

of Increments GAINED by the Retiree .

Illustration 2 given by CPC is Relevant in this Connection.

The above Views may please be given Wide CIRCULATION

VII th Pay Commission has not looked into value of rupee at the times of various pay commissions. The only aspect considered is that pensioners are not dying early and they live long life with peace of mind.