Sale of KVPs can be made direct to the applicant or through SAS Agent. Form A, attached with the notification shall be used for issue of KVPs and in CBS post offices existing Account Opening Forms (AOF) shall be used by manually substituting the words “certificates” as “KVP”

SB ORDER NO. 12/2014

F.No.113-01/2011-SB (Vol-II)

Government of India

Ministry of Communications & IT

Department of Posts

Dak Bhawan, Sansad Marg,

New Delhi-110001, Dated: 17.11.2014

To

All Heads of Circles/Regions

Addl. Director General, APS, New Delhi.

Subject: – Re-introduction of sale of Kisan Vikas Patra: procedure regarding

Sir/ Madam,

Min. of Finance (DEA) vide its O.M No. 2/4/2014-NS-II dated 11.11.2014 has forwarded Notification No. G.S.R 705 (E) dated 23.9.2014 regarding notification of Kisan Vikas Patra (KVP) Rules 2014 (copy enclosed) . For starting of sale of KVPs under these rules, following procedure should be followed:-

1. Till new KVPs are printed and made available, old KVPs lying in CSDs as a reserve stock and old KVPs returned to ISP Nasik by CSDs for destruction will be supplied back by ISP Nasik to CSDs. The same are to be used by placing a rubber stamp of revised maturity period and pre-maturity table mentioned in the KVP Rule 16 and 17. KVPs of denominations of Rs.100/- and Rs.500/- are to remain discontinued and will not be supplied by ISP Nasik to CSDs. Out of reserve stock also with ‘CSDs, denomination of Rs. 100/- and Rs.500/- should not supplied to HOs.

2. Sale of KVPs can be made direct to the applicant or through SAS Agent. Form A, attached with the notification shall be used for issue of KVPs and in CBS post offices existing Account Opening Forms (AOF) shall be used by manually substituting the words “certificates” as “KVP”.

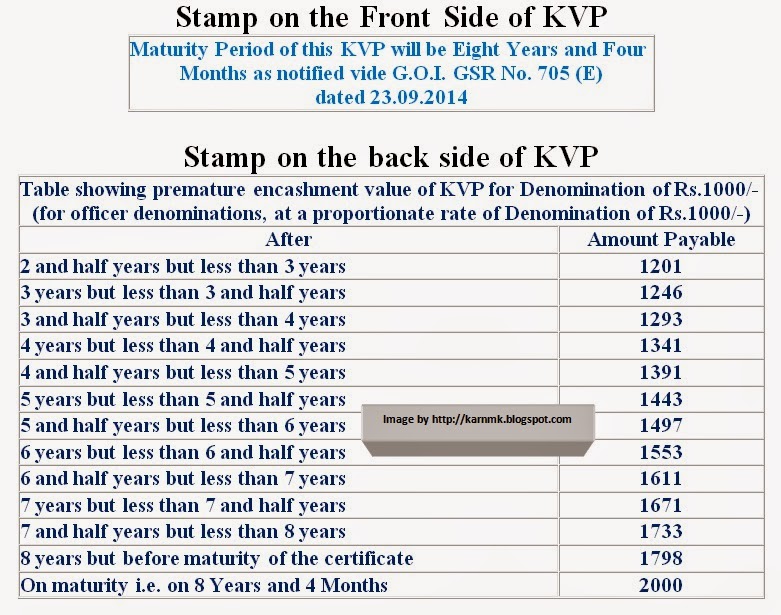

3. Specimen of stamps to be placed on the front side of old KVPs and back side of old KVPs is given below:-

Stamp on the Front Side of KVP

|

Maturity Period of this KVP will be Eight Years and Four

Months as notified vide G.O.I. GSR No. 705 (E) dated 23.09.2014 |

Stamp on the back side of KVP

| Table showing premature encashment value of KVP for Denomination of Rs.1000/-

(for officer denominations, at a proportionate rate of Denomination

of Rs.1000/-) |

|

|

After

|

Amount Payable

|

| 2 and half years but less than 3 years | 1201 |

| 3 years but less than 3 and half years | 1246 |

| 3 and half years but less than 4 years | 1293 |

| 4 years but less than 4 and half years | 1341 |

| 4 and half years but less than 5 years | 1391 |

| 5 years but less than 5 and half years | 1443 |

| 5 and half years but less than 6 years | 1497 |

| 6 years but less than 6 and half years | 1553 |

| 6 and half years but less than 7 years | 1611 |

| 7 years but less than 7 and half years | 1671 |

| 7 and half years but less than 8 years | 1733 |

| 8 years but before maturity of the certificate | 1798 |

| On maturity i.e. on 8 Years and 4 Months | 2000 |

4. Existing rules and procedure for indenting, stocking and supply of. Certificates/KVPs laid down for SOs, HOs and CSDs in POSB Manual Vol-II shall be followed except that sale of Denominations of Rs.100/- and Rs.500/- are discontinued.

5. No operations under Rule 9 of KVP Rules 2014 relating to transfer of KVPs from Post Office to Bank and Vice Versa shall be carried out till detailed procedure is circulated by this office.

6. in case of non availability of stock of KVPs, application for purchase should be accepted and preliminary receipt NC4(a) should be issued and alreadyllaid down procedure for issue of certificates in such cases should be followed.

This issues with the approval of Competent Authority.

Encl.: As above

Yours Faithfully,

(Kawal Jit Singh)

Assistant Director (SB-ll)

Source: http://www.indiapost.gov.in/DOP/Pdf%5CCirculars%5CKVP_SB_Order_1680_21112014_Pub_Upload.PDF

Stay connected with us via Facebook, Google+ or Email Subscription.

Subscribe to Central Government Employee News & Tools by Email [Click Here]

Follow us: Twitter [click here] | Facebook [click here] | Google+ [click here]

Admin

COMMENTS