No: BPMS / 7CPC / 226 A (8/3/L)

To

The Secretary,

7th Central Pay Commission,

Chatrapati Shivaji Bhawan,

1st Floor, B-14/1, Qutab Institutional Area,

New Delhi – 110016

Subject: Submission of oral evidence before 7th CPC by BPMS.

Reference: Your Letter No. 7CPC/158/Meetings/2015, Dated: 19.03.2015

Dear Madam,

Thanking You,

Principles of Pay Determination

In such circumstances, the family unit for minimum salary should be taken as Six (06), i.e., 01 Unit = Govt Employee, 01 Unit = Spouse, 02 Unit = 2 Children & 02 Unit = Parents. Total 06 Unit

| SL | Item | Consumption per Unit of 3 per Family | Consumption per Unit of 6 per Family | Present Market Rate** | Total Cost Rs. |

| 01 | Wheat/Rice | 470 gms/day = 15 Kg/Month | 30 Kg/Month | 40/Kg | 1200 |

| 02 | Dal/Pulses | 7.2 Kg/Mth | 14.4 Kg/Mth | 90/Kg | 1296 |

| 03 | Raw Veg. | 9 Kg/Mth | 18 Kg/Mth | 40/Kg | 720 |

| 04 | Veg Green Leaf | 11.25 Kg/M | 22.5 Kg/Mth | 30/Kg | 675 |

| 05 | Other Veg | 6.75 Kg/Mth | 13.5 Kg/Mth | 30/Kg | 405 |

| 06 | Fruits | 10.8 Kg/Mth | 21.6 Kg/Mth | 100/Kg | 2160 |

| 07 | Milk | 18 Ltr/Mth | 36 Ltr/Mth | 45/Ltr | 1620 |

| 08 | Sugar | 5 Kg/Mth | 10 Kg/Mth | 35/Kg | 350 |

| 09 | Edible Oil | 3.6 Kg/Mth | 7.2 Kg/Mth | 120/Kg | 864 |

| 10 | Fish | 2.5 Kg/Mth | 5 Kg/Mth | 300/Kg | 1500 |

| 11 | Meat | 5 Kg/Mth | 10 Kg/Mth | 400/Kg | 4000 |

| 12 | Egg | 90 Nos/Mth | 180 Nos/Mth | 5/No. | 900 |

| 13 | Clothing | 5.5 Mtr/Mth | 11 Mtr/Mth | 400/Mtr | 4400 |

| TOTAL | 20090 | ||||

| Add 20% as Fuel Charges | 4018 | ||||

| Add 25% towards Medical, Housing Maint etc | 6027 | ||||

| GRAND TOTAL | 30135 | ||||

It has also been observed that the prices given above are present day prices and are likely to increase by at least 40% by 01-01-2016 (i.e., inflation @ 10% per semester from 01.01.2014 to 31.12.2015) when the 7th CPC will be implemented and hence it would be proper if a boosting of 40% can be given on the above Grand Total to make it realistic as on 01-01-2016.

Minimum-Maximum Ratio

Hence, it is our considered opinion that the ratio between the minimum & maximum Salary should be of 1:7.

Considerations for determining salary for various Levels

Nevertheless, it is once again reiterated that under no circumstances, should the ratio between minimum-maximum pay exceed 1:7.

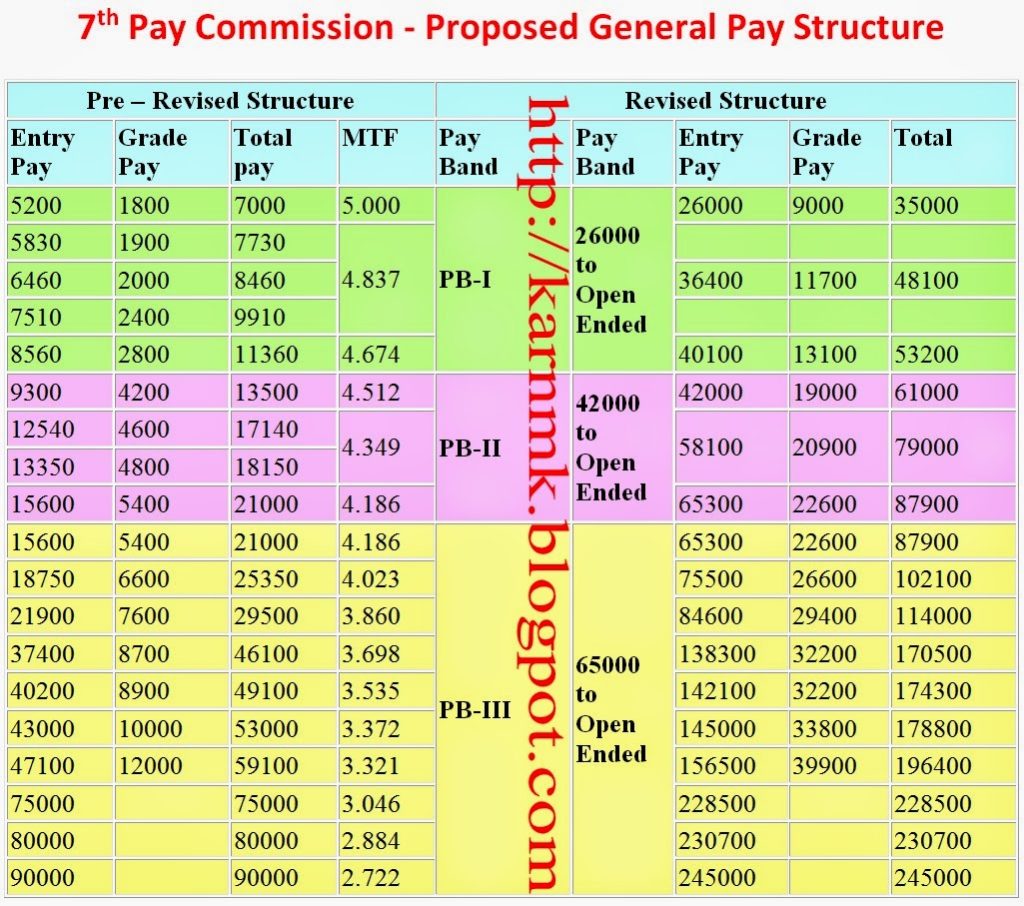

Proposed General Pay Structure

| Pre – Revised Structure | Revised Structure | |||||||

| Entry Pay |

Grade Pay |

Total pay |

MTF | Pay Band |

Pay Band |

Entry Pay |

Grade Pay |

Total |

| 5200 | 1800 | 7000 | 5.000 | PB-I | 26000 to Open Ended |

26000 | 9000 | 35000 |

| 5830 | 1900 | 7730 | 4.837 | |||||

| 6460 | 2000 | 8460 | 36400 | 11700 | 48100 | |||

| 7510 | 2400 | 9910 | ||||||

| 8560 | 2800 | 11360 | 4.674 | 40100 | 13100 | 53200 | ||

| 9300 | 4200 | 13500 | 4.512 | PB-II | 42000 to Open Ended |

42000 | 19000 | 61000 |

| 12540 | 4600 | 17140 | 4.349 | 58100 | 20900 | 79000 | ||

| 13350 | 4800 | 18150 | ||||||

| 15600 | 5400 | 21000 | 4.186 | 65300 | 22600 | 87900 | ||

| 15600 | 5400 | 21000 | 4.186 | PB-III | 65000 to Open Ended |

65300 | 22600 | 87900 |

| 18750 | 6600 | 25350 | 4.023 | 75500 | 26600 | 102100 | ||

| 21900 | 7600 | 29500 | 3.860 | 84600 | 29400 | 114000 | ||

| 37400 | 8700 | 46100 | 3.698 | 138300 | 32200 | 170500 | ||

| 40200 | 8900 | 49100 | 3.535 | 142100 | 32200 | 174300 | ||

| 43000 | 10000 | 53000 | 3.372 | 145000 | 33800 | 178800 | ||

| 47100 | 12000 | 59100 | 3.321 | 156500 | 39900 | 196400 | ||

| 75000 | 75000 | 3.046 | 228500 | 228500 | ||||

| 80000 | 80000 | 2.884 | 230700 | 230700 | ||||

| 90000 | 90000 | 2.722 | 245000 | 245000 | ||||

On the recommendation of Sixth CPC various pay scales of erstwhile

Group ‘D’ & Group ‘B’ employees were merged and upgraded but none of the pay scales of Group ‘C’ were merged and upgraded. Hence, we demand that there should be only 03 grade pay each in PB-1 & PB-2 by merging/upgrading as under:-

| Rs. 1900 | Merged & | – | Rs. 2400 |

| Rs. 2000 | Upgraded | ||

| Rs. 2400 | Merged | – | Rs. 2800 |

| Rs. 2800 | |||

| Rs. 4600 | Merged | – | Rs. 4800 |

| Rs. 4800 |

The minimum-maximum ratio has been fixed at 1:7

Only Three Pay Bands have been proposed since consequent upon abolition of Group “D” Posts, there now remains only 3 Groups viz : C, B, and A. PB-I is for Group “C”, PB-II is for Group “B” and PB-III is for Group “A”.

A large span has been kept in PB-III to ensure financial movement to HAG slot of Officers who otherwise do not find promotional space in the slot.

Multiplication Factor (MTF):

Workshop Staff

| SL. | Grade | Existing grade pay |

Upgrade Grade pay |

Pay Band |

Entry Pay |

Grade Pay |

Total |

|

Pre Revised

|

Revised | ||||||

| 01 | Semi-Skilled | 1800 | 1800 | 26000- to O.E. | 26000 | 9000 | 35000 |

| 02 | Skilled | 1900 | 2400 | 26000- to O.E. | 36400 | 11700 | 48100 |

| 03 | Highly Skilled-II & I | 2400 2800 |

2800 | 26000- to O.E. | 40100 | 13100 | 53200 |

| 04 | Master Craftsman | 4200 | 4200 | 42000 to O.E. | 42000 | 19000 | 61000 |

| (i) | Skilled | – | 45% |

| (ii) | Highly Skilled Grade II | – | 20.5% |

| (iii) | Highly Skilled Grade I | – | 20.5% |

| (iv) | Master Craftsman | – | 14% |

Simultaneously, Ministry of Railways has also revised the inter grade ratio of Industrial Employees as under:

| (i) | Skilled | – | 20 % |

| (ii) | Highly Skilled Grade II | – | 20 % |

| (iii) | Highly Skilled Grade I | – | 44 % |

| (iv) | Master Craftsman | – | 16 % |

Hence, 07th CPC should recommend for similar inter grade ratio in all the Ministries.

Further, in the Corps of EME, Navy HQrs, Air HQrs sufficient number of Technical Workers are being recruited directly as Highly Skilled with B.Sc./Diploma in Engineering because they are required to handle most sophisticated equipments Radars, Laser Ray Finders, Night Vision Devices Electronic Gadgets, GPS, Multi type Test Equipments etc, hence they should be recruited in the Highly Skilled Grade – I.

Clerical Staff

| SL. | Grade | Existing Grade Pay |

Upgraded Grade Pay |

Pay Band |

Entry Pay |

Grade Pay |

Total |

| Pre – Revised | Revised | ||||||

| 01 | Admin Assistant Grade. “A” | 1900 | 2400 | 26000- to O.E. | 36400 | 11700 | 48100 |

| 02 | Admin Assistant Grade “B” | 2400 | 2800 | 26000- to O.E. | 40100 | 13100 | 53200 |

| 03 | Section Superintendent | 4200 | 4200 | 42000- to O.E. | 42000 | 19000 | 61000 |

| 04 | Junior Works Manager/ Civilian Gazetted Officer/Admin Officer |

4600 | 4800 | 42000- to O.E. |

58100 | 20900 | 79000 |

Store Keeping Staff

| SL. | Grade | Existing Grade Pay | Upgraded Grade Pay | Pay Band | Entry Pay | Grade Pay | Total |

| Pre – Revised | Revised | ||||||

| 01 | Store Keeper/Assistant Store Keeper/Store Assistant “A” | 1900 | 2400 | 26000- to O.E. | 36400 | 11700 | 48100 |

| 02 | Supervisor/Store Superintendent/Senior Store Keeper/Store Assistant “B”/Barrack & Store Gr.II | 2400 | 2800 | 26000- to O.E. | 40100 | 13100 | 53200 |

| 03 | Chargeman/Senior Store Superintendent/ Foreman (Store)/Barrack & Store Gr.I/Senior Store Assistant | 4200 | 4200 | 42000- to O.E. | 42000 | 19000 | 61000 |

| 04 | Junior Works Manager (Store)/Ordnance Officer (Civ- Store)/Civ.Gaztt. Officer (Equip)Asstt. Naval Store Officer- II/Store Officer | 4600 | 4800 | 42000 – to O.E. | 58100 | 20900 | 79000 |

| 05 | Civilian Staff Officer/Asstt. Naval Store Officer-I/Sr. Barrack & Store Officer | – | 5400 | 42000- to O.E. | 65300 | 22600 | 87900 |

Stenographer

| SL. | Grade | Existing Grade Pay |

Upgraded Grade Pay |

Pay Band |

Entry Pay |

Grade Pay |

Total |

| Pre – Revised | Revised | ||||||

| 1 | Stenographer | 2400 | 2800 | 26000- to O.E. | 40100 | 13100 | 53200 |

| 2 | Per. Asstt. | 4200 | 4200 | 42000- to O.E. | 42000 | 19000 | 61000 |

| 3 | Per. Secretary | 4600 | 4800 | 42000- to O.E. | 58100 | 20900 | 79000 |

| 4 | Sr. Per. Secretary | 4800 | 5400 | 42000- to O.E | 65300 | 22600 | 87900 |

| 5 | Principal Private Secretary | 6600 | 65300- to O.E. | 76200 | 26600 | 102800 | |

Data Entry Operators

| SL. | Grade | Existing Grade Pay |

Upgraded Grade Pay |

Pay Band | Entry Pay |

Grade Pay |

Total |

| 1 | DEO ‘A’ | 2400 | 2800 | 26000- to O.E. | 40100 | 13100 | 53200 |

| 2 | DEO ‘B’ | 2800 | 2800 | 26000- to O.E. | 40100 | 13100 | 53200 |

| 3 | DEO ‘C’ | 4200 | 4200 | 42000- to O.E. | 42000 | 19000 | 61000 |

Telephone Operator

| SL. | Grade | Existing Grade Pay |

Upgraded Grade Pay |

Pay Band |

Entry Pay |

Grade Pay |

Total |

| 1 | Tel. Optr. Gr.II | 2400 | 26000- to O.E. | 36400 | 11700 | 48100 | |

| 2 | Tel. Optr. Gr.I | 2800 | 26000- to O.E. | 40100 | 13100 | 53200 | |

| 3 | Tel. Supr. | 4200 | 42000- to O.E. | 42000 | 19000 | 61000 |

Drivers

| SL. | Grade | Existing Grade Pay |

Upgraded Grade Pay |

Pay Band |

Entry Pay |

Grade Pay |

Total |

| Pre – Revised | Revised | ||||||

| 1 | Driver Ordinary Grade |

1900 | 2400 | 26000- to O.E. | 36400 | 11700 | 48100 |

| 2 | Driver Gr.II | 2400 | 2800 | 26000-to O.E. | 40100 | 13100 | 53200 |

| 3 | Driver Gr.I | 2800 | |||||

| 4 | Driver Spl. Grade | 4200 | 4200 | 42000- to O.E. | 42000 | 19000 | 61000 |

Security Staff

| SL. | Grade | Existing Grade Pay |

Upgraded Grade Pay |

Pay Band |

Entry Pay |

Grade Pay |

Total |

| 1 | Security Asstt “A” | 1800 | 1800 | 26000-to O.E. | 26000 | 9000 | 35000 |

| 2 | Security Asstt “B” | 2400 | 26000-to O.E. | 36400 | 11700 | 48100 | |

| 3 | Security Asstt “C” | 2800 | 26000-to O.E. | 40100 | 13100 | 53200 | |

| 4 | Security Asstt “D” | 4200 | 42000-to O.E. | 42000 | 19000 | 61000 |

Multi-Tasking Staff

| SL. | Grade | Existing Grade Pay | Upgraded Grade Pay | Pay Band | Entry Pay | Grade Pay | Total |

| 1 | MTS Gr.III | 1800 | 26000-to O.E. | 26000 | 9000 | 35000 | |

| 2 | MTS Gr.II | 2400 | 26000-to O.E. | 36400 | 11700 | 48100 | |

| 3 | MTS Gr.I | 2800 | 26000-to O.E. | 40100 | 13100 | 53200 |

Photographers

| SL. | Grade | Existing Grade Pay | Upgraded Grade Pay | Pay Band | Entry Pay | Grade Pay | Total |

| 1 | PhotographerGr.III | 1800 | 26000-to O.E. | 26000 | 9000 | 35000 | |

| 2 | PhotographerGr.II | 2400 | 26000-to O.E. | 36400 | 11700 | 48100 | |

| 3 | PhgotographerGr.I | 2800 | 26000-to O.E. | 40100 | 13100 | 53200 |

Rajbhasha Staff

It is suggested that at least 03 Grade structure be made for Rajbhasha Cadre in Lower Formation and their pay scales be at par with those announced by the Official Language Implementation Committee (JHT – 4600, SHT-5400 & HO – 6600).

Fire Fighting Staff

| SL. | Grade | Existing Grade Pay | Upgraded Grade Pay | Pay Band | Entry Pay | Grade Pay | Total |

| Pre – Revised | Revised | ||||||

| 1 | Firemen | 1900 | 2400 | 26000-to O.E. | 36400 | 11700 | 48100 |

| 2 | Leading Fireman | 2000 | |||||

| 3 | Station Officer | 2800 | 2800 | 26000-to O.E. | 40100 | 13100 | 53200 |

| 4 | Asstt. Divisional Fire Officer | 4200 | 4200 | 42000-to O.E. | 42000 | 19000 | 61000 |

| 5 | Dy. Divisional Fire Officer | 4600 | 4800 | 42000-to O.E. | 58100 | 20900 | 79000 |

Canteen Staff

| SL. | Grade | Existing Grade Pay | Upgraded Grade Pay | Pay Band | Entry Pay | Grade Pay | Total |

| Pre – Revised | Revised | ||||||

| 1 | Vendor | 1800 | 1800 | 26000-to O.E. | 26000 | 9000 | 35000 |

| 2 | Cook | 1900 | 2400 | 26000-to O.E. | 36400 | 11700 | 48100 |

| 3 | Asstt. Cashier | 2400 | 2800 | 26000-to O.E. | 40100 | 13100 | 53200 |

| 4 | Canteen Supr. | 4200 | 4200 | 42000-to O.E. | 42000 | 19000 | 61000 |

| 5 | Canteen Manager | 4600 | 4800 | 42000-to O.E. | 58100 | 20900 | 79000 |

Drawing Office Staff

| SL. | Grade | Existing Grade Pay | Upgraded Grade Pay | Pay Band | Entry Pay | Grade Pay | Total |

| Pre – Revised | Revised | ||||||

| 1 | Blue Printer | 1800 | 1800 | 26000-to O.E. | 26000 | 9000 | 35000 |

| 2 | Draughtsman | 2400 | 2800 | 26000-to O.E. | 40100 | 13100 | 53200 |

| 3 | Sr. Draughtsman | 4200 | 4200 | 42000-to O.E. | 42000 | 19000 | 61000 |

| 4 | Jr. Tech. Officer | 4600 | 4800 | 42000-to O.E. | 58100 | 20900 | 79000 |

Para Medical Staff

Nursing Staff

| SL. | Grade | Existing Grade Pay | Revised Grade Pay | Pay Band | Entry Pay | Grade Pay | Total |

| Pre – Revised | Revised | ||||||

| 1 | Midwife | 2000 | 2800 | 26000-to O.E. | 40100 | 13100 | 53200 |

| 2 | Nurse Gr.II | 4600 | 4800 | 42000-to O.E. | 58100 | 20900 | 79000 |

| 3 | Nurse Gr.I | 4800 | 4800 | 42000-to O.E. | 58100 | 20900 | 79000 |

| 4 | Public Health Nurse | 4800 | 4800 | 42000-to O.E. | 58100 | 20900 | 79000 |

| 5 | Matron | 5400 | 5400 | 65300-to O.E. | 65300 | 22600 | 87900 |

Pharmacist

| SL. | Grade | Pay Band | Entry Pay | Grade Pay | Total | ||

| Pre – Revised | Revised | ||||||

| 1 | Pharmacist Gr.II | 2800, after 02 yrs 4200 | 4200 | 42000-to O.E. | 42000 | 19000 | 61000 |

| 2 | Pharmacist Gr.I | 4600 | 4800 | 42000-to O.E. | 58100 | 20900 | 79000 |

| 3 | Sr. Pharmacist | 4800 | 4800 | 42000-to O.E. | 58100 | 20900 | 79000 |

| 4 | Chief Pharmacist | 5400 | 65300-to O.E. | 65300 | 22600 | 87900 | |

Laboratory Staff

| SL. | Grade | Existing Grade Pay | Upgraded Grade Pay | Pay Band | Entry Pay | Grade Pay | Total |

| Pre – Revised | Revised | ||||||

| 1 | Medical Lab Technician | 4200 | 4200 | 42000- to O.E. | 42000 | 19000 | 61000 |

| 2 | Sr. Medical Lab Technician | 4600 | 4800 | 42000- to O.E. | 58100 | 20900 | 79000 |

| 3 | Chief Medical Lab Technician | – | 5400 | 42000- to O.E. | 65300 | 22600 | 87900 |

Radiographer

| SL. | Grade | Existing Grade Pay | Upgraded Grade Pay | Pay Band | Entry Pay | Grade Pay | Total |

| Pre – Revised | Revised | ||||||

| 1 | Radiographer Gr.I | 4200 | 4200 | 42000- to O.E. | 42000 | 19000 | 61000 |

| 2 | Radiographer Gr.II | – | 4800 | 42000- to O.E. | 58100 | 20900 | 79000 |

| 3 | Radiographer Gr.III | – | 5400 | 42000- to O.E. | 65300 | 22600 | 87900 |

Medical Staff

| SL. | Grade | Existing Grade Pay | Upgraded Grade Pay | Pay Band | Entry Pay | Grade Pay | Total |

| Pre – Revised | Revised | ||||||

| 1 | Ward Sahayak | 1800 | 1800 | 26000- to O.E. | 26000 | 9000 | 35000 |

| 2 | Medical Asstt. | 1800 | 2400 | 26000- to O.E. | 36400 | 11700 | 48100 |

| 3 | Ward Master | 1900 | 2400 | 26000 to O.E. | 36400 | 11700 | 48100 |

| 4 | Sr. Medical Asstt./Sr. Ward Master | – | 2800 | 26000- to O.E. | 40100 | 13100 | 53200 |

Supervisory Staff

| SL. | Grade | Existing Grade Pay | Upgraded Grade Pay | Pay Band | Entry Pay | Grade Pay | Total |

| Pre – Revised | Revised | ||||||

| 1 | Chargeman (Tech) | 4200 | 4200 | 42000- to O.E. | 42000 | 19000 | 61000 |

| 2 | Chargeman (Non Tech) | 4200 | 4200 | 42000- to O.E. | 42000 | 19000 | 61000 |

| 3 | Chargeman (Non Tech) (Stores) | 4200 | 4200 | 42000 to O.E. | 42000 | 19000 | 61000 |

| 4 | Chargeman (Non Tech) (other than Stores) | 4200 | 4200 | 42000- to O.E. | 42000 | 19000 | 61000 |

| 5 | JWM (Tech) | 4600 | 4800 | 42000- to O.E. | 58100 | 20900 | 79000 |

| 6 | JWM (Non Tech) | 4600 | 4800 | 42000- to O.E. | 58100 | 20900 | 79000 |

| 1. Annual Increments: |

|||||||||||||||||||||||

| (i) Two dates of Annual Increments | |||||||||||||||||||||||

| (a) 01st January for those who have been recruited or promoted between 01st January and 30th June of last year; (b) 01st July for those who have been recruited or promoted between 01st July and 31st December of last year. |

|||||||||||||||||||||||

| (ii) Rate of Annual Increment | |||||||||||||||||||||||

| (a) 5% of (BP +GP) for first 05 years; (b) 7.5% of (BP + GP) for subsequent years. |

|||||||||||||||||||||||

| (iii) One Notional Increment | |||||||||||||||||||||||

| On superannuation for calculating retirement benefits | |||||||||||||||||||||||

| 2. Pay Fixation Formula: |

|||||||||||||||||||||||

| In no case promotee will draw less pay in comparison to Direct Recruit. | |||||||||||||||||||||||

| 3. House Rent Allowance: | |||||||||||||||||||||||

|

|||||||||||||||||||||||

| 4. Children Education Allowance: |

|||||||||||||||||||||||

| (i) | CEA be extended upto Graduation for any 02 children; | ||||||||||||||||||||||

| (ii) | Rs. 36000/- per annum per child and linked with DA increase; | ||||||||||||||||||||||

| (iii) | CEA should be exempted from Income Tax; | ||||||||||||||||||||||

| (iv) | CEA should be granted without any claim | ||||||||||||||||||||||

| 5. Knowledge Update Allowance: |

|||||||||||||||||||||||

| (i) | Every employee irrespective of Rank and Grade Pay; | ||||||||||||||||||||||

| (ii) | Monthly KUA at the rate of Annual Increment. | ||||||||||||||||||||||

| 6. Leave Travel Concession (LTC): |

|||||||||||||||||||||||

| (i) | New Concept of LTC Promotional Allowance equivalent to one month salary (BP + GP) in place of leave encashment; | ||||||||||||||||||||||

| (ii) | LTC for retired employees; | ||||||||||||||||||||||

| (iii) | Irrespective of GP, employee may be entitled to travel by Air if he avails LTC only once in 04 years; |

||||||||||||||||||||||

| (iv) | Irrespective of Grade Pay, employees may avail one International LTC in entire service career. |

||||||||||||||||||||||

| 7. Transport Allowance: |

|||||||||||||||||||||||

| (i) | Criteria of City Classification should be dispensed off; |

||||||||||||||||||||||

| (ii) | GP 2800 and below Rs. 1600 x 3 GP 4200 and above Rs. 3200 x 3 |

||||||||||||||||||||||

| (iii) | TA on retirement equal weight & rates per km for all; | ||||||||||||||||||||||

| (iv) | TA to deceased family same as on retirement. |

||||||||||||||||||||||

|

8. TA/DA while on tour:

|

|||||||||||||||||||||||

| (i) Entitlement; | |||||||||||||||||||||||

|

|||||||||||||||||||||||

| (ii) | Hotel Charges – Minimum Rs. 2000/- per day; | ||||||||||||||||||||||

| (iii) | Food Charges – Minimum Rs. 500/- per day; | ||||||||||||||||||||||

| (iv) | Local Transport Charges Minimum Rs. 300/- per day; |

||||||||||||||||||||||

| (v) | All the above allowances should be granted to Defence Assistant / Assisting Officer in the CCS (CC&A) Rules; |

||||||||||||||||||||||

| (vi) | No Bill/Receipt should be required for above; | ||||||||||||||||||||||

| (vii) | Above rates should be neutralized with increase of DA. |

||||||||||||||||||||||

| 9. Washing Allowance: |

|||||||||||||||||||||||

| (i) Rs. 300/- per month plus DA for the employees provided with protective clothing or uniforms. | |||||||||||||||||||||||

| 10. Split Duty Allowance: |

|||||||||||||||||||||||

| (i) Rs. 2000/- per month | |||||||||||||||||||||||

| 11. Risk Allowance: |

|||||||||||||||||||||||

| (i) @ one annual increment per month | |||||||||||||||||||||||

| 12. Armoured Vehicle Allowance: |

|||||||||||||||||||||||

| (i) @ one annual increment per month | |||||||||||||||||||||||

| 13. Technical Allowance: |

|||||||||||||||||||||||

| (i) | For similar nature of job, civilians should be granted Technical Allowance (Airworthyness Allowance/Flight Charge Certificate Allowance/Aeronautical Technical Allowance/Submarine Allowance, Sea/Field Trial Allowance) at par with Combatants. | ||||||||||||||||||||||

| 14. Incentive for Quality Control: |

|||||||||||||||||||||||

| Artisan Staff/Industrial Employees engaged in Ordnance Factories are entitled to “Piece-Work” and the IEs engaged in electrical or mechanical or civil work maintenance/repair are entitled for 50% of average piece work as Incentive Bonus and this system is in vogue since decades. However, Artisan Staff/Industrial Employees engaged in Inspection/Quality Control of the jobs being produced are not covered under any “piece-work” and/or any other system. Since these category of workmen perform a very critical task ensuring zero defect products, it is essential that they should be covered under the “Incentive Scheme” at par with their counterparts in the Maintenance stream. |

|||||||||||||||||||||||

| 15. Incentive for Promoting Small Family: |

|||||||||||||||||||||||

| (i) | Extended to Re-employed pensioners; | ||||||||||||||||||||||

| (ii) | Extended to newly recruited even he/she of his/her spouse has undergone sterilization operation prior to recruitment. | ||||||||||||||||||||||

| 16. HPCA / PCA: | |||||||||||||||||||||||

| All Paramedical Staff irrespective of classification of posts subject to fulfilling other conditions at par with Nursing Allowance. | |||||||||||||||||||||||

| 17. Odd Hours Visit Allowance: |

|||||||||||||||||||||||

| Be extended to Radiographers / Laboratory Technicians. 03 Additional Increments should be granted to these categories, if there is no Radiologist / Pathologist in the hospital. | |||||||||||||||||||||||

| 18. Overtime Allowance: |

|||||||||||||||||||||||

| (i) | OTA for employees in Offices: No pay limit; |

||||||||||||||||||||||

| (ii) | Formula for OTA : {(BP+GP) ÷200} x Overtime hours |

||||||||||||||||||||||

| 19. Other Allowance: |

|||||||||||||||||||||||

| All other allowances in vogue at present and for which specific proposals have been mooted, may be increased by 3 times of the present. It is also demanded that the rates of such allowances shall automatically increase by 50% whenever the Dearness Allowance payable on the revised pay bands goes up by 50%. | |||||||||||||||||||||||

| 20. Interest Free Advances: |

|||||||||||||||||||||||

| (i) | Bicycle / Warm Clothing : | Rs. 10000/-; | |||||||||||||||||||||

| (ii) | Computer : | Rs. 50000/- on 1st Occasion on Rs. 40000/- on 2nd Occasion; Eligibility – All Govt Emp.; |

|||||||||||||||||||||

| (iii) | Scooter/Motor Cycle : | Rs. 60000/- , Eligibility- All; | |||||||||||||||||||||

| (iv) | Medical treatment : | 100% of package or Conservative treatment; |

|||||||||||||||||||||

| (v) | Festival : | 01 month’s Gross Pay for all; | |||||||||||||||||||||

| (vi) | Natural Calamity : | 05 times of (BP+GP + DA), to be recovered in 60 monthly installments; |

|||||||||||||||||||||

| (vii) | Training in Hindi : | Rs. 1500/-. | |||||||||||||||||||||

| 21. Interest Bearing Advances: |

|||||||||||||||||||||||

| (i) | Motor Car : | Rs. 500000/- , Eligibility – GP 4200 | |||||||||||||||||||||

| (ii) | HBA : | Eligibility and Loan amount should be as adopted by Public Sector Banks. For this purpose, Departments should enter into MOU with designated/selected PSBs and ensure full disbursement of Loan and the rate of interest should be at par with prevailing interest in the Saving Bank Account. |

|||||||||||||||||||||

| 22. Leave: |

|||||||||||||||||||||||

| (i) | EL Accumulation : | 300 days | |||||||||||||||||||||

| (ii) | EL Encashment : | 10 days per year | |||||||||||||||||||||

| (iii) | CCL: | It should be extended to Male employees also at par with Females Employees in case of death or insane condition of wife; | |||||||||||||||||||||

| (iv) | CL should be restored to 12 days per year for those Offices/Organizations working on a 5 day/week schedule and 15 days per year for those Offices/organizations working on a 6 days/week schedule; | ||||||||||||||||||||||

| (v) | Paternity Leave be extended to 30 days; | ||||||||||||||||||||||

| (vi) | Special Casual Leave for Federation activities be revised/modified as under and the leave facilities should be extended to Office-bearers/members of Unrecognized Unions affiliated to Recognized Federations – (a) 30 days to Office-Bearers; (b) 20 days to Central Executive Members; (c) 15 days to outstation delegates to attend meeting/conferences; (d) 10 days to local members for attending local meetings. |

||||||||||||||||||||||

| (vii) | Special Casual Leave should be given to those employees who donate Kidney/any other Organ till such time as he is declared fit to resume duties by the Doctor as per Medical Certificate | ||||||||||||||||||||||

| (viii) | Study Leave: | It should be extended to all employees. | |||||||||||||||||||||

| 23. Gratuity: |

|||||||||||||||||||||||

| (i) | One month pay per completed year of service; | ||||||||||||||||||||||

| (ii) | It should be extended to employees recruited on or after 01.01.2004; | ||||||||||||||||||||||

| 24. CGEGIS: | |||||||||||||||||||||||

| (i) | Minimum Coverage : Rs. 10 lakh | ||||||||||||||||||||||

| (ii) | “Optional Coverage” by dependents upto restoration of pension should also be provided | ||||||||||||||||||||||

| 25. Adhoc / Productivity Linked Bonus: |

|||||||||||||||||||||||

| (i) | Monthly Gross Pay (removing the ceiling of Rs. 3500); | ||||||||||||||||||||||

| (ii) | All categories of employees irrespective of Rank and GP, including Gazetted Officers. | ||||||||||||||||||||||

| 26. Income Tax: |

|||||||||||||||||||||||

| (i) | All allowances should be exempted from Income Tax. | ||||||||||||||||||||||

| 27. Professional Tax: |

|||||||||||||||||||||||

| (i) | All employees under the Ministry of Defence including Civilians be granted exemption from payment of Professional Tax | ||||||||||||||||||||||

| 28. MACP Scheme: | |||||||||||||||||||||||

| (i) | Instead of vacancy based promotion, Time Bound Promotion Scheme should be introduced for all group of employees; | ||||||||||||||||||||||

| (ii) | As a safety net, MACP may be continued but financial upgradation should be granted in promotional hierarchy on completion of every 06 yrs and not less than 05 upgradations in service career. | ||||||||||||||||||||||

| 29. Death Relief: | |||||||||||||||||||||||

| Rs. 25000/- (Non-Refundable) to next of kin. | |||||||||||||||||||||||

| 30. Judicial Pronouncements: | |||||||||||||||||||||||

| It should be extended to similarly placed non-petitioners. | |||||||||||||||||||||||

| 31. Compassionate Appointment: |

|||||||||||||||||||||||

| The quota of 5% be removed and 100% appointments on compassionate grounds be made. |

|||||||||||||||||||||||

| 32. Pension: |

|||||||||||||||||||||||

| (i) | National Pension Scheme should be scrapped; | ||||||||||||||||||||||

| (ii) | Pension shall not be less than 60% of last pay drawn; | ||||||||||||||||||||||

| (iii) | Family pension shall not be less than 40% of last pay drawn; | ||||||||||||||||||||||

| (iv) | Concept of one rank one pension should be implemented in letter and spirit; | ||||||||||||||||||||||

| (v) | Commutation restoration after 12 years instead of 15 years; | ||||||||||||||||||||||

| (vi) | Fixed Medical Allowance for all pensioners @ Rs. 1500 per month for OPD treatment and this amount should be automatically raised by 50% every time the Dearness Allowance on the revised pay structure goes up by 50%; | ||||||||||||||||||||||

| (vii) | Those totally depend on pension should be exempted from Income Tax payment as well as submission of IT return; | ||||||||||||||||||||||

| (viii) | Retirement / Death Gratuity should be paid @ one month for every completed year service without limit of maximum 33 yrs and without ceiling of Maximum Rs.10.00 lakh; | ||||||||||||||||||||||

| (ix) | “Emoluments- Fifteen days wages shall be calculated by dividing the pay in pay band plus grade pay last drawn by him by twenty six and multiplying the quotient by fifteen and in addition DA admissible on the date of retirement/death of Govt employee.‟ | ||||||||||||||||||||||

| 33. Speedy decision in Service matters: |

|||||||||||||||||||||||

| Probable date of completion (PDC) on the pattern of citizen charters should be fixed for resolving the issues, for movement of file/paper from desk to desk/section in respect of issues raised by JCM/Federations and latest position should be updated in website. | |||||||||||||||||||||||

| 34. Strengthening of JCM Forums: |

|||||||||||||||||||||||

| Non-conduction of regular meetings, non-implementation of Arbitration Awards without approval of both Houses of Parliament is some of the major challenges. If these constraints are removed, the JCM forum may resolve various issues in time which will reduce the litigations on service matters and that will have the cascading effect upon the functioning of Government machinery. | |||||||||||||||||||||||

| 35. Amendment to Service Rules: Co-relation of Pay |

|||||||||||||||||||||||

| Central Civil Services (Conduct) Rules, 1964 states that Rules 4, 6, 7, 12, 14, sub-rule (3) of Rule 15, Rule 16, sub-rules (1), (2) and (3) of Rule 18, Rule 19, 20 and 21 shall not apply to any Government Servant who draws a pay which does not exceed Rs.500 per mensem and holds a non-gazetted post in various establishments. | |||||||||||||||||||||||

| This monetary limit of Rs. 500 per Menem has never been revised since 1964. If this monetary limit is correlated to the revised pay of 7th CPC, conduct rule will relax the employees and reduce the supervisor’s burden in the following matters;- | |||||||||||||||||||||||

| a) |

Employment of near relatives of Government servants in companies or firms (Rule-4);

|

||||||||||||||||||||||

| b) | Joining of associations by Government servants (Rule 6); |

||||||||||||||||||||||

| c) | Demonstration and strikes (Rule 7); |

||||||||||||||||||||||

| d) | Subscriptions (Rule 12); |

||||||||||||||||||||||

| e) | Public demonstrations in honour of Government Servants (Rule 14); |

||||||||||||||||||||||

| f) | Private trade and employment (Rule 15); |

||||||||||||||||||||||

| g) | Investment, lending and borrowing (Rule 16); |

||||||||||||||||||||||

| h) | Movable, immovable and valuable property (Rule 18); |

||||||||||||||||||||||

| i) | Vindication of acts and character of Government servant (Rule 19); |

||||||||||||||||||||||

| j) | Canvassing of non-official or other outside influence (Rule 20) & |

||||||||||||||||||||||

| k) | Restriction regarding marriage (Rule 21) |

||||||||||||||||||||||

Source: http://bpms.org.in/documents/pad-bpms-emgw.pdf

Stay connected with us via Facebook, Google+ or Email Subscription.

Subscribe to Central Government Employee News & Tools by Email [Click Here]

Follow us: Twitter [click here] | Facebook [click here] | Google+ [click here]

Admin

COMMENTS

I am of the opinion that there be a Master Scale(MS) devoid of PB and GP.From the MS only starting pay for each post be fixed by the concerned dept. analyzing each such post.,especially the professional posts,while general posts such as clerks,stenos ,drivers etc may have the same starting pay in all depts.This will avoid overlapping of pay&increment,stagnation,non-functional grade etc.I hope 7th CPC will give a serious thought to this suggestion.

How many time will increase in existing pensioners